|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

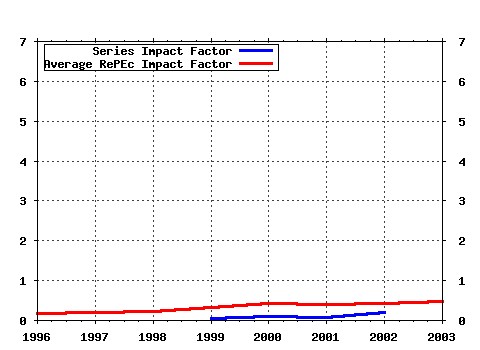

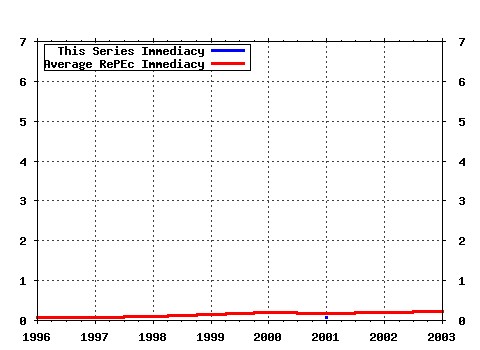

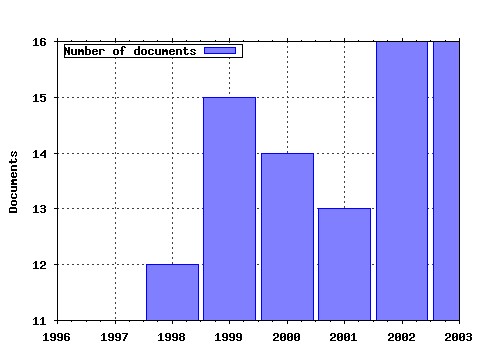

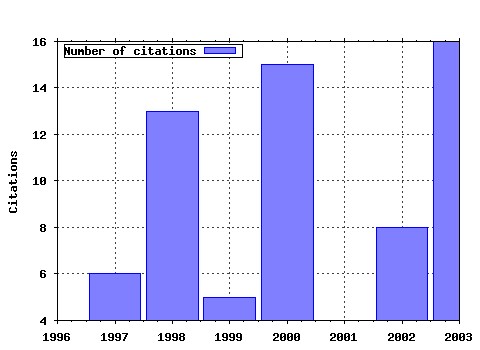

Applied Mathematical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apmtfi:v:7:y:2000:i:1:p:1-32 Volatility skews and extensions of the Libor market model (2000). Applied Mathematical Finance (2) RePEc:taf:apmtfi:v:12:y:2005:i:4:p:313-335 (). Applied Mathematical Finance (3) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:45-82 General Black-Scholes models accounting for increased market volatility from hedging strategies (1998). Applied Mathematical Finance (4) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:17-52 The Dynamic Interaction of Speculation and Diversification (2005). Applied Mathematical Finance (5) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:39-59 A Theoretically Consistent Version of the Nelson and Siegel Class of Yield Curve Models (2006). Applied Mathematical Finance (6) RePEc:taf:apmtfi:v:10:y:2003:i:4:p:303-324 On arbitrage-free pricing of weather derivatives based on fractional Brownian motion (2003). Applied Mathematical Finance (7) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:1-18 A Semi-Explicit Approach to Canary Swaptions in HJM One-Factor Model (2006). Applied Mathematical Finance (8) RePEc:taf:apmtfi:v:9:y:2002:i:2:p:69-85 Bivariate option pricing with copulas (2002). Applied Mathematical Finance (9) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:1-18 Optimal execution with nonlinear impact functions and trading-enhanced risk (2003). Applied Mathematical Finance (10) RePEc:taf:apmtfi:v:10:y:2003:i:4:p:325-336 A note on arbitrage-free pricing of forward contracts in energy markets (2003). Applied Mathematical Finance (11) RePEc:taf:apmtfi:v:4:y:1997:i:1:p:37-64 Calibrating volatility surfaces via relative-entropy minimization (1997). Applied Mathematical Finance (12) RePEc:taf:apmtfi:v:6:y:1999:i:2:p:87-106 A finite element approach to the pricing of discrete lookbacks with stochastic volatility (1999). Applied Mathematical Finance (13) RePEc:taf:apmtfi:v:8:y:2001:i:2:p:79-95 Liquidity and credit risk (2001). Applied Mathematical Finance (14) RePEc:taf:apmtfi:v:5:y:1998:i:2:p:107-116 Optimal exercise boundary for an American put option (1998). Applied Mathematical Finance (15) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:49-74 A new approximate swaption formula in the LIBOR market model: an asymptotic expansion approach (2003). Applied Mathematical Finance (16) RePEc:taf:apmtfi:v:4:y:1997:i:4:p:181-199 Interest rate futures: estimation of volatility parameters in an arbitrage-free framework (1997). Applied Mathematical Finance (17) RePEc:taf:apmtfi:v:11:y:2004:i:3:p:259-282 Calculating hedge fund risk: the draw down and the maximum draw down (2004). Applied Mathematical Finance (18) RePEc:taf:apmtfi:v:6:y:1999:i:3:p:197-208 Optimal hedging strategies for misspecified asset price models (1999). Applied Mathematical Finance (19) RePEc:taf:apmtfi:v:4:y:1997:i:1:p:21-36 Misspecified asset price models and robust hedging strategies (1997). Applied Mathematical Finance (20) RePEc:taf:apmtfi:v:8:y:2001:i:4:p:209-233 valuation of options on joint minima and maxima (2001). Applied Mathematical Finance (21) RePEc:taf:apmtfi:v:5:y:1998:i:3-4:p:143-163 A framework for valuing corporate securities (1998). Applied Mathematical Finance (22) RePEc:taf:apmtfi:v:8:y:2001:i:1:p:49-77 A numerical PDE approach for pricing callable bonds (2001). Applied Mathematical Finance (23) RePEc:taf:apmtfi:v:10:y:2003:i:2:p:91-119 Tracking error decision rules and accumulated wealth (2003). Applied Mathematical Finance (24) RePEc:taf:apmtfi:v:9:y:2002:i:3:p:143-161 A model of speculative behaviour with a strange attractor (2002). Applied Mathematical Finance (25) RePEc:taf:apmtfi:v:7:y:2000:i:1:p:33-60 Unstructured meshing for two asset barrier options (2000). Applied Mathematical Finance (26) RePEc:taf:apmtfi:v:10:y:2003:i:2:p:121-147 Stock options as barrier contingent claims (2003). Applied Mathematical Finance (27) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:1-15 Detecting mean reversion within reflecting barriers: application to the European Exchange Rate Mechanism (1998). Applied Mathematical Finance (28) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:45-60 Basics of electricity derivative pricing in competitive markets (2002). Applied Mathematical Finance (29) RePEc:taf:apmtfi:v:6:y:1999:i:3:p:209-232 Phenomenology of the interest rate curve (1999). Applied Mathematical Finance (30) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:19-47 Contingent claim pricing using probability distortion operators: methods from insurance risk pricing and their relationship to financial theory (2003). Applied Mathematical Finance (31) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:1-20 On modelling and pricing weather derivatives (2002). Applied Mathematical Finance (32) RePEc:taf:apmtfi:v:11:y:2004:i:2:p:125-146 Modelling credit default swap spreads by means of normal mixtures and copulas (2004). Applied Mathematical Finance (33) RePEc:taf:apmtfi:v:13:y:2006:i:4:p:309-331 An EZI Method to Reduce the Rank of a Correlation Matrix in Financial Modelling (2006). Applied Mathematical Finance (34) RePEc:taf:apmtfi:v:7:y:2000:i:2:p:115-125 Estimating fees for managed futures: a continuous-time model with a knockout feature (2000). Applied Mathematical Finance (35) RePEc:taf:apmtfi:v:10:y:2003:i:2:p:163-181 Minimizing coherent risk measures of shortfall in discrete-time models with cone constraints (2003). Applied Mathematical Finance (36) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:17-43 An explicit finite difference approach to the pricing of barrier options (1998). Applied Mathematical Finance (37) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:53-85 Stochastic Modelling of Temperature Variations with a View Towards Weather Derivatives (2005). Applied Mathematical Finance (38) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:21-43 Energy futures prices: term structure models with Kalman filter estimation (2002). Applied Mathematical Finance Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 (1) RePEc:taf:apmtfi:v:8:y:2001:i:4:p:197-208 Valuation formulae for window barrier options (2001). Applied Mathematical Finance Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |