|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

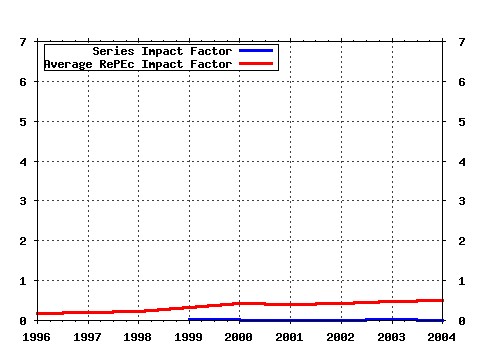

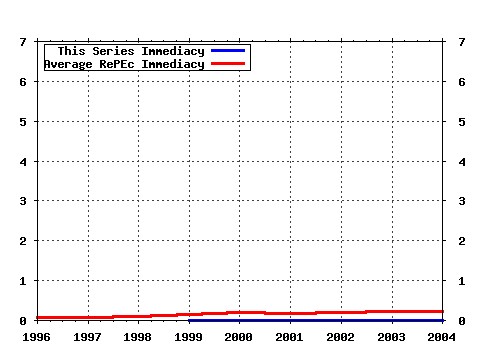

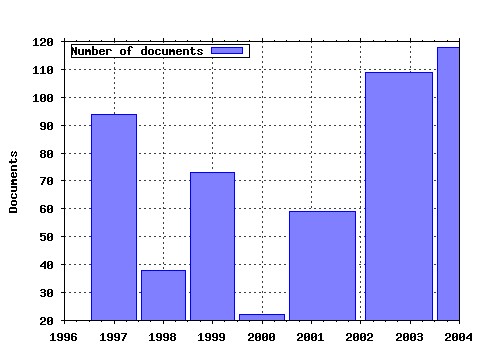

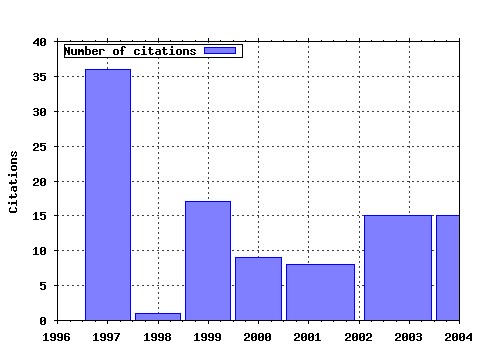

Journal of Journal of Business Finance & Accounting Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jbfnac:v:25:y:1998-06:i:5&6:p:521-570 (). (2) RePEc:bla:jbfnac:v:27:y:2000-11:i:9&10:p:1139-1183 (). (3) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:309-342 Detecting Information from Directors Trades: Signal Definition and Variable Size Effects (1997). (4) RePEc:bla:jbfnac:v:26:y:1999-06:i:5&6:p:681-708 (). (5) RePEc:bla:jbfnac:v:27:y:2000-05:i:3&4:p:487-510 (). (6) RePEc:bla:jbfnac:v:29:y:2002:i:9&10:p:1367-1398 (). (7) RePEc:bla:jbfnac:v:24:y:1997-09:i:7&8:p:943-961 (). (8) RePEc:bla:jbfnac:v:25:y:1998:i:5&6:p:721-745 (). (9) RePEc:bla:jbfnac:v:26:y:1999-04:i:3-4:p:419-449 Penetrating the Book-to-Market Black Box: The R&D Effect (1999). (10) RePEc:bla:jbfnac:v:26:y:1999-09:i:7&8:p:833-862 (). (11) RePEc:bla:jbfnac:v:24:y:1997-09:i:7&8:p:971-1002 (). (12) RePEc:bla:jbfnac:v:24:y:1997-06:i:5:p:705-725 Ethical Unit Trust Financial Performance: Small Company Effects and Fund Size Effects (1997). (13) RePEc:bla:jbfnac:v:25:y:1998-06:i:5&6:p:721-745 (). (14) RePEc:bla:jbfnac:v:27:y:2000-06:i:5&6:p:523-554 (). (15) RePEc:bla:jbfnac:v:24:y:1997-07:i:6:p:803-813 International Stock Market Efficiency and Integration: A Study of Eighteen Nations (1997). (16) RePEc:bla:jbfnac:v:27:y:2000-11:i:9&10:p:1311-1342 (). (17) RePEc:bla:jbfnac:v:25:y:1998-01:i:1&2:p:187-202 (). (18) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:497-509 The Effect of Bond Rating Changes and New Ratings on UK Stock Returns (1997). (19) RePEc:bla:jbfnac:v:34:y:2007-11:i:9-10:p:1548-1568 Trading with Asymmetric Volatility Spillovers (2007). (20) RePEc:bla:jbfnac:v:27:y:2000:i:5&6:p:523-554 (). (21) RePEc:bla:jbfnac:v:25:y:1998-01:i:1&2:p:225-249 (). (22) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:511-525 The Provision of Non-audit Services and the Pricing of Audit Fees (1997). (23) RePEc:bla:jbfnac:v:25:y:1998-09:i:7&8:p:945-968 (). (24) RePEc:bla:jbfnac:v:27:y:2000-04:i:3-4:p:487-510 The Distributional Characteristics of a Selection of Contracts Traded on the London International Financial Futures Exchange (2000). (25) RePEc:bla:jbfnac:v:31:y:2004-09:i:7-8:p:1097-1124 Firm Characteristics as Cross-sectional Determinants of Adverse Selection (2004). (26) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:343-362 Bid-ask Spreads, Trading Volume and Volatility: Intra-day Evidence from the London Stock Exchange (1997). (27) RePEc:bla:jbfnac:v:25:y:1998-04:i:3&4:p:265-288 (). (28) RePEc:bla:jbfnac:v:26:y:1999-11:i:9-10:p:1043-1091 The Profitability of Momentum Investing (1999). (29) RePEc:bla:jbfnac:v:31:y:2004-06:i:5-6:p:647-676 Intra Day Bid-Ask Spreads, Trading Volume and Volatility: Recent Empirical Evidence from the London Stock Exchange (2004). (30) RePEc:bla:jbfnac:v:29:y:2002-04:i:3&4:p:317-351 (). (31) RePEc:bla:jbfnac:v:28:y:2001-06:i:5-6:p:531-562 A Comparative Analysis of Earnings Forecasts in Europe (2001). (32) RePEc:bla:jbfnac:v:29:y:2002:i:7&8:p:1023-1046 (). (33) RePEc:bla:jbfnac:v:30:y:2003-06:i:5-6:p:715-747 Measuring the Impact of Corporate Investment Announcements on Share Prices: The Spanish Experience (2003). (34) RePEc:bla:jbfnac:v:25:y:1998-01:i:1&2:p:103-113 (). (35) RePEc:bla:jbfnac:v:25:y:1998-09:i:7&8:p:987-1003 (). (36) RePEc:bla:jbfnac:v:29:y:2002:i:5&6:p:695-729 (). (37) RePEc:bla:jbfnac:v:31:y:2004-01:i:1-2:p:49-82 Are Economically Significant Stock Returns and Trading Volumes Driven by Firm-specific News Releases? (2004). (38) RePEc:bla:jbfnac:v:25:y:1998-04:i:3&4:p:419-437 (). (39) RePEc:bla:jbfnac:v:26:y:1999:i:5&6:p:559-593 (). (40) RePEc:bla:jbfnac:v:27:y:2000-06:i:5&6:p:603-626 (). (41) RePEc:bla:jbfnac:v:27:y:2000-04:i:3-4:p:423-446 An Empirical Analysis of the Bias and Rationality of Profit Forecasts Published in New Issue Prospectuses (2000). (42) RePEc:bla:jbfnac:v:32:y:2005-01:i:1-2:p:31-64 Firm Size Dependence in the Determinants of Bank Term Loan Maturity (2005). (43) RePEc:bla:jbfnac:v:25:y:1998-04:i:3&4:p:371-385 (). (44) RePEc:bla:jbfnac:v:26:y:1999-11:i:9-10:p:1281-1307 The Life Cycle of Initial Public Offering Firms (1999). (45) RePEc:bla:jbfnac:v:30:y:2003-01:i:1-2:p:125-168 Voluntary Disclosure of Management Earnings Forecasts in IPO Prospectuses (2003). (46) RePEc:bla:jbfnac:v:25:y:1998-06:i:5&6:p:765-773 (). (47) RePEc:bla:jbfnac:v:26:y:1999-06:i:5&6:p:559-593 (). (48) RePEc:bla:jbfnac:v:27:y:2000-04:i:3-4:p:333-357 The Gilt-Equity Yield Ratio and the Predictability of UK and US Equity Returns (2000). (49) RePEc:bla:jbfnac:v:29:y:2002-04:i:3&4:p:457-476 (). (50) RePEc:bla:jbfnac:v:30:y:2003-09:i::p:1089-1114 Interdependence and Volatility Spillovers Under Market Liberalization: The Case of Istanbul Stock Exchange (2003). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:upf:upfgen:786 Overconfidence and Market Efficiency with Heterogeneous Agents (2004). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Latest citations received in: 2003 (1) RePEc:taf:apeclt:v:10:y:2003:i:9:p:527-533 Financial crisis and African stock market integration (2003). Applied Economics Letters Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |