|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

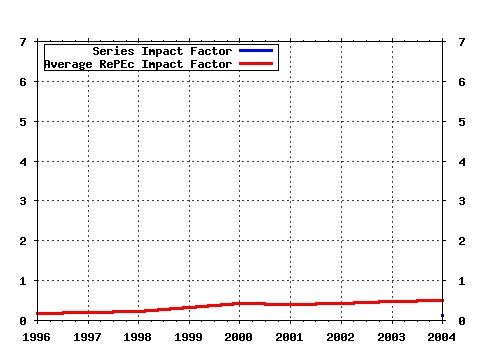

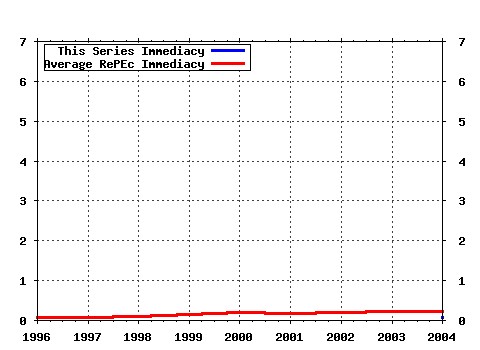

Real Estate Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:reesec:v:32:y:2004:i:4:p:541-569 The Effect of Conforming Loan Status on Mortgage Yield Spreads: A Loan Level Analysis (2004). (2) RePEc:bla:reesec:v:33:y:2005:i:3:p:427-463 The Effect of Housing Government-Sponsored Enterprises on Mortgage Rates (2005). (3) RePEc:bla:reesec:v:32:y:2004:i:1:p:1-32 An Anatomy of Price Dynamics in Illiquid Markets: Analysis and Evidence from Local Housing Markets (2004). (4) RePEc:bla:reesec:v:31:y:2003:i:2:p:269-303 Controlling for the Impact of Variable Liquidity in Commercial Real Estate Price Indices (2003). (5) RePEc:bla:reesec:v:31:y:2003:i:4:p:527-575 The Spatial Distribution of Housing-Related Ordinary Income Tax Benefits (2003). (6) RePEc:bla:reesec:v:33:y:2005:i:2:p:323-350 Real Estate and Economies of Scale: The Case of REITs (2005). (7) RePEc:bla:reesec:v:33:y:2005:i:3:p:465-486 The GSE Implicit Subsidy and the Value of Government Ambiguity (2005). (8) RePEc:bla:reesec:v:31:y:2003:i:1:p:53-74 Modeling the Korean Chonsei Lease Contract (2003). (9) RePEc:bla:reesec:v:31:y:2003:i:4:p:577-600 A Measure of Fundamental Volatility in the Commercial Property Market (2003). (10) RePEc:bla:reesec:v:31:y:2003:i:1:p:75-98 Estimating the Lagging Error in Real Estate Price Indices (2003). (11) RePEc:bla:reesec:v:31:y:2003:i:1:p:23-51 Do CRA Agreements Influence Lending Patterns? (2003). (12) RePEc:bla:reesec:v:32:y:2004:i:3:p:385-411 Do Riskier Borrowers Borrow More? (2004). (13) RePEc:bla:reesec:v:33:y:2005:i:4:p:681-710 An Empirical Test of a Two-Factor Mortgage Valuation Model: How Much Do House Prices Matter? (2005). (14) RePEc:bla:reesec:v:35:y:2007:i:2:p:135-154 The Impact of Homeowners Housing Wealth Misestimation on Consumption and Saving Decisions (2007). (15) RePEc:bla:reesec:v:32:y:2004:i:1:p:127-160 A Semiparametric Method for Estimating Local House Price Indices (2004). (16) RePEc:bla:reesec:v:33:y:2005:i:3:p:509-537 Appraisal, Agency and Atypicality: Evidence from Manufactured Homes (2005). (17) RePEc:bla:reesec:v:33:y:2005:i:2:p:351-380 The Long-Run Performance of REIT Stock Repurchases (2005). (18) RePEc:bla:reesec:v:31:y:2003:i:1:p:117-138 Housing Transactions and the Changing Decisions of Young Households in Britain: The Microeconomic Evidence (2003). (19) RePEc:bla:reesec:v:32:y:2004:i:3:p:487-507 On the Use of Spline Smoothing in Estimating Hedonic Housing Price Models: Empirical Evidence Using Hong Kong Data (2004). (20) RePEc:bla:reesec:v:33:y:2005:i:4:p:765-782 A Note on Hybrid Mortgages (2005). (21) RePEc:bla:reesec:v:31:y:2003:i:3:p:451-479 The Cross Section of Expected REIT Returns (2003). (22) RePEc:bla:reesec:v:33:y:2005:i:2:p:237-268 Self-Selection and Discrimination in Credit Markets (2005). (23) RePEc:bla:reesec:v:35:y:2007:i:2:p:233-263 Subprime Refinancing: Equity Extraction and Mortgage Termination (2007). (24) RePEc:bla:reesec:v:32:y:2004:i:2:p:183-215 Implicit Forward Rents as Predictors of Future Rents (2004). (25) RePEc:bla:reesec:v:33:y:2005:i:4:p:595-617 The Effect of Refinancing Costs and Market Imperfections on the Optimal Call Strategy and the Pricing of Debt Contracts (2005). (26) RePEc:bla:reesec:v:32:y:2004:i:4:p:673-694 The Pricing of the Emergent Leasehold (Possessory) Estates of Ghana (2004). (27) RePEc:bla:reesec:v:34:y:2006:i:4:p:553-566 Housing Density and the Effect of Proximity to Public Open Space in Aberdeen, Scotland (2006). (28) RePEc:bla:reesec:v:33:y:2005:i:3:p:487-507 Gracing the Land of Elvis and Beale Street: Historic Designation and Property Values in Memphis (2005). (29) RePEc:bla:reesec:v:32:y:2004:i:4:p:589-617 Stochastic Modeling of Federal Housing Administration Home Equity Conversion Mortgages with Low-Cost Refinancing (2004). (30) RePEc:bla:reesec:v:34:y:2006:i:2:p:275-302 Revisiting the Past and Settling the Score: Index Revision for House Price Derivatives (2006). (31) RePEc:bla:reesec:v:31:y:2003:i:4:p:601-622 Estimating Bargaining Effects in Hedonic Models: Evidence from the Housing Market (2003). (32) RePEc:bla:reesec:v:34:y:2006:i:1:p:1-49 Equilibrium Real Options Exercise Strategies with Multiple Players: The Case of Real Estate Markets (2006). (33) RePEc:bla:reesec:v:31:y:2003:i:3:p:313-346 Financing Choice and Liability Structure of Real Estate Investment Trusts (2003). (34) RePEc:bla:reesec:v:33:y:2005:i:1:p:89-120 Changes in REIT Structure and Stock Performance: Evidence from the Monday Stock Anomaly (2005). (35) RePEc:bla:reesec:v:31:y:2003:i:1:p:99-116 House Price Appreciation, Transactions and Structural Change in the British Housing Market: A Macroeconomic Perspective (2003). (36) RePEc:bla:reesec:v:32:y:2004:i:4:p:619-643 The Wealth Effects of Sale and Leasebacks: New Evidence (2004). (37) RePEc:bla:reesec:v:34:y:2006:i:3:p:417-438 The Long-Run Relationship between House Prices and Income: Evidence from Local Housing Markets (2006). (38) RePEc:bla:reesec:v:31:y:2003:i:4:p:623-646 Modeling Spatial Variation in Housing Prices: A Variable Interaction Approach (2003). (39) RePEc:bla:reesec:v:32:y:2004:i:4:p:571-587 The Conditional Probability of Foreclosure: An Empirical Analysis of Conventional Mortgage Loan Defaults (2004). (40) RePEc:bla:reesec:v:34:y:2006:i:1:p:109-131 Asymmetric Volatility, Correlation and Returns Dynamics Between the U.S. and U.K. Securitized Real Estate Markets (2006). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:fip:fedawp:2004-26 Fussing and fuming over Fannie and Freddie: how much smoke, how much fire? (2004). Federal Reserve Bank of Atlanta / Working Paper (2) RePEc:ste:nystbu:04-27 Fussing and Fuming over Fannie and Freddie: How Much Smoke, How Much Fire? (2004). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |