|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

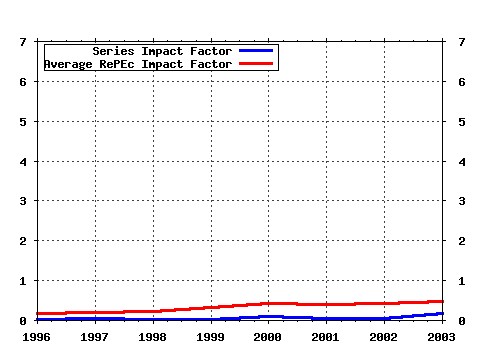

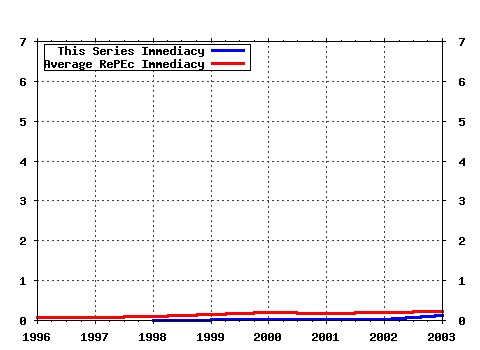

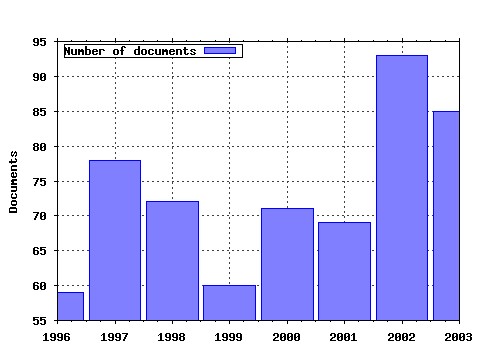

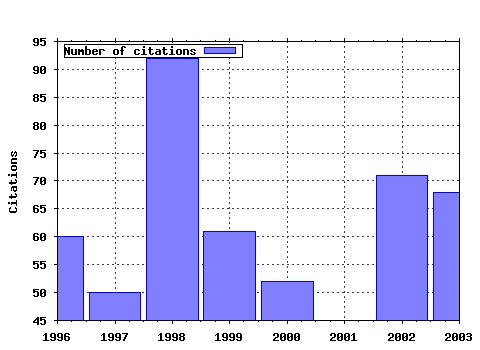

Applied Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apfiec:v:8:y:1998:i:6:p:607-14 Linkages between the US and European Equity Markets: Further Evidence from Cointegration Tests. (1998). Applied Financial Economics (2) RePEc:taf:apfiec:v:4:y:1994:i:2:p:121-32 Investment Decisions and the Role of Debt, Liquid Assets and Cash Flow: Evidence from Panel Data. (1994). Applied Financial Economics (3) RePEc:taf:apfiec:v:15:y:2005:i:14:p:1007-1017 Does patenting increase the probability of being acquired? Evidence from cross-border and domestic acquisitions (2005). Applied Financial Economics (4) RePEc:taf:apfiec:v:6:y:1996:i:6:p:463-75 The Stable Paretian Hypothesis and the Frequency of Large Returns: An Examination of Major German Stocks. (1996). Applied Financial Economics (5) RePEc:taf:apfiec:v:8:y:1998:i:6:p:689-96 Efficiency of Multinational Banks: An Empirical Investigation. (1998). Applied Financial Economics (6) RePEc:taf:apfiec:v:11:y:2001:i:1:p:1-8 Nonparametric Cointegration Analysis of Real Exchange Rates. (2001). Applied Financial Economics (7) RePEc:taf:apfiec:v:15:y:2005:i:5:p:315-326 Can mergers in Europe help banks hedge against macroeconomic risk? (2005). Applied Financial Economics (8) RePEc:taf:apfiec:v:5:y:1995:i:4:p:257-64 The Effect of Financial Liberalization on the Efficiency of Turkish Commercial Banks. (1995). Applied Financial Economics (9) RePEc:taf:apfiec:v:6:y:1996:i:4:p:307-17 Testing for Non-linearity in Daily Sterling Exchange Rates. (1996). Applied Financial Economics (10) RePEc:taf:apfiec:v:6:y:1996:i:4:p:367-75 Economies of Scale and Scope in European Banking. (1996). Applied Financial Economics (11) RePEc:taf:apfiec:v:2:y:1992:i:1:p:43-47 The International Transmission of Stock Market Fluctuation between the Developed Markets and the Asian-Pacific Markets. (1992). Applied Financial Economics (12) RePEc:taf:apfiec:v:13:y:2003:i:7:p:477-486 Stock market integration and financial crises: the case of Asia (2003). Applied Financial Economics (13) RePEc:taf:apfiec:v:14:y:2004:i:17:p:1253-1268 International portfolio diversification to Central European stock markets (2004). Applied Financial Economics (14) RePEc:taf:apfiec:v:8:y:1998:i:6:p:577-87 Modelling Real Exchange Rate Behaviour: A Cross-Country Study. (1998). Applied Financial Economics (15) RePEc:taf:apfiec:v:9:y:1999:i:4:p:385-95 The Information Content of the German Term Structure Regarding Inflation. (1999). Applied Financial Economics (16) RePEc:taf:apfiec:v:8:y:1998:i:4:p:401-07 Continuous-Time Short Term Interest Rate Models. (1998). Applied Financial Economics (17) RePEc:taf:apfiec:v:13:y:2003:i:2:p:113-122 Technical analysis in foreign exchange markets: evidence from the EMS (2003). Applied Financial Economics (18) RePEc:taf:apfiec:v:8:y:1998:i:3:p:245-56 Volatility Spillovers across Equity Markets: European Evidence. (1998). Applied Financial Economics (19) RePEc:taf:apfiec:v:7:y:1997:i:2:p:177-91 Regime Switching in Stock Market Returns. (1997). Applied Financial Economics (20) RePEc:taf:apfiec:v:9:y:1999:i:1:p:73-85 Macroeconomic Determinants of Long-Term Stock Market Comovements among Major EMS Countries. (1999). Applied Financial Economics (21) RePEc:taf:apfiec:v:12:y:2002:i:1:p:19-24 The Determinants of Corporate Debt Maturity: Evidence from UK Firms. (2002). Applied Financial Economics (22) RePEc:taf:apfiec:v:5:y:1995:i:1:p:11-18 Long Run Behaviour of Pacific-Basin Stock Prices. (1995). Applied Financial Economics (23) RePEc:taf:apfiec:v:12:y:2002:i:8:p:589-600 Accounting for Conditional Leptokurtosis and Closing Days Effects in FIGARCH Models of Daily Exchange Rates. (2002). Applied Financial Economics (24) RePEc:taf:apfiec:v:9:y:1999:i:1:p:1-9 Short- and Long-Term links among European and US Stock Markets. (1999). Applied Financial Economics (25) RePEc:taf:apfiec:v:2:y:1992:i:3:p:145-59 Dynamics of the Composition of Household Asset Portfolios and the Life Cycle. (1992). Applied Financial Economics (26) RePEc:taf:apfiec:v:4:y:1994:i:1:p:1-10 International Diversification among the Capital Markets of the EEC. (1994). Applied Financial Economics (27) RePEc:taf:apfiec:v:12:y:2002:i:7:p:475-84 African Stock Markets: Multiple Variance Ratio Tests of Random Walks. (2002). Applied Financial Economics (28) RePEc:taf:apfiec:v:4:y:1994:i:1:p:33-39 Some International Evidence Regarding the Stochastic Memory of Stock Returns. (1994). Applied Financial Economics (29) RePEc:taf:apfiec:v:5:y:1995:i:1:p:33-42 The Long-Run Gains from International Equity Diversification: Australian Evidence from Cointegration Tests. (1995). Applied Financial Economics (30) RePEc:taf:apfiec:v:7:y:1997:i:5:p:493-98 Stock Market Returns in Thin Markets: Evidence from the Vienna Stock Exchange. (1997). Applied Financial Economics (31) RePEc:taf:apfiec:v:7:y:1997:i:6:p:635-43 A Re-examination of the Fragility of Evidence from Cointegration-Based Tests of Foreign Exchange Market Efficiency. (1997). Applied Financial Economics (32) RePEc:taf:apfiec:v:8:y:1998:i:3:p:289-300 Efficiency and Technical Change for Spanish Banks. (1998). Applied Financial Economics (33) RePEc:taf:apfiec:v:5:y:1995:i:1:p:43-50 Day of the Week Effect on the Greek Stock Market. (1995). Applied Financial Economics (34) RePEc:taf:apfiec:v:9:y:1999:i:5:p:501-11 Short-Term and Long-Term Price Linkages between the Equity Markets of Australia and Its Major Trading Partners. (1999). Applied Financial Economics (35) RePEc:taf:apfiec:v:12:y:2002:i:1:p:47-55 Modelling Volatility and Testing for Efficiency in Emerging Capital Markets: The Case of the Athens Stock Exchange. (2002). Applied Financial Economics (36) RePEc:taf:apfiec:v:15:y:2005:i:3:p:153-163 International financial contagion: evidence from the Argentine crisis of 2001-2002 (2005). Applied Financial Economics (37) RePEc:taf:apfiec:v:12:y:2002:i:12:p:895-911 Credit Risk and Efficiency in the European Banking System: A Three-Stage Analysis. (2002). Applied Financial Economics (38) RePEc:taf:apfiec:v:14:y:2004:i:2:p:83-92 A simple test of the Fama and French model using daily data: Australian evidence (2004). Applied Financial Economics (39) RePEc:taf:apfiec:v:3:y:1993:i:3:p:255-66 The Causality between Official and Parallel Exchange Rates in Developing Countries. (1993). Applied Financial Economics (40) RePEc:taf:apfiec:v:8:y:1998:i:6:p:559-66 A Fractional Cointegration Test of Purchasing Power Parity: The Case of Selected Members of OPEC. (1998). Applied Financial Economics (41) RePEc:taf:apfiec:v:10:y:2000:i:6:p:615-22 Purchasing Power Parity, Nonlinearity and Chaos. (2000). Applied Financial Economics (42) RePEc:taf:apfiec:v:6:y:1996:i:3:p:287-92 Betting Bias and Market Equilibrium in Racetrack Betting. (1996). Applied Financial Economics (43) RePEc:taf:apfiec:v:4:y:1994:i:3:p:193-205 A Revenue-Restricted Cost Study of 100 Large Banks. (1994). Applied Financial Economics (44) RePEc:taf:apfiec:v:10:y:2000:i:2:p:177-84 Long Memory in the Greek Stock Market. (2000). Applied Financial Economics (45) RePEc:taf:apfiec:v:12:y:2002:i:3:p:193-202 Forecasting Volatility in the New Zealand Stock Market. (2002). Applied Financial Economics (46) RePEc:taf:apfiec:v:14:y:2004:i:4:p:221-231 Short patches of outliers, ARCH and volatility modelling (2004). Applied Financial Economics (47) RePEc:taf:apfiec:v:3:y:1993:i:4:p:335-38 Money, Output and Stock Prices in the UK: Evidence on Some (Non)relationships. (1993). Applied Financial Economics (48) RePEc:taf:apfiec:v:9:y:1999:i:5:p:477-82 Revisiting the Holiday Effect: Is It on Holiday? (1999). Applied Financial Economics (49) RePEc:taf:apfiec:v:9:y:1999:i:2:p:117-27 Purchasing Power Parity in the Long Run and Structural Breaks: Evidence from Real Sterling Exchange Rates. (1999). Applied Financial Economics (50) RePEc:taf:apfiec:v:13:y:2003:i:7:p:537-541 An alternative conditional asymmetry specification for stock returns (2003). Applied Financial Economics Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:bog:wpaper:02 Greek Monetary Economics in Retrospect: The Adventures of the Drachma (2003). Special Studies Division, Economic Research Department, Bank of Greece / Working Papers (2) RePEc:car:carecp:03-13 Modeling Money Demand under the Profit-Sharing Banking Scheme: Evidence on Policy Invariance and Long-Run Stability. Policy (2003). Carleton University, Department of Economics / Carleton Economic Papers (3) RePEc:ebl:ecbull:v:7:y:2003:i:3:p:1-13 Long memory in a small stock market (2003). Economics Bulletin (4) RePEc:fda:fdaddt:2003-15 Forecasting the Dollar/Euro Exchange Rate: Can International Parities Help? (2003). FEDEA / Working Papers (5) RePEc:fem:femwpa:2003.43 STAR-GARCH Models for Stock Market Interactions in the Pacific Basin Region, Japan and US (2003). Fondazione Eni Enrico Mattei / Working Papers (6) RePEc:hhs:umnees:0614 Temporal Aggregation of the Returns of a Stock Index Series (2003). Umeå University, Department of Economics / Umeå Economic Studies (7) RePEc:taf:apeclt:v:10:y:2003:i:10:p:643-645 An empirical comparison of interest rates using an interest rate model and nonparametric methods (2003). Applied Economics Letters (8) RePEc:taf:apeclt:v:10:y:2003:i:9:p:527-533 Financial crisis and African stock market integration (2003). Applied Economics Letters (9) RePEc:taf:applec:v:35:y:2003:i:18:p:1923-1933 Regimen changes and duration in the European Monetary System (2003). Applied Economics (10) RePEc:tky:fseres:2003cf208 Modelling the Asymmetric Volatility of Electronics Patents in the USA (2003). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series Latest citations received in: 2002 (1) RePEc:cte:wsrepe:ws025414 ESTIMATION METHODS FOR STOCHASTIC VOLATILITY MODELS: A SURVEY (2002). Universidad Carlos III, Departamento de Estadística y Econometría / Statistics and Econometrics Working Papers (2) RePEc:qut:dpaper:123 Tests of the Random Walk Hypothesis for Australian Electricity Spot Prices: An Application Employing Multiple Variance Ratio Tests (2002). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series (3) RePEc:taf:apmtfi:v:9:y:2002:i:3:p:179-188 Estimating volatility on overlapping returns when returns are autocorrelated (2002). Applied Mathematical Finance Latest citations received in: 2001 Latest citations received in: 2000 (1) RePEc:dnb:wormem:637 Capital Structure, Corporate Goverance, and Monetary Policy: Firm-Level Evidence for the Euro Area (2000). Netherlands Central Bank, Research Department / WO Research Memoranda (discontinued) (2) RePEc:may:mayecw:n1000500 Explaining European Short-term Interest Rate Differentials: An Application of Tobins Portfolio Theory (2000). Department of Economics, National University of Ireland - Maynooth / Economics Department Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |