|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

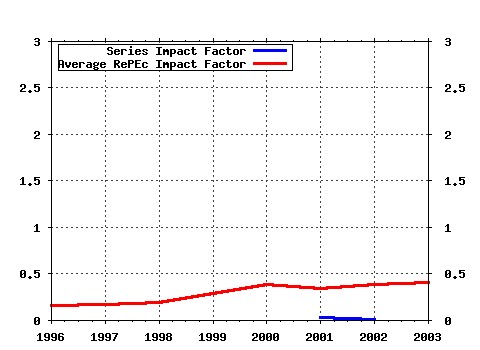

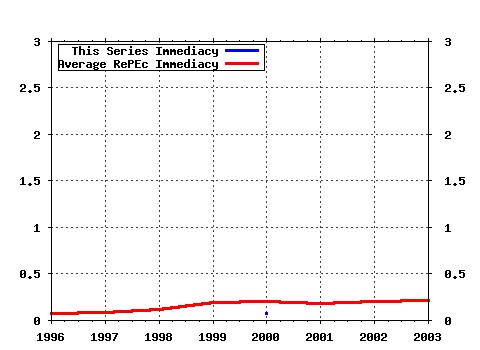

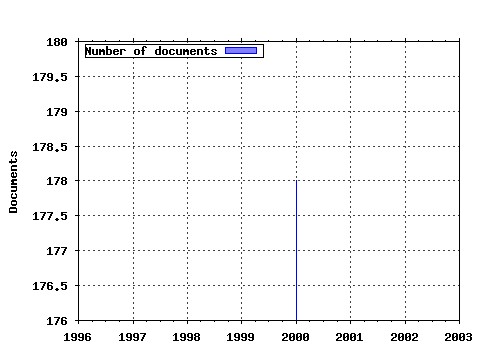

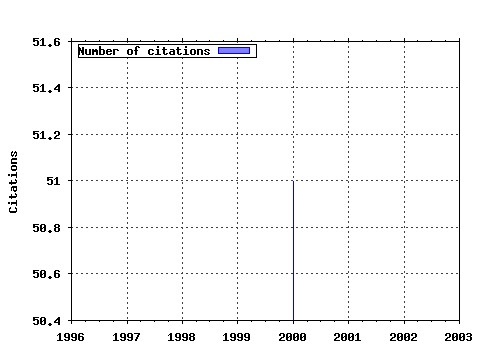

Society for Computational Economics / Computing in Economics and Finance 1997 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf7:11 Monetary Policy and Uncertainty about the Natural Unemployment Rate (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (2) RePEc:sce:scecf7:2 A Test for Strong Hysteresis (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (3) RePEc:sce:scecf7:105 Transitional Dynamics in Non-Scale Growth Models (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (4) RePEc:sce:scecf7:126 Mergers and Dynamic Oligopoly (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (5) RePEc:sce:scecf7:61 The Emergence of Economic Classes in an Agent-based Bargaining Model (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (6) RePEc:sce:scecf7:35 Computationally Efficient Solution and Maximum Likelihood Estimation of Nonlinear Rational Expectations Models (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (7) RePEc:sce:scecf7:128 A Microeconomic Theory of Learning-by-Doing: An Application of Nascent Technology Approach (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (8) RePEc:sce:scecf7:178 Procyclical Labor Productivity: Sources and Implications (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (9) RePEc:sce:scecf7:84 A Quantitative Analysis of Employment Guarantee Programs with an Application to Rural India (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (10) RePEc:sce:scecf7:163 Information Processing and Organizational Structure (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (11) RePEc:sce:scecf7:58 A Theory of Technical Analysis (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (12) RePEc:sce:scecf7:147 Genetic Learning in Double Auctions (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (13) RePEc:sce:scecf7:50 Structural Breaks and VAR Modeling with Marginal Likelihoods (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (14) RePEc:sce:scecf7:13 Technological Diversity in an Evolutionary Industry Model with Localized Learning and Network Externalities (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (15) RePEc:sce:scecf7:88 Decentralized Interaction and Co-adaptation in the Repeated Prisoners Dilemma (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (16) RePEc:sce:scecf7:176 Forecasting Fundamental Asset Return Distributions (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (17) RePEc:sce:scecf7:154 Learning With a Known Average: a Simulation Study of Alternative Learning Rules (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (18) RePEc:sce:scecf7:55 Optimization of Trading Systems and Portfolios (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (19) RePEc:sce:scecf7:130 Pricing Double Barrier Options: An Analytical Approach (2000). Society for Computational Economics / Computing in Economics and Finance 1997 (20) RePEc:sce:scecf7:125 Optimal Open Loop Cheating in Dynamic Reversed LQG Stackelberg Games (2000). Society for Computational Economics / Computing in Economics and Finance 1997 Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 (1) RePEc:ces:ceswps:_297 Employment and Welfare Effects of a Two-Tier Unemployment Compensation System (2000). CESifo GmbH / CESifo Working Paper Series (2) RePEc:cpr:ceprdp:2479 Do Interventions Smooth Interest Rates? (2000). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:dgr:kubcen:2000112 Hedging double barriers with singles (2000). Tilburg University, Center for Economic Research / Discussion Paper (4) RePEc:ecm:wc2000:1284 A Small Estimated Euro-Area Model with Rational Expectations and Nominal Rigidities (2000). Econometric Society / Econometric Society World Congress 2000 Contributed Papers (5) RePEc:fip:fedhwp:wp-00-22 An empirical examination of the price-dividend relation with dividend management (2000). Federal Reserve Bank of Chicago / Working Paper Series (6) RePEc:fip:fedmsr:264 Do mergers lead to monopoly in the long run? Results from the dominant firm model (2000). Federal Reserve Bank of Minneapolis / Staff Report (7) RePEc:fth:washer:0018 The Transitional Dynamics of Fiscal Policy: Long-run Capital Accumulation and Growth (2000). Department of Economics at the University of Washington / Discussion Papers in Economics at the University of Washington (8) RePEc:nbr:nberwo:6518 Rethinking the Role of NAIRU in Monetary Policy: Implications of Model Formulation and Uncertainty (2000). National Bureau of Economic Research, Inc / NBER Working Papers (9) RePEc:sce:scecf0:199 THE TRANSITIONAL DYNAMICS OF FISCAL POLICY; LONG-RUN CAPITAL ACCUMULATION AND GROWTH (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (10) RePEc:sce:scecf0:279 COLLECTIVE ACTION, FREE RIDING AND EVOLUTION (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (11) RePEc:sce:scecf0:3 EMPLOYMENT AND WELFARE EFFECTS OF A TWO-TIER UNEMPLOYMENT COMPENSATION SYSTEM (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (12) RePEc:szg:worpap:0004 Do Interventions Smooth Interest Rates'DONE' (2000). Swiss National Bank, Study Center Gerzensee / Working Papers (13) RePEc:wpa:wuwpco:0004003 Hysteresis in an Evolutionary Labor Market with Adaptive Search (2000). EconWPA / Computational Economics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |