|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

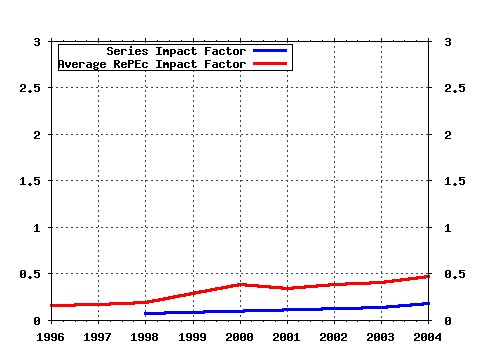

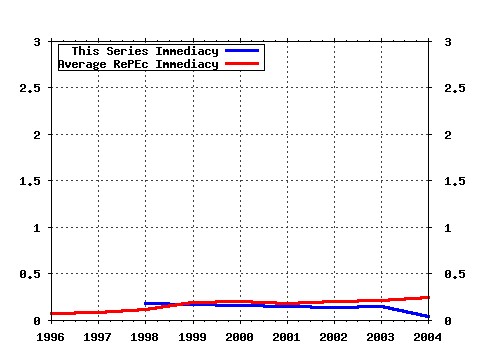

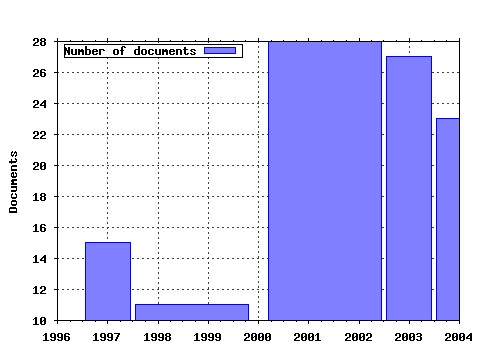

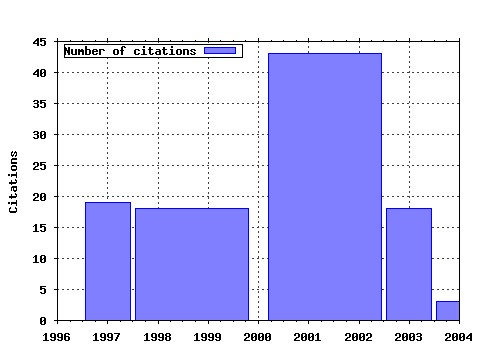

Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bru:bruedp:02-16 Unemployment Alters the Set-Point for Life Satisfaction (2002). (2) RePEc:bru:bruedp:98-06 Job Satisfaction, Wage changes and Quits: Evidence from Germany (1998). (3) RePEc:bru:bruedp:97-14 Real Exchange Rates under the Recent Float: Unequivocal Evidence of Mean Reversion (1997). (4) RePEc:bru:bruedp:03-07 DEMOGRAPHICS AND FINANCIAL ASSET PRICES IN THE MAJOR INDUSTRIAL ECONOMIES (2003). (5) RePEc:bru:bruedp:03-04 EQUITY PRICES, PRODUCTIVITY GROWTH, AND THE NEW ECONOMY (2003). (6) RePEc:bru:bruedp:03-19 Should Monetary Policy Respond to Asset Price Misalignments? (2003). (7) RePEc:bru:bruedp:02-04 A Test for Volatility Spillovers (2002). (8) RePEc:bru:bruedp:02-21 Are International R&D Spillovers Costly for the US? (2002). (9) RePEc:bru:bruedp:02-08 Building and Managing Facilities for Public Services (2002). (10) RePEc:bru:bruedp:97-09 Efficiency Wages: Combining the Shirking and Turnover Cost Models (1997). (11) RePEc:bru:bruedp:02-12 Inflation Targeting and Inflation Persistence (2002). (12) RePEc:bru:bruedp:98-05 The Optimal Linear Taxation of Employment and Self-Employment Incomes (1998). (13) RePEc:bru:bruedp:97-10 Efficiency Wages and Union-Firm Bargaining (1997). (14) RePEc:bru:bruedp:98-08 Stabilisation, Policy Targets and Unemployment in Imperfectly Competitive Economies (1998). (15) RePEc:bru:bruedp:03-24 Privatization Methods and Economic Growth (0000). (16) RePEc:bru:bruedp:97-12 Real Interest Rates, Liquidity Constraints and Financial Deregulation: Private Consumption Behaviour in the UK (1997). (17) RePEc:bru:bruedp:98-07 Evidence from UK Establishments (1998). (18) RePEc:bru:bruedp:97-07 Hot Money, Accounting Labels and the Persistence of Capital Flows to Developing Countries: An Empirical Investigation (1997). (19) RePEc:bru:bruedp:04-18 PANEL DATA TESTS OF PPP: A CRITICAL OVERVIEW (2004). (20) RePEc:bru:bruedp:03-05 PANEL ESTIMATION OF THE IMPACT OF EXCHANGE RATE UNCERTAINTY ON INVESTMENT IN THE MAJOR INDUSTRIAL COUNTRIES (2003). (21) RePEc:bru:bruedp:06-24 Understanding the Effects of Siblings on Child Mortality: Evidence from India (2006). (22) RePEc:bru:bruedp:04-02 External Financing of Us Corporations: Are Loans and Securities Complements or Substitutes? (2004). (23) RePEc:bru:bruedp:97-13 European Capital Flows and Regional Risk (1997). (24) RePEc:bru:bruedp:06-19 On the Composition of Government Spending, Optimal Fiscal Policy, and Endogenous Growth: Theory and Evidence (2006). (25) RePEc:bru:bruedp:03-22 Optimal Monetary Policy and Asset Price Misalignments (2003). (26) RePEc:bru:bruedp:06-08 Regulatory Barriers and Entry in Developing Economies (2006). (27) RePEc:bru:bruedp:03-14 Red Signals: Trade Deficits and the Current Account (2003). (28) RePEc:bru:bruedp:97-08 A Model of Temporary Search Market Equilibrium (1997). (29) RePEc:bru:bruedp:05-14 Contracting Out Public Service Provision to Not-for-Profit Firms (2005). (30) RePEc:bru:bruedp:03-06 Macroeconomic Effects of Reallocation Shocks:A generalised impulse response function analysis for three European countries (2003). (31) RePEc:bru:bruedp:97-06 Saving-Investment Correlations: Transitory versus Permanent (1997). (32) RePEc:bru:bruedp:04-17 NON-LINEARITIES AND FRACTIONAL INTEGRATION IN THE US UNEMPLOYMENT RATE (2004). (33) RePEc:bru:bruedp:06-23 How Does Ownership Structure Affect Capital Structure and Firm Performance? Recent Evidence from East Asia (2006). (34) RePEc:bru:bruedp:02-17 Decision Rules and Information Provision:Monitoring versus Manipulation (2002). (35) RePEc:bru:bruedp:06-18 COINTEGRATION TESTS OF PPP:DO THEY ALSO EXHIBIT ERRATIC BEHAVIOUR? (2006). (36) RePEc:bru:bruedp:05-17 NON-LINEARITIES AND FRACTIONAL INTEGRATION IN THE US UNEMPLOYMENT RATE (2005). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:onb:oenbmp:y:2004:i:4:b:3 The Role of Corporate Bonds for Finance in Austria (2004). Monetary Policy & the Economy Latest citations received in: 2003 (1) RePEc:bru:bruedp:03-22 Optimal Monetary Policy and Asset Price Misalignments (2003). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:bru:bruppp:03-22 Optimal Monetary Policy and Asset Price Misalignments (2003). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers (3) RePEc:kud:epruwp:03-11 The Macroeconomics of Share Prices in the Medium Term and in the Long Run. (2003). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (4) RePEc:wpa:wuwppe:0302001 Polish Pension Funds, Does The System Work? Cost, Efficiency and Performance MeasurementIssues (2003). EconWPA / Public Economics Latest citations received in: 2002 (1) RePEc:bri:cmpowp:02/059 Public and Private Sector Discount Rates in Public-Private Partnerships (2002). Department of Economics, University of Bristol, UK / The Centre for Market and Public Organisation (2) RePEc:bri:cmpowp:02/061 Incomplete Contracts and Public Ownership: Remarks, and an Application to Public-Private Partnerships (2002). Department of Economics, University of Bristol, UK / The Centre for Market and Public Organisation (3) RePEc:bru:bruedp:02-28 Inflation and Inflation Uncertainty in the United Kingdom: Evidence from GARCH modelling (2002). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (4) RePEc:bru:bruppp:02-28 Inflation and Inflation Uncertainty in the United Kingdom: Evidence from GARCH modelling (2002). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |