|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

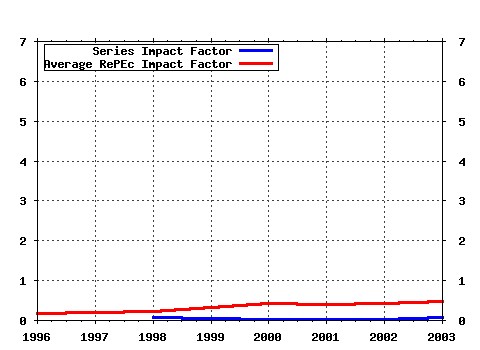

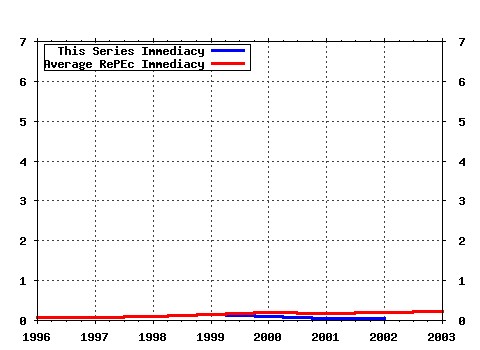

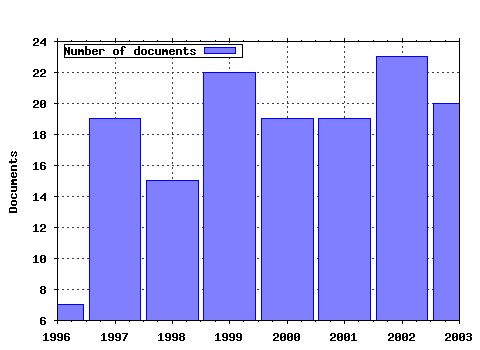

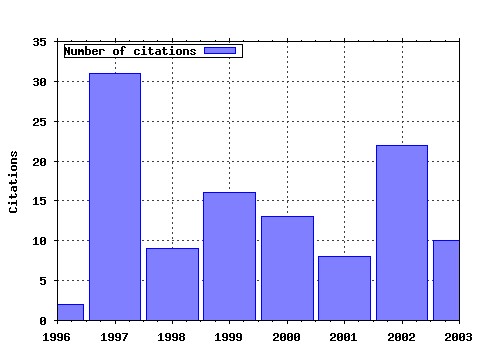

European Journal of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:eurjfi:v:3:y:1997:i:4:p:291-309 The numeraire portfolio: a new perspective on financial theory (1997). European Journal of Finance (2) RePEc:taf:eurjfi:v:3:y:1997:i:3:p:203-224 Comment (1997). European Journal of Finance (3) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:371-401 Modelling the demand for M3 in the Euro area (2002). European Journal of Finance (4) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:402-421 Forecasting inflation in the European Monetary Union: A disaggregated approach by countries and by sectors (2002). European Journal of Finance (5) RePEc:taf:eurjfi:v:3:y:1997:i:1:p:73-85 Implied volatility skews and stock return skewness and kurtosis implied by stock option prices (1997). European Journal of Finance (6) RePEc:taf:eurjfi:v:9:y:2003:i:4:p:343-357 Asset pricing implications of benchmarking: a two-factor CAPM (2003). European Journal of Finance (7) RePEc:taf:eurjfi:v:10:y:2004:i:5:p:329-344 Predictability of stock markets with disequilibrium trading (2004). European Journal of Finance (8) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:213-224 Beta lives - some statistical perspectives on the capital asset pricing model (1999). European Journal of Finance (9) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:163-175 The effects of trading activity on market volatility (2000). European Journal of Finance (10) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:202-212 Is beta still alive? Conclusive evidence from the Swiss stock market (1999). European Journal of Finance (11) RePEc:taf:eurjfi:v:5:y:1999:i:4:p:331-341 Modelling normal returns in event studies: a model-selection approach and pilot study (1999). European Journal of Finance (12) RePEc:taf:eurjfi:v:7:y:2001:i:3:p:198-230 Implied volatility surfaces: uncovering regularities for options on financial futures (2001). European Journal of Finance (13) RePEc:taf:eurjfi:v:10:y:2004:i:2:p:105-122 Employee stock option plans and stock market reaction: evidence from Finland (2004). European Journal of Finance (14) RePEc:taf:eurjfi:v:7:y:2001:i:2:p:165-183 Bank failure: a multidimensional scaling approach (2001). European Journal of Finance (15) RePEc:taf:eurjfi:v:12:y:2006:i:2:p:171-188 (). European Journal of Finance (16) RePEc:taf:eurjfi:v:11:y:2005:i:3:p:169-181 Generating science-based growth: an econometric analysis of the impact of organizational incentives on university--industry technology transfer (2005). European Journal of Finance (17) RePEc:taf:eurjfi:v:8:y:2002:i:1:p:21-45 The information in the term structure of German interest rates (2002). European Journal of Finance (18) RePEc:taf:eurjfi:v:12:y:2006:i:6-7:p:567-582 Comovements and correlations in international stock markets (2006). European Journal of Finance (19) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:196-224 Further insights on the puzzle of technical analysis profitability (2000). European Journal of Finance (20) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:257-278 Fund managers attitudes to risk and time horizons: the effect of performance benchmarking (1998). European Journal of Finance (21) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:126-145 Combining forecasts: some results on exchange and interest rates (2000). European Journal of Finance (22) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:322-343 World capital markets and Finnish stock returns (2002). European Journal of Finance (23) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:165-180 An introduction to security returns (1999). European Journal of Finance (24) RePEc:taf:eurjfi:v:7:y:2001:i:1:p:63-91 Derivatives usage in UK non-financial listed companies (2001). European Journal of Finance (25) RePEc:taf:eurjfi:v:9:y:2003:i:5:p:514-532 Evaluating capital mobility in the EU: a new approach using swaps data (2003). European Journal of Finance (26) RePEc:taf:eurjfi:v:8:y:2002:i:2:p:152-175 An analysis of the causes of recent banking crises (2002). European Journal of Finance (27) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:480-501 US dollar/Euro exchange rate: a monthly econometric model for forecasting (2002). European Journal of Finance (28) RePEc:taf:eurjfi:v:12:y:2006:i:6-7:p:473-494 Small sample properties of GARCH estimates and persistence (2006). European Journal of Finance (29) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:291-304 Board size and corporate performance: evidence from European countries (1998). European Journal of Finance (30) RePEc:taf:eurjfi:v:9:y:2003:i:6:p:557-580 Information criteria for GARCH model selection (2003). European Journal of Finance (31) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:233-256 A survey of corporate perceptions of short-termism among analysts and fund managers (1998). European Journal of Finance (32) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:113-125 Expectations of monetary policy in Australia implied by the probability distribution of interest rate derivatives (2000). European Journal of Finance (33) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:302-321 Forecasting stock market volatility and the informational efficiency of the DAX-index options market (2002). European Journal of Finance (34) RePEc:taf:eurjfi:v:5:y:1999:i:2:p:123-139 LIFFE cycles: intraday evidence from the FTSE-100 Stock Index futures market (1999). European Journal of Finance (35) RePEc:taf:eurjfi:v:6:y:2000:i:3:p:298-310 Forecasting the returns on UK investment trusts: a comparison (2000). European Journal of Finance (36) RePEc:taf:eurjfi:v:4:y:1998:i:2:p:129-155 Financial institutions, private acquisition of corporate information, and fund management (1998). European Journal of Finance (37) RePEc:taf:eurjfi:v:8:y:2002:i:2:p:187-205 New evidence on the implied-realized volatility relation (2002). European Journal of Finance (38) RePEc:taf:eurjfi:v:2:y:1996:i:1:p:103-123 A comparison of diffusion models of the term structure (1996). European Journal of Finance (39) RePEc:taf:eurjfi:v:5:y:1999:i:1:p:29-50 Insider trading and portfolio structure in experimental asset markets with a long-lived asset (1999). European Journal of Finance (40) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:93-112 Switching regime models in the Spanish inter-bank market (2000). European Journal of Finance (41) RePEc:taf:eurjfi:v:9:y:2003:i:3:p:199-218 Legal constraints, transaction costs and the evaluation of mutual funds (2003). European Journal of Finance (42) RePEc:taf:eurjfi:v:10:y:2004:i:6:p:542-566 On the bi-dimensionality of liquidity (2004). European Journal of Finance (43) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:236-246 Estimating the equity premium (1999). European Journal of Finance (44) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:305-309 The influence of earnings per share on capital issues: some evidence from UK companies (1998). European Journal of Finance (45) RePEc:taf:eurjfi:v:3:y:1997:i:3:p:261-275 Information asymmetry, long-run relationship and price discovery in property investment markets (1997). European Journal of Finance (46) RePEc:taf:eurjfi:v:9:y:2003:i:6:p:581-601 Motives for partial acquisitions between firms in the spanish stock market (2003). European Journal of Finance (47) RePEc:taf:eurjfi:v:12:y:2006:i:5:p:449-453 Volatility clustering and event-induced volatility: Evidence from UK mergers and acquisitions (2006). European Journal of Finance (48) RePEc:taf:eurjfi:v:3:y:1997:i:3:p:183-202 Feedforward neural networks in the classification of financial information (1997). European Journal of Finance (49) RePEc:taf:eurjfi:v:12:y:2006:i:1:p:1-22 (). European Journal of Finance (50) RePEc:taf:eurjfi:v:4:y:1998:i:2:p:93-111 A study on the efficiency of the market for Dutch long-term call options (1998). European Journal of Finance Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:bdi:wptemi:td_440_02 Bootstrap bias-correction procedure in estimating long-run relationships from dynamic panels, with an application to money demand in the euro area (2002). Bank of Italy, Economic Research Department / Temi di discussione (Economic working papers) Latest citations received in: 2001 (1) RePEc:dgr:kubcen:200162 The impact of institutional differences on derivatives usage : a comparative study of US and Dutch firms (2001). Tilburg University, Center for Economic Research / Discussion Paper Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |