|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

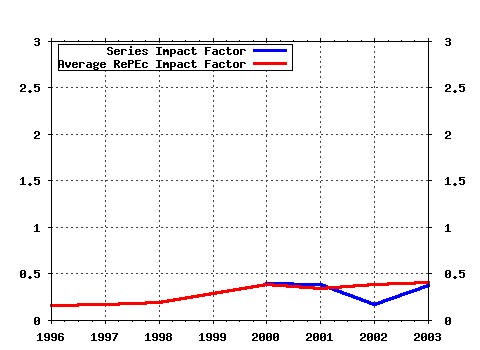

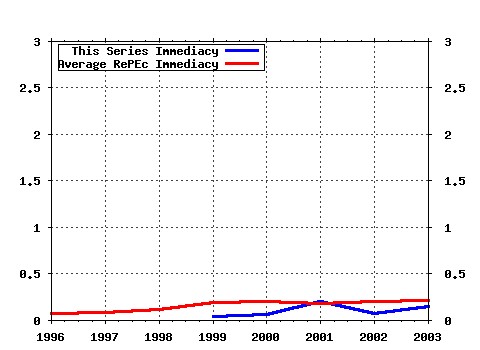

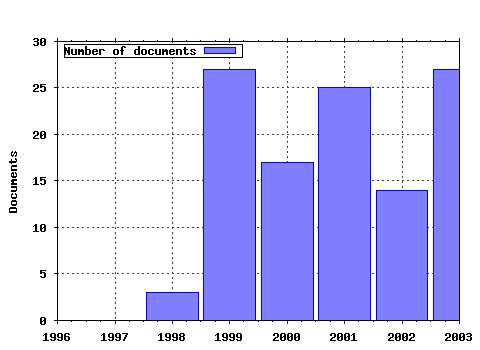

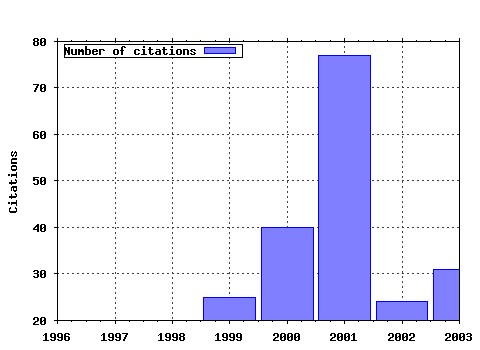

Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:uts:rpaper:72 Arbitrage in Continuous Complete Markets (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (2) RePEc:uts:rpaper:56 Asset Price and Wealth Dynamics Under Heterogeneous Expectations (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (3) RePEc:uts:rpaper:35 Heterogeneous Beliefs, Risk and Learning in a Simple Asset Pricing Model with a Market Maker (2000). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (4) RePEc:uts:rpaper:48 A Minimal Financial Market Model (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (5) RePEc:uts:rpaper:103 Modeling the Volatility and Expected Value of a Diversified World Index (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (6) RePEc:uts:rpaper:49 Speculative Behaviour and Complex Asset Price Dynamics (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (7) RePEc:uts:rpaper:55 Dynamics of Beliefs and Learning Under aL Processes - The Heterogeneous Case (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (8) RePEc:uts:rpaper:84 An Adaptive Model on Asset Pricing and Wealth Dynamics with Heterogeneous Trading Strategies (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (9) RePEc:uts:rpaper:129 Diversified Portfolios with Jumps in a Benchmark Framework (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (10) RePEc:uts:rpaper:78 Consistent Pricing and Hedging for a Modified Constant Elasticity of Variance Model (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (11) RePEc:uts:rpaper:138 A Benchmark Approach to Finance (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (12) RePEc:uts:rpaper:153 On the Distributional Characterization of Log-returns of a World Stock Index (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (13) RePEc:uts:rpaper:5 Forward Rate Dependent Markovian Transformations of the Heath-Jarrow-Morton Term Structure Model (1999). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (14) RePEc:uts:rpaper:113 A Benchmark Framework for Risk Management (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (15) RePEc:uts:rpaper:46 Mean Variance Preferences, Expectations Formation, and the Dynamics of Random Asset Prices (2000). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (16) RePEc:uts:rpaper:101 Pricing of Index Options Under a Minimal Market Model with Lognormal Scaling (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (17) RePEc:uts:rpaper:81 Benchmark Model with Intensity Based Jumps (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (18) RePEc:uts:rpaper:6 An Introduction to Numerical Methods for Stochastic Differential Equations (1999). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (19) RePEc:uts:rpaper:168 Multivariate Autoregressive Conditional Heteroskedasticity with Smooth Transitions in Conditional Correlations (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (20) RePEc:uts:rpaper:143 Capital Asset Pricing for Markets with Intensity Based Jumps (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (21) RePEc:uts:rpaper:53 Dynamics of Beliefs and Learning Under aL Processes - The Homogeneous Case (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (22) RePEc:uts:rpaper:91 A Structure for General and Specific Market Risk (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (23) RePEc:uts:rpaper:74 A Discrete Time Benchmark Approach for Finance and Insurance (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (24) RePEc:uts:rpaper:144 On the Role of the Growth Optimal Portfolio in Finance (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (25) RePEc:uts:rpaper:45 Risk Premia and Financial Modelling Without Measure Transformation (2000). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (26) RePEc:uts:rpaper:125 Intraday Empirical Analysis and Modeling of Diversified World Stock Indices (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (27) RePEc:uts:rpaper:114 On the Efficiency of Simplified Weak Taylor Schemes for Monte Carlo Simulation in Finance (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (28) RePEc:uts:rpaper:13 Classes of Interest Rate Models Under the HJM Framework (1999). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (29) RePEc:uts:rpaper:44 Strong Discrete Time Approximation of Stochastic Differential Equations with Time Delay (2000). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (30) RePEc:uts:rpaper:128 Understanding the Implied Volatility Surface for Options on a Diversified Index (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (31) RePEc:uts:rpaper:32 Bayesian Target Zones (2000). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (32) RePEc:uts:rpaper:139 A General Benchmark Model for Stochastic Jump Sizes (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (33) RePEc:uts:rpaper:65 On Filtering in Markovian Term Structure Models (An Approximation Approach) (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (34) RePEc:uts:rpaper:106 Fair Pricing of Weather Derivatives (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (35) RePEc:uts:rpaper:118 A Survey of the Integral Representation of American Option Prices (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (36) RePEc:uts:rpaper:130 Two-Factor Model for Low Interest Rate Regimes (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (37) RePEc:uts:rpaper:175 Volatility Forecast Comparison using Imperfect Volatility Proxies (2006). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (38) RePEc:uts:rpaper:54 Rate of Weak Convergence of the Euler Approximation for Diffusion Processes with Jumps (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (39) RePEc:uts:rpaper:68 Estimation in Models of the Instantaneous Short Term Interest Rate By Use of a Dynamic Bayesian Algorithm (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (40) RePEc:uts:rpaper:31 Using Bayesian Variable Selection Methods to Choose Style Factors in Global Stock Return (2000). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (41) RePEc:uts:rpaper:63 Filtering and Forecasting Spot Electricity Prices in the Increasingly Deregulated Australian Electricity Market (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (42) RePEc:uts:rpaper:157 On the Strong Approximation of Jump-Diffusion Processes (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (43) RePEc:uts:rpaper:21 A Minimal Share Market Model with Stochastic Volatility (1999). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (44) RePEc:uts:rpaper:110 Pricing and Hedging for Incomplete Jump Diffusion Benchmark Models (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (45) RePEc:uts:rpaper:29 Fourth Moment Structure of a Family of First-Order Exponential GARCH Models (1999). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (46) RePEc:uts:rpaper:184 Approximating the Growth Optimal Portfolio with a Diversified World Stock Index (2006). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (47) RePEc:uts:rpaper:155 Benchmarking and Fair Pricing Applied to Two Market Models (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (48) RePEc:uts:rpaper:87 Diversified Portfolios in a Benchmark Framework (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (49) RePEc:uts:rpaper:83 Evaluation of American Strangles (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (50) RePEc:uts:rpaper:165 Panel Smooth Transition Regression Models (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:uts:rpaper:103 Modeling the Volatility and Expected Value of a Diversified World Index (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (2) RePEc:uts:rpaper:106 Fair Pricing of Weather Derivatives (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (3) RePEc:uts:rpaper:110 Pricing and Hedging for Incomplete Jump Diffusion Benchmark Models (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (4) RePEc:uts:rpaper:113 A Benchmark Framework for Risk Management (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2002 (1) RePEc:uts:rpaper:77 A Benchmark Approach to Filtering in Finance (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2001 (1) RePEc:ams:cdws01:5a.2 Asset Price and Wealth Dynamics under Heterogeneous Expectations (2001). Universiteit van Amsterdam, Center for Nonlinear Dynamics in Economics and Finance / CeNDEF Workshop Papers, January 2001 (2) RePEc:uts:rpaper:53 Dynamics of Beliefs and Learning Under aL Processes - The Homogeneous Case (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (3) RePEc:uts:rpaper:56 Asset Price and Wealth Dynamics Under Heterogeneous Expectations (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (4) RePEc:uts:rpaper:65 On Filtering in Markovian Term Structure Models (An Approximation Approach) (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (5) RePEc:uts:rpaper:68 Estimation in Models of the Instantaneous Short Term Interest Rate By Use of a Dynamic Bayesian Algorithm (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2000 (1) RePEc:wop:humbsf:2000-91 A Minimal Financial Market Model (2000). Humboldt Universitaet Berlin / Sonderforschungsbereich 373 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |