|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

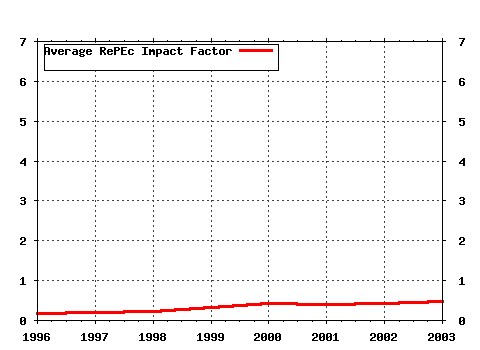

Journal of Financial Econometrics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:oup:jfinec:v:2:y:2004:i:1:p:1-37 Power and Bipower Variation with Stochastic Volatility and Jumps (2004). Journal of Financial Econometrics (2) RePEc:oup:jfinec:v:4:y:2006:i:4:p:537-572 Asymmetric Dynamics in the Correlations of Global Equity and Bond Returns (2006). Journal of Financial Econometrics (3) RePEc:oup:jfinec:v:4:y:2006:i:1:p:1-30 Econometrics of Testing for Jumps in Financial Economics Using Bipower Variation (2006). Journal of Financial Econometrics (4) RePEc:oup:jfinec:v:3:y:2005:i:4:p:525-554 A Realized Variance for the Whole Day Based on Intermittent High-Frequency Data (2005). Journal of Financial Econometrics (5) RePEc:oup:jfinec:v:2:y:2004:i:2:p:211-250 Mixed Normal Conditional Heteroskedasticity (2004). Journal of Financial Econometrics (6) RePEc:oup:jfinec:v:2:y:2004:i:4:p:493-530 A New Approach to Markov-Switching GARCH Models (2004). Journal of Financial Econometrics (7) RePEc:oup:jfinec:v:2:y:2004:i:1:p:130-168 On the Out-of-Sample Importance of Skewness and Asymmetric Dependence for Asset Allocation (2004). Journal of Financial Econometrics (8) RePEc:oup:jfinec:v:5:y:2007:i:1:p:68-104 Integrated Covariance Estimation using High-frequency Data in the Presence of Noise (2007). Journal of Financial Econometrics (9) RePEc:oup:jfinec:v:2:y:2004:i:1:p:84-108 Backtesting Value-at-Risk: A Duration-Based Approach (2004). Journal of Financial Econometrics (10) RePEc:oup:jfinec:v:4:y:2006:i:1:p:53-89 Value-at-Risk Prediction: A Comparison of Alternative Strategies (2006). Journal of Financial Econometrics (11) RePEc:oup:jfinec:v:1:y:2003:i:1:p:96-125 Modeling the U.S. Short-Term Interest Rate by Mixture Autoregressive Processes (2003). Journal of Financial Econometrics (12) RePEc:oup:jfinec:v:2:y:2004:i:2:p:319-342 Persistence and Kurtosis in GARCH and Stochastic Volatility Models (2004). Journal of Financial Econometrics (13) RePEc:oup:jfinec:v:3:y:2005:i:4:p:456-499 The Relative Contribution of Jumps to Total Price Variance (2005). Journal of Financial Econometrics (14) RePEc:oup:jfinec:v:3:y:2005:i:3:p:399-421 Autoregressive Conditional Kurtosis (2005). Journal of Financial Econometrics (15) RePEc:oup:jfinec:v:1:y:2003:i:1:p:26-54 Fourth Moment Structure of Multivariate GARCH Models (2003). Journal of Financial Econometrics (16) RePEc:oup:jfinec:v:1:y:2003:i:2:p:272-289 The Robustness of the Conditional CAPM with Human Capital (2003). Journal of Financial Econometrics (17) RePEc:oup:jfinec:v:1:y:2003:i:2:p:159-188 Trades and Quotes: A Bivariate Point Process (2003). Journal of Financial Econometrics (18) RePEc:oup:jfinec:v:3:y:2005:i:4:p:555-577 Properties of Bias-Corrected Realized Variance Under Alternative Sampling Schemes (2005). Journal of Financial Econometrics (19) RePEc:oup:jfinec:v:2:y:2004:i:4:p:477-492 Pessimistic Portfolio Allocation and Choquet Expected Utility (2004). Journal of Financial Econometrics (20) RePEc:oup:jfinec:v:4:y:2006:i:3:p:450-493 Stochastic Conditional Intensity Processes (2006). Journal of Financial Econometrics (21) RePEc:oup:jfinec:v:1:y:2003:i:1:p:55-95 Time Inhomogeneous Multiple Volatility Modeling (2003). Journal of Financial Econometrics (22) RePEc:oup:jfinec:v:2:y:2004:i:4:p:531-564 Modeling the Conditional Covariance Between Stock and Bond Returns: A Multivariate GARCH Approach (2004). Journal of Financial Econometrics (23) RePEc:oup:jfinec:v:1:y:2003:i:1:p:2-25 Dynamics of Trade-by-Trade Price Movements: Decomposition and Models (2003). Journal of Financial Econometrics (24) RePEc:oup:jfinec:v:1:y:2003:i:3:p:445-470 The Local Whittle Estimator of Long-Memory Stochastic Volatility (2003). Journal of Financial Econometrics (25) RePEc:oup:jfinec:v:4:y:2006:i:2:p:275-309 The Generalized Hyperbolic Skew Students t-Distribution (2006). Journal of Financial Econometrics (26) RePEc:oup:jfinec:v:1:y:2003:i:2:p:189-215 Assessing the Risk of Liquidity Suppliers on the Basis of Excess Demand Intensities (2003). Journal of Financial Econometrics (27) RePEc:oup:jfinec:v:3:y:2005:i:1:p:26-36 New Directions in Risk Management (2005). Journal of Financial Econometrics (28) RePEc:oup:jfinec:v:3:y:2005:i:3:p:422-441 The Stability of Factor Models of Interest Rates (2005). Journal of Financial Econometrics (29) RePEc:oup:jfinec:v:4:y:2006:i:2:p:238-274 Structural Breaks and Predictive Regression Models of Aggregate U.S. Stock Returns (2006). Journal of Financial Econometrics (30) RePEc:oup:jfinec:v:2:y:2004:i:1:p:49-83 How to Forecast Long-Run Volatility: Regime Switching and the Estimation of Multifractal Processes (2004). Journal of Financial Econometrics (31) RePEc:oup:jfinec:v:2:y:2004:i:3:p:370-389 Asset Allocation by Variance Sensitivity Analysis (2004). Journal of Financial Econometrics (32) RePEc:oup:jfinec:v:1:y:2003:i:3:p:365-419 A Closer Look at the Relation between GARCH and Stochastic Autoregressive Volatility (2003). Journal of Financial Econometrics (33) RePEc:oup:jfinec:v:1:y:2003:i:3:p:297-326 Kernel-Based Indirect Inference (2003). Journal of Financial Econometrics (34) RePEc:oup:jfinec:v:3:y:2005:i:3:p:315-343 Asymptotic and Bayesian Confidence Intervals for Sharpe-Style Weights (2005). Journal of Financial Econometrics (35) RePEc:oup:jfinec:v:1:y:2003:i:3:p:420-444 Properties of the Sample Autocorrelations of Nonlinear Transformations in Long-Memory Stochastic Volatility Models (2003). Journal of Financial Econometrics (36) RePEc:oup:jfinec:v:3:y:2005:i:3:p:372-398 Multivariate Lagrange Multiplier Tests for Fractional Integration (2005). Journal of Financial Econometrics (37) RePEc:oup:jfinec:v:4:y:2006:i:4:p:594-616 A Mixture Multiplicative Error Model for Realized Volatility (2006). Journal of Financial Econometrics (38) RePEc:oup:jfinec:v:4:y:2006:i:3:p:413-449 Inequality Constraints in the Fractionally Integrated GARCH Model (2006). Journal of Financial Econometrics (39) RePEc:oup:jfinec:v:4:y:2006:i:4:p:636-670 Long Memory and the Relation Between Implied and Realized Volatility (2006). Journal of Financial Econometrics (40) RePEc:oup:jfinec:v:4:y:2006:i:4:p:573-593 Stationarity of a Markov-Switching GARCH Model (2006). Journal of Financial Econometrics (41) RePEc:oup:jfinec:v:2:y:2004:i:3:p:390-421 Stochastic Conditional Duration Models with Leverage Effect for Financial Transaction Data (2004). Journal of Financial Econometrics (42) RePEc:oup:jfinec:v:3:y:2005:i:1:p:37-55 Optimal Estimation of the Risk Premium for the Long Run and Asset Allocation: A Case of Compounded Estimation Risk (2005). Journal of Financial Econometrics (43) RePEc:oup:jfinec:v:4:y:2006:i:3:p:385-412 Dynamic Asymmetric GARCH (2006). Journal of Financial Econometrics (44) RePEc:oup:jfinec:v:5:y:2007:i:1:p:31-67 Why Do Absolute Returns Predict Volatility So Well? (2007). Journal of Financial Econometrics (45) RePEc:oup:jfinec:v:1:y:2003:i:3:p:327-364 A Pricing and Hedging Comparison of Parametric and Nonparametric Approaches for American Index Options (2003). Journal of Financial Econometrics (46) RePEc:oup:jfinec:v:2:y:2004:i:3:p:451-471 Improving Tests of Abnormal Returns by Bootstrapping the Multivariate Regression Model with Event Parameters (2004). Journal of Financial Econometrics (47) RePEc:oup:jfinec:v:4:y:2006:i:1:p:136-160 Incomplete Information, Heterogeneity, and Asset Pricing (2006). Journal of Financial Econometrics (48) RePEc:oup:jfinec:v:2:y:2004:i:1:p:109-129 Circuit Breakers and the Tail Index of Equity Returns (2004). Journal of Financial Econometrics (49) RePEc:oup:jfinec:v:3:y:2005:i:2:p:227-255 Nonparametric Inference of Value-at-Risk for Dependent Financial Returns (2005). Journal of Financial Econometrics (50) RePEc:oup:jfinec:v:3:y:2005:i:1:p:3-25 The Present and Future of Financial Risk Management (2005). Journal of Financial Econometrics Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:nuf:econwp:0303 Modelling Security Market Events in Continuous Time: Intensity Based, Multivariate Point Process Models (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |