|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

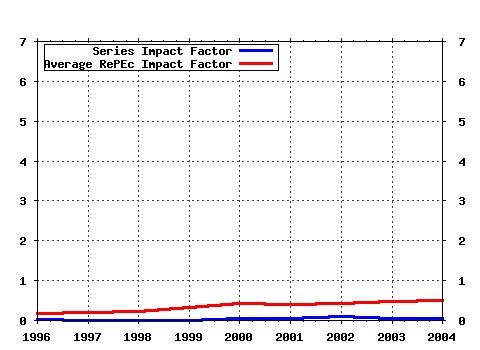

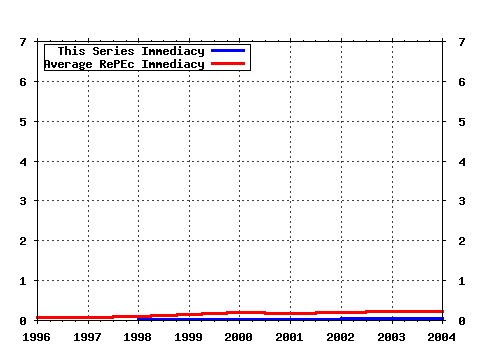

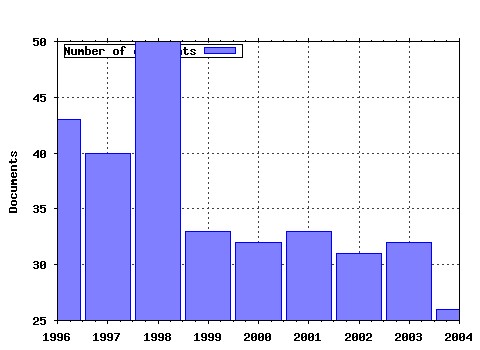

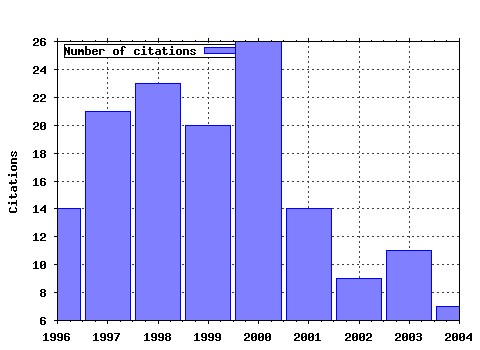

The Financial Review Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:finrev:v:35:y:2000:i:1:p:29-48 Multivariate GARCH Modeling of Exchange Rate Volatility Transmission in the European Monetary System. (2000). (2) RePEc:bla:finrev:v:27:y:1992:i:2:p:289-307 An Empirical Analysis of Stock Prices in Major Asian Markets and the United States. (1992). (3) RePEc:bla:finrev:v:34:y:1999:i:2:p:57-72 Random Walks and Market Efficiency Tests of Latin American Emerging Equity Markets: A Revisit. (1999). (4) RePEc:bla:finrev:v:19:y:1984:i:4:p:301-20 Weak Form Tests of the Efficiency of Real Estate Investment Markets. (1984). (5) RePEc:bla:finrev:v:27:y:1992:i:4:p:553-70 Deviations from Purchasing Power Parity. (1992). (6) RePEc:bla:finrev:v:24:y:1989:i:4:p:541-50 Seasonal and Day-of-the-Week Effects in Four Emerging Stock Markets. (1989). (7) RePEc:bla:finrev:v:32:y:1997:i:4:p:659-89 The Impact of Antitakeover Amendments on Corporate Financial Performance. (1997). (8) RePEc:bla:finrev:v:30:y:1995:i:2:p:289-311 Information Asymmetry and Valuation Effects of Debt Financing. (1995). (9) RePEc:bla:finrev:v:33:y:1998:i:1:p:1-16 The Effect of Leverage on Bargaining with a Corporation. (1998). (10) RePEc:bla:finrev:v:29:y:1994:i:3:p:293-317 Conditional Heteroskedasticity and Global Stock Return Distributions. (1994). (11) RePEc:bla:finrev:v:31:y:1996:i:2:p:343-63 Long-Run Diversification Potential in Emerging Stock Markets. (1996). (12) RePEc:bla:finrev:v:33:y:1998:i:2:p:35-53 An Empirical Comparison of Bankruptcy Models. (1998). (13) RePEc:bla:finrev:v:34:y:1999:i:4:p:55-73 The Impact of Market Maker Competition on Nasdaq Spreads. (1999). (14) RePEc:bla:finrev:v:35:y:2000:i:4:p:31-50 Corporate Bankruptcy in Korea: Only the Strong Survive? (2000). (15) RePEc:bla:finrev:v:25:y:1990:i:4:p:593-622 A Comprehensive Test of Futures Market Disequilibrium. (1990). (16) RePEc:bla:finrev:v:32:y:1997:i:1:p:145-62 Unbiasedness of the Forward Exchange Rates. (1997). (17) RePEc:bla:finrev:v:23:y:1988:i:3:p:351-57 Using Dummy Variables in the Event Methodology. (1988). (18) RePEc:bla:finrev:v:25:y:1990:i:3:p:371-94 High Road to a Global Marketplace: The International Transmission of Stock Market Fluctuations. (1990). (19) RePEc:bla:finrev:v:28:y:1993:i:2:p:181-202 Do Gold Market Returns Have Long Memory? (1993). (20) RePEc:bla:finrev:v:33:y:1998:i:3:p:1-20 Insider Trading and the Bid-Ask Spread. (1998). (21) RePEc:bla:finrev:v:30:y:1995:i:2:p:367-85 An Investigation of the Dynamic Relationship between Agency Theory and Dividend Policy. (1995). (22) RePEc:bla:finrev:v:32:y:1997:i:3:p:449-76 Tobins q-Ratio and Market Reaction to Capital Investment Announcements. (1997). (23) RePEc:bla:finrev:v:35:y:2000:i:3:p:125-43 Asymmetric Effects of Interest Rate Changes on Stock Prices. (2000). (24) RePEc:bla:finrev:v:39:y:2004:i:1:p:79-99 When Are Commercial Loans Secured? (2004). (25) RePEc:bla:finrev:v:24:y:1989:i:1:p:123-34 Intra-industry Effects of a Regulatory Shift: Capital Market Evidence from Penn Square. (1989). (26) RePEc:bla:finrev:v:33:y:1998:i:2:p:195-212 Price Discovery around Trading Halts on the Montreal Exchange Using Trade-by-Trade Data. (1998). (27) RePEc:bla:finrev:v:36:y:2001:i:4:p:157-74 A Multivariate Test of a Dual-Beta CAPM: Australian Evidence. (2001). (28) RePEc:bla:finrev:v:31:y:1996:i:3:p:553-64 Further Evidence on Foreign Exchange Market Efficiency: An Application of Cointegration Tests. (1996). (29) RePEc:bla:finrev:v:25:y:1990:i:3:p:457-71 Dual Bond Ratings: A Test of the Certification Function of Rating Agencies. (1990). (30) RePEc:bla:finrev:v:36:y:2001:i:4:p:7-25 Rational Pricing of Internet Companies Revisited. (2001). (31) RePEc:bla:finrev:v:32:y:1997:i:3:p:431-48 Accuracy of International Interest Rate Forecasts. (1997). (32) RePEc:bla:finrev:v:36:y:2001:i:3:p:89-99 An Improved Approach to Computing Implied Volatility. (2001). (33) RePEc:bla:finrev:v:31:y:1996:i:2:p:431-52 The Diversification and Cost Effects of Interstate Banking. (1996). (34) RePEc:bla:finrev:v:24:y:1989:i:3:p:431-55 Interest Rate Risk at Commercial Banks: An Empirical Investigation. (1989). (35) RePEc:bla:finrev:v:27:y:1992:i:1:p:107-23 Betas in Up and Down Markets. (1992). (36) RePEc:bla:finrev:v:29:y:1994:i:4:p:577-97 Modeling International Long-Term Interest Rates. (1994). (37) RePEc:bla:finrev:v:37:y:2002:i:2:p:137-163 Mean and Variance Causality between Official and Parallel Currency Markets: Evidence from Four Latin American Countries (2002). (38) RePEc:bla:finrev:v:20:y:1985:i:4:p:287-301 Options Market Efficiency and the Box Spread Strategy. (1985). (39) RePEc:bla:finrev:v:22:y:1987:i:2:p:221-32 The Adoption of New-Issue Dividend Reinvestment Plans and Shareholder Wealth. (1987). (40) RePEc:bla:finrev:v:26:y:1991:i:3:p:409-30 The Interactions between the Investment, Financing, and Dividend Decisions of Major U.S. Firms. (1991). (41) RePEc:bla:finrev:v:36:y:2001:i:4:p:75-98 How Do Investors Expectations Drive Asset Prices? (2001). (42) RePEc:bla:finrev:v:25:y:1990:i:2:p:175-98 Restricted Voting Stock, Acquisition Premiums, and the Market Value of Corporate Control. (1990). (43) RePEc:bla:finrev:v:21:y:1986:i:4:p:399-418 Option Pricing Theory and Asset Expectations: A Review and Discussion in Tribute to James Boness. (1986). (44) RePEc:bla:finrev:v:26:y:1991:i:2:p:223-35 Direct Bankruptcy Costs: Evidence from the Trucking Industry. (1991). (45) RePEc:bla:finrev:v:23:y:1988:i:2:p:183-200 Effects of Inflation on Capital Structure. (1988). (46) RePEc:bla:finrev:v:27:y:1992:i:4:p:531-52 Risk-Adjusted Day-of-the-Week, Day-of-the-Month, and Month-of-the-Year Effects on Stock Indexes and Stock Index Futures. (1992). (47) RePEc:bla:finrev:v:32:y:1997:i:2:p:293-307 Co-Kurtosis and Capital Asset Pricing. (1997). (48) RePEc:bla:finrev:v:34:y:1999:i:4:p:1-27 Symposium on Market Microstructure: A Review of Empirical Research. (1999). (49) RePEc:bla:finrev:v:23:y:1988:i:1:p:39-51 Information Asymmetry and Options Trading. (1988). (50) RePEc:bla:finrev:v:27:y:1992:i:2:p:211-25 Institutional Ownership and the Liquidity of Common Stock Offerings. (1992). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:fip:fedawp:2004-23 Resolving large financial intermediaries: banks versus housing enterprises (2004). Federal Reserve Bank of Atlanta / Working Paper Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |