|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

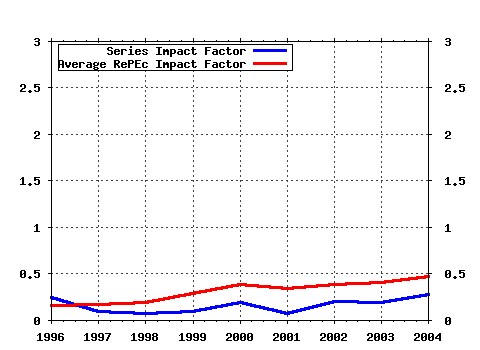

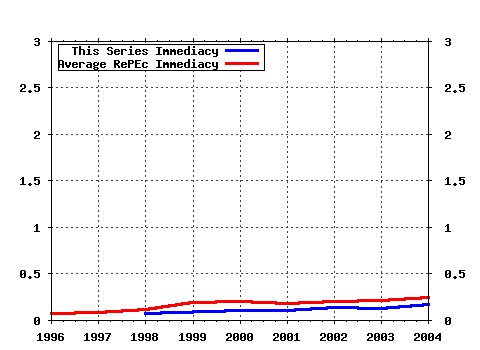

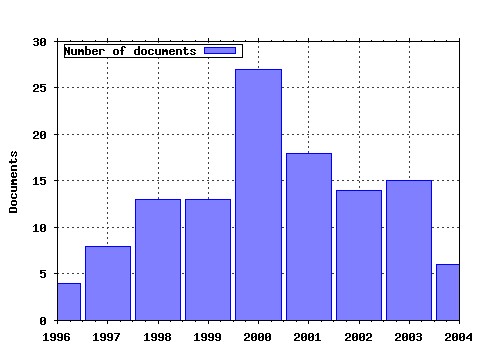

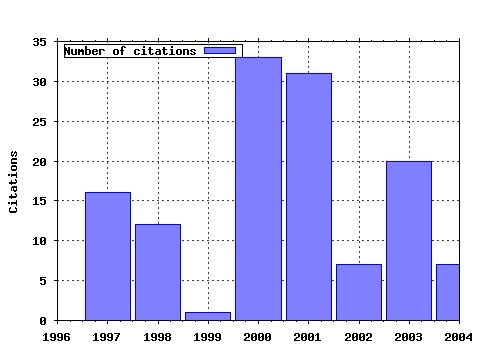

Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cdl:anderf:1144 An Analytic Solution for Interest Rate Swap Spreads (1995). (2) RePEc:cdl:anderf:1147 Agency and Asset Pricing (1993). (3) RePEc:cdl:anderf:1025 The Components of Corporate Credit Spreads: Default, Recovery, Tax, Jumps, Liquidity, and Market Factors (2001). (4) RePEc:cdl:anderf:1193 Facilitation of Competing Bids and the Price of a Takeover Target (1989). (5) RePEc:cdl:anderf:1015 International Risk Sharing is Better Than You Think (or Exchange Rates are Much Too Smooth! (2001). (6) RePEc:cdl:anderf:1076 The Market Price of Credit Risk: An Empirical Analysis of Interest Rate Swap Spreads (2000). (7) RePEc:cdl:anderf:1002 An Econometric Model of the Yield Curve With Macroeconomic Jump Effects (2001). (8) RePEc:cdl:anderf:1123 On the Evolution of Overconfidence and Entrepreneurs (1997). (9) RePEc:cdl:anderf:1127 Bond Pricing with Default Risk (1997). (10) RePEc:cdl:anderf:1114 Credit Risk and Risk Neutral Default Probabilities: Information About Migrations and Defaults (1998). (11) RePEc:cdl:anderf:1117 Resolution of a Financial Puzzle (1998). (12) RePEc:cdl:anderf:1054 Losing Money on Arbitrages: Optimal Dynamic Portfolio Choice in Markets with Arbitrage Opportunities (2000). (13) RePEc:cdl:anderf:1141 Regime Shifts in Short Term Riskless Interest Rates (1995). (14) RePEc:cdl:anderf:1188 Price Volatility, International Market Links and their Implications for Regulatory Policies (1989). (15) RePEc:cdl:anderf:1142 Is Institutional Investment in Initial Public Offerings Related to Long-Run Performance of These Firms? (1995). (16) RePEc:cdl:anderf:1019 The Disposition Effect and Momentum (2001). (17) RePEc:cdl:anderf:1011 Estimation and Test of a Simple Model of Intertemporal Capital Asset Pricing (2003). (18) RePEc:cdl:anderf:1063 Stochastic Correlation Across International Stock Markets (2000). (19) RePEc:cdl:anderf:1058 The Feds Effect on Excess Returns and Inflation is Much Bigger Than You Think (2000). (20) RePEc:cdl:anderf:1032 Empirical TIPs (2003). (21) RePEc:cdl:anderf:1079 Does Diversification Cause the Diversification Discount? (2000). (22) RePEc:cdl:anderf:1043 Financial Market Runs (2002). (23) RePEc:cdl:anderf:1252 European M&A Regulation is Protectionist (2004). (24) RePEc:cdl:anderf:1122 The Role of Learning in Dynamic Portfolio Decisions (1997). (25) RePEc:cdl:anderf:1155 There is a Risk-Return Tradeoff After All (2003). (26) RePEc:cdl:anderf:1251 International Capital Markets and Foreign Exchange Risk (2004). (27) RePEc:cdl:anderf:1055 The Value of Voting Rights to Majority Shareholders: Evidence from Dual Class Stock Unifications (2000). (28) RePEc:cdl:anderf:1248 Two Trees: Asset Price Dynamics Induced By Market Clearing (2003). (29) RePEc:cdl:anderf:1046 Electricity Forward Prices: A High-Frequency Empirical Analysis (2002). (30) RePEc:cdl:anderf:1108 Organization Capital and Intrafirm Communication (2003). (31) RePEc:cdl:anderf:1003 Dynamic Portfolio Choice: A Simulation Approach (2001). (32) RePEc:cdl:anderf:1061 Electricity prices and power derivatives: Evidence from the Nordic Power Exchange (2000). (33) RePEc:cdl:anderf:1037 A Unifying Theory of Value Based Management (2003). (34) RePEc:cdl:anderf:1057 Learning About Predictability: The Effects of Parameter Uncertainty on Dynamic Asset Allocation (2000). (35) RePEc:cdl:anderf:1040 Extracting Inflation from Stock Returns to test Purchasing Power Parity (2002). (36) RePEc:cdl:anderf:1098 Assessing Assets Pricing Anomalies (1999). (37) RePEc:cdl:anderf:1169 Do Benchmarks Matter? Do Measures Matter? A Study of Monthly Mutual Fund Returns (1991). (38) RePEc:cdl:anderf:1253 Order Flow Patterns around Seasoned Equity Offerings and their Implications for Stock Price Movements (2004). (39) RePEc:cdl:anderf:1222 Inflation Measurement and Tests of Asset Pricing Models (1984). (40) RePEc:cdl:anderf:1082 The Risk and Return of Venture Capital (2000). (41) RePEc:cdl:anderf:1206 The Information Conveyed by a Takeover Bid (1984). (42) RePEc:cdl:anderf:1112 Relative Pricing of Options with Stochastic Volatility (1998). (43) RePEc:cdl:anderf:1066 The Problem of Optimal Asset Allocation with Stable Distributed Returns (2000). (44) RePEc:cdl:anderf:1245 Bond Pricing with Default Risk (2003). (45) RePEc:cdl:anderf:1181 Resolution Preference and Project Choice (1990). (46) RePEc:cdl:anderf:1241 Interpersonal Effects in Consumption: Evidence from the Automobile Purchases of Neighbors (2003). (47) RePEc:cdl:anderf:1083 Demographics and the Equity Premium (2000). (48) RePEc:cdl:anderf:1156 The Blind Leading the Blind: Social Influence, Fads, and Informational Cascades (1993). (49) RePEc:cdl:anderf:1217 Estimating the Risk Premium on the Market, and Discriminating between the CAPM and APT (1984). (50) RePEc:cdl:anderf:1030 Valuation of Information Technology Investments as Real Options (2000). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:cdl:anderf:1250 How Did It Happen? (2004). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management Latest citations received in: 2003 (1) RePEc:fip:fedlwp:2003-025 Does idiosyncratic risk matter: another look (2003). Federal Reserve Bank of St. Louis / Working Papers (2) RePEc:nbr:nberwo:9759 Household Risk Management and Optimal Mortgage Choice (2003). National Bureau of Economic Research, Inc / NBER Working Papers Latest citations received in: 2002 (1) RePEc:cdl:anderf:1047 Chicanery, Intelligence, and Financial Market Equilibrium (2002). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (2) RePEc:nbr:nberwo:9398 Exchange Rate, Equity Prices and Capital Flows (2002). National Bureau of Economic Research, Inc / NBER Working Papers Latest citations received in: 2001 (1) RePEc:nbr:nberwo:8363 A No-Arbitrage Vector Autoregression of Term Structure Dynamics with Macroeconomic and Latent Variables (2001). National Bureau of Economic Research, Inc / NBER Working Papers (2) RePEc:wpa:wuwpma:0110003 Monetary policy and the term structure of interest rates in a small open economy - a model framework approach (2001). EconWPA / Macroeconomics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |