|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

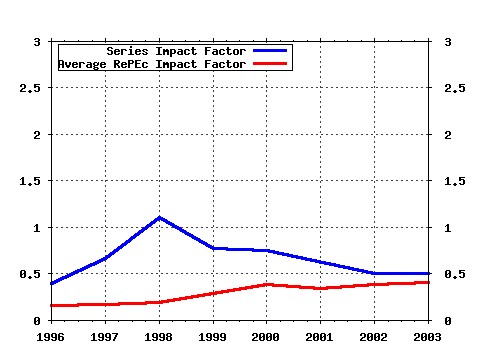

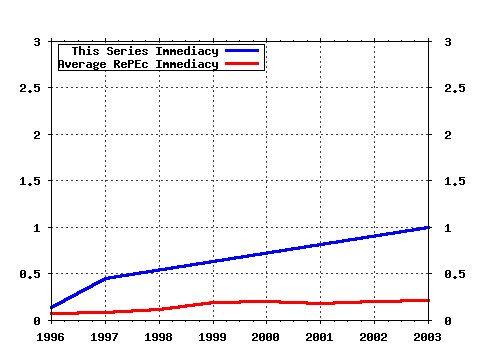

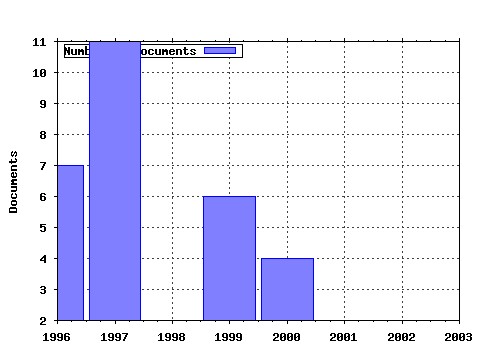

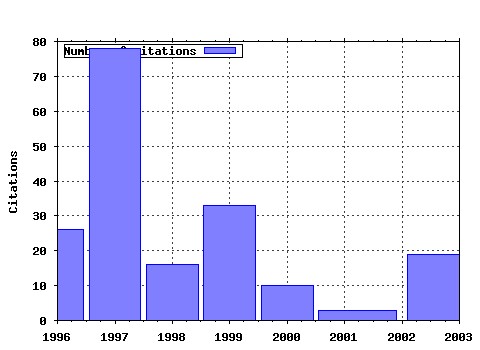

Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fip:fedmem:24 Current real business cycle theories and aggregate labor market fluctuations (1990). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (2) RePEc:fip:fedmem:75 Empirical cross-section dynamics in economic growth (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (3) RePEc:fip:fedmem:53 Productive externalities and business cycles (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (4) RePEc:fip:fedmem:3 Bayesian skepticism on unit root econometrics (1988). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (5) RePEc:fip:fedmem:74 Communication, commitment, and growth (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (6) RePEc:fip:fedmem:36 Recursive methods for computing equilibria of business cycle models (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (7) RePEc:fip:fedmem:116 Entrepreneurship, saving and social mobility (1997). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (8) RePEc:fip:fedmem:43 On Bayesian routes to unit roots (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (9) RePEc:fip:fedmem:6 Behavior of male workers at the end of the life-cycle: an empirical analysis of states and controls (1989). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (10) RePEc:fip:fedmem:120 Rational herd behavior and the globalization of securities markets (1997). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (11) RePEc:fip:fedmem:55 Money and growth revisited (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (12) RePEc:fip:fedmem:63 The Swedish business cycle: stylized facts over 130 years (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (13) RePEc:fip:fedmem:76 Macroeconomic implications of investment-specific technological change (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (14) RePEc:fip:fedmem:29 Implications of security market data for models of dynamic economies (1990). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (15) RePEc:fip:fedmem:112 Aggregate employment fluctuations with microeconomic asymmetries (1996). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (16) RePEc:fip:fedmem:128 Private money and reserve management in a random-matching model (1999). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (17) RePEc:fip:fedmem:95 The replacement problem (1994). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (18) RePEc:fip:fedmem:127 Staggered contracts and business cycle persistence (1998). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (19) RePEc:fip:fedmem:11 Models and their uses (1989). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (20) RePEc:fip:fedmem:105 The one-sector growth model with idiosyncratic shocks (1995). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (21) RePEc:fip:fedmem:33 Have postwar economic fluctuations been stabilized? (1990). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (22) RePEc:fip:fedmem:133 Political economy of taxation in an overlapping-generations economy (1999). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (23) RePEc:fip:fedmem:1 Aggregation of time series variables-a survey (1988). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (24) RePEc:fip:fedmem:101 A toolkit for analyzing nonlinear dynamic stochastic models easily (1995). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (25) RePEc:fip:fedmem:70 Liquidity effects, monetary policy, and the business cycle (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (26) RePEc:fip:fedmem:91 Solving nonlinear rational expectations models by parameterized expectations: convergence to stationary solutions (1994). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (27) RePEc:fip:fedmem:141 Urban structure and growth (2003). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (28) RePEc:fip:fedmem:12 Stochastic inflation and the equity premium (1989). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (29) RePEc:fip:fedmem:94 Fiscal spending shocks, endogenous government spending, and real business cycles (1994). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (30) RePEc:fip:fedmem:77 A dynamic index model for large cross sections (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (31) RePEc:fip:fedmem:71 On the cyclical allocation of risk (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (32) RePEc:fip:fedmem:37 The macroeconomic effects of distortionary taxation (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (33) RePEc:fip:fedmem:25 The output, employment, and interest rate effects of government consumption (1990). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (34) RePEc:fip:fedmem:60 The equity premium and the allocation of income risk (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (35) RePEc:fip:fedmem:104 (S,s) inventory policies in general equilibrium (1995). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (36) RePEc:fip:fedmem:54 Individual heterogeneity and interindustry wage differentials (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (37) RePEc:fip:fedmem:145 Learning your earning: are labor income shocks really very persistent? (2006). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (38) RePEc:fip:fedmem:23 The role of money in a business cycle model (1989). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (39) RePEc:fip:fedmem:59 Business cycles and the asset structure of foreign trade (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (40) RePEc:fip:fedmem:118 Monetary policy regimes and beliefs (1997). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (41) RePEc:fip:fedmem:67 A monetary, open-economy model with capital mobility (1992). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (42) RePEc:fip:fedmem:140 Dynamic optimal taxation with private information (2003). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (43) RePEc:fip:fedmem:93 Stock returns and volatility in emerging financial markets (1994). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (44) RePEc:fip:fedmem:50 Energy price shocks, capacity utilization and business cycle fluctuations (1991). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (45) RePEc:fip:fedmem:96 Stochastic volatility and the distribution of exchange rate news (1994). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (46) RePEc:fip:fedmem:110 On convergence in endogenous growth models (1996). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (47) RePEc:fip:fedmem:136 Time inconsistent preferences and Social Security (2000). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (48) RePEc:fip:fedmem:121 The syndrome of exchange-rate-based stabilizations and the uncertain duration of currency pegs (1997). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (49) RePEc:fip:fedmem:17 Hours and employment variation in business cycle theory (1989). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics (50) RePEc:fip:fedmem:114 The role of trade in technology diffusion (1996). Federal Reserve Bank of Minneapolis / Discussion Paper / Institute for Empirical Macroeconomics Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:nbr:nberwo:10119 Pareto Efficient Income Taxation with Stochastic Abilities (2003). National Bureau of Economic Research, Inc / NBER Working Papers (2) RePEc:tuf:tuftec:0310 The Evolution of City Size Distributions (2003). Department of Economics, Tufts University / Discussion Papers Series, Department of Economics, Tufts University Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |