|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

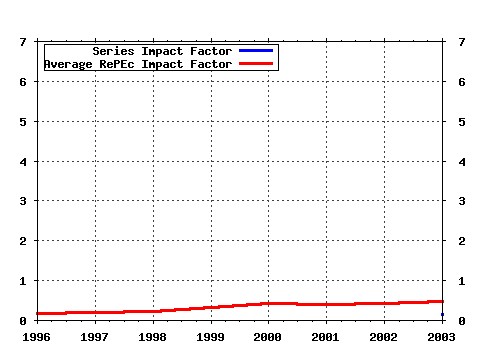

Quantitative Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:quantf:v:2:y:2002:i:6:p:459-467 Consistent pricing and hedging for a modified constant elasticity of variance model (2002). Quantitative Finance (2) RePEc:taf:quantf:v:2:y:2002:i:6:p:432-442 Pricing of perpetual Bermudan options (2002). Quantitative Finance (3) RePEc:taf:quantf:v:5:y:2005:i:5:p:489-501 Empirical estimation of tail dependence using copulas: application to Asian markets (2005). Quantitative Finance (4) RePEc:taf:quantf:v:2:y:2002:i:6:p:415-431 A theory of non-Gaussian option pricing (2002). Quantitative Finance (5) RePEc:taf:quantf:v:6:y:2006:i:6:p:449-449 The modified Weibull distribution for asset returns (2006). Quantitative Finance (6) RePEc:taf:quantf:v:6:y:2006:i:2:p:147-158 A new technique for calibrating stochastic volatility models: the Malliavin gradient method (2006). Quantitative Finance (7) RePEc:taf:quantf:v:5:y:2005:i:6:p:513-517 Statistical properties of demand fluctuation in the financial market (2005). Quantitative Finance (8) RePEc:taf:quantf:v:6:y:2006:i:6:p:513-536 Fast strong approximation Monte Carlo schemes for stochastic volatility models (2006). Quantitative Finance (9) RePEc:taf:quantf:v:6:y:2006:i:3:p:197-206 Local volatility function models under a benchmark approach (2006). Quantitative Finance (10) RePEc:taf:quantf:v:5:y:2005:i:6:p:531-542 Valuation of volatility derivatives as an inverse problem (2005). Quantitative Finance (11) RePEc:taf:quantf:v:7:y:2007:i:1:p:63-74 The geometry of crashes. A measure of the dynamics of stock market crises (2007). Quantitative Finance (12) RePEc:taf:quantf:v:2:y:2002:i:6:p:443-453 Probability distribution of returns in the Heston model with stochastic volatility* (2002). Quantitative Finance Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |