|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

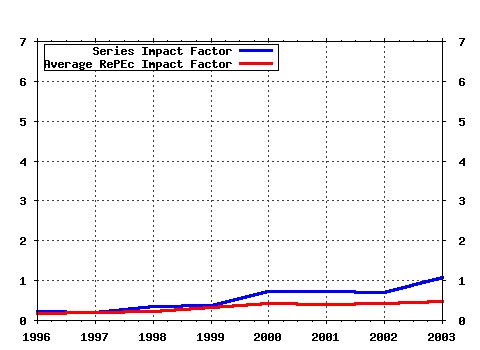

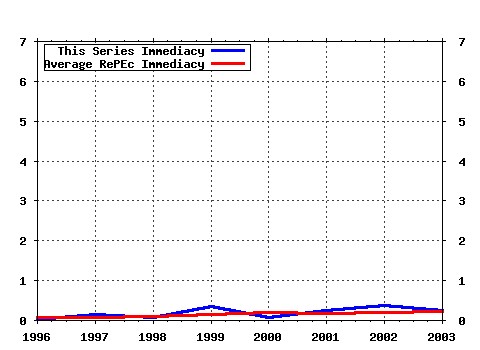

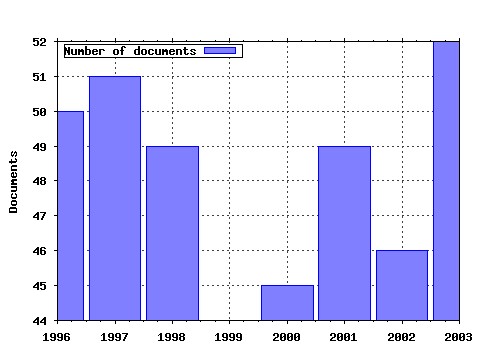

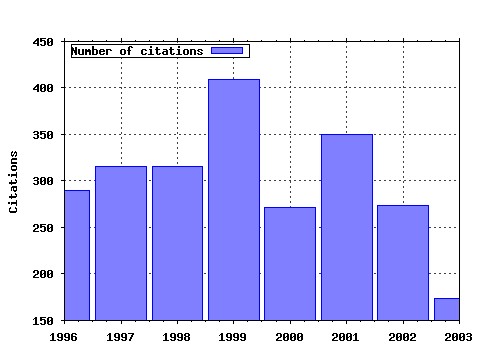

Journal of International Money and Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jimfin:v:14:y:1995:i:4:p:467-492 Home bias and high turnover (1995). Journal of International Money and Finance (2) RePEc:eee:jimfin:v:11:y:1992:i:3:p:304-314 The use of technical analysis in the foreign exchange market (1992). Journal of International Money and Finance (3) RePEc:eee:jimfin:v:18:y:1999:i:4:p:603-617 Contagion and trade: Why are currency crises regional? (1999). Journal of International Money and Finance (4) RePEc:eee:jimfin:v:20:y:2001:i:2:p:249-272 Unit root tests for panel data (2001). Journal of International Money and Finance (5) RePEc:eee:jimfin:v:20:y:2001:i:3:p:379-399 Nonlinear adjustment to purchasing power parity in the post-Bretton Woods era (2001). Journal of International Money and Finance (6) RePEc:eee:jimfin:v:21:y:2002:i:6:p:749-776 International financial integration and economic growth (2002). Journal of International Money and Finance (7) RePEc:eee:jimfin:v:18:y:1999:i:4:p:537-560 What triggers market jitters?: A chronicle of the Asian crisis (1999). Journal of International Money and Finance (8) RePEc:eee:jimfin:v:19:y:2000:i:1:p:33-53 Nonlinear adjustment, long-run equilibrium and exchange rate fundamentals (2000). Journal of International Money and Finance (9) RePEc:eee:jimfin:v:15:y:1996:i:3:p:405-418 Purchasing power parity and unit root tests using panel data (1996). Journal of International Money and Finance (10) RePEc:eee:jimfin:v:10:y:1991:i:4:p:571-581 Cointegration: how short is the long run? (1991). Journal of International Money and Finance (11) RePEc:eee:jimfin:v:12:y:1993:i:4:p:413-438 A geographical model for the daily and weekly seasonal volatility in the foreign exchange market (1993). Journal of International Money and Finance (12) RePEc:eee:jimfin:v:20:y:2001:i:4:p:439-471 Currency traders and exchange rate dynamics: a survey of the US market (2001). Journal of International Money and Finance (13) RePEc:eee:jimfin:v:17:y:1998:i:1:p:161-190 Central bank intervention and exchange rate volatility1 (1998). Journal of International Money and Finance (14) RePEc:eee:jimfin:v:16:y:1997:i:6:p:945-954 Real exchange rate behavior (1997). Journal of International Money and Finance (15) RePEc:eee:jimfin:v:24:y:2005:i:8:p:1177-1199 Some contagion, some interdependence: More pitfalls in tests of financial contagion (2005). Journal of International Money and Finance (16) RePEc:eee:jimfin:v:13:y:1994:i:3:p:276-290 The monetary model of the exchange rate: long-run relationships, short-run dynamics and how to beat a random walk (1994). Journal of International Money and Finance (17) RePEc:eee:jimfin:v:21:y:2002:i:6:p:725-748 A century of current account dynamics (2002). Journal of International Money and Finance (18) RePEc:eee:jimfin:v:18:y:1999:i:4:p:709-723 Lessons from the Asian crisis (1999). Journal of International Money and Finance (19) RePEc:eee:jimfin:v:15:y:1996:i:6:p:853-878 Central bank intervention and the volatility of foreign exchange rates: evidence from the options market (1996). Journal of International Money and Finance (20) RePEc:eee:jimfin:v:16:y:1997:i:1:p:19-35 Multi-country evidence on the behavior of purchasing power parity under the current float (1997). Journal of International Money and Finance (21) RePEc:eee:jimfin:v:16:y:1997:i:6:p:909-919 Why do central banks intervene? (1997). Journal of International Money and Finance (22) RePEc:eee:jimfin:v:2:y:1983:i:3:p:231-237 Foreign currency option values (1983). Journal of International Money and Finance (23) RePEc:eee:jimfin:v:24:y:2005:i:7:p:1150-1175 Empirical exchange rate models of the nineties: Are any fit to survive? (2005). Journal of International Money and Finance (24) RePEc:eee:jimfin:v:12:y:1993:i:1:p:29-45 Exchange rate exposure and industry characteristics: evidence from Canada, Japan, and the USA (1993). Journal of International Money and Finance (25) RePEc:eee:jimfin:v:20:y:2001:i:6:p:895-948 The microstructure of the euro money market (2001). Journal of International Money and Finance (26) RePEc:eee:jimfin:v:16:y:1997:i:5:p:779-793 Intervention strategies and exchange rate volatility: a noise trading perspective (1997). Journal of International Money and Finance (27) RePEc:eee:jimfin:v:19:y:2000:i:4:p:471-488 The forward premium anomaly is not as bad as you think (2000). Journal of International Money and Finance (28) RePEc:eee:jimfin:v:16:y:1997:i:2:p:305-321 The term structure of Euro-rates: some evidence in support of the expectations hypothesis (1997). Journal of International Money and Finance (29) RePEc:eee:jimfin:v:21:y:2002:i:3:p:295-350 The dynamics of emerging market equity flows (2002). Journal of International Money and Finance (30) RePEc:eee:jimfin:v:3:y:1984:i:1:p:5-29 An investigation of risk and return in forward foreign exchange (1984). Journal of International Money and Finance (31) RePEc:eee:jimfin:v:14:y:1995:i:2:p:289-310 Markup adjustment and exchange rate fluctuations: evidence from panel data on automobile exports (1995). Journal of International Money and Finance (32) RePEc:eee:jimfin:v:15:y:1996:i:4:p:535-550 Mean reversion in real exchange rates: evidence and implications for forecasting (1996). Journal of International Money and Finance (33) RePEc:eee:jimfin:v:12:y:1993:i:2:p:115-138 On biases in the measurement of foreign exchange risk premiums (1993). Journal of International Money and Finance (34) RePEc:eee:jimfin:v:18:y:1999:i:4:p:587-602 Contagion:: macroeconomic models with multiple equilibria (1999). Journal of International Money and Finance (35) RePEc:eee:jimfin:v:18:y:1999:i:4:p:561-586 Predicting currency crises:: The indicators approach and an alternative (1999). Journal of International Money and Finance (36) RePEc:eee:jimfin:v:3:y:1984:i:3:p:327-342 Capital mobility and the relationship between saving and investment rates in OECD countries (1984). Journal of International Money and Finance (37) RePEc:eee:jimfin:v:17:y:1998:i:4:p:671-689 On inflation and inflation uncertainty in the G7 countries (1998). Journal of International Money and Finance (38) RePEc:eee:jimfin:v:17:y:1998:i:1:p:41-50 Increasing evidence of purchasing power parity over the current float (1998). Journal of International Money and Finance (39) RePEc:eee:jimfin:v:12:y:1993:i:3:p:298-318 The impact of exchange rate volatility on international trade: Reduced form estimates using the GARCH-in-mean model (1993). Journal of International Money and Finance (40) RePEc:eee:jimfin:v:19:y:2000:i:6:p:813-832 The determinants of bank interest rate margins: an international study (2000). Journal of International Money and Finance (41) RePEc:eee:jimfin:v:13:y:1994:i:5:p:565-571 The long memory of the forward premium (1994). Journal of International Money and Finance (42) RePEc:eee:jimfin:v:11:y:1992:i:1:p:3-16 Realistic cross-country consumption correlations in a two-country, equilibrium, business cycle model (1992). Journal of International Money and Finance (43) RePEc:eee:jimfin:v:12:y:1993:i:5:p:451-474 The significance of technical trading-rule profits in the foreign exchange market: a bootstrap approach (1993). Journal of International Money and Finance (44) RePEc:eee:jimfin:v:10:y:1991:i:2:p:292-307 Exchange rate volatility and international trading strategy (1991). Journal of International Money and Finance (45) RePEc:eee:jimfin:v:17:y:1998:i:4:p:597-614 Parity reversion in real exchange rates during the post-Bretton Woods period (1998). Journal of International Money and Finance (46) RePEc:eee:jimfin:v:16:y:1997:i:1:p:1-17 Understanding the empirical literature on purchasing power parity: the post-Bretton Woods era (1997). Journal of International Money and Finance (47) RePEc:eee:jimfin:v:13:y:1994:i:1:p:3-25 Hourly volatility spillovers between international equity markets (1994). Journal of International Money and Finance (48) RePEc:eee:jimfin:v:18:y:1999:i:1:p:27-45 Modeling non-linearities in real effective exchange rates (1999). Journal of International Money and Finance (49) RePEc:eee:jimfin:v:24:y:2005:i:3:p:481-507 Simple monetary policy rules and exchange rate uncertainty (2005). Journal of International Money and Finance (50) RePEc:eee:jimfin:v:1:y:1982:i::p:39-56 Fluctuations in the dollar: A model of nominal and real exchange rate determination (1982). Journal of International Money and Finance Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:bca:bocawp:03-35 Real Exchange Rate Persistence in Dynamic General-Equilibrium Sticky-Price Models: An Analytical Characterization (2003). Bank of Canada / Working Papers (2) RePEc:chb:bcchwp:237 The Role of Credibility in the Cyclical Properties of Macroeconomic Policies in Emerging Economies (2003). Central Bank of Chile / Working Papers Central Bank of Chile (3) RePEc:dnb:wormem:741 Shortfall allowed: loss aversion and habit formation (2003). Netherlands Central Bank, Research Department / WO Research Memoranda (discontinued) (4) RePEc:epr:enepwp:wp021 Fiscal Policy in the New Open Economy. Macroeconomics and Prospects for Fiscal Policy Coordination. (2003). European Network of Economic Policy Research Institutes / Economics Working Papers (5) RePEc:fip:fedcwp:0315 Government intervention in the foreign exchange market (2003). Federal Reserve Bank of Cleveland / Working Paper (6) RePEc:hhb:aarfin:2003_008 Volatility-Spillover E ffects in European Bond Markets (2003). Aarhus School of Business, Department of Finance / Working Papers (7) RePEc:nbr:nberwo:10036 Currency Mismatches, Debt Intolerance and Original Sin: Why They Are Not the Same and Why it Matters (2003). National Bureau of Economic Research, Inc / NBER Working Papers (8) RePEc:ssa:lemwps:2003/07 Graphical Models for Structural Vector Autoregressions (2003). Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy / LEM Papers Series (9) RePEc:taf:apeclt:v:10:y:2003:i:9:p:527-533 Financial crisis and African stock market integration (2003). Applied Economics Letters (10) RePEc:tcd:tcduee:20039 Public Spending Management and Macroeconomic Interdependence (2003). Trinity College Dublin, Department of Economics / Trinity Economics Papers (11) RePEc:wiw:wiwrsa:ersa03p273 Evidence on the Purchasing Power Parity in Panel of Cities (2003). European Regional Science Association / ERSA conference papers (12) RePEc:wpa:wuwpif:0311014 Exchange Rate Relative Price Relationship: Nonlinear Evidence from Malaysia (2003). EconWPA / International Finance (13) RePEc:wpa:wuwpif:0312001 Exchange Rate Relative Price Relationship: Nonlinear Evidence from Malaysia (2003). EconWPA / International Finance Latest citations received in: 2002 (1) RePEc:clu:wpaper:0102-42 Income inequality: The aftermath of stock market liberalization in emerging markets (2002). Columbia University, Department of Economics / Discussion Papers (2) RePEc:dnb:wormem:716 External Wealth and the Trade Balance: A Time-Series Analysis for the Netherlands (2002). Netherlands Central Bank, Research Department / WO Research Memoranda (discontinued) (3) RePEc:eab:financ:385 The Compatibility of Capital Controls and Financial Development: A Selective Survey and Empirical Evidence (2002). East Asian Bureau of Economic Research / Finance Working Papers (4) RePEc:fip:fedgif:722 Financial centers and the geography of capital flows (2002). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (5) RePEc:hhs:bofitp:2002_014 Do efficient banking sectors accelerate economic growth in transition countries (2002). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (6) RePEc:hhs:hastef:0513 International Financial Liberalization and Industry Growth (2002). Stockholm School of Economics / Working Paper Series in Economics and Finance (7) RePEc:hhs:iuiwop:0586 International Financial Liberalization and Industry Growth (2002). The Research Institute of Industrial Economics / IUI Working Paper Series (8) RePEc:lsu:lsuwpp:2002-01 Macroeconomic Stabilization and Economic Growth: Analysis of Reform Policies in Tanzania (2002). Department of Economics, Louisiana State University / Departmental Working Papers (9) RePEc:nbr:nberwo:8959 Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange (2002). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:nbr:nberwo:8994 Are Financial Assets Priced Locally or Globally? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (11) RePEc:nbr:nberwo:9000 Daily Cross-Border Equity Flows: Pushed or Pulled? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:nbr:nberwo:9398 Exchange Rate, Equity Prices and Capital Flows (2002). National Bureau of Economic Research, Inc / NBER Working Papers (13) RePEc:taf:intecj:v:16:y:2002:i:1:p:21-42 ASYMMETRY IN ECONOMIC FLUCTUATIONS IN THE US ECONOMY: THE PRE-WAR AND THE 1946--1991 PREIODS COMPARED (2002). International Economic Journal (14) RePEc:tcb:dpaper:0206 Is there Room for Forex Interventions under Inflation Targeting Framework? Evidence from Mexico and Turkey (2002). Research and Monetary Policy Department, Central Bank of the Republic of Turkey / Discussion Papers (15) RePEc:una:unccee:wp0102 Stock Market Cycles and Stock Market Development in Spain (2002). School of Economics and Business Administration, University of Navarra / Faculty Working Papers (16) RePEc:wfo:wpaper:y:2002:i:187 The Politics of Financial Development. The Case of Austria (2002). WIFO / WIFO Working Papers (17) RePEc:wpa:wuwpma:0212013 Do efficient banking sectors accelerate economic growth in transition countries? (2002). EconWPA / Macroeconomics Latest citations received in: 2001 (1) RePEc:aea:aecrev:v:91:y:2001:i:2:p:391-395 Exchange-Rate Hedging: Financial versus Operational Strategies (2001). American Economic Review (2) RePEc:bde:wpaper:0105 Why Did the Banks Overbid? An Empirical Model of the Fixed Rate Tenders of the European Central Bank. (2001). Banco de Espana / Banco de Espana Working Papers (3) RePEc:boc:bocoec:518 A New Look at Panel Testing of Stationarity and the PPP Hypothesis (2001). Boston College Department of Economics / Boston College Working Papers in Economics (4) RePEc:boc:bocoec:519 A PANIC Attack on Unit Roots and Cointegration (2001). Boston College Department of Economics / Boston College Working Papers in Economics (5) RePEc:cns:cnscwp:200110 Evaluating non-linear models on point and interval forecasts: an application with exchange rate returns (2001). Centre for North South Economic Research, University of Cagliari and Sassari, Sardinia / Working Paper CRENoS (6) RePEc:ecb:ecbwps:20010069 The ECB monetary policy strategy and the money market. (2001). European Central Bank / Working Paper Series (7) RePEc:fip:fedfpb:01-10 Foreign exchange: macro puzzles, micro tools (2001). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (8) RePEc:fip:fedgfe:2001-49 Estimating stochastic volatility diffusion using conditional moments of integrated volatility (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (9) RePEc:fip:fedlwp:1999-016 Intraday technical trading in the foreign exchange market (2001). Federal Reserve Bank of St. Louis / Working Papers (10) RePEc:fip:fedlwp:2001-009 Predicting exchange rate volatility: genetic programming vs. GARCH and RiskMetrics (2001). Federal Reserve Bank of St. Louis / Working Papers (11) RePEc:nbr:nberwo:8453 Exchange Rate Exposure (2001). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:nuf:econwp:0211 Economic Forecasting: Some Lessons from Recent Research (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers Latest citations received in: 2000 (1) RePEc:cpr:ceprdp:2583 External Capital Structure: Theory and Evidence (2000). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:fip:fednsr:112 Beggar-thy-neighbor or beggar-thyself? the income effect of exchange rate fluctuations (2000). Federal Reserve Bank of New York / Staff Reports (3) RePEc:man:cgbcrp:02 Predicting UK Business Cycle Regimes (2000). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |