|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

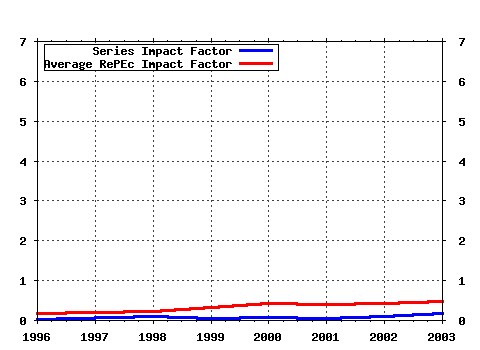

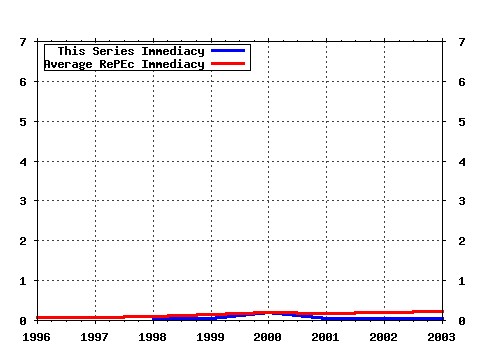

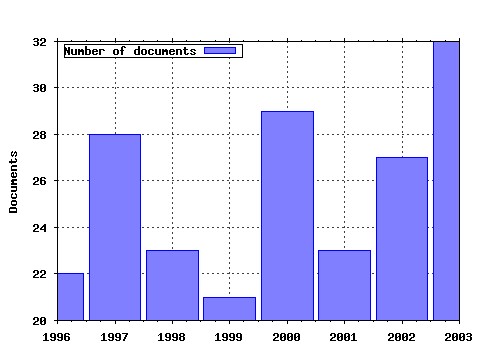

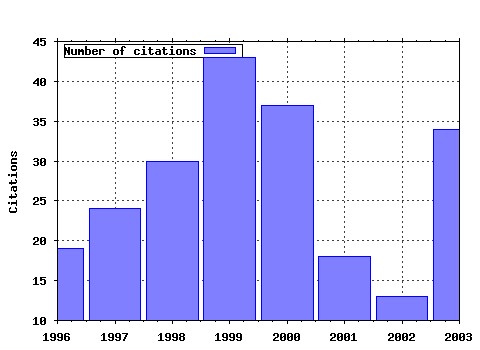

Pacific-Basin Finance Journal Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:pacfin:v:2:y:1994:i:2-3:p:165-199 Initial public offerings: International insights (1994). Pacific-Basin Finance Journal (2) RePEc:eee:pacfin:v:7:y:1999:i:2:p:173-202 An empirical investigation of underpricing in Chinese IPOs (1999). Pacific-Basin Finance Journal (3) RePEc:eee:pacfin:v:8:y:2000:i:1:p:85-113 International linkages and macroeconomic news effects on interest rate volatility -- Australia and the US (2000). Pacific-Basin Finance Journal (4) RePEc:eee:pacfin:v:2:y:1994:i:2-3:p:243-260 Risk and return on Chinas new stock markets: Some preliminary evidence (1994). Pacific-Basin Finance Journal (5) RePEc:eee:pacfin:v:3:y:1995:i:2-3:p:257-284 The profitability of technical trading rules in the Asian stock markets (1995). Pacific-Basin Finance Journal (6) RePEc:eee:pacfin:v:9:y:2001:i:4:p:323-362 Controlling shareholders and corporate value: Evidence from Thailand (2001). Pacific-Basin Finance Journal (7) RePEc:eee:pacfin:v:11:y:2003:i:1:p:23-43 International equity market comovements: Economic fundamentals or contagion? (2003). Pacific-Basin Finance Journal (8) RePEc:eee:pacfin:v:10:y:2002:i:4:p:411-442 Did the Asian financial crisis scare foreign investors out of Japan? (2002). Pacific-Basin Finance Journal (9) RePEc:eee:pacfin:v:3:y:1995:i:4:p:485-496 Reducing tick size on the Stock Exchange of Singapore (1995). Pacific-Basin Finance Journal (10) RePEc:eee:pacfin:v:2:y:1994:i:2-3:p:349-373 Pacific-Basin stock markets and real activity (1994). Pacific-Basin Finance Journal (11) RePEc:eee:pacfin:v:6:y:1998:i:5:p:453-474 Underpricing and aftermarket performance of IPOs in Shanghai, China (1998). Pacific-Basin Finance Journal (12) RePEc:eee:pacfin:v:7:y:1999:i:3-4:p:229-249 Bank monitoring and the maturity structure of Japanese corporate debt issues (1999). Pacific-Basin Finance Journal (13) RePEc:eee:pacfin:v:8:y:2000:i:5:p:587-610 Shareholding structure and corporate performance of partially privatized firms: Evidence from listed Chinese companies (2000). Pacific-Basin Finance Journal (14) RePEc:eee:pacfin:v:6:y:1998:i:1-2:p:1-26 The deterioration of bank balance sheets in Japan: Risk-taking and recapitalization (1998). Pacific-Basin Finance Journal (15) RePEc:eee:pacfin:v:11:y:2003:i:2:p:153-173 An empirical analysis of the Australian dollar swap spreads (2003). Pacific-Basin Finance Journal (16) RePEc:eee:pacfin:v:5:y:1997:i:4:p:389-417 The investment and operating performance of Japanese initial public offerings (1997). Pacific-Basin Finance Journal (17) RePEc:eee:pacfin:v:9:y:2001:i:3:p:195-217 The impact of salient political and economic news on the trading activity (2001). Pacific-Basin Finance Journal (18) RePEc:eee:pacfin:v:8:y:2000:i:5:p:v-vii Editorial (2000). Pacific-Basin Finance Journal (19) RePEc:eee:pacfin:v:4:y:1996:i:1:p:15-30 The winners curse and international methods of allocating initial public offerings (1996). Pacific-Basin Finance Journal (20) RePEc:eee:pacfin:v:7:y:1999:i:3-4:p:251-282 Are Asian stock market fluctuations due mainly to intra-regional contagion effects? Evidence based on Asian emerging stock markets (1999). Pacific-Basin Finance Journal (21) RePEc:eee:pacfin:v:6:y:1998:i:5:p:427-451 Privatisation initial public offerings in Malaysia: Initial premium and long-term performance (1998). Pacific-Basin Finance Journal (22) RePEc:eee:pacfin:v:4:y:1996:i:2-3:p:259-275 Political risk and stock price volatility: The case of Hong Kong (1996). Pacific-Basin Finance Journal (23) RePEc:eee:pacfin:v:2:y:1994:i:1:p:73-90 Assessing the cost of Taiwans deposit insurance (1994). Pacific-Basin Finance Journal (24) RePEc:eee:pacfin:v:7:y:1999:i:5:p:471-493 Cross-autocorrelation in Asian stock markets (1999). Pacific-Basin Finance Journal (25) RePEc:eee:pacfin:v:11:y:2003:i:1:p:45-59 How should liquidity be measured? (2003). Pacific-Basin Finance Journal (26) RePEc:eee:pacfin:v:2:y:1994:i:4:p:463-479 Beta stability and portfolio formation (1994). Pacific-Basin Finance Journal (27) RePEc:eee:pacfin:v:7:y:1999:i:1:p:1-22 Alternative mechanisms for corporate governance in Japan: An analysis of independent and bank-affiliated firms (1999). Pacific-Basin Finance Journal (28) RePEc:eee:pacfin:v:8:y:2000:i:2:p:177-216 Banks, the IMF, and the Asian crisis (2000). Pacific-Basin Finance Journal (29) RePEc:eee:pacfin:v:8:y:2000:i:5:p:iii-iv Editorial (2000). Pacific-Basin Finance Journal (30) RePEc:eee:pacfin:v:6:y:1998:i:3-4:p:321-346 Fundamental and nonfundamental components in stock prices of Pacific-Rim countries (1998). Pacific-Basin Finance Journal (31) RePEc:eee:pacfin:v:7:y:1999:i:5:p:557-586 Why does return volatility differ in Chinese stock markets? (1999). Pacific-Basin Finance Journal (32) RePEc:eee:pacfin:v:11:y:2003:i:2:p:175-195 The cross-sectional and cross-temporal universality of nonlinear serial dependencies: Evidence from world stock indices and the Taiwan Stock Exchange (2003). Pacific-Basin Finance Journal (33) RePEc:eee:pacfin:v:4:y:1996:i:2-3:p:241-258 The effects of removing price limits and introducing auctions upon short-term IPO returns: The case of Japanese IPOs (1996). Pacific-Basin Finance Journal (34) RePEc:eee:pacfin:v:8:y:2000:i:3-4:p:483-503 The value of liquidity: Evidence from the derivatives market (2000). Pacific-Basin Finance Journal (35) RePEc:eee:pacfin:v:5:y:1997:i:2:p:195-213 Capital market integration in the Pacific-Basin region: An analysis of real interest rate linkages (1997). Pacific-Basin Finance Journal (36) RePEc:eee:pacfin:v:5:y:1997:i:1:p:63-85 An analysis of the stock market performance of new issues in New Zealand (1997). Pacific-Basin Finance Journal (37) RePEc:eee:pacfin:v:6:y:1998:i:1-2:p:61-76 Economic growth and stationarity of real exchange rates: Evidence from some fast-growing Asian countries (1998). Pacific-Basin Finance Journal (38) RePEc:eee:pacfin:v:8:y:2000:i:2:p:135-152 Understanding the financial crisis in Asia (2000). Pacific-Basin Finance Journal (39) RePEc:eee:pacfin:v:11:y:2003:i:3:p:305-325 A review of Japans bank crisis from the governance perspective (2003). Pacific-Basin Finance Journal (40) RePEc:eee:pacfin:v:12:y:2004:i:1:p:1-18 Determinants of the decision to submit market or limit orders on the ASX (2004). Pacific-Basin Finance Journal (41) RePEc:eee:pacfin:v:3:y:1995:i:4:p:429-448 The aftermarket performance of initial public offerings in Korea (1995). Pacific-Basin Finance Journal (42) RePEc:eee:pacfin:v:5:y:1997:i:5:p:527-537 Testing the conditional CAPM and the effect of intervaling: A note (1997). Pacific-Basin Finance Journal (43) RePEc:eee:pacfin:v:11:y:2003:i:4:p:413-428 What kind of multinational deposit-insurance arrangements might best enhance world welfare? (2003). Pacific-Basin Finance Journal (44) RePEc:eee:pacfin:v:4:y:1996:i:2-3:p:297-314 Price clustering on the Australian Stock Exchange (1996). Pacific-Basin Finance Journal (45) RePEc:eee:pacfin:v:8:y:2000:i:5:p:529-558 Institutional affiliation and the role of venture capital: Evidence from initial public offerings in Japan (2000). Pacific-Basin Finance Journal (46) RePEc:eee:pacfin:v:10:y:2002:i:1:p:29-54 Private placements and rights issues in Singapore (2002). Pacific-Basin Finance Journal (47) RePEc:eee:pacfin:v:3:y:1995:i:1:p:113-136 Volatility and price change spillover effects across the developed and emerging markets (1995). Pacific-Basin Finance Journal (48) RePEc:eee:pacfin:v:5:y:1997:i:5:p:539-557 The interaction between order imbalance and stock price (1997). Pacific-Basin Finance Journal (49) RePEc:eee:pacfin:v:7:y:1999:i:3-4:p:371-403 An empirical study on the determinants of the capital structure of Thai firms (1999). Pacific-Basin Finance Journal (50) RePEc:eee:pacfin:v:2:y:1994:i:4:p:405-438 Good news, bad news and international spillovers of stock return volatility between Japan and the U.S. (1994). Pacific-Basin Finance Journal Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:wai:econwp:03/01 Modelling the Yield Curve with Orthonomalised Laguerre Polynomials: An Intertemporally Consistent Approach with an Economic Interpretation (2003). University of Waikato, Department of Economics / Working Papers in Economics (2) RePEc:wpa:wuwpfi:0312012 Weak-form Efficient Market Hypothesis, Behavioural Finance and Episodic Transient Dependencies: The Case of the Kuala Lumpur Stock Exchange (2003). EconWPA / Finance Latest citations received in: 2002 Latest citations received in: 2001 (1) RePEc:clm:clmeco:2001-23 Testing for Contagion during the Asian Crisis (2001). Claremont Colleges / Claremont Colleges Working Papers Latest citations received in: 2000 (1) RePEc:aea:aecrev:v:90:y:2000:i:2:p:28-31 U.S. Banks, Crises, and Bailouts: From Mexico to LTCM (2000). American Economic Review (2) RePEc:cdl:anderf:1070 East Asia and Europe During the 1997 Asian Collapse: A Clinical Study of a Financial Crisis (2000). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (3) RePEc:fip:fedhep:y:2000:i:qiii:p:9-28:n:v.25no.3 Banking and currency crisis and systemic risk: lessons from recent events (2000). Economic Perspectives (4) RePEc:uma:periwp:wp5 Is Africa a Net Creditor? New Estimates of Capital Flight from Severely Indebted Sub-Saharan African Countries (2000). Political Economy Research Institute, University of Massachusetts at Amherst / Working Papers (5) RePEc:ums:papers:2000-01 Is Africa a Net Creditor? New Estimates of Capital Flight from Severely Indebted Sub-Saharan African Countries, 1970-1996 (2000). University of Massachusetts Amherst, Department of Economics / Working Papers (6) RePEc:yor:yorken:00/29 Moments of the ARMA-EGARCH Model (2000). Department of Economics, University of York / Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |