|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

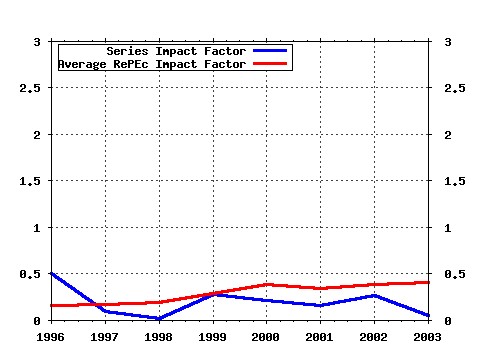

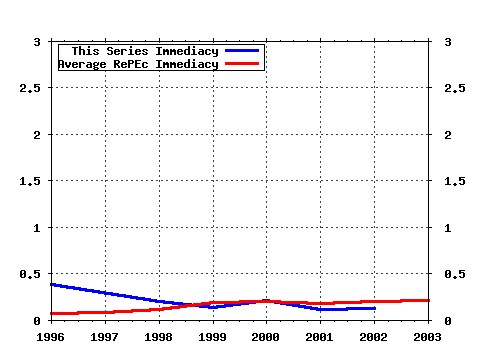

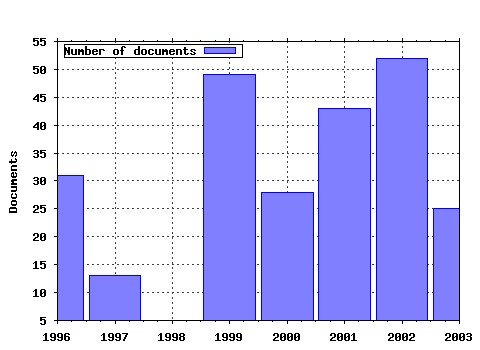

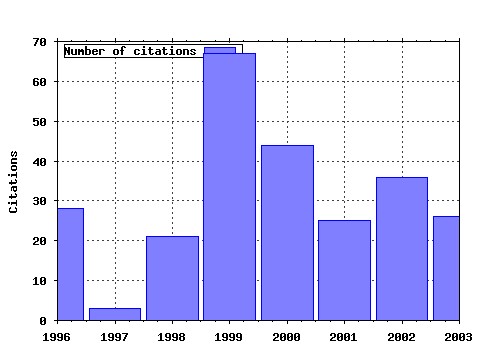

Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:dgr:eureir:2002272 Reverse logistics (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (2) RePEc:dgr:eureir:1998145 Does the absence of cointegration explain the typical findings in long horizon regressions? (1998). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (3) RePEc:dgr:eureir:2000200 Smooth transition autoregressive models - A survey of recent developments (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (4) RePEc:dgr:eureir:1999163 Testing for integration using evolving trend and seasonal models A Bayesian approach (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (5) RePEc:dgr:eureir:1999105 Are Living Standards Converging? (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (6) RePEc:dgr:eureir:2003321 Forecasting industrial production with linear, nonlinear and structural change models (2003). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (7) RePEc:dgr:eureir:1997134 Flexible seasonal long memory and economic time series (1995). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (8) RePEc:dgr:eureir:1999167 Adaptive Polar Sampling with an application to a Bayes measure of Value-at-Risk (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (9) RePEc:dgr:eureir:1999171 Inference and forecasting for fractional autoregressive integrated moving average models; with an application to US and UK inflation. (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (10) RePEc:dgr:eureir:199729 An efficient optimal solution method for the joint replenishment problemm (1996). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (11) RePEc:dgr:eureir:1999141 On SETAR non-linearity and forecasting (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (12) RePEc:dgr:eureir:2002261 Inflation rates (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (13) RePEc:dgr:eureir:2000204 A nonlinear long memory model for US unemployment (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (14) RePEc:dgr:eureir:2000201 Daily exchange rate behaviour and hedging of currency risk (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (15) RePEc:dgr:eureir:2003323 A generalized dynamic conditional correlation model for many asset returns (2003). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (16) RePEc:dgr:eureir:199728 A review of multi-component maintenance models with economic dependence (1996). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (17) RePEc:dgr:eureir:2000187 Optimal portfolio choice under loss aversion (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (18) RePEc:dgr:eureir:2002282 Changes in variability of the business cycle in the G7 countries (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (19) RePEc:dgr:eureir:2000185 Seasonal smooth transition autoregression (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (20) RePEc:dgr:eureir:1999177 Learning, network formation and coordination (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (21) RePEc:dgr:eureir:1999101 Unit roots and asymetric adjustment - a reassessment (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (22) RePEc:dgr:eureir:2001251 An empirical comparison of default swap pricing models (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (23) RePEc:dgr:eureir:1997117 Symmetric primal-dual path following algorithms for semidefinite programming (1995). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (24) RePEc:dgr:eureir:199739 Bayesian analysis of ARMA models using noninformative priors (1996). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (25) RePEc:dgr:eureir:1999144 How to deal with intercept and trend in practical cointegration analysis? (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (26) RePEc:dgr:eureir:2000184 Asymmetric and common absorption of shocks in nonlinear autoregressive models. (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (27) RePEc:dgr:eureir:1998103 A Simple Strategy to Prune Neural Networks with an Application to Economic Time Series (1998). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (28) RePEc:dgr:eureir:2000207 Determining the direct mailing frequency with dynamic stochastic programming (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (29) RePEc:dgr:eureir:2001224 Testing for common deterministic trend slopes (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (30) RePEc:dgr:eureir:2001219 Short-term volatility versus long-term growth (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (31) RePEc:dgr:eureir:1999175 Networks of collaboration in oligopoly (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (32) RePEc:dgr:eureir:1999111 Bayes estimates of Markov trends in possibly cointegrated series - an application to US consumption and income (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (33) RePEc:dgr:eureir:199718 A general approach for the coordination of maintenance frequencies (1995). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (34) RePEc:dgr:eureir:199726 Duality and Self-Duality for Conic Convex Programming (1996). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (35) RePEc:dgr:eureir:2003317 Bayesian model selection for a sharp null and a diffuse alternative with econometric applications (2003). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (36) RePEc:dgr:eureir:199736 Equality restricted random variables: densities and sampling algorithms (1996). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (37) RePEc:dgr:eureir:1998 Nonparametric estimation of the spectral measure of an extreme value distribution (1998). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (38) RePEc:dgr:eureir:2000202 R&D Networks (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (39) RePEc:dgr:eureir:2003301 Generalized reduced rank tests using the singular value decomposition (2003). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (40) RePEc:dgr:eureir:199717 A dynamic policy for grouping maintenance activities (1995). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (41) RePEc:dgr:eureir:1999156 Forecasting with periodic autoregressive time series models (1999). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (42) RePEc:dgr:eureir:1997135 Duality results for conic convex programming (1997). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (43) RePEc:dgr:eureir:199744 Oil price shocks and long run price and import demand behavior (1996). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (44) RePEc:dgr:eureir:2000196 From boom til bust (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (45) RePEc:dgr:eureir:2001230 Are statistical reporting agencies getting it right? Data rationality and business cycle asymmetry (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (46) RePEc:dgr:eureir:2003313 A derivative based estimator for semiparametric index (2003). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (47) RePEc:dgr:eureir:1998102 Conditional densities in Econometrics (1998). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (48) RePEc:dgr:eureir:2002271 Joint optimization of customer segmentation and marketing policy to maximize long-term profitability (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (49) RePEc:dgr:eureir:2003326 Analytical quasi maximum likelihood inference in multivariate volatility models (2003). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (50) RePEc:dgr:eureir:2002291 Instrumental variable estimation for duration data (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:dgr:eureir:2002264 How to organise return handling (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (2) RePEc:dgr:eureir:2002272 Reverse logistics (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (3) RePEc:dgr:eureir:2002279 Inventory control with product returns (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (4) RePEc:dgr:eureir:2002281 Direct mailing decisions for a Dutch fundraiser (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (5) RePEc:dgr:eureir:2002290 Reverse logistics - a framework (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (6) RePEc:dgr:eureri:2002196 Modeling Generational Transitions from Aggregate Data (2002). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (7) RePEc:dgr:kubcar:20021 Redesign of a recycling system for LPG-tanks (2002). Tilburg University, Center Applied Research / Discussion Paper Latest citations received in: 2001 (1) RePEc:dgr:eureir:2001233 Integrating a web-based system with business processes in closed loop supply chains (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (2) RePEc:dgr:eureir:2001246 The correlation between the convergence of subdivision processes and solvability of refinement equations. (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (3) RePEc:dgr:eureir:2001250 Constancy of distributions (2001). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (4) RePEc:dgr:eureri:2001133 Dynamic Scheduling of Handling Equipment at Automated Container Terminals (2001). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (5) RePEc:fip:fednsr:126 Recent changes in the U.S. business cycle (2001). Federal Reserve Bank of New York / Staff Reports Latest citations received in: 2000 (1) RePEc:chb:bcchwp:73 Ajuste Estacional e Integración en Variables Macroeconómicas (2000). Central Bank of Chile / Working Papers Central Bank of Chile (2) RePEc:dgr:eureir:2000196 From boom til bust (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (3) RePEc:dgr:eureir:2000200 Smooth transition autoregressive models - A survey of recent developments (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (4) RePEc:dgr:eureir:2000204 A nonlinear long memory model for US unemployment (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (5) RePEc:dgr:eureir:2000208 Estimting parameters of a microsimulation model for breast cancer screening using the score function method (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (6) RePEc:nbr:nberwo:7783 Why Stocks May Disappoint (2000). National Bureau of Economic Research, Inc / NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |