|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

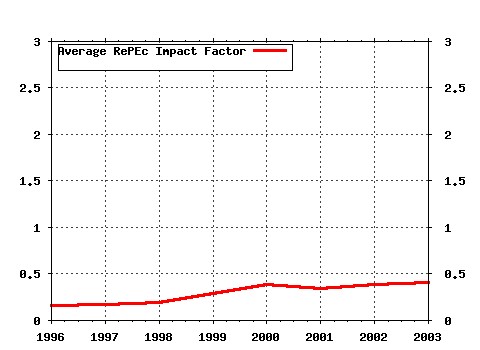

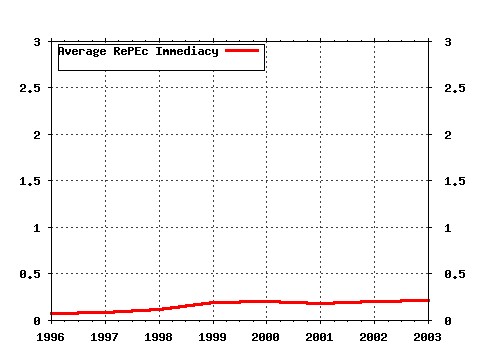

Society for Computational Economics / Computing in Economics and Finance 2005 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf5:478 Monetary Policy under Uncertainty in Micro-Founded Macroeconometric Models (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (2) RePEc:sce:scecf5:323 Do Actions Speak Louder Than Words?The Response of Asset Prices to Monetary Policy Actions and Statements (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (3) RePEc:sce:scecf5:108 Monetary Policy with Model Uncertainty: Distribution Forecast Targeting (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (4) RePEc:sce:scecf5:474 Term Structure Estimation with Survey Data on Interest Rate Forecasts (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (5) RePEc:sce:scecf5:128 Expansionary Fiscal Shocks and the Trade Deficit (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (6) RePEc:sce:scecf5:60 How the Bundesbank really conducted monetary policy (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (7) RePEc:sce:scecf5:183 A QUANTITATIVE COMPARISON OF STICKY-PRICE AND STICKY-INFORMATION MODELS OF PRICE SETTING (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (8) RePEc:sce:scecf5:321 A Limited Information Approach to the Simultaneous Estimation of Wage and Price Dynamics (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (9) RePEc:sce:scecf5:80 Monetary Policy under Adaptive Learning (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (10) RePEc:sce:scecf5:87 Persistence and Nominal Inertia in a Generalized Taylor Economy: How Longer Contracts Dominate Shorter Contracts (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (11) RePEc:sce:scecf5:304 Accounting for Changes in the Homeownership Rate (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (12) RePEc:sce:scecf5:141 Approximate Aggregation (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (13) RePEc:sce:scecf5:388 The Design of Monetary and Fiscal Policy: A Global Perspective (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (14) RePEc:sce:scecf5:457 Gains from International Monetary Policy Coordination: Does It Pay to Be Different? (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (15) RePEc:sce:scecf5:400 Robust Monetary Policy with Imperfect Knowledge (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (16) RePEc:sce:scecf5:452 Optimal Interest Rate Rules, Asset Prices and Credit Frictions (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (17) RePEc:sce:scecf5:431 DSGE Models in a Data-Rich Environment (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (18) RePEc:sce:scecf5:102 Non-Ricardian Households and Fiscal Policy in an Estimated DSGE Model of the Euro Area (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (19) RePEc:sce:scecf5:37 Commercial Mortgage Backed Securities: How Much Subordination is Enough? (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (20) RePEc:sce:scecf5:98 Measuring the Effects of Employment Protection on Job Flows: Evidence from Seasonal Cycles (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (21) RePEc:sce:scecf5:252 Trend and Cycles: A New Approach and Explanations of Some Old Puzzles (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (22) RePEc:sce:scecf5:107 U.K. Monetary Regimes and Macroeconomic Stylised Facts (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (23) RePEc:sce:scecf5:169 Welfare Effects of Tax Policy in Open Economies: Stabilization and Cooperation (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (24) RePEc:sce:scecf5:370 Price setting in General Equilibrium: Alternative Specifications (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (25) RePEc:sce:scecf5:427 Simple Pricing Rules, the Phillips Curve and the Microfoundations of Inflation Persistence (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (26) RePEc:sce:scecf5:123 Aging, pension reform, and capital flows: A multi-country simulation model (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (27) RePEc:sce:scecf5:202 Estimating the Stochastic Discount Factor without a Utility Function (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (28) RePEc:sce:scecf5:405 On the Benefits of Exchange Rate Flexibility under Endogenous Tradedness of Goods (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (29) RePEc:sce:scecf5:186 Spurious regression under broken trend stationarity (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (30) RePEc:sce:scecf5:134 Time Consistent Policy in Markov Switching Models (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (31) RePEc:sce:scecf5:459 Measuring Inflation Persistence: A Structural Time Series Approach (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (32) RePEc:sce:scecf5:258 Common Trends and Common Cycles in Latin America: A 2-step vs an Iterative Approach (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (33) RePEc:sce:scecf5:191 Vacancy Persistence (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (34) RePEc:sce:scecf5:293 The Fed and the Stock Market (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (35) RePEc:sce:scecf5:298 A Two Sector Small Open Economy Model. Which Inflation to Target? (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (36) RePEc:sce:scecf5:140 Extreme Value Theory and Fat Tails in Equity Markets (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (37) RePEc:sce:scecf5:33 Model Uncertainty and Endogenous Volatility (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (38) RePEc:sce:scecf5:275 On the Effects of Redistribution on Growth and Entrepreneurial Risk-Taking (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (39) RePEc:sce:scecf5:127 Bias in Federal Reserve Inflation Forecasts: Is the Federal Reserve Irrational or Just Cautious? (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (40) RePEc:sce:scecf5:205 The Scarring Effect of Recessions (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (41) RePEc:sce:scecf5:412 A Computational Approach to Proving Uniqueness in Dynamic Games (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (42) RePEc:sce:scecf5:147 Optimal Nonlinear Policy: Signal Extraction with a Non-Normal Prior (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (43) RePEc:sce:scecf5:351 Agency Conflicts, Investment, and Asset Pricing (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (44) RePEc:sce:scecf5:49 Climate Change and Extreme Events: an Assessment of Economic Implications (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (45) RePEc:sce:scecf5:25 The Optimal Inflation Buffer with a Zero Bound on Nominal Interest Rates (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (46) RePEc:sce:scecf5:138 Central Bank Estimates of the Unemployment Natural Rate (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (47) RePEc:sce:scecf5:215 Using Copulas to Construct Bivariate Foreign Exchange Distributions with an Application to the Sterling Exchange Rate Index (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (48) RePEc:sce:scecf5:62 Monetary and Fiscal Interactions without Commitment and the Value of Monetary Conservatism (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (49) RePEc:sce:scecf5:277 Social Networks in Labor Markets: The Effects of Symmetry, Randomness and Exclusion on Output and Inequality (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (50) RePEc:sce:scecf5:46 Measuring the NAIRU with Reduced Uncertainty: A Multiple Indicator-Common Component Approach (2005). Society for Computational Economics / Computing in Economics and Finance 2005 Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |