|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

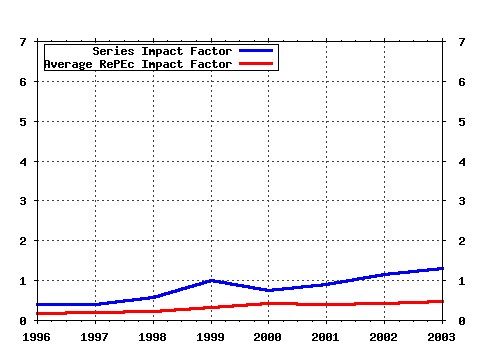

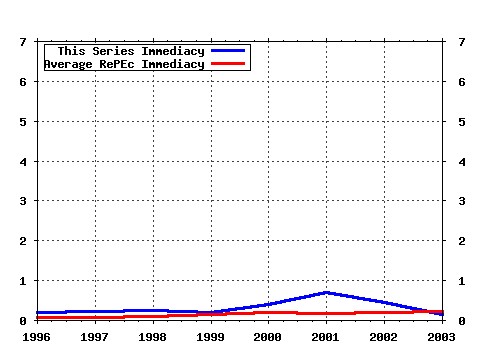

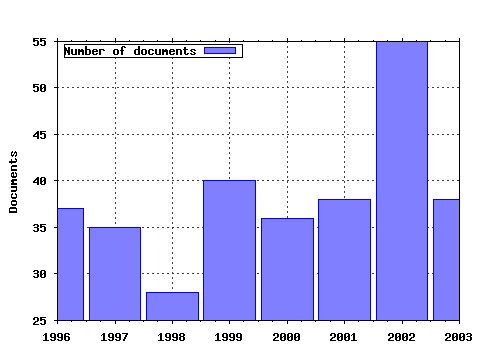

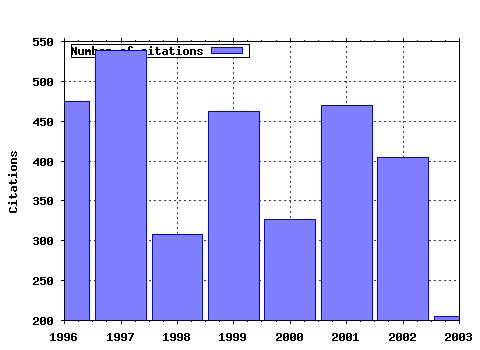

Review of Financial Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:oup:rfinst:v:1:y:1988:i:3:p:195-228 The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors (1988). Review of Financial Studies (2) RePEc:oup:rfinst:v:1:y:1988:i:1:p:41-66 Stock Market Prices do not Follow Random Walks: Evidence from a Simple Specification Test (1988). Review of Financial Studies (3) RePEc:oup:rfinst:v:6:y:1993:i:2:p:327-43 A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options. (1993). Review of Financial Studies (4) RePEc:oup:rfinst:v:1:y:1988:i:1:p:3-40 A Theory of Intraday Patterns: Volume and Price Variability (1988). Review of Financial Studies (5) RePEc:oup:rfinst:v:5:y:1992:i:3:p:357-86 Dividend Yields and Expected Stock Returns: Alternative Procedures for Inference and Measurement. (1992). Review of Financial Studies (6) RePEc:oup:rfinst:v:3:y:1990:i:4:p:573-92 Pricing Interest-Rate-Derivative Securities. (1990). Review of Financial Studies (7) RePEc:oup:rfinst:v:3:y:1990:i:1:p:5-33 Transmission of Volatility between Stock Markets. (1990). Review of Financial Studies (8) RePEc:oup:rfinst:v:5:y:1992:i:2:p:153-80 Dynamic Equilibrium and the Real Exchange Rate in a Spatially Separated World. (1992). Review of Financial Studies (9) RePEc:oup:rfinst:v:9:y:1996:i:2:p:385-426 Testing Continuous-Time Models of the Spot Interest Rate. (1996). Review of Financial Studies (10) RePEc:oup:rfinst:v:5:y:1992:i:2:p:199-242 Stock Prices and Volume. (1992). Review of Financial Studies (11) RePEc:oup:rfinst:v:9:y:1996:i:1:p:69-107 Jumps and Stochastic Volatility: Exchange Rate Processes Implicit in Deutsche Mark Options. (1996). Review of Financial Studies (12) RePEc:oup:rfinst:v:3:y:1990:i:2:p:281-307 Correlations in Price Changes and Volatility across International Stock Markets. (1990). Review of Financial Studies (13) RePEc:oup:rfinst:v:13:y:2000:i:4:p:959-84 The Interaction between Product Market and Financing Strategy: The Role of Venture Capital. (2000). Review of Financial Studies (14) RePEc:oup:rfinst:v:12:y:1999:i:4:p:687-720 Modeling Term Structures of Defaultable Bonds. (1999). Review of Financial Studies (15) RePEc:oup:rfinst:v:10:y:1997:i:2:p:481-523 A Markov Model for the Term Structure of Credit Risk Spreads. (1997). Review of Financial Studies (16) RePEc:oup:rfinst:v:6:y:1993:i:3:p:527-66 The Risk and Predictability of International Equity Returns. (1993). Review of Financial Studies (17) RePEc:oup:rfinst:v:14:y:2001:i:3:p:659-80 Familiarity Breeds Investment. (2001). Review of Financial Studies (18) RePEc:oup:rfinst:v:8:y:1995:i:3:p:773-816 Predictable Risk and Returns in Emerging Markets. (1995). Review of Financial Studies (19) RePEc:oup:rfinst:v:6:y:1993:i:3:p:473-506 Differences of Opinion Make a Horse Race. (1993). Review of Financial Studies (20) RePEc:oup:rfinst:v:10:y:1997:i:3:p:661-91 Trade Credit: Theories and Evidence. (1997). Review of Financial Studies (21) RePEc:oup:rfinst:v:15:y:2002:i:4:p:1137-1187 International Asset Allocation With Regime Shifts (2002). Review of Financial Studies (22) RePEc:oup:rfinst:v:1:y:1988:i:4:p:427-445 On Jump Processes in the Foreign Exchange and Stock Markets (1988). Review of Financial Studies (23) RePEc:oup:rfinst:v:5:y:1992:i:1:p:1-33 On the Estimation of Beta-Pricing Models. (1992). Review of Financial Studies (24) RePEc:oup:rfinst:v:3:y:1990:i:2:p:175-205 When Are Contrarian Profits Due to Stock Market Overreaction? (1990). Review of Financial Studies (25) RePEc:oup:rfinst:v:2:y:1989:i:1:p:73-89 Intertemporally Dependent Preferences and the Volatility of Consumption and Wealth. (1989). Review of Financial Studies (26) RePEc:oup:rfinst:v:4:y:1991:i:4:p:727-52 Stock Price Distributions with Stochastic Volatility: An Analytic Approach. (1991). Review of Financial Studies (27) RePEc:oup:rfinst:v:14:y:2001:i:1:p:1-27 Learning to be Overconfident. (2001). Review of Financial Studies (28) RePEc:oup:rfinst:v:7:y:1994:i:4:p:631-51 Transactions, Volume, and Volatility. (1994). Review of Financial Studies (29) RePEc:oup:rfinst:v:9:y:1996:i:1:p:141-61 Dynamic Nonmyopic Portfolio Behavior. (1996). Review of Financial Studies (30) RePEc:oup:rfinst:v:7:y:1994:i:1:p:125-48 The Value of the Voting Right: A Study of the Milan Stock Exchange Experience. (1994). Review of Financial Studies (31) RePEc:oup:rfinst:v:11:y:1998:i:2:p:309-41 An Equilibrium Model with Restricted Stock Market Participation. (1998). Review of Financial Studies (32) RePEc:oup:rfinst:v:5:y:1992:i:4:p:531-52 A Theory of the Nominal Term Structure of Interest Rates. (1992). Review of Financial Studies (33) RePEc:oup:rfinst:v:15:y:2002:i:1:p:1-33 Testing Trade-Off and Pecking Order Predictions About Dividends and Debt (2002). Review of Financial Studies (34) RePEc:oup:rfinst:v:6:y:1993:i:4:p:733-64 Auctions of Divisible Goods: On the Rationale for the Treasury Experiment. (1993). Review of Financial Studies (35) RePEc:oup:rfinst:v:6:y:1993:i:3:p:659-81 The Informational Content of Implied Volatility. (1993). Review of Financial Studies (36) RePEc:oup:rfinst:v:15:y:2002:i:2:p:413-444 Why Dont Issuers Get Upset About Leaving Money on the Table in IPOs? (2002). Review of Financial Studies (37) RePEc:oup:rfinst:v:12:y:1999:i:3:p:579-607 Deposits and Relationship Lending. (1999). Review of Financial Studies (38) RePEc:oup:rfinst:v:11:y:1998:i:4:p:817-44 Modeling Asymmetric Comovements of Asset Returns. (1998). Review of Financial Studies (39) RePEc:oup:rfinst:v:9:y:1996:i:1:p:37-68 Design and Valuation of Debt Contracts. (1996). Review of Financial Studies (40) RePEc:oup:rfinst:v:15:y:2002:i:1:p:243-288 Quadratic Term Structure Models: Theory and Evidence (2002). Review of Financial Studies (41) RePEc:oup:rfinst:v:12:y:1999:i:4:p:653-86 Conflict of Interest and the Credibility of Underwriter Analyst Recommendations. (1999). Review of Financial Studies (42) RePEc:oup:rfinst:v:12:y:1999:i:1:p:197-226 Estimating the Price of Default Risk. (1999). Review of Financial Studies (43) RePEc:oup:rfinst:v:3:y:1990:i:3:p:431-67 Data-Snooping Biases in Tests of Financial Asset Pricing Models. (1990). Review of Financial Studies (44) RePEc:oup:rfinst:v:13:y:2000:i:1:p:1-42 Asymmetric Volatility and Risk in Equity Markets. (2000). Review of Financial Studies (45) RePEc:oup:rfinst:v:3:y:1990:i:1:p:115-31 The Stock Market and Investment. (1990). Review of Financial Studies (46) RePEc:oup:rfinst:v:3:y:1990:i:1:p:77-102 Stock Volatility and the Crash of 87. (1990). Review of Financial Studies (47) RePEc:oup:rfinst:v:6:y:1993:i:2:p:293-326 Forecasting Stock-Return Variance: Toward an Understanding of Stochastic Implied Volatilities. (1993). Review of Financial Studies (48) RePEc:oup:rfinst:v:10:y:1997:i:1:p:205-36 Endogenous Communication among Lenders and Entrepreneurial Incentives. (1997). Review of Financial Studies (49) RePEc:oup:rfinst:v:13:y:2000:i:2:p:433-51 Recovering Risk Aversion from Option Prices and Realized Returns. (2000). Review of Financial Studies (50) RePEc:oup:rfinst:v:12:y:1999:i:5:p:975-1007 Stock Market Overreaction to Bad News in Good Times: A Rational Expectations Equilibrium Model. (1999). Review of Financial Studies Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:ecb:ecbwps:20030297 Measurement of contagion in banksâ equity prices. (2003). European Central Bank / Working Paper Series (2) RePEc:hal:papers:halshs-00165026_v1 French IPO returns and subsequent security offerings: (3) RePEc:ibm:finlab:flwp_49 Evaluating an Alternative Risk Preference in Affine Term Structure Models (2003). Finance Lab, Ibmec São Paulo / Finance Lab Working Papers (4) RePEc:nbr:nberwo:9674 Diversification and the Taxation of Capital Gains and Losses (2003). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:nbr:nberwo:9995 Appearing and Disappearing Dividends: The Link to Catering Incentives (2003). National Bureau of Economic Research, Inc / NBER Working Papers (6) RePEc:wbk:wbrwps:3103 Ownership Structure and Initial Public Offerings (2003). The World Bank / Policy Research Working Paper Series Latest citations received in: 2002 (1) RePEc:bon:bonedp:bgse20_2002 Trader Anonymity, Price Formation and Liquidity (2002). University of Bonn, Germany / Bonn Econ Discussion Papers (2) RePEc:cdl:anderf:1040 Extracting Inflation from Stock Returns to test Purchasing Power Parity (2002). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (3) RePEc:cie:wpaper:0206 Market Participation, Information and Volatility (2002). Centro de Investigacion Economica, ITAM / Working Papers (4) RePEc:cpr:ceprdp:3314 IPO Pricing in the dot-com Bubble (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:dgr:eureri:2002263 Do Macroeconomic Announcements Cause Asymetric Volatility? (2002). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (6) RePEc:edj:ceauch:146 Bank Lending and Relationship Banking: Evidence from Chilean Firms (2002). Centro de Economía Aplicada, Universidad de Chile / Documentos de Trabajo (7) RePEc:fam:rpseri:rp100 Mutual Fund Flows and Performance in Rational Markets (2002). International Center for Financial Asset Management and Engineering / FAME Research Paper Series (8) RePEc:fip:fedawp:2002-23 International diversification strategies (2002). Federal Reserve Bank of Atlanta / Working Paper (9) RePEc:fip:fedhwp:wp-02-25 Local market consolidation and bank productive efficiency (2002). Federal Reserve Bank of Chicago / Working Paper Series (10) RePEc:fra:franaf:97 Avoiding the rating bounce: Why rating agencies are slow to react to new information (2002). Goethe University Frankfurt am Main / Working Paper Series: Finance and Accounting (11) RePEc:nbr:nberwo:8745 Tax-Loss Trading and Wash Sales (2002). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:nbr:nberwo:8826 Rational Asset Prices (2002). National Bureau of Economic Research, Inc / NBER Working Papers (13) RePEc:nbr:nberwo:8987 Stocks as Money: Convenience Yield and the Tech-Stock Bubble (2002). National Bureau of Economic Research, Inc / NBER Working Papers (14) RePEc:nbr:nberwo:9032 Is There an Optimal Industry Financial Structure? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (15) RePEc:nbr:nberwo:9070 Institutional Allocation In Initial Public Offerings: Empirical Evidence (2002). National Bureau of Economic Research, Inc / NBER Working Papers (16) RePEc:nbr:nberwo:9277 Anomalies and Market Efficiency (2002). National Bureau of Economic Research, Inc / NBER Working Papers (17) RePEc:por:fepwps:120 The Cross-Sectional Determinants of Returns: Evidence from Emerging Markets Stocks (2002). Universidade do Porto, Faculdade de Economia do Porto / FEP Working Papers (18) RePEc:sbs:wpsefe:2002fe06 Evidence of Information Spillovers in the Production of Investment Banking Services (2002). Oxford Financial Research Centre / OFRC Working Papers Series (19) RePEc:sbs:wpsefe:2002fe07 IPO Pricing in the Dot-com Bubble (2002). Oxford Financial Research Centre / OFRC Working Papers Series (20) RePEc:ssa:lemwps:2002/02 Which Model for the Italian Interest Rates? (2002). Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy / LEM Papers Series (21) RePEc:tor:tecipa:shouyong-02-03 Signalling in the Internet Craze of Initial Public Offerings (2002). University of Toronto, Department of Economics / Working Papers (22) RePEc:wop:pennin:01-33 Is the Offer Price in IPOs Informative? Underpricing, Ownership Structure, and Performance (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (23) RePEc:wpa:wuwpfi:0207014 Design and Estimation of Quadratic Term Structure Models (2002). EconWPA / Finance (24) RePEc:wpa:wuwpfi:0207015 Asset Pricing Under The Quadratic Class (2002). EconWPA / Finance (25) RePEc:wpa:wuwpfi:0207016 A Dynamic Equilibrium Model of Real Exchange Rates with General Transaction Costs (2002). EconWPA / Finance Latest citations received in: 2001 (1) RePEc:aea:aecrev:v:91:y:2001:i:2:p:367-370 Trade and Exposure (2001). American Economic Review (2) RePEc:aea:aecrev:v:91:y:2001:i:2:p:391-395 Exchange-Rate Hedging: Financial versus Operational Strategies (2001). American Economic Review (3) RePEc:aea:aecrev:v:91:y:2001:i:2:p:45-50 Sharing Ambiguity (2001). American Economic Review (4) RePEc:cdl:anderf:1016 Brand Perceptions and the Market for Common Stock (2001). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (5) RePEc:cdl:anderf:1088 The Scarcity of Effective Monitors and Its Implications For Corporate Takeovers and Ownership Structures (2001). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (6) RePEc:cpr:ceprdp:2733 Outside Finance, Dominant Investors and Strategic Transparency (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (7) RePEc:cpr:ceprdp:2988 Evidence of Information Spillovers in the Production of Investment Banking Services (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cpr:ceprdp:3053 Hot Markets, Investor Sentiment and IPO Pricing (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (9) RePEc:del:abcdef:2001-08 The Determinants of Cross-Border Equity Flows. (2001). DELTA (Ecole normale supérieure) / DELTA Working Papers (10) RePEc:dgr:unutaf:eifc01-1 European Financial Markets after Emu: A Review of Recent Literature and Evidence (2001). United Nations University, Institute for New Technologies / EIFC - Technology and Finance Working Papers (11) RePEc:dgr:uvatin:20010019 Outside Finance, Dominant Investors and Strategic Transparancy (2001). Tinbergen Institute / Tinbergen Institute Discussion Papers (12) RePEc:dgr:uvatin:20010069 Optimal Portfolio Allocation under a Probabilistic Risk Constraint and the Incentives for Financial Innovation (2001). Tinbergen Institute / Tinbergen Institute Discussion Papers (13) RePEc:ebl:ecbull:eb-01g10003 Super-replicating Bounds on European Option Prices when the Underlying Asset is Illiquid (2001). Economics Bulletin (14) RePEc:esi:discus:2001-02 Illusion of Expertise in Portfolio Decisions - An Experimental Approach - (2001). Max Planck Institute of Economics, Strategic Interaction Group / Discussion Papers on Strategic Interaction (15) RePEc:esi:discus:2001-03 Overconfidence in Investment Decisions: An Experimental Approach (2001). Max Planck Institute of Economics, Strategic Interaction Group / Discussion Papers on Strategic Interaction (16) RePEc:fip:fedgfe:2001-57 Who benefits from a bull market? an analysis of employee stock option grants and stock prices (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (17) RePEc:fip:fednep:y:2001:i:dec:p:51-70:n:v.7no.3 The effect of interest rate options hedging on term-structure dynamics (2001). Economic Policy Review (18) RePEc:hhs:hastef:0482 Where to Go after the Lamfalussy Report? - An Economic Analysis of Securities Market Regulation and Supervision (2001). Stockholm School of Economics / Working Paper Series in Economics and Finance (19) RePEc:nbr:nberwo:8358 Social Interaction and Stock-Market Participation (2001). National Bureau of Economic Research, Inc / NBER Working Papers (20) RePEc:nbr:nberwo:8453 Exchange Rate Exposure (2001). National Bureau of Economic Research, Inc / NBER Working Papers (21) RePEc:nbr:nberwo:8508 The Psychophysiology of Real-Time Financial Risk Processing (2001). National Bureau of Economic Research, Inc / NBER Working Papers (22) RePEc:nbr:nberwo:8686 Equity Portfolio Diversification (2001). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:rif:dpaper:781 Exiting Venture Capital Investments: Lessons from Finland (2001). The Research Institute of the Finnish Economy / Discussion Papers (24) RePEc:sbs:wpsefe:2001mf09 A note on the pricing and hedging of volatility derivatives (2001). Oxford Financial Research Centre / OFRC Working Papers Series (25) RePEc:wop:humbsf:2001-44 Simultaneous Over- and Underconfidence: Evidence from Experimental Asset Markets (2001). Humboldt Universitaet Berlin / Sonderforschungsbereich 373 (26) RePEc:wpa:wuwpfi:0111004 The Market Price of Aggregate Risk and the Wealth Distribution (2001). EconWPA / Finance (27) RePEc:zbw:zewdip:5419 Dynamics in ownership and firm survival : evidence from corporate Germany (2001). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2000 (1) RePEc:bai:series:wp0009 Il finanziamento dello sviluppo: Teorie ed evidenza empirica (2000). Dipartimento di Scienze Economiche - Università di Bari / series (2) RePEc:chb:bcchwp:90 Un Modelo de Intervención Cambiaria (2000). Central Bank of Chile / Working Papers Central Bank of Chile (3) RePEc:ema:worpap:2000-39 Fundamental Properties of Bond Prices in Models of the Short-Term Rate (2000). THEMA / Working papers (4) RePEc:fip:fedawp:2000-9 If at first you dont succeed: an experimental investigation of the impact of repetition options on corporate takeovers (2000). Federal Reserve Bank of Atlanta / Working Paper (5) RePEc:fth:nystfi:99-014 Empirical Pricing Kernels (2000). New York University, Leonard N. Stern School of Business- / New York University, Leonard N. Stern School Finance Department Working Paper Seires (6) RePEc:kie:kieliw:982 The Positive Economics of Corporatism and Corporate Governance (2000). Kiel Institute for World Economics / Working Papers (7) RePEc:nbr:nberwo:7786 Building the IPO Order Book: Underpricing and Participation Limits With Costly Information (2000). National Bureau of Economic Research, Inc / NBER Working Papers (8) RePEc:nbr:nberwo:7808 Firm Value, Risk, and Growth Opportunities (2000). National Bureau of Economic Research, Inc / NBER Working Papers (9) RePEc:nbr:nberwo:7851 When Does Start-Up Innovation Spur the Gale of Creative Destruction? (2000). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:nbr:nberwo:7877 When Does Funding Research by Smaller Firms Bear Fruit?: Evidence from the SBIR Program (2000). National Bureau of Economic Research, Inc / NBER Working Papers (11) RePEc:nbr:nberwo:7933 The Distribution of Stock Return Volatility (2000). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:qed:wpaper:997 Registered trader participation during the Toronto Stock Exchanges pre-opening session (2000). Queen's University, Department of Economics / Working Papers (13) RePEc:sfi:sfiwpa:0006034 Correlation structure of extreme stock returns (2000). Science & Finance, Capital Fund Management / Science & Finance (CFM) working paper archive (14) RePEc:wop:pennin:00-27 The Distribution of Stock Return Volatility (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |