|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

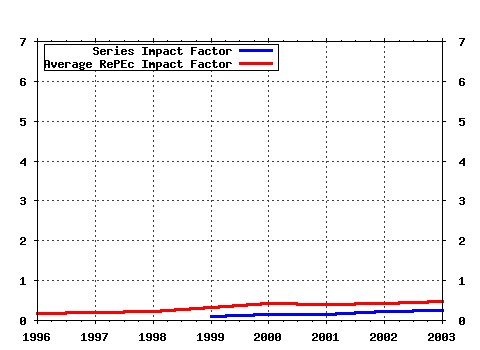

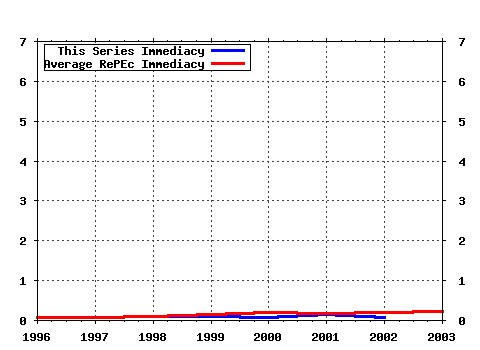

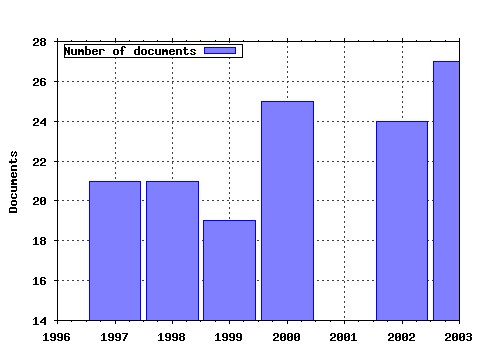

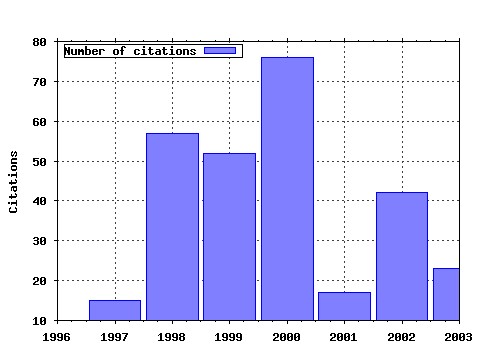

Journal of International Financial Markets, Institutions and Money Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:407-421 Intervention from an information perspective (2000). Journal of International Financial Markets, Institutions and Money (2) RePEc:eee:intfin:v:12:y:2002:i:1:p:33-58 Cost and profit efficiency in European banks (2002). Journal of International Financial Markets, Institutions and Money (3) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:303-322 Central bank intervention and exchange rates: the case of Sweden (2000). Journal of International Financial Markets, Institutions and Money (4) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:287-302 The United States as an informed foreign-exchange speculator (2000). Journal of International Financial Markets, Institutions and Money (5) RePEc:eee:intfin:v:9:y:1999:i:4:p:359-376 Long memory or structural breaks: can either explain nonstationary real exchange rates under the current float? (1999). Journal of International Financial Markets, Institutions and Money (6) RePEc:eee:intfin:v:8:y:1998:i:2:p:117-153 What determines real exchange rates?: The long and the short of it (1998). Journal of International Financial Markets, Institutions and Money (7) RePEc:eee:intfin:v:10:y:2000:i:2:p:107-130 Intraday and interday volatility in the Japanese stock market (2000). Journal of International Financial Markets, Institutions and Money (8) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:381-405 Central bank intervention and exchange rate volatility -- Australian evidence (2000). Journal of International Financial Markets, Institutions and Money (9) RePEc:eee:intfin:v:12:y:2002:i:3:p:183-200 On measuring volatility and the GARCH forecasting performance (2002). Journal of International Financial Markets, Institutions and Money (10) RePEc:eee:intfin:v:10:y:2000:i:1:p:69-82 Testing for nonlinear Granger causality from fundamentals to exchange rates in the ERM (2000). Journal of International Financial Markets, Institutions and Money (11) RePEc:eee:intfin:v:8:y:1998:i:1:p:21-38 The impact of exchange rate volatility on Australian trade flows (1998). Journal of International Financial Markets, Institutions and Money (12) RePEc:eee:intfin:v:8:y:1998:i:2:p:155-173 An empirical examination of linkages between Pacific-Basin stock markets (1998). Journal of International Financial Markets, Institutions and Money (13) RePEc:eee:intfin:v:9:y:1999:i:2:p:163-182 Factor price misspecification in bank cost function estimation (1999). Journal of International Financial Markets, Institutions and Money (14) RePEc:eee:intfin:v:8:y:1998:i:1:p:1-19 Monetary-based models of the exchange rate: a panel perspective (1998). Journal of International Financial Markets, Institutions and Money (15) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:393-412 Multimarket trading and liquidity: a transaction data analysis of Canada-US interlistings (1998). Journal of International Financial Markets, Institutions and Money (16) RePEc:eee:intfin:v:9:y:1999:i:2:p:183-193 A test of purchasing power parity for emerging economies (1999). Journal of International Financial Markets, Institutions and Money (17) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:229-247 Foreign reserve and money dynamics with asset portfolio adjustment: international evidence (2000). Journal of International Financial Markets, Institutions and Money (18) RePEc:eee:intfin:v:11:y:2001:i:1:p:75-96 Inflation and rates of return on stocks: evidence from high inflation countries (2001). Journal of International Financial Markets, Institutions and Money (19) RePEc:eee:intfin:v:13:y:2003:i:2:p:85-112 Information arrivals and intraday exchange rate volatility (2003). Journal of International Financial Markets, Institutions and Money (20) RePEc:eee:intfin:v:9:y:1999:i:4:p:377-391 Assessing competitive conditions in the Greek banking system (1999). Journal of International Financial Markets, Institutions and Money (21) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:363-379 Deviations from daily uncovered interest rate parity and the role of intervention (2000). Journal of International Financial Markets, Institutions and Money (22) RePEc:eee:intfin:v:9:y:1999:i:1:p:61-74 Causal relations among stock returns and macroeconomic variables in a small, open economy (1999). Journal of International Financial Markets, Institutions and Money (23) RePEc:eee:intfin:v:13:y:2003:i:4:p:383-399 Spillovers of stock return volatility to Asian equity markets from Japan and the US (2003). Journal of International Financial Markets, Institutions and Money (24) RePEc:eee:intfin:v:9:y:1999:i:2:p:115-128 Asymmetric information and the bid-ask spread: an empirical comparison between automated order execution and open outcry auction (1999). Journal of International Financial Markets, Institutions and Money (25) RePEc:eee:intfin:v:9:y:1999:i:3:p:267-283 A multivariate analysis of the determinants of Moodys bank financial strength ratings (1999). Journal of International Financial Markets, Institutions and Money (26) RePEc:eee:intfin:v:10:y:2000:i:2:p:131-150 Cross-sectional variations in the degree of global integration: the case of Russian equities (2000). Journal of International Financial Markets, Institutions and Money (27) RePEc:eee:intfin:v:14:y:2004:i:1:p:25-36 The accuracy of press reports regarding the foreign exchange interventions of the Bank of Japan (2004). Journal of International Financial Markets, Institutions and Money (28) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:299-324 Two months in the life of several gilt-edged market makers on the London Stock Exchange (1998). Journal of International Financial Markets, Institutions and Money (29) RePEc:eee:intfin:v:7:y:1997:i:1:p:73-87 The impact of exchange rate volatility on German-US trade flows (1997). Journal of International Financial Markets, Institutions and Money (30) RePEc:eee:intfin:v:12:y:2002:i:2:p:139-155 Before and after international cross-listing: an intraday examination of volume and volatility (2002). Journal of International Financial Markets, Institutions and Money (31) RePEc:eee:intfin:v:13:y:2003:i:2:p:113-136 Models of exchange rate expectations: how much heterogeneity? (2003). Journal of International Financial Markets, Institutions and Money (32) RePEc:eee:intfin:v:11:y:2001:i:2:p:147-165 A test of the accuracy of the Lee/Ready trade classification algorithm (2001). Journal of International Financial Markets, Institutions and Money (33) RePEc:eee:intfin:v:15:y:2005:i:2:p:141-157 Bank provisioning behaviour and procyclicality (2005). Journal of International Financial Markets, Institutions and Money (34) RePEc:eee:intfin:v:9:y:1999:i:3:p:321-333 A preliminary look at gains from asset securitization (1999). Journal of International Financial Markets, Institutions and Money (35) RePEc:eee:intfin:v:7:y:1997:i:4:p:303-327 International portfolio diversification: a synthesis and an update (1997). Journal of International Financial Markets, Institutions and Money (36) RePEc:eee:intfin:v:14:y:2004:i:3:p:221-233 The future of cash: falling legal use and implications for government policy (2004). Journal of International Financial Markets, Institutions and Money (37) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:323-347 The effect of interventions on realignment probabilities (2000). Journal of International Financial Markets, Institutions and Money (38) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:225-241 The liquidity of automated exchanges: new evidence from German Bund futures (1998). Journal of International Financial Markets, Institutions and Money (39) RePEc:eee:intfin:v:9:y:1999:i:3:p:303-320 Malmquist indices of productivity change in Australian financial services (1999). Journal of International Financial Markets, Institutions and Money (40) RePEc:eee:intfin:v:11:y:2001:i:1:p:1-28 Global equity styles and industry effects: the pre-eminence of value relative to size (2001). Journal of International Financial Markets, Institutions and Money (41) RePEc:eee:intfin:v:12:y:2002:i:3:p:253-278 Components of execution costs: evidence of asymmetric information at the Mexican Stock Exchange (2002). Journal of International Financial Markets, Institutions and Money (42) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:325-356 Information asymmetry, market segmentation and the pricing of cross-listed shares: theory and evidence from Chinese A and B shares (1998). Journal of International Financial Markets, Institutions and Money (43) RePEc:eee:intfin:v:14:y:2004:i:3:p:255-266 Who owns the major US subsidiaries of foreign banks?: A note (2004). Journal of International Financial Markets, Institutions and Money (44) RePEc:eee:intfin:v:8:y:1998:i:1:p:83-100 Asymmetric impact of trade balance news on asset prices (1998). Journal of International Financial Markets, Institutions and Money (45) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:277-298 Inter- and intra-day liquidity patterns on the Stock Exchange of Hong Kong (1998). Journal of International Financial Markets, Institutions and Money (46) RePEc:eee:intfin:v:14:y:2004:i:3:p:203-219 Banking competition and macroeconomic conditions: a disaggregate analysis (2004). Journal of International Financial Markets, Institutions and Money (47) RePEc:eee:intfin:v:13:y:2003:i:3:p:271-289 Gold factor exposures in international asset pricing (2003). Journal of International Financial Markets, Institutions and Money (48) RePEc:eee:intfin:v:7:y:1997:i:1:p:43-60 Are banks market timers or market makers? Explaining foreign exchange trading profits (1997). Journal of International Financial Markets, Institutions and Money (49) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:243-260 Price discovery in high and low volatility periods: open outcry versus electronic trading (1998). Journal of International Financial Markets, Institutions and Money (50) RePEc:eee:intfin:v:9:y:1999:i:1:p:1-18 Modeling asset market volatility in a small market:: Accounting for non-synchronous trading effects (1999). Journal of International Financial Markets, Institutions and Money Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:dgr:unutaf:eifc02-14 Integration of European Banking and Financial Markets (2002). United Nations University, Institute for New Technologies / EIFC - Technology and Finance Working Papers (2) RePEc:wop:pennin:02-27 Parametric and Nonparametric Volatility Measurement (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Latest citations received in: 2001 (1) RePEc:fip:fedgif:702 Home bias and high turnover reconsidered (2001). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (2) RePEc:wpa:wuwpif:0107003 Equity Returns and Inflation: The Puzzlingly Long Lags (2001). EconWPA / International Finance Latest citations received in: 2000 (1) RePEc:hhs:osloec:2000_010 Risk externalities in a payments oligopoly (2000). Oslo University, Department of Economics / Memorandum (2) RePEc:wdi:papers:2005-760 Official Foreign Exchange Interventions in the Czech Republic: Did They Matter? (2000). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |