|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

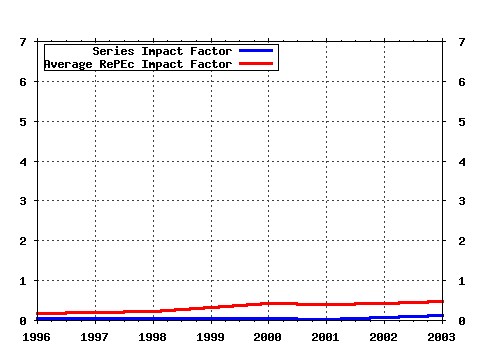

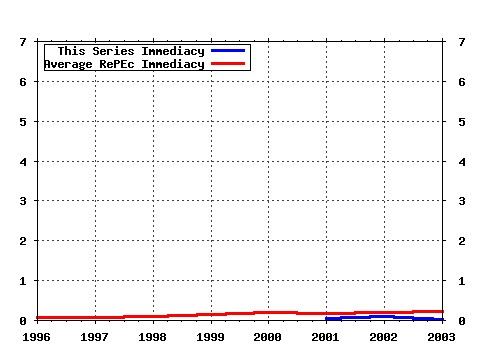

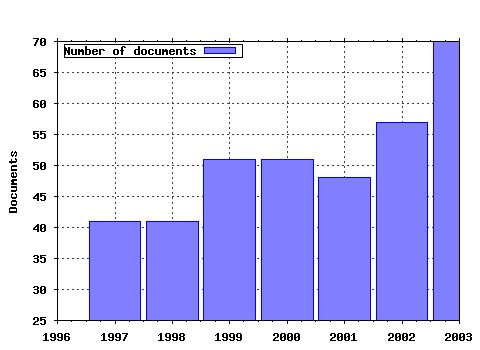

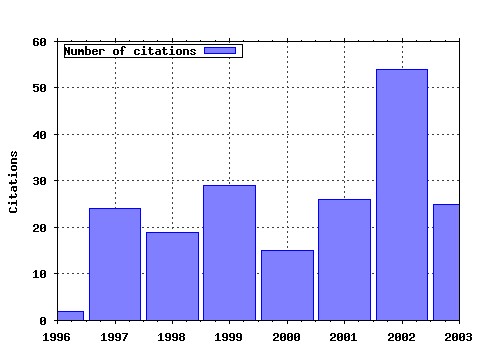

Insurance: Mathematics and Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:insuma:v:31:y:2002:i:1:p:3-33 The concept of comonotonicity in actuarial science and finance: theory (2002). Insurance: Mathematics and Economics (2) RePEc:eee:insuma:v:31:y:2002:i:2:p:249-265 Optimal portfolio and background risk: an exact and an approximated solution (2002). Insurance: Mathematics and Economics (3) RePEc:eee:insuma:v:33:y:2003:i:1:p:29-47 Pensionmetrics 2: stochastic pension plan design during the distribution phase (2003). Insurance: Mathematics and Economics (4) RePEc:eee:insuma:v:21:y:1997:i:2:p:173-183 Axiomatic characterization of insurance prices (1997). Insurance: Mathematics and Economics (5) RePEc:eee:insuma:v:31:y:2002:i:1:p:35-69 Optimal investment strategies and risk measures in defined contribution pension schemes (2002). Insurance: Mathematics and Economics (6) RePEc:eee:insuma:v:31:y:2002:i:2:p:267-284 Insurance premia consistent with the market (2002). Insurance: Mathematics and Economics (7) RePEc:eee:insuma:v:17:y:1995:i:1:p:43-54 Insurance pricing and increased limits ratemaking by proportional hazards transforms (1995). Insurance: Mathematics and Economics (8) RePEc:eee:insuma:v:31:y:2002:i:2:p:133-161 The concept of comonotonicity in actuarial science and finance: applications (2002). Insurance: Mathematics and Economics (9) RePEc:eee:insuma:v:30:y:2002:i:2:p:199-209 Optimal asset allocation in life annuities: a note (2002). Insurance: Mathematics and Economics (10) RePEc:eee:insuma:v:21:y:1997:i:2:p:113-127 Reserving for maturity guarantees: Two approaches (1997). Insurance: Mathematics and Economics (11) RePEc:eee:insuma:v:25:y:1999:i:3:p:337-347 A synthesis of risk measures for capital adequacy (1999). Insurance: Mathematics and Economics (12) RePEc:eee:insuma:v:28:y:2001:i:3:p:305-308 Does positive dependence between individual risks increase stop-loss premiums? (2001). Insurance: Mathematics and Economics (13) RePEc:eee:insuma:v:22:y:1998:i:3:p:235-242 Comonotonicity, correlation order and premium principles (1998). Insurance: Mathematics and Economics (14) RePEc:eee:insuma:v:31:y:2002:i:3:p:373-393 A Poisson log-bilinear regression approach to the construction of projected lifetables (2002). Insurance: Mathematics and Economics (15) RePEc:eee:insuma:v:24:y:1999:i:1-2:p:139-148 Fitting bivariate loss distributions with copulas (1999). Insurance: Mathematics and Economics (16) RePEc:eee:insuma:v:25:y:1999:i:1:p:11-21 The safest dependence structure among risks (1999). Insurance: Mathematics and Economics (17) RePEc:eee:insuma:v:16:y:1995:i:3:p:225-253 Equity-linked life insurance: A model with stochastic interest rates (1995). Insurance: Mathematics and Economics (18) RePEc:eee:insuma:v:29:y:2001:i:1:p:35-45 Minimization of risks in pension funding by means of contributions and portfolio selection (2001). Insurance: Mathematics and Economics (19) RePEc:eee:insuma:v:22:y:1998:i:2:p:145-161 Ordering risks: Expected utility theory versus Yaaris dual theory of risk (1998). Insurance: Mathematics and Economics (20) RePEc:eee:insuma:v:29:y:2001:i:2:p:187-215 Pensionmetrics: stochastic pension plan design and value-at-risk during the accumulation phase (2001). Insurance: Mathematics and Economics (21) RePEc:eee:insuma:v:11:y:1992:i:2:p:113-127 Stochastic discounting (1992). Insurance: Mathematics and Economics (22) RePEc:eee:insuma:v:33:y:2003:i:2:p:255-272 Lee-Carter mortality forecasting with age-specific enhancement (2003). Insurance: Mathematics and Economics (23) RePEc:eee:insuma:v:35:y:2004:i:2:p:187-203 Another look at the Picard-Lefevre formula for finite-time ruin probabilities (2004). Insurance: Mathematics and Economics (24) RePEc:eee:insuma:v:26:y:2000:i:1:p:37-57 Fair valuation of life insurance liabilities: The impact of interest rate guarantees, surrender options, and bonus policies (2000). Insurance: Mathematics and Economics (25) RePEc:eee:insuma:v:37:y:2005:i:1:p:13-26 Some notions of multivariate positive dependence (2005). Insurance: Mathematics and Economics (26) RePEc:eee:insuma:v:16:y:1995:i:1:p:7-22 Ruin estimates under interest force (1995). Insurance: Mathematics and Economics (27) RePEc:eee:insuma:v:11:y:1992:i:4:p:249-257 A Hilbert space proof of the fundamental theorem of asset pricing in finite discrete time (1992). Insurance: Mathematics and Economics (28) RePEc:eee:insuma:v:28:y:2001:i:2:p:233-262 Optimal investment strategy for defined contribution pension schemes (2001). Insurance: Mathematics and Economics (29) RePEc:eee:insuma:v:14:y:1994:i:1:p:33-37 An analytical inversion of a Laplace transform related to annuities certain (1994). Insurance: Mathematics and Economics (30) RePEc:eee:insuma:v:27:y:2000:i:2:p:151-168 Upper and lower bounds for sums of random variables (2000). Insurance: Mathematics and Economics (31) RePEc:eee:insuma:v:35:y:2004:i:1:p:113-136 Stochastic mortality in life insurance: market reserves and mortality-linked insurance contracts (2004). Insurance: Mathematics and Economics (32) RePEc:eee:insuma:v:22:y:1998:i:1:p:53-64 On some filtering problems arising in mathematical finance (1998). Insurance: Mathematics and Economics (33) RePEc:eee:insuma:v:35:y:2004:i:2:p:321-342 Optimal investment choices post-retirement in a defined contribution pension scheme (2004). Insurance: Mathematics and Economics (34) RePEc:eee:insuma:v:10:y:1991:i:2:p:125-131 A note on Shiu--Fisher--Weil immunization theorem (1991). Insurance: Mathematics and Economics (35) RePEc:eee:insuma:v:17:y:1996:i:3:p:215-222 Orderings of risks: A comparative study via stop-loss transforms (1996). Insurance: Mathematics and Economics (36) RePEc:eee:insuma:v:23:y:1998:i:3:p:263-286 Pension schemes as options on pension fund assets: implications for pension fund management (1998). Insurance: Mathematics and Economics (37) RePEc:eee:insuma:v:26:y:2000:i:2-3:p:175-183 An easy computable upper bound for the price of an arithmetic Asian option (2000). Insurance: Mathematics and Economics (38) RePEc:eee:insuma:v:32:y:2003:i:3:p:379-401 On the forecasting of mortality reduction factors (2003). Insurance: Mathematics and Economics (39) RePEc:eee:insuma:v:17:y:1995:i:1:p:19-34 Allocation of solvency cost in group annuities: Actuarial principles and cooperative game theory (1995). Insurance: Mathematics and Economics (40) RePEc:eee:insuma:v:23:y:1998:i:2:p:157-172 The moments of ruin time in the classical risk model with discrete claim size distribution (1998). Insurance: Mathematics and Economics (41) RePEc:eee:insuma:v:33:y:2003:i:3:p:595-609 Fair valuation of path-dependent participating life insurance contracts (2003). Insurance: Mathematics and Economics (42) RePEc:eee:insuma:v:12:y:1993:i:2:p:133-142 Ruin probabilities in the compound binomial model (1993). Insurance: Mathematics and Economics (43) RePEc:eee:insuma:v:6:y:1987:i:2:p:135-144 Retroactive price regulation and the fair rate of return (1987). Insurance: Mathematics and Economics (44) RePEc:eee:insuma:v:24:y:1999:i:1-2:p:67-81 Modelling different types of automobile insurance fraud behaviour in the Spanish market (1999). Insurance: Mathematics and Economics (45) RePEc:eee:insuma:v:27:y:2000:i:1:p:19-44 The moments of the time of ruin, the surplus before ruin, and the deficit at ruin (2000). Insurance: Mathematics and Economics (46) RePEc:eee:insuma:v:34:y:2004:i:2:p:177-192 Heterogeneous INAR(1) model with application to car insurance (2004). Insurance: Mathematics and Economics (47) RePEc:eee:insuma:v:25:y:1999:i:2:p:197-217 A new stochastically flexible event methodology with application to Proposition 103 (1999). Insurance: Mathematics and Economics (48) RePEc:eee:insuma:v:30:y:2002:i:3:p:405-420 Copula convergence theorems for tail events (2002). Insurance: Mathematics and Economics (49) RePEc:eee:insuma:v:37:y:2005:i:3:p:443-468 Affine processes for dynamic mortality and actuarial valuations (2005). Insurance: Mathematics and Economics (50) RePEc:eee:insuma:v:10:y:1991:i:3:p:173-179 A stop-loss experience rating scheme for fleets of cars (1991). Insurance: Mathematics and Economics Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:mrr:papers:wp063 Betting on Death and Capital Markets in Retirement: A Shortfall Risk Analysis of Life Annuities versus Phased Withdrawal Plans (2003). University of Michigan, Michigan Retirement Research Center / Working Papers (2) RePEc:xrs:sfbmaa:03-02 Risk Based Capital Allocation (2003). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Latest citations received in: 2002 (1) RePEc:ctl:louvir:2002005 Optimal Portfolio Strategies with Stochastic Wage Income : The Case of A defined Contribution Pension Plan (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (2) RePEc:ctl:louvir:2002021 Optimal Pension Management under Stochastic Interest Rates, Wages, and Inflation (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (3) RePEc:ctl:louvir:2002022 How the Financial Managersâ Remuneration Can Affect the Optimal Portfolio Composition ? (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (4) RePEc:icr:wpmath:10-2002 Coherence without Additivity. (2002). ICER - International Centre for Economic Research / ICER Working Papers - Applied Mathematics Series (5) RePEc:icr:wpmath:24-2002 Insurance Premia Consistent with the Market. (2002). ICER - International Centre for Economic Research / ICER Working Papers - Applied Mathematics Series Latest citations received in: 2001 (1) RePEc:ctl:louvir:2001009 Nonparametric Tests for Positive Quadrant Dependence (2001). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (2) RePEc:ctl:louvir:2001019 Endogenous Distribution, Politics, and Growth (2001). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |