|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

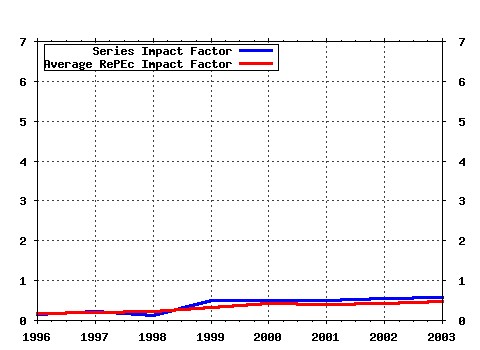

Journal of Banking & Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jbfina:v:21:y:1997:i:7:p:895-947 Inside the black box: What explains differences in the efficiencies of financial institutions? (1997). Journal of Banking & Finance (2) RePEc:eee:jbfina:v:22:y:1998:i:6-8:p:613-673 The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle (1998). Journal of Banking & Finance (3) RePEc:eee:jbfina:v:25:y:2001:i:12:p:2209-2237 The changing structure of local credit markets: Are small businesses special? (2001). Journal of Banking & Finance (4) RePEc:eee:jbfina:v:25:y:2001:i:5:p:891-911 How does foreign entry affect domestic banking markets? (2001). Journal of Banking & Finance (5) RePEc:eee:jbfina:v:22:y:1998:i:6-8:p:959-977 The importance of relationships to the availability of credit (1998). Journal of Banking & Finance (6) RePEc:eee:jbfina:v:19:y:1995:i:3-4:p:393-430 The role of capital in financial institutions (1995). Journal of Banking & Finance (7) RePEc:eee:jbfina:v:23:y:1999:i:2-4:p:135-194 The consolidation of the financial services industry: Causes, consequences, and implications for the future (1999). Journal of Banking & Finance (8) RePEc:eee:jbfina:v:1:y:1977:i:1:p:3-11 An analytic derivation of the cost of deposit insurance and loan guarantees An application of modern option pricing theory (1977). Journal of Banking & Finance (9) RePEc:eee:jbfina:v:22:y:1998:i:10-11:p:1283-1316 Is relationship lending special? Evidence from credit-file data in Germany (1998). Journal of Banking & Finance (10) RePEc:eee:jbfina:v:15:y:1991:i:1:p:133-149 Bank commercial loan markets and the role of market structure: evidence from surveys of commercial lending (1991). Journal of Banking & Finance (11) RePEc:eee:jbfina:v:17:y:1993:i:2-3:p:389-405 Resolving the scale efficiency puzzle in banking (1993). Journal of Banking & Finance (12) RePEc:eee:jbfina:v:24:y:2000:i:1-2:p:119-149 A comparative anatomy of credit risk models (2000). Journal of Banking & Finance (13) RePEc:eee:jbfina:v:22:y:1998:i:10-11:p:1317-1353 Lending relationships in Germany - Empirical evidence from survey data (1998). Journal of Banking & Finance (14) RePEc:eee:jbfina:v:17:y:1993:i:2-3:p:221-249 The efficiency of financial institutions: A review and preview of research past, present and future (1993). Journal of Banking & Finance (15) RePEc:eee:jbfina:v:23:y:1999:i:10:p:1499-1519 Building an incentive-compatible safety net (1999). Journal of Banking & Finance (16) RePEc:eee:jbfina:v:3:y:1979:i:2:p:133-155 A continuous time approach to the pricing of bonds (1979). Journal of Banking & Finance (17) RePEc:eee:jbfina:v:17:y:1993:i:2-3:p:317-347 Bank efficiency derived from the profit function (1993). Journal of Banking & Finance (18) RePEc:eee:jbfina:v:25:y:2001:i:12:p:2127-2167 The ability of banks to lend to informationally opaque small businesses (2001). Journal of Banking & Finance (19) RePEc:eee:jbfina:v:24:y:2000:i:1-2:p:203-227 Stability of rating transitions (2000). Journal of Banking & Finance (20) RePEc:eee:jbfina:v:4:y:1980:i:4:p:335-344 A model of reserves, bank runs, and deposit insurance (1980). Journal of Banking & Finance (21) RePEc:eee:jbfina:v:19:y:1995:i:3-4:p:679-692 Bank regulation and the credit crunch (1995). Journal of Banking & Finance (22) RePEc:eee:jbfina:v:21:y:1997:i:6:p:849-870 Problem loans and cost efficiency in commercial banks (1997). Journal of Banking & Finance (23) RePEc:eee:jbfina:v:23:y:1999:i:2-4:p:291-324 The dollars and sense of bank consolidation (1999). Journal of Banking & Finance (24) RePEc:eee:jbfina:v:26:y:2002:i:2-3:p:445-474 Ratings migration and the business cycle, with application to credit portfolio stress testing (2002). Journal of Banking & Finance (25) RePEc:eee:jbfina:v:24:y:2000:i:1-2:p:59-117 A comparative analysis of current credit risk models (2000). Journal of Banking & Finance (26) RePEc:eee:jbfina:v:18:y:1994:i:3:p:445-459 Competitive conditions in european banking (1994). Journal of Banking & Finance (27) RePEc:eee:jbfina:v:15:y:1991:i:4-5:p:805-824 Capital controls and bank risk (1991). Journal of Banking & Finance (28) RePEc:eee:jbfina:v:22:y:1998:i:6-8:p:799-819 Bank consolidation and small business lending: Its not just bank size that matters (1998). Journal of Banking & Finance (29) RePEc:eee:jbfina:v:20:y:1996:i:6:p:1025-1045 A study of bank efficiency taking into account risk-preferences (1996). Journal of Banking & Finance (30) RePEc:eee:jbfina:v:20:y:1996:i:4:p:655-672 Operational efficiency in banking: An international comparison (1996). Journal of Banking & Finance (31) RePEc:eee:jbfina:v:24:y:2000:i:1-2:p:35-58 Emerging problems with the Basel Capital Accord: Regulatory capital arbitrage and related issues (2000). Journal of Banking & Finance (32) RePEc:eee:jbfina:v:14:y:1990:i:6:p:1189-1208 Statistical study of foreign exchange rates, empirical evidence of a price change scaling law, and intraday analysis (1990). Journal of Banking & Finance (33) RePEc:eee:jbfina:v:17:y:1993:i:2-3:p:267-286 Efficiency in the savings and loan industry (1993). Journal of Banking & Finance (34) RePEc:eee:jbfina:v:13:y:1989:i:6:p:883-891 Capital regulation and bank risk-taking: A note (1989). Journal of Banking & Finance (35) RePEc:eee:jbfina:v:22:y:1998:i:6-8:p:925-954 Availability and cost of credit for small businesses: Customer relationships and credit cooperatives (1998). Journal of Banking & Finance (36) RePEc:eee:jbfina:v:22:y:1998:i:5:p:565-587 The performance of de novo commercial banks: A profit efficiency approach (1998). Journal of Banking & Finance (37) RePEc:eee:jbfina:v:17:y:1993:i:2-3:p:371-388 Banking efficiency in the Nordic countries (1993). Journal of Banking & Finance (38) RePEc:eee:jbfina:v:22:y:1998:i:6-8:p:821-845 Small business lending and the changing structure of the banking industry1 (1998). Journal of Banking & Finance (39) RePEc:eee:jbfina:v:28:y:2004:i:9:p:2103-2134 Corporate cash holdings: An empirical investigation of UK companies (2004). Journal of Banking & Finance (40) RePEc:eee:jbfina:v:15:y:1991:i:6:p:1093-1112 Foreign bank activity in the United States: An analysis by country of origin (1991). Journal of Banking & Finance (41) RePEc:eee:jbfina:v:14:y:1990:i:1:p:69-84 A reexamination of mean-variance analysis of bank capital regulation (1990). Journal of Banking & Finance (42) RePEc:eee:jbfina:v:5:y:1981:i:1:p:17-32 The determinants of foreign banking activity in the United States (1981). Journal of Banking & Finance (43) RePEc:eee:jbfina:v:26:y:2002:i:11:p:2155-2189 Bank concentration and retail interest rates (2002). Journal of Banking & Finance (44) RePEc:eee:jbfina:v:26:y:2002:i:2-3:p:423-444 Analyzing rating transitions and rating drift with continuous observations (2002). Journal of Banking & Finance (45) RePEc:eee:jbfina:v:18:y:1994:i:6:p:1155-1176 The overall gains from large bank mergers (1994). Journal of Banking & Finance (46) RePEc:eee:jbfina:v:22:y:1998:i:1:p:1-18 An analysis of competitive externalities in gross settlement systems (1998). Journal of Banking & Finance (47) RePEc:eee:jbfina:v:20:y:1996:i:9:p:1531-1558 The effect of mergers and acquisitions on the efficiency and profitability of EC credit institutions (1996). Journal of Banking & Finance (48) RePEc:eee:jbfina:v:27:y:2003:i:8:p:1539-1560 The fiscal cost implications of an accommodating approach to banking crises (2003). Journal of Banking & Finance (49) RePEc:eee:jbfina:v:24:y:2000:i:6:p:1045-1066 Competition, contestability and market structure in European banking sectors on the eve of EMU (2000). Journal of Banking & Finance (50) RePEc:eee:jbfina:v:25:y:2001:i:12:p:2305-2337 The patterns of cross-border bank mergers and shareholdings in OECD countries (2001). Journal of Banking & Finance Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:bon:bonedp:bgse27_2003 Cointegration and Regime-Switching Risk Premia in the U.S. Term Structure of Interest Rates (2003). University of Bonn, Germany / Bonn Econ Discussion Papers (2) RePEc:ces:ceswps:_1100 How Important are Foreign Banks in the Financial Development of European Transition Countries? (2003). CESifo GmbH / CESifo Working Paper Series (3) RePEc:ces:ceswps:_995 Macroeconomic Dynamics and Credit Risk: A Global Perspective (2003). CESifo GmbH / CESifo Working Paper Series (4) RePEc:chb:bcchwp:240 Banking Industry and Monetary Policy: an Overview (2003). Central Bank of Chile / Working Papers Central Bank of Chile (5) RePEc:chb:bcchwp:243 Modeling a Small Open Economy: The Case of Chile (2003). Central Bank of Chile / Working Papers Central Bank of Chile (6) RePEc:dgr:kubcen:2003102 Economic hedging portfolios (2003). Tilburg University, Center for Economic Research / Discussion Paper (7) RePEc:dgr:kubcen:200375 Country and consumer segmentation : multi-level latent class analysis of financial product ownership (2003). Tilburg University, Center for Economic Research / Discussion Paper (8) RePEc:dnb:staffs:109 Foreign Banks and Credit Stability in Central and Eastern Europe: A Panel Data Analysis (2003). Netherlands Central Bank / DNB Staff Reports (discontinued) (9) RePEc:fip:feddcl:0303 Financial liberalizaton, market discipline and bank risk (2003). Federal Reserve Bank of Dallas / Center for Latin America Working Papers (10) RePEc:fip:fedfap:2004-01 Does regional economic performance affect bank health? New analysis of an old question (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (11) RePEc:fip:fedgfe:2003-55 Central bank talk: does it matter and why? (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (12) RePEc:fip:fedlsp:2003-02 Discipline and liquidity in the market for federal funds (2003). Federal Reserve Bank of St. Louis / Supervisory Policy Analysis Working Papers (13) RePEc:fip:fedlwp:2003-032 The efficient market hypothesis and identification in structural VARs (2003). Federal Reserve Bank of St. Louis / Working Papers (14) RePEc:fip:fedlwp:2003-033 Testing the expectations hypothesis: some new evidence for Japan (2003). Federal Reserve Bank of St. Louis / Working Papers (15) RePEc:fip:fednsr:165 The execution of monetary policy: a tale of two central banks (2003). Federal Reserve Bank of New York / Staff Reports (16) RePEc:fip:fednsr:175 Cross-country differences in monetary policy execution and money market rates volatility (2003). Federal Reserve Bank of New York / Staff Reports (17) RePEc:rtv:ceisrp:24 The Italian Overnight Market: Microstructure Effects, the Martingale Hypothesis and the Payment System (2003). Tor Vergata University, CEIS / Research Paper Series (18) RePEc:sef:csefwp:93 Winner-Picking or Cross-Subsidization? The Strategic Impact of Resource Flexibility in Business Groups (2003). Centre for Studies in Economics and Finance (CSEF), University of Salerno, Italy / CSEF Working Papers (19) RePEc:uct:uconnp:2003-46 The Restructuring in the Post-Crisis Korean Economy (2003). University of Connecticut, Department of Economics / Working papers (20) RePEc:wai:econwp:03/01 Modelling the Yield Curve with Orthonomalised Laguerre Polynomials: An Intertemporally Consistent Approach with an Economic Interpretation (2003). University of Waikato, Department of Economics / Working Papers in Economics (21) RePEc:wbk:wbrwps:3173 Distributional Effects of Crises: The Role of Financial Transfers (2003). The World Bank / Policy Research Working Paper Series (22) RePEc:wdi:papers:2003-569 How Important is Ownership in a Market with Level Playing Field? The Indian Banking Sector Revisited (2003). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series Latest citations received in: 2002 (1) RePEc:bru:bruedp:02-29 On the dynamics of lending and deposit interest rates in emerging markets:a non-linear approach (2002). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:bru:bruppp:02-29 On the dynamics of lending and deposit interest rates in emerging markets:a non-linear approach (2002). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers (3) RePEc:dgr:uvatin:20020107 Pro-Cyclicality, Empirical Credit Cycles, and Capital Buffer Formation (2002). Tinbergen Institute / Tinbergen Institute Discussion Papers (4) RePEc:dnb:wormem:714 Credit Ratings of the Banking Sector (2002). Netherlands Central Bank, Research Department / WO Research Memoranda (discontinued) (5) RePEc:fip:fedawp:2002-18 Subordinated debt and prompt corrective regulatory action (2002). Federal Reserve Bank of Atlanta / Working Paper (6) RePEc:fip:fedawp:2002-31 The major supervisory initiatives post-FDICIA: Are they based on the goals of PCA? Should they be? (2002). Federal Reserve Bank of Atlanta / Working Paper (7) RePEc:fip:fedbcp:y:2002:x:4 Equity and bond market signals as leading indicators of bank fragility (2002). Conference Series ; [Proceedings] (8) RePEc:fip:fedbcp:y:2002:x:7 Internal ratings, the business cycle, and capital requirements: some evidence from an emerging market economy (2002). Conference Series ; [Proceedings] (9) RePEc:fip:fedgfe:2002-55 A risk-factor model foundation for ratings-based bank capital rules (2002). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (10) RePEc:fip:fedhwp:wp-02-25 Local market consolidation and bank productive efficiency (2002). Federal Reserve Bank of Chicago / Working Paper Series (11) RePEc:fip:fedkpw:psrwp02-02 Nonbanks in the payments system (2002). Federal Reserve Bank of Kansas City / Payments System Research Working Paper (12) RePEc:fra:franaf:97 Avoiding the rating bounce: Why rating agencies are slow to react to new information (2002). Goethe University Frankfurt am Main / Working Paper Series: Finance and Accounting (13) RePEc:una:unccee:wp0102 Stock Market Cycles and Stock Market Development in Spain (2002). School of Economics and Business Administration, University of Navarra / Faculty Working Papers (14) RePEc:upj:weupjo:02-79 A Spoonful of Sugar: Privatization and Popular Support for Reform in the Czech Republic (2002). W.E. Upjohn Institute for Employment Research / Staff Working Papers (15) RePEc:wop:pennin:02-02 Deposit Insurance and Risk Management of the U.S. Banking System: How Much? How Safe? Who Pays? (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (16) RePEc:wop:pennin:03-02 Risk Measurement, Risk Management and Capital Adequacy in Financial Conglomerates (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Latest citations received in: 2001 (1) RePEc:cbr:cbrwps:wp215 The Long-Run Performance of Hostile Takeovers: UK Evidence (2001). ESRC Centre for Business Research / ESRC Centre for Business Research - Working Papers (2) RePEc:cdl:anderf:1019 The Disposition Effect and Momentum (2001). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (3) RePEc:cpr:ceprdp:2681 The Geography of Equity Listing: Why Do Companies List Abroad? (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:cpr:ceprdp:2683 What Makes Stock Exchanges Succeed? Evidence from Cross-Listing Decisions (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:cpr:ceprdp:2762 New Extreme-Value Dependence Measures and Finance Applications (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:cpr:ceprdp:2813 Loss Aversion and Seller Behaviour: Evidence from the Housing Market (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (7) RePEc:dgr:kubcen:200148 The disciplining role of leverage in Dutch firms (2001). Tilburg University, Center for Economic Research / Discussion Paper (8) RePEc:dgr:uvatin:20010023 Tail Behavior of Credit Loss Distributions for General Latent Factor Models (2001). Tinbergen Institute / Tinbergen Institute Discussion Papers (9) RePEc:dgr:vuarem:2001-32 New economy, old central banks? Monetary transmission in a new economic environment (2001). Free University Amsterdam, Faculty of Economics, Business Administration and Econometrics / Serie Research Memoranda (10) RePEc:ebg:heccah:0719 New Extreme-Value Dependance Measures and Finance Applications (2001). Groupe HEC / Les Cahiers de Recherche (11) RePEc:ecb:ecbwps:20010076 Rating agency actions and the pricing of debt and equity of European banks: What can we infer about private sector monitoring of bank soundness? (2001). European Central Bank / Working Paper Series (12) RePEc:fip:fedawp:2001-13 Bank failures in banking panics: Risky banks or road kill? (2001). Federal Reserve Bank of Atlanta / Working Paper (13) RePEc:fip:fedawp:2001-25 Measures of the riskiness of banking organizations: Subordinated debt yields, risk-based capital, and examination ratings (2001). Federal Reserve Bank of Atlanta / Working Paper (14) RePEc:fip:fedfpb:01-07 The impact of Japans financial stabilization laws on bank equity values (2001). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (15) RePEc:fip:fedgfe:2001-34 The ability of banks to lend to informationally opaque small businesses (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (16) RePEc:fip:fedgfe:2001-36 Small business credit availability and relationship lending: the importance of bank organizational structure (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (17) RePEc:fip:fedgfe:2001-42 The effect of monetary policy on monthly and quarterly stock market returns: cross-country evidence and sensitivity analyses (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (18) RePEc:fip:fedgfe:2001-48 Capital requirements, business loans, and business cycles: an empirical analysis of the standardized approach in the new Basel Capital Accord (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (19) RePEc:fip:fedgfe:2001-63 The effect of market size structure on competition: the case of small business lending (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (20) RePEc:fip:fedhep:y:2001:i:qi:p:24-45:n:v.25no.1 Market discipline and subordinated debt: a review of some salient issues (2001). Economic Perspectives (21) RePEc:fip:fedhwp:wp-01-10 The effect of market size structure on competition: the case of small business lending (2001). Federal Reserve Bank of Chicago / Working Paper Series (22) RePEc:hhs:iuiwop:0567 The Impact of Foreign Board Membership on Firm Value (2001). The Research Institute of Industrial Economics / IUI Working Paper Series (23) RePEc:hit:hitcei:2001-16 Institutional Herding, Business Groups, and Economic Regimes: Evidence from Japan (2001). Institute of Economic Research, Hitotsubashi University / Working Paper Series (24) RePEc:phd:dpaper:pascn_dp_2001-08 The Impact of Liberalization of Foreign Bank Entry on the Philippine Domestic Banking Market (2001). Philippine Institute for Development Studies / Discussion Papers (25) RePEc:rif:dpaper:774 Financial Systems and Venture Capital in Nordic Countries: A comparative Study (2001). The Research Institute of the Finnish Economy / Discussion Papers (26) RePEc:rif:dpaper:776 Preventing Systemic Crises through Bank Transparency (2001). The Research Institute of the Finnish Economy / Discussion Papers (27) RePEc:rut:rutres:200117 Do Bankers Sacrifice Value to Build Empires? Managerial Incentives, Industry Consolidation, and Financial Performance (2001). Rutgers University, Department of Economics / Departmental Working Papers (28) RePEc:tky:fseres:2001cf130 Can the Financial Restraint Hypothesis Explain Japans Postwar Experience? (2001). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series (29) RePEc:wbk:wbrwps:2716 Does Foreign Bank Penetration Reduce Access to Credit in Developing Countries? Evidence from Asking Borrowers (2001). The World Bank / Policy Research Working Paper Series (30) RePEc:wbk:wbrwps:2751 Contractual savings institutions and banks stability and efficiency (2001). The World Bank / Policy Research Working Paper Series (31) RePEc:wop:pennin:01-04 Do Financial Institutions Matter? (2001). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Latest citations received in: 2000 (1) RePEc:apr:aprewp:wp0005 Using Stratified Sampling Methods To Improve Percentile Estimates In The Context of Risk Measurement (2000). Australian Prudential Regulation Authority / Working Papers (2) RePEc:bon:bonedp:bgse15_2001 A Libor Market Model with Default Risk (2000). University of Bonn, Germany / Bonn Econ Discussion Papers (3) RePEc:cam:camdae:0028 The Transparency and Accountability of UK Debt Management: A Proposal (2000). Faculty of Economics (formerly DAE), University of Cambridge / Cambridge Working Papers in Economics (4) RePEc:ces:ceswps:_263 An Empirical Investigation into Exchange Rate Regime Choice and Exchange Rate Volatility (2000). CESifo GmbH / CESifo Working Paper Series (5) RePEc:ces:ceswps:_274 Agency Cost of Debt and Lending Market Competition: Is there a Relationship? (2000). CESifo GmbH / CESifo Working Paper Series (6) RePEc:dgr:kubcen:200087 The impact of bank consolidation on commercial borrower welfare (2000). Tilburg University, Center for Economic Research / Discussion Paper (7) RePEc:dnb:ressup:27 Measures of competition and concentration in the banking industry: a review of the literature (2000). Netherlands Central Bank, Directorate Supervision / Research Series Supervision (discontinued) (8) RePEc:ema:worpap:2000-51 An Empirical Estimation in Credit Spread Indices (2000). THEMA / Working papers (9) RePEc:fep:journl:v:13:y:2000:i:1:p:3-18 Bank mergers and the fragility of loan markets (2000). Finnish Economic Papers (10) RePEc:fip:fedawp:2000-18 Bank capital structure, regulatory capital, and securities innovations (2000). Federal Reserve Bank of Atlanta / Working Paper (11) RePEc:fip:fedawp:2000-24 Subordinated debt and bank capital reform (2000). Federal Reserve Bank of Atlanta / Working Paper (12) RePEc:fip:fedawp:2000-25 Managing the risk of loans with basis risk: sell, hedge, or do nothing? (2000). Federal Reserve Bank of Atlanta / Working Paper (13) RePEc:fip:fedgfe:2000-18 Dimensions of credit risk and their relationship to economic capital requirements (2000). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (14) RePEc:fip:fedgfe:2000-36 The integration of the financial services industry: where are the efficiencies? (2000). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (15) RePEc:fip:fedgfe:2000-47 Parameterizing credit risk models with rating data (2000). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (16) RePEc:fip:fedgif:679 The impact of bank consolidation on commercial borrower welfare (2000). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (17) RePEc:fip:fedhep:y:2000:i:qii:p:40-53:n:v.25no.2 Subordinated debt as bank capital: a proposal for regulatory reform (2000). Economic Perspectives (18) RePEc:fip:fedhwp:wp-00-10 Bank capital regulation with and without state-contingent penalties (2000). Federal Reserve Bank of Chicago / Working Paper Series (19) RePEc:fip:fedhwp:wp-00-7 Subordinated debt and bank capital reform (2000). Federal Reserve Bank of Chicago / Working Paper Series (20) RePEc:fip:fednci:y:2000:i:aug:n:v.6no.9 Explaining the rising concentration of banking assets in the 1990s (2000). Current Issues in Economics and Finance (21) RePEc:fra:franaf:62 Einfache ökonometrische Verfahren für die Kreditrisikomessung: Verweildauermodelle (2000). Goethe University Frankfurt am Main / Working Paper Series: Finance and Accounting (22) RePEc:hhs:bofitp:2000_007 Development and Efficiency of the Banking Sector in a Transitional Economy: Hungarian Experience (2000). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (23) RePEc:kie:kieliw:1004 Financial Market Integration in the US: Lessons for Europe? (2000). Kiel Institute for World Economics / Working Papers (24) RePEc:knz:cofedp:0028 Einfache oekonomische Verfahren fuer die Kreditrisikomessung (2000). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (25) RePEc:nbr:nberwo:7629 Dimensions of Credit Risk and Their Relationship to Economic Capital Requirements (2000). National Bureau of Economic Research, Inc / NBER Working Papers (26) RePEc:rtv:ceiswp:132 BANKRUPTCY RISK AND PRODUCTIVE EFFICIENCY BANKRUPTCY RISK AND PRODUCTIVE EFFICIENCY IN MANUFACTURING FIRMS (2000). Tor Vergata University, CEIS / Departmental Working Papers (27) RePEc:wop:pennin:00-26 Ratings Migration and the Business Cycle, With Application to Credit Portfolio Stress Testing (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (28) RePEc:wop:pennin:00-38 Optimal Bank Regulation and Monetary Policy (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (29) RePEc:wop:pennin:03-13 Macroeconomic Dynamics and Credit Risk: A Global Perspective (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (30) RePEc:wop:pennin:03-14 The New Basel Capital Accord and Questions for Research (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (31) RePEc:wvu:wpaper:04-12 Optimal Transaction Filters under Transitory Trading Opportunities: Theory and Empirical Illustration (2000). Department of Economics, West Virginia University / Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |