|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

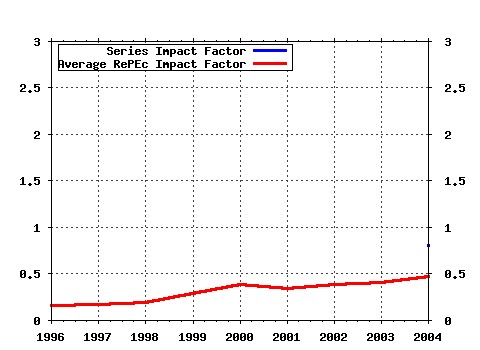

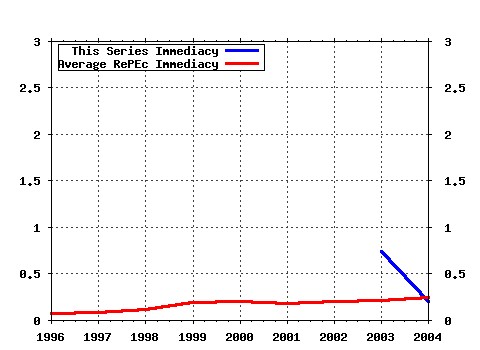

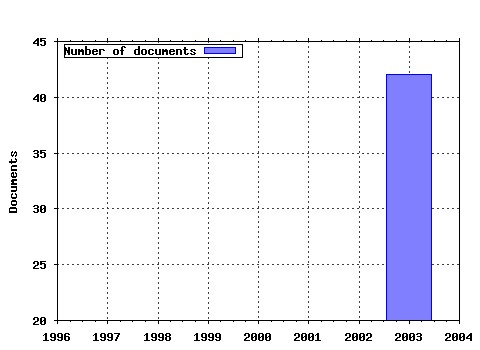

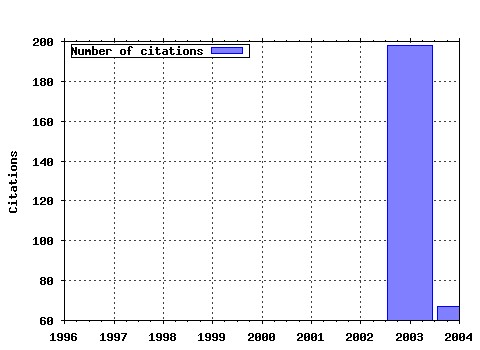

Center for Financial Studies / CFS Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cfs:cfswop:wp200306 The Performance of Forecast-Based Monetary Policy Rules under Model Uncertainty (2003). (2) RePEc:cfs:cfswop:wp200507 Competitive Risk Sharing Contracts with One-Sided Commitment (2005). (3) RePEc:cfs:cfswop:wp200423 Understanding the Effects of Government Spending on Consumption (2004). (4) RePEc:cfs:cfswop:wp200309 The Zero-Interest-Rate and the Role of the Exchange Rate for Monetary Policy in Japan (2003). (5) RePEc:cfs:cfswop:wp200503 Modeling Bond Yields in Finance and Macroeconomics (2005). (6) RePEc:cfs:cfswop:wp200341 Permanent and Transitory Policy Shocks in an Empirical Macro Model with Asymmetric Information (2003). (7) RePEc:cfs:cfswop:wp200340 Imperfect Knowledge, Inflation Expectations, and Monetary Policy (2003). (8) RePEc:cfs:cfswop:wp200510 On the Optimal Progressivity of the Income Tax Code (2005). (9) RePEc:cfs:cfswop:wp200320 Universal Banks and Relationships with Firms (2003). (10) RePEc:cfs:cfswop:wp200335 Some Like it Smooth, and Some Like it Rough: Untangling Continuous and Jump Components in Measuring, Modeling, and Forecasting Asset Return Volatility (2003). (11) RePEc:cfs:cfswop:wp200506 Default Risk Sharing Between Banks and Markets: The Contribution of Collateralized Debt Obligations (2005). (12) RePEc:cfs:cfswop:wp200529 Awareness and Stock Market Participation (2005). (13) RePEc:cfs:cfswop:wp200331 The Macroeconomy and the Yield Curve: A Nonstructural Analysis (2003). (14) RePEc:cfs:cfswop:wp200504 A Framework for Exploring the Macroeconomic Determinants of Systematic Risk (2005). (15) RePEc:cfs:cfswop:wp200303 Learning and Equilibrium Selection in a Monetary Overlapping Generations Model with Sticky Prices (2003). (16) RePEc:cfs:cfswop:wp200518 The Method of Endogenous Gridpoints for Solving Dynamic Stochastic Optimization Problems (2005). (17) RePEc:cfs:cfswop:wp200422 Monetary Discretion, Pricing Complementarity and Dynamic Multiple Equilibria (2004). (18) RePEc:cfs:cfswop:wp200344 Bayesian Fan Charts for U.K. Inflation: Forecasting and Sources of Uncertainty in an Evolving Monetary System (2003). (19) RePEc:cfs:cfswop:wp200515 Does Income Inequality Lead to Consumption Inequality? Evidence and Theory (2005). (20) RePEc:cfs:cfswop:wp200330 Inflation convergence after the introduction of the Euro (2003). (21) RePEc:cfs:cfswop:wp200523 Credit Market Competition and Capital Regulation (2005). (22) RePEc:cfs:cfswop:wp200310 Nonlinearities and Cyclical Behavior: The Role of Chartists and Fundamentalists (2003). (23) RePEc:cfs:cfswop:wp200527 Trusting the Stock Market (2005). (24) RePEc:cfs:cfswop:wp200512 Pareto Improving Social Security Reform when Financial Markets are Incomplete!? (2005). (25) RePEc:cfs:cfswop:wp200508 Volatility Forecasting (2005). (26) RePEc:cfs:cfswop:wp200308 A Small Estimated Euro Area Model with Rational Expectations and Nominal Rigidities (2003). (27) RePEc:cfs:cfswop:wp200416 Realized Beta: Persistence and Predictability (2004). (28) RePEc:cfs:cfswop:wp200414 Exchange-Rate Policy and the Zero Bound on Nominal Interest (2004). (29) RePEc:cfs:cfswop:wp200415 Are Stationary Hyperinflation Paths Learnable? (2004). (30) RePEc:cfs:cfswop:wp200404 Ramsey Monetary Policy and International Relative Prices (2004). (31) RePEc:cfs:cfswop:wp200314 Institutional Investors in Germany: Insurance Companies and Investment Funds (2003). (32) RePEc:cfs:cfswop:wp200312 Optimal Monetary Policy with Imperfect Common Knowledge (2003). (33) RePEc:cfs:cfswop:wp200619 Credit Cards: Facts and Theories (2006). (34) RePEc:cfs:cfswop:wp200316 The Role of Accounting in the German Financial System (2003). (35) RePEc:cfs:cfswop:wp200305 Monetary Policy and Uncertainty about the Natural Unemployment Rate (2003). (36) RePEc:cfs:cfswop:wp200630 Global Monetary Policy Shocks in the G5: A SVAR Approach (2006). (37) RePEc:cfs:cfswop:wp200502 Practical Volatility and Correlation Modeling for Financial Market Risk Management (2005). (38) RePEc:cfs:cfswop:wp200526 Credit Card Debt Puzzles (2005). (39) RePEc:cfs:cfswop:wp200628 Optimal Choice and Beliefs with Ex Ante Savoring and Ex Post Disappointment (2006). (40) RePEc:cfs:cfswop:wp200621 Taxing Capital? Not a Bad Idea After All! (2006). (41) RePEc:cfs:cfswop:wp200307 Data Uncertainty and the Role of Money as an Information Variable for Monetary Policy (2003). (42) RePEc:cfs:cfswop:wp200418 Multiple-bank lending: diversification and free-riding in monitoring (2004). (43) RePEc:cfs:cfswop:wp200725 Capturing Common Components in High-Frequency Financial Time Series: A Multivariate Stochastic Multiplicative Error Model (2007). (44) RePEc:cfs:cfswop:wp200413 Optimal Monetary Policy under Commitment with a Zero Bound on Nominal Interest Rates (2004). (45) RePEc:cfs:cfswop:wp200530 Price Stability, Inflation Convergence and Diversity in EMU: Does One Size Fit All? (2005). (46) RePEc:cfs:cfswop:wp200708 A New Keynesian Model with Unemployment (2007). (47) RePEc:cfs:cfswop:wp200514 In this paper we compare expected loss minimization to worst-case or minimax analysis in the design of simple Taylor-style rules for monetary policy using a small model estimated for the euro area by (2005). (48) RePEc:cfs:cfswop:wp200336 Corporate Governance in Germany: An Economic Perspective (2003). (49) RePEc:cfs:cfswop:wp200717 Money in Monetary Policy Design under Uncertainty: The Two-Pillar Phillips Curve versus ECB-Style Cross-Checking (2007). (50) RePEc:cfs:cfswop:wp200710 Mortgage Markets, Collateral Constraints, and Monetary Policy: Do Institutional Factors Matter? (2007). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:ecb:ecbwps:20040350 Exchange-rate policy and the zero bound on nominal interest rates (2004). European Central Bank / Working Paper Series (2) RePEc:ecm:nasm04:230 Regime Switching for Dynamic Correlations (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (3) RePEc:fip:fedgfe:2004-48 Monetary policy alternatives at the zero bound: an empirical assessment (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (4) RePEc:nbr:nberwo:10602 Managing Volatility and Crises: A Practitioners Guide Overview (2004). National Bureau of Economic Research, Inc / NBER Working Papers Latest citations received in: 2003 (1) RePEc:ces:ceswps:_936 Are Stationary Hyperinflation Paths Learnable? (2003). CESifo GmbH / CESifo Working Paper Series (2) RePEc:cfs:cfswop:wp200313 Price Stability and Monetary Policy Effectiveness when Nominal Interest Rates are Bounded at Zero (2003). Center for Financial Studies / CFS Working Paper Series (3) RePEc:cfs:cfswop:wp200322 Do Changes in Sovereign Credit Ratings Contribute to Financial Contagion in Emerging Market Crises? (2003). Center for Financial Studies / CFS Working Paper Series (4) RePEc:cfs:cfswop:wp200323 A Critique on the Proposed Use of External Sovereign Credit Ratings in Basel II (2003). Center for Financial Studies / CFS Working Paper Series (5) RePEc:cfs:cfswop:wp200326 Initial Public Offerings and Venture Capital in Germany (2003). Center for Financial Studies / CFS Working Paper Series (6) RePEc:cfs:cfswop:wp200340 Imperfect Knowledge, Inflation Expectations, and Monetary Policy (2003). Center for Financial Studies / CFS Working Paper Series (7) RePEc:cfs:cfswop:wp200341 Permanent and Transitory Policy Shocks in an Empirical Macro Model with Asymmetric Information (2003). Center for Financial Studies / CFS Working Paper Series (8) RePEc:cla:levrem:506439000000000384 Optimal Interest-Rate Rules: I. General Theory (2003). UCLA Department of Economics / Levine's Bibliography (9) RePEc:cla:levrem:666156000000000092 Public and Private Information in Monetary Policy Models (2003). UCLA Department of Economics / Levine's Bibliography (10) RePEc:cpr:ceprdp:3892 Price Stability and Monetary Policy Effectiveness when Nominal Interest Rates are Bounded at Zero (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:4111 Optimal Monetary Policy Under Commitment with a Zero Bound on Nominal Interest Rates (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:4125 Information Variables for Monetary Policy in a Small Structural Model of the Euro Area (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:ecb:ecbwps:20030226 The Central Bank as a risk manager: quantifying and forecasting fnflation risks. (2003). European Central Bank / Working Paper Series (14) RePEc:ecb:ecbwps:20030231 Price stability and monetary policy effectiveness when nominal interest rates are bounded at zero. (2003). European Central Bank / Working Paper Series (15) RePEc:ecb:ecbwps:20030269 Zero lower bound - is it a problem with the euro area? (2003). European Central Bank / Working Paper Series (16) RePEc:ecb:ecbwps:20030272 Inflation targets and the liquidity trap. (2003). European Central Bank / Working Paper Series (17) RePEc:ecb:ecbwps:20030283 US, Japan and the euro area - comparing business-cycle features. (2003). European Central Bank / Working Paper Series (18) RePEc:ecb:ecbwps:20030290 Inflation persistence and robust monetary policy design. (2003). European Central Bank / Working Paper Series (19) RePEc:fip:fedawp:2003-21 Inflation scares and forecast-based monetary policy (2003). Federal Reserve Bank of Atlanta / Working Paper (20) RePEc:fip:fedfap:2003-11 Inflation scares and forecast-based monetary policy (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (21) RePEc:fip:fedfap:2003-21 The responses of wages and prices to technology shocks (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (22) RePEc:fip:fedfap:2003-24 The decline of activist stabilization policy: natural rate misperceptions, learning, and expectations (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (23) RePEc:fip:fedgfe:2003-07 A monetary policy rule based on nominal and inflation-indexed treasury yields (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (24) RePEc:fip:fedgfe:2003-36 Historical monetary policy analysis and the Taylor rule (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (25) RePEc:fip:fedgfe:2003-41 Inflation scares and forecast-based monetary policy (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (26) RePEc:fip:fedgfe:2003-65 The responses of wages and prices to technology shocks (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (27) RePEc:fip:fedkrw:rwp03-09 Permanent and transitory policy shocks in an empirical macro model with asymmetric information (2003). Federal Reserve Bank of Kansas City / Research Working Paper (28) RePEc:nbr:nberwo:10195 Escaping from a Liquidity Trap and Deflation: The Foolproof Way and Others (2003). National Bureau of Economic Research, Inc / NBER Working Papers (29) RePEc:nuf:econwp:0321 Econometrics of testing for jumps in financial economics using bipower variation (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (30) RePEc:sce:scecf3:38 Public and Private Information in Monetary Policy Models (2003). Society for Computational Economics / Computing in Economics and Finance 2003 (31) RePEc:wpa:wuwpma:0310002 Methods Available to Monetary Policy Makers to Deal with Uncertainty (2003). EconWPA / Macroeconomics Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |