|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

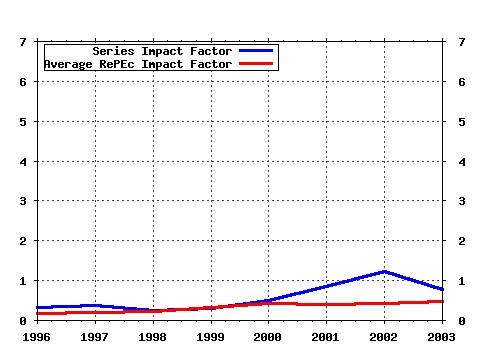

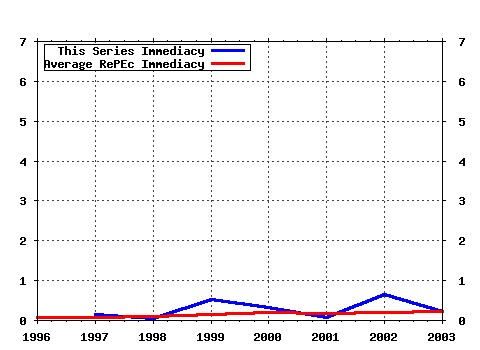

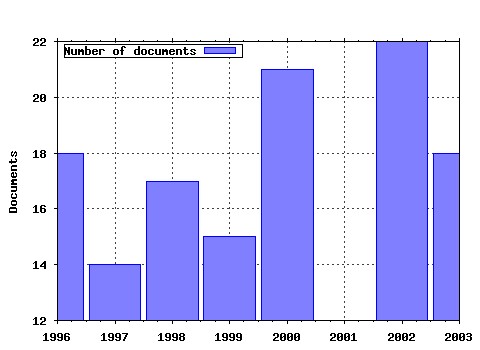

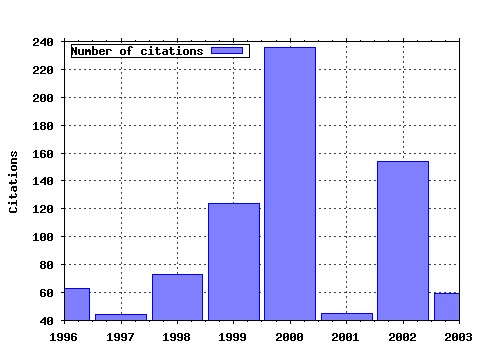

Journal of Financial Intermediation Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jfinin:v:3:y:1993:i:1:p:2-50 Contemporary Banking Theory (1993). Journal of Financial Intermediation (2) RePEc:eee:jfinin:v:9:y:2000:i:1:p:7-25 Relationship Banking: What Do We Know? (2000). Journal of Financial Intermediation (3) RePEc:eee:jfinin:v:11:y:2002:i:4:p:398-428 Bank-Based or Market-Based Financial Systems: Which Is Better? (2002). Journal of Financial Intermediation (4) RePEc:eee:jfinin:v:9:y:2000:i:1:p:3-5 Relationship Banking (2000). Journal of Financial Intermediation (5) RePEc:eee:jfinin:v:8:y:1999:i:1-2:p:8-35 Law, Finance, and Economic Growth (1999). Journal of Financial Intermediation (6) RePEc:eee:jfinin:v:9:y:2000:i:1:p:90-109 Relationship Lending within a Bank-Based System: Evidence from European Small Business Data (2000). Journal of Financial Intermediation (7) RePEc:eee:jfinin:v:4:y:1995:i:4:p:328-357 Proprietary Information, Financial Intermediation, and Research Incentives (1995). Journal of Financial Intermediation (8) RePEc:eee:jfinin:v:9:y:2000:i:1:p:26-56 What Determines the Number of Bank Relationships? Cross-Country Evidence (2000). Journal of Financial Intermediation (9) RePEc:eee:jfinin:v:4:y:1995:i:1:p:3-20 Information Disclosure Costs and the Choice of Financing Source (1995). Journal of Financial Intermediation (10) RePEc:eee:jfinin:v:7:y:1998:i:4:p:359-392 The Winners Curse in Banking (1998). Journal of Financial Intermediation (11) RePEc:eee:jfinin:v:13:y:2004:i:2:p:205-248 Bank regulation and supervision: what works best? (2004). Journal of Financial Intermediation (12) RePEc:eee:jfinin:v:1:y:1990:i:1:p:3-30 The market for information and the origin of financial intermediation (1990). Journal of Financial Intermediation (13) RePEc:eee:jfinin:v:13:y:2004:i:4:p:414-435 House prices, consumption, and monetary policy: a financial accelerator approach (2004). Journal of Financial Intermediation (14) RePEc:eee:jfinin:v:11:y:2002:i:2:p:124-151 Switching from Single to Multiple Bank Lending Relationships: Determinants and Implications (2002). Journal of Financial Intermediation (15) RePEc:eee:jfinin:v:8:y:1999:i:1-2:p:68-89 Diversity of Opinion and Financing of New Technologies (1999). Journal of Financial Intermediation (16) RePEc:eee:jfinin:v:3:y:1994:i:3:p:272-299 A Positive Analysis of Bank Closure (1994). Journal of Financial Intermediation (17) RePEc:eee:jfinin:v:5:y:1996:i:2:p:160-183 The Regulation of Bank Capital: Do Capital Standards Promote Bank Safety? (1996). Journal of Financial Intermediation (18) RePEc:eee:jfinin:v:9:y:2000:i:4:p:404-426 Syndicated Loans (2000). Journal of Financial Intermediation (19) RePEc:eee:jfinin:v:1:y:1991:i:3:p:257-278 Agency costs among savings and loans (1991). Journal of Financial Intermediation (20) RePEc:eee:jfinin:v:2:y:1992:i:2:p:95-133 Debt covenants and renegotiation (1992). Journal of Financial Intermediation (21) RePEc:eee:jfinin:v:2:y:1992:i:2:p:134-167 Laissez-faire banking and circulating media of exchange (1992). Journal of Financial Intermediation (22) RePEc:eee:jfinin:v:14:y:2005:i:1:p:32-57 Empirical determinants of relationship lending (2005). Journal of Financial Intermediation (23) RePEc:eee:jfinin:v:10:y:2001:i:3-4:p:209-248 Who Disciplines Management in Poorly Performing Companies? (2001). Journal of Financial Intermediation (24) RePEc:eee:jfinin:v:13:y:2004:i:4:p:496-521 Loan pricing under Basel capital requirements (2004). Journal of Financial Intermediation (25) RePEc:eee:jfinin:v:9:y:2000:i:1:p:57-89 The Importance of Bank Seniority for Relationship Lending (2000). Journal of Financial Intermediation (26) RePEc:eee:jfinin:v:5:y:1996:i:2:p:184-216 Competition for Deposits, Fragility, and Insurance (1996). Journal of Financial Intermediation (27) RePEc:eee:jfinin:v:8:y:1999:i:1-2:p:36-67 Disintermediation and the Role of Banks in Europe: An International Comparison (1999). Journal of Financial Intermediation (28) RePEc:eee:jfinin:v:12:y:2003:i:4:p:300-330 Bank bailouts: moral hazard vs. value effect (2003). Journal of Financial Intermediation (29) RePEc:eee:jfinin:v:13:y:2004:i:4:p:436-457 Does bank capital affect lending behavior? (2004). Journal of Financial Intermediation (30) RePEc:eee:jfinin:v:11:y:2002:i:1:p:61-86 Information Externalities and the Role of Underwriters in Primary Equity Markets (2002). Journal of Financial Intermediation (31) RePEc:eee:jfinin:v:11:y:2002:i:2:p:176-211 Internal Capital Markets and Corporate Refocusing (2002). Journal of Financial Intermediation (32) RePEc:eee:jfinin:v:12:y:2003:i:3:p:199-232 A risk-factor model foundation for ratings-based bank capital rules (2003). Journal of Financial Intermediation (33) RePEc:eee:jfinin:v:11:y:2002:i:4:p:366-397 Banks as Catalysts for Industrialization (2002). Journal of Financial Intermediation (34) RePEc:eee:jfinin:v:12:y:2003:i:1:p:57-95 Explaining the dramatic changes in performance of US banks: technological change, deregulation, and dynamic changes in competition (2003). Journal of Financial Intermediation (35) RePEc:eee:jfinin:v:4:y:1995:i:3:p:189-212 The Simple Analytics of Observed Discrimination in Credit Markets (1995). Journal of Financial Intermediation (36) RePEc:eee:jfinin:v:4:y:1995:i:2:p:158-187 Delegated Monitoring and Bank Structure in a Finite Economy (1995). Journal of Financial Intermediation (37) RePEc:eee:jfinin:v:9:y:2000:i:3:p:240-273 Market Discipline and Incentive Problems in Conglomerate Firms with Applications to Banking (2000). Journal of Financial Intermediation (38) RePEc:eee:jfinin:v:13:y:2004:i:2:p:156-182 Capital requirements, market power, and risk-taking in banking (2004). Journal of Financial Intermediation (39) RePEc:eee:jfinin:v:1:y:1990:i:2:p:105-124 Dual-capacity trading and the quality of the market (1990). Journal of Financial Intermediation (40) RePEc:eee:jfinin:v:12:y:2003:i:2:p:178-197 Loan loss provisioning and economic slowdowns: too much, too late? (2003). Journal of Financial Intermediation (41) RePEc:eee:jfinin:v:4:y:1995:i:4:p:305-327 Banks, Payments, and Coordination (1995). Journal of Financial Intermediation (42) RePEc:eee:jfinin:v:7:y:1998:i:1:p:3-31 Contagion and Efficiency in Gross and Net Interbank Payment Systems (1998). Journal of Financial Intermediation (43) RePEc:eee:jfinin:v:10:y:2001:i:1:p:1-27 Bad Debts and the Cleaning of Banks Balance Sheets: An Application to Transition Economies (2001). Journal of Financial Intermediation (44) RePEc:eee:jfinin:v:2:y:1992:i:3:p:255-276 An incentive-based theory of bank regulation (1992). Journal of Financial Intermediation (45) RePEc:eee:jfinin:v:5:y:1996:i:3:p:225-254 Optimal Transparency in a Dealer Market with an Application to Foreign Exchange (1996). Journal of Financial Intermediation (46) RePEc:eee:jfinin:v:11:y:2002:i:1:p:9-36 IPO Auctions: English, Dutch, ... French, and Internet (2002). Journal of Financial Intermediation (47) RePEc:eee:jfinin:v:8:y:1999:i:4:p:317-352 The Impact of Capital-Based Regulation on Bank Risk-Taking (1999). Journal of Financial Intermediation (48) RePEc:eee:jfinin:v:3:y:1993:i:1:p:77-103 Borrowing Constraints, Household Debt, and Racial Discrimination in Loan Markets (1993). Journal of Financial Intermediation (49) RePEc:eee:jfinin:v:4:y:1995:i:1:p:77-93 Dual Trading: Winners, Losers, and Market Impact (1995). Journal of Financial Intermediation (50) RePEc:eee:jfinin:v:13:y:2004:i:2:p:265-283 The empirical relationship between average asset correlation, firm probability of default, and asset size (2004). Journal of Financial Intermediation Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:dgr:kubcen:2003123 Distance, lending relationships, and competition (2003). Tilburg University, Center for Economic Research / Discussion Paper (2) RePEc:fip:fedgfe:2003-35 Nationwide branching and its impact on market structure, quality and bank performance (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (3) RePEc:fip:fedlwp:2003-037 Robust nonparametric estimation of efficiency and technical change in U.S. commercial banking (2003). Federal Reserve Bank of St. Louis / Working Papers (4) RePEc:fip:fedpwp:03-13 Applying efficiency measurement techniques to central banks (2003). Federal Reserve Bank of Philadelphia / Working Papers Latest citations received in: 2002 (1) RePEc:aea:jecper:v:16:y:2002:i:1:p:77-100 The Great Divide and Beyond: Financial Architecture in Transition (2002). Journal of Economic Perspectives (2) RePEc:boc:bocoec:537 Credit Constraints in Latin America: An Overview of the Micro Evidence (2002). Boston College Department of Economics / Boston College Working Papers in Economics (3) RePEc:chb:bcchwp:157 Finance and Growth: New Evidence and Policy Analyses for Chile (2002). Central Bank of Chile / Working Papers Central Bank of Chile (4) RePEc:cpr:ceprdp:3314 IPO Pricing in the dot-com Bubble (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:cpr:ceprdp:3369 Strategic Liquidity Supply and Security Design (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:dgr:kubcen:2002101 The rise and fall of the European new markets : on the short and long-run performance of high-tech initial public offerings (2002). Tilburg University, Center for Economic Research / Discussion Paper (7) RePEc:eab:financ:385 The Compatibility of Capital Controls and Financial Development: A Selective Survey and Empirical Evidence (2002). East Asian Bureau of Economic Research / Finance Working Papers (8) RePEc:edj:ceauch:141 Corporate Diversification: Good for Some Bad for Others (2002). Centro de Economía Aplicada, Universidad de Chile / Documentos de Trabajo (9) RePEc:nbr:nberwo:8982 Industry Growth and Capital Allocation: Does Having a Market- or Bank-Based System Matter? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:ore:uoecwp:2003-6 Bank-based versus Market-based Financial Systems: A Growth-theoretic Analysis (2002). University of Oregon Economics Department / University of Oregon Economics Department Working Papers (11) RePEc:sbs:wpsefe:2002fe06 Evidence of Information Spillovers in the Production of Investment Banking Services (2002). Oxford Financial Research Centre / OFRC Working Papers Series (12) RePEc:sbs:wpsefe:2002fe07 IPO Pricing in the Dot-com Bubble (2002). Oxford Financial Research Centre / OFRC Working Papers Series (13) RePEc:taf:ijecbs:v:9:y:2002:i:3:p:401-417 Bank-Firm Relationships and International Banking Markets (2002). International Journal of the Economics of Business (14) RePEc:wpa:wuwpga:0210003 Tilting the Supply Schedule to Enhance Competition in Uniform- Price Auctions (2002). EconWPA / Game Theory and Information Latest citations received in: 2001 (1) RePEc:cwl:cwldpp:1307 On the Evolution of Overconfidence and Entrepreneurs (2001). Cowles Foundation, Yale University / Cowles Foundation Discussion Papers Latest citations received in: 2000 (1) RePEc:ces:ceswps:_274 Agency Cost of Debt and Lending Market Competition: Is there a Relationship? (2000). CESifo GmbH / CESifo Working Paper Series (2) RePEc:cpr:ceprdp:2540 Collateral, Default Risk, and Relationship Lending: An Empirical Study on Financial Contracting (2000). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:dgr:kubcen:200014 Bank relationships and firm profitability (2000). Tilburg University, Center for Economic Research / Discussion Paper (4) RePEc:fip:fedcwp:0013 Relationship loans and information exploitability in a competitive market: loan commitments vs. spot loans (2000). Federal Reserve Bank of Cleveland / Working Paper (5) RePEc:fip:fedgfe:2000-36 The integration of the financial services industry: where are the efficiencies? (2000). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (6) RePEc:sbs:wpsefe:2000fe07 Regulator Reputation and Optimal Banking Competition Policy (2000). Oxford Financial Research Centre / OFRC Working Papers Series (7) RePEc:wop:pennin:00-13 Relationship Banking and Competition under Differentiated Asymmetric Information (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |