|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Annals of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

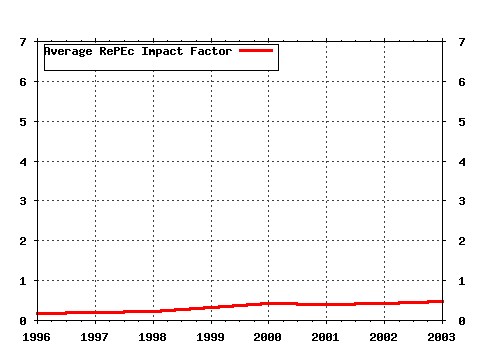

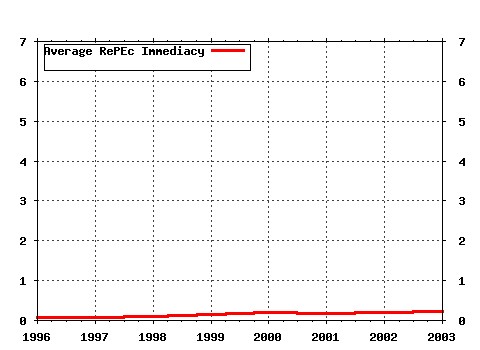

Most cited documents in this series: (1) RePEc:kap:annfin:v:1:y:2005:i:1:p:35-50 On user costs of risky monetary assets (2005). Annals of Finance (2) RePEc:kap:annfin:v:2:y:2006:i:1:p:1-21 A Time Series Analysis of Financial Fragility in the UK Banking System (2006). Annals of Finance (3) RePEc:kap:annfin:v:1:y:2005:i:2:p:197-224 A risk assessment model for banks (2005). Annals of Finance (4) RePEc:kap:annfin:v:2:y:2006:i:3:p:259-285 Heterogeneous Beliefs, the Term Structure and Time-varying Risk Premia (2006). Annals of Finance (5) RePEc:kap:annfin:v:2:y:2006:i:3:p:229-258 The Discounted Economic Stock of Money with VAR Forecasting (2006). Annals of Finance (6) RePEc:kap:annfin:v:1:y:2005:i:3:p:267-292 American options: the EPV pricing model (2005). Annals of Finance (7) RePEc:kap:annfin:v:1:y:2005:i:3:p:293-326 Completion time structures of stock price movements (2005). Annals of Finance (8) RePEc:kap:annfin:v:1:y:2005:i:2:p:109-147 Determinants of stock market volatility and risk premia (2005). Annals of Finance (9) RePEc:kap:annfin:v:1:y:2005:i:4:p:423-432 Option pricing and Esscher transform under regime switching (2005). Annals of Finance (10) RePEc:kap:annfin:v:1:y:2005:i:2:p:149-177 Relative arbitrage in volatility-stabilized markets (2005). Annals of Finance (11) RePEc:kap:annfin:v:1:y:2005:i:1:p:51-72 Shaking the tree: an agency-theoretic model of asset pricing (2005). Annals of Finance (12) RePEc:kap:annfin:v:4:y:2008:i:1:p:75-103 Who controls Allianz? (2008). Annals of Finance Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |