|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

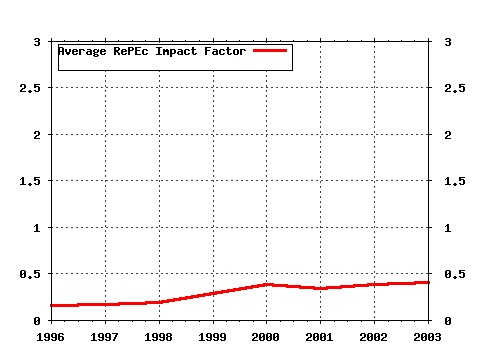

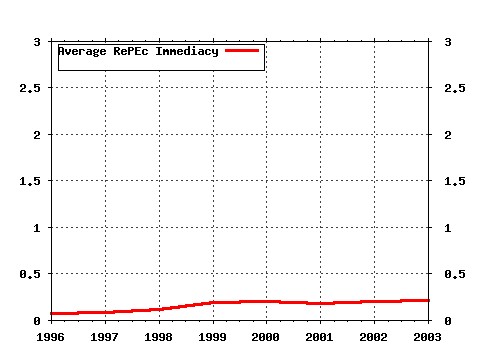

Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:zbw:bubdp2:2227 Forecasting Credit Portfolio Risk (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (2) RePEc:zbw:bubdp2:4264 Accounting for distress in bank mergers (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (3) RePEc:zbw:bubdp2:2226 Credit Risk Factor Modeling and the Basel II IRB Approach (2003). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (4) RePEc:zbw:bubdp2:4269 Time series properties of a rating system based on financial ratios (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (5) RePEc:zbw:bubdp2:4270 Inefficient or just different? Effects of heterogeneity on bank efficiency scores (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (6) RePEc:zbw:bubdp2:2225 Measuring the Discriminative Power of Rating Systems (2003). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (7) RePEc:zbw:bubdp2:4252 Does capital regulation matter for bank behaviour? Evidence for German savings banks (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (8) RePEc:zbw:bubdp2:4267 Evaluating the German bank merger wave (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (9) RePEc:zbw:bubdp2:4262 Banksâ regulatory capital buffer and the business cycle: evidence for German savings and

cooperative banks (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (10) RePEc:zbw:bubdp2:6927 Creditor concentration: an empirical investigation (2007). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (11) RePEc:zbw:bubdp2:4255 Estimating probabilities of default for German savings banks and credit cooperatives (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (12) RePEc:zbw:bubdp2:5096 The stability of efficiency rankings when risk-preferences and objectives are different (2006). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (13) RePEc:zbw:bubdp2:6352 Asset correlations and credit portfolio risk: an empirical analysis (2007). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (14) RePEc:zbw:bubdp2:4254 How will Basel II affect bank lending to emerging markets? An analysis based on German bank level

data (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (15) RePEc:zbw:bubdp2:4536 Does diversification improve the performance of German banks? : Evidence from individual bank loan

portfolios (2006). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |