|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

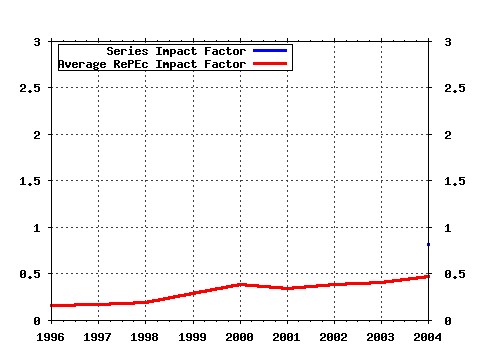

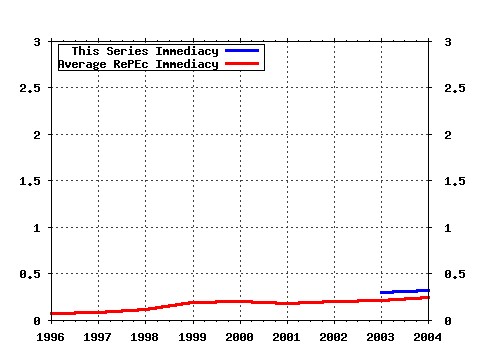

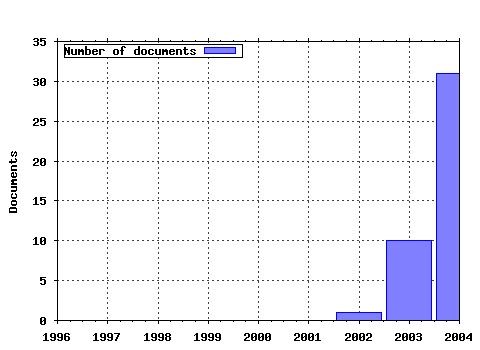

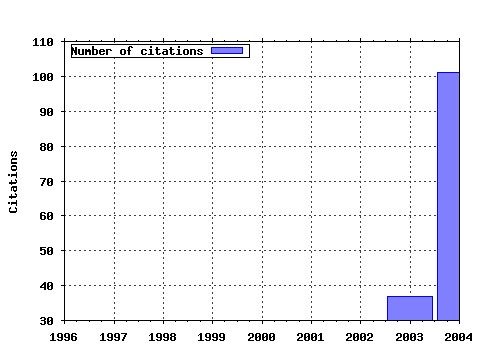

Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cra:wpaper:2004-11 Valuing Public Goods: The Life Satisfaction Approach (2004). (2) RePEc:cra:wpaper:2004-23 Calculating Tragedy: Assessing the Costs of Terrorism (2004). (3) RePEc:cra:wpaper:2003-02 Introducing Procedural Utility: Not only What, but also How Matters (2003). (4) RePEc:cra:wpaper:2004-26 Demokratische Beteiligung und Staatsausgaben: Die

Auswirkungen des Frauenstimmrechts (2004). (5) RePEc:cra:wpaper:2005-04 Economic Consequences of Mispredicting Utility (2004). (6) RePEc:cra:wpaper:2004-28 Making International Organizations More Democratic (2004). (7) RePEc:cra:wpaper:2005-27 Russian Attitudes Toward Paying Taxes â Before, During, and

After the Transition (2005). (8) RePEc:cra:wpaper:2004-03 Shadow Economies Around the World: What Do We Know? (2004). (9) RePEc:cra:wpaper:2004-14 Culture Differences and Tax Morale in the United States and

in Europe (2004). (10) RePEc:cra:wpaper:2005-15 Does Watching TV Make Us Happy? (2005). (11) RePEc:cra:wpaper:2004-09 Repetition and Reputation: Implications for Trust and

Trustworthiness When Institutions Change (2004). (12) RePEc:cra:wpaper:2005-12 Knight Fever: Towards an Economics of Awards (2005). (13) RePEc:cra:wpaper:2004-07 Is Trust a Bad Investment? (2004). (14) RePEc:cra:wpaper:2005-13 Shadow Economies of 145 Countries all over the World: What

Do We Really Know? (2005). (15) RePEc:cra:wpaper:2006-24 The Effect of Direct Democracy on Income Redistribution:

Evidence for Switzerland (2006). (16) RePEc:cra:wpaper:2006-01 Corruption and the Shadow Economy: An Empirical Analysis (2006). (17) RePEc:cra:wpaper:2006-21 On the Effectiveness of Debt Brakes: The Swiss Experience (2006). (18) RePEc:cra:wpaper:2005-03 Yes, Managers Should Be Paid Like Bureaucrats (2004). (19) RePEc:cra:wpaper:2006-10 Tax Compliance as the Result of a Psychological Tax

Contract: The Role of Incentives and Responsive Regulation (2006). (20) RePEc:cra:wpaper:2003-09 Tax Morale and Institutions (2003). (21) RePEc:cra:wpaper:2003-07 Reported Subjective Well-Being: A Challenge for Economic

Theory and Economic Policy (2003). (22) RePEc:cra:wpaper:2005-29 Effects of Tax Morale on Tax Compliance: Experimental and

Survey Evidence (2005). (23) RePEc:cra:wpaper:2005-19 Strategic Tax Competition in Switzerland: Evidence from a

Panel of the Swiss Cantons (2005). (24) RePEc:cra:wpaper:2005-17 Achieving Compliance when Legal Sanctions are Non-Deterrent (2005). (25) RePEc:cra:wpaper:2005-21 Voters as a Hard Budget Constraint: On the Determination of

Intergovernmental Grants (2005). (26) RePEc:cra:wpaper:2004-20 Taxation and Conditional Cooperation (2004). (27) RePEc:cra:wpaper:2004-27 Attitudes Towards Paying Taxes in Austria: An Empirical Analysis (2004). (28) RePEc:cra:wpaper:2006-03 Relative Income Position and Performance: An Empirical

Panel Analysis (2006). (29) RePEc:cra:wpaper:2005-05 Trust and Fiscal Performance: A Panel Analysis with Swiss Data (2005). (30) RePEc:cra:wpaper:2004-04 Tax Morale in Australia: What Shapes it and Has it Changed

over Time? (2004). (31) RePEc:cra:wpaper:2005-07 Fiscal Autonomy and Tax Morale: Evidence from Germany (2005). (32) RePEc:cra:wpaper:2004-21 Societal Institutions and Tax Effort in Developing Countries (2004). (33) RePEc:cra:wpaper:2004-08 Social comparisons in ultimatum bargaining (2004). (34) RePEc:cra:wpaper:2006-15 Women and Illegal Activities: Gender Differences and

Womenâs Willingness to Comply over Time (2006). (35) RePEc:cra:wpaper:2007-02 Shadow Economy, Tax Morale, Governance and Institutional

Quality: A Panel Analysis (2007). (36) RePEc:cra:wpaper:2006-11 Tax Morale and Conditional Cooperation (2006). (37) RePEc:cra:wpaper:2006-08 Blood and Ink! The Common-Interest-Game Between Terrorists

and the Media (2006). (38) RePEc:cra:wpaper:2005-16 Sustainable Fiscal Policy in a Federal System: Switzerland

as an Example (2004). (39) RePEc:cra:wpaper:2006-17 Environmental Morale and Motivation (2006). (40) RePEc:cra:wpaper:2004-02 Tax Morale in Asian Countries (2004). (41) RePEc:cra:wpaper:2004-05 Tax Morale, Trust and Corruption: Empirical Evidence from

Transition Countries (2004). (42) RePEc:cra:wpaper:2005-33 The Evolution of Tax Morale in Modern Spain (2005). (43) RePEc:cra:wpaper:2007-13 Tax Effort: The Impact of Corruption, Voice and Accountability (2007). (44) RePEc:cra:wpaper:2004-15 Do Large Cabinets Favor Large Governments? Evidence from

Swiss Sub-federal Jurisdictions (2004). (45) RePEc:cra:wpaper:2004-13 Effects of Culture on Tax Compliance: A Cross Check of

Experimental and Survey Evidence (2004). (46) RePEc:cra:wpaper:2004-22 âLa Grande Boucleâ: Determinants of Success at the Tour de France (2005). (47) RePEc:cra:wpaper:2005-18 On Government Centralization and Fiscal Referendums: A

Theoretical Model and Evidence from Switzerland (2005). (48) RePEc:cra:wpaper:2003-05 Direct Democracy: Designing a Living Constitution (2003). (49) RePEc:cra:wpaper:2004-18 âHistorical Excellenceâ in Football World Cup Tournaments:

Empirical Evidence with Data From 1930 to 2002 (2004). (50) RePEc:cra:wpaper:2007-05 Social Capital and Relative Income Concerns: Evidence from

26 Countries (2007). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:aea:aecrev:v:94:y:2004:i:5:p:1717-1722 Social Comparisons and Pro-social Behavior: Testing Conditional Cooperation in a Field Experiment (2004). American Economic Review (2) RePEc:ays:ispwps:paper0406 Societal Institutions and Tax Effort in Developing Countries (2004). International Studies program, Andrew young School of policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:iza:izadps:dp1045 Is Volunteering Rewarding in Itself? (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (4) RePEc:iza:izadps:dp1175 Income and Happiness: New Results from Generalized Threshold and Sequential Models (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (5) RePEc:kls:series:0005 Trust among Internet Traders: A Behavioral Economics Approach (2004). University of Cologne, Seminar of Economics / Working Paper Series in Economics (6) RePEc:nbr:nberwo:10667 Neighbors as Negatives: Relative Earnings and Well-Being (2004). National Bureau of Economic Research, Inc / NBER Working Papers (7) RePEc:nbr:nberwo:10859 Poverty, Political Freedom, and the Roots of Terrorism (2004). National Bureau of Economic Research, Inc / NBER Working Papers (8) RePEc:nub:occpap:9 Do Cultures Clash? Evidence from Cross-National Ultimatum Game Experiments (2004). Industrial Economics Division / Occasional Papers (9) RePEc:soz:wpaper:0407 Income and Happiness: New Results from Generalized Threshold and Sequential Models (2004). University of Zurich, Socioeconomic Institute / Working Papers (10) RePEc:ttp:itpwps:0411 Societal Institutions and Tax Effort in Developing Countries (2004). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers Latest citations received in: 2003 (1) RePEc:ces:ceswps:_959 Being Independent is a Great Thing: Subjective Evaluations of Self-Employment and Hierarchy (2003). CESifo GmbH / CESifo Working Paper Series (2) RePEc:cpr:ceprdp:3860 Is Strong Reciprocity a Maladaption? On the Evolutionary Foundations of Human Altruism (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:upf:upfgen:819 A One-Shot Prisonersâ Dilemma with Procedural Utility (2003). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |