|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

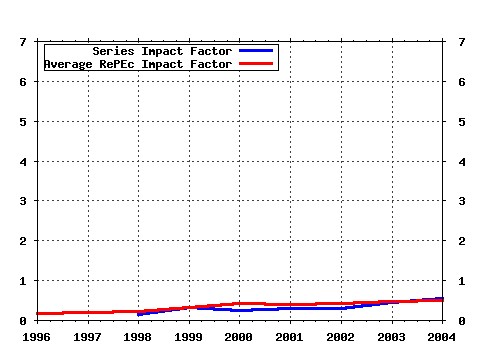

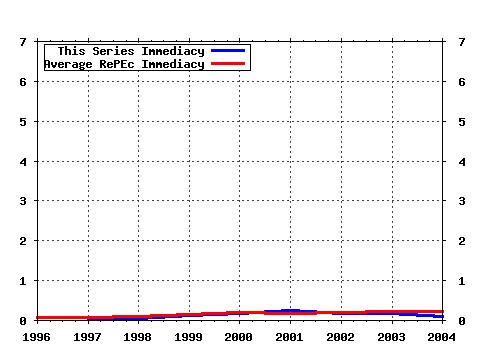

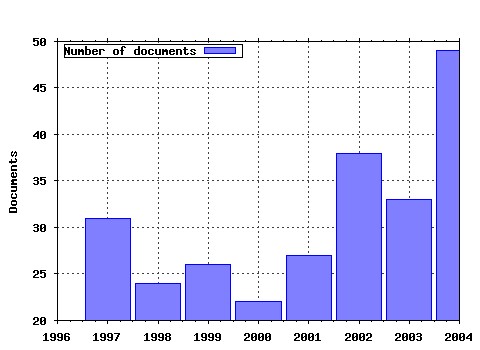

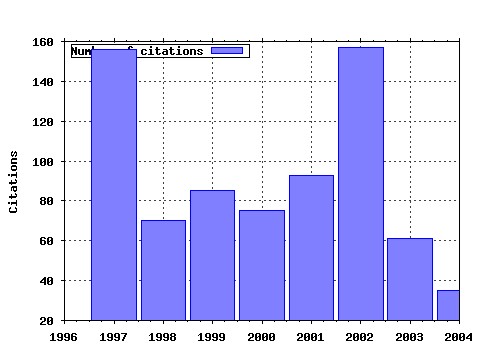

Macroeconomic Dynamics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cup:macdyn:v:6:y:2002:i:1:p:111-44 Does Model Uncertainty Justify Caution? Robust Optimal Monetary Policy in a Forward-Looking Model. (2002). (2) RePEc:cup:macdyn:v:3:y:1999:i:2:p:204-25 A Mixed Blessing: Natural Resources and Economic Growth. (1999). (3) RePEc:cup:macdyn:v:1:y:1997:i:2:p:387-422 Income and Wealth Heterogeneity, Portfolio Choice, and Equilibrium Asset Returns. (1997). (4) RePEc:cup:macdyn:v:1:y:1997:i:1:p:7-44 Two Computations to Fund Social Security. (1997). (5) RePEc:cup:macdyn:v:2:y:1998:i:3:p:287-321 Consistent Expectations Equilibria. (1998). (6) RePEc:cup:macdyn:v:1:y:1997:i:1:p:76-101 Market Frictions, Savings Behavior, and Portfolio Choice. (1997). (7) RePEc:cup:macdyn:v:5:y:2002:i:05:p:742-747_03 DOES INTRAFIRM BARGAINING MATTER IN THE LARGE FIRMS MATCHING MODEL? (2002). (8) RePEc:cup:macdyn:v:6:y:2002:i:5:p:633-64 Fiscal Policy, Increasing Returns, and Endogenous Fluctuations. (2002). (9) RePEc:cup:macdyn:v:6:y:2002:i:1:p:85-110 Robust Monetary Policy under Model Uncertainty in a Small Model of the U.S. Economy. (2002). (10) RePEc:cup:macdyn:v:1:y:1997:i:2:p:312-32 Habit Persistence and Asset Returns in an Exchange Economy. (1997). (11) RePEc:cup:macdyn:v:1:y:1997:i:1:p:45-75 Solving Large-Scale Rational-Expectations Models. (1997). (12) RePEc:cup:macdyn:v:5:y:2001:i:1:p:81-100 Comparison of Bootstrap Confidence Intervals for Impulse Responses of German Monetary Systems. (2001). (13) RePEc:cup:macdyn:v:4:y:2000:i:4:p:423-47 Financial Intermediation and Aggregate Fluctuations: A Quantitative Analysis. (2000). (14) RePEc:cup:macdyn:v:7:y:2003:i:2:p:239-62 The Real-Interest-Rate Gap as an Inflation Indicator. (2003). (15) RePEc:cup:macdyn:v:5:y:2001:i:3:p:413-33 Financial Development and Economic Growth. (2001). (16) RePEc:cup:macdyn:v:8:y:2004:i:1:p:27-50 Signal Extraction and Non-certainty-Equivalence in Optimal Monetary Policy Rules. (2004). (17) RePEc:cup:macdyn:v:5:y:2001:i:2:p:272-302 Learning and Excess Volatility. (2001). (18) RePEc:cup:macdyn:v:5:y:2001:i:4:p:533-76 Threshold Cointegration and Nonlinear Adjustment to the Law of One Price. (2001). (19) RePEc:cup:macdyn:v:8:y:2004:i:01:p:27-50_02 SIGNAL EXTRACTION AND NON-CERTAINTY-EQUIVALENCE IN OPTIMAL MONETARY POLICY RULES (2004). (20) RePEc:cup:macdyn:v:6:y:2002:i:1:p:40-84 Robust Permanent Income and Pricing with Filtering. (2002). (21) RePEc:cup:macdyn:v:6:y:2002:i:5:p:713-47 Stabilization Policy as Bifurcation Selection: Would Stabilization Policy Work if the Economy Really Were Unstable? (2002). (22) RePEc:cup:macdyn:v:2:y:1998:i:3:p:322-44 Virtues of Bad Times: Interaction between Productivity Growth and Economic Fluctuations. (1998). (23) RePEc:cup:macdyn:v:5:y:2001:i:4:p:598-620 Out-of-Sample Tests for Granger Causality. (2001). (24) RePEc:cup:macdyn:v:4:y:2000:i:2:p:170-96 Herd Behavior and Aggregate Fluctuations in Financial Markets. (2000). (25) RePEc:cup:macdyn:v:1:y:1997:i:2:p:355-86 Solving Dynamic Models with Aggregate Shocks and Heterogeneous Agents. (1997). (26) RePEc:cup:macdyn:v:1:y:1997:i:3:p:615-39 Fiscal Policy in a Growing Economy with Public Capital. (1997). (27) RePEc:cup:macdyn:v:2:y:1998:i:3:p:383-400 Superneutrality of Money in Staggered Wage-Setting Models. (1998). (28) RePEc:cup:macdyn:v:3:y:1999:i:2:p:243-77 Equilibrium Asset Prices and Savings of Heterogeneous Agents in the Presence of Incomplete Markets and Portfolio Constraints. (1999). (29) RePEc:cup:macdyn:v:4:y:2000:i:2:p:197-221 The Exact Theoretical Rational Expectations Monetary Aggregate. (2000). (30) RePEc:cup:macdyn:v:2:y:1998:i:4:p:443-55 Uncertain Duration of Reform: Dynamic Implications. (1998). (31) RePEc:cup:macdyn:v:3:y:1999:i:4:p:482-505 Minimum Consumption Requirements: Theoretical and Quantitative Implications for Growth and Distribution. (1999). (32) RePEc:cup:macdyn:v:6:y:2002:i:2:p:284-306 Recursive Equilibria in Economies with Incomplete Markets. (2002). (33) RePEc:cup:macdyn:v:3:y:1999:i:3:p:311-40 Modeling Multiple Regimes in the Business Cycle. (1999). (34) RePEc:cup:macdyn:v:7:y:2003:i:3:p:333-62 Optimal Inflation Tax and Structural Reform. (2003). (35) RePEc:cup:macdyn:v:6:y:2002:i:1:p:167-85 Robust Decision Theory and the Lucas Critique. (2002). (36) RePEc:cup:macdyn:v:4:y:2000:i:3:p:343-72 Stock Returns, Term Structure, Inflation, and Real Activity: An International Perspective. (2000). (37) RePEc:cup:macdyn:v:10:y:2006:i:04:p:467-501_05 DO FIRING COSTS AFFECT THE INCIDENCE OF FIRM BANKRUPTCY? (2006). (38) RePEc:cup:macdyn:v:8:y:2004:i:5:p:559-81 Endogenous Growth and Endogenous Business Cycles. (2004). (39) RePEc:cup:macdyn:v:8:y:2004:i:05:p:559-581_04 ENDOGENOUS GROWTH AND ENDOGENOUS BUSINESS CYCLES (2004). (40) RePEc:cup:macdyn:v:4:y:2000:i:3:p:373-414 Evolutionary Algorithms in Macroeconomic Models. (2000). (41) RePEc:cup:macdyn:v:6:y:2002:i:2:p:242-65 The Sharpe Ratio and Preferences: A Parametric Approach. (2002). (42) RePEc:cup:macdyn:v:7:y:2003:i:1:p:63-88 Dynamic Equivalence Principle in Linear Rational Expectations Models. (2003). (43) RePEc:cup:macdyn:v:5:y:2001:i:4:p:466-81 Overview of Nonlinear Macroeconometric Empirical Models. (2001). (44) RePEc:cup:macdyn:v:4:y:2000:i:4:p:448-66 Expectations, Credibility, and Time-Consistent Monetary Policy. (2000). (45) RePEc:cup:macdyn:v:4:y:2000:i:1:p:74-107 Two New Keynesian Theories of Sticky Prices. (2000). (46) RePEc:cup:macdyn:v:1:y:1997:i:3:p:640-57 Regime-Sensitive Cointegration with an Application to Interest-Rate Parity. (1997). (47) RePEc:cup:macdyn:v:5:y:2001:i:1:p:101-31 An Interview with Milton Friedman. (2001). (48) RePEc:cup:macdyn:v:1:y:1997:i:2:p:485-512 CAPM Risk Adjustment for Exact Aggregation over Financial Assets. (1997). (49) RePEc:cup:macdyn:v:2:y:1998:i:1:p:22-48 Learning and the Stability of Cycles. (1998). (50) RePEc:cup:macdyn:v:4:y:2000:i:2:p:139-69 Information Dynamics in Financial Markets. (2000). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:bru:bruedp:04-11 Uncertainty and UK Monetary Policy (2004). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:bru:bruppp:04-11 Uncertainty and UK Monetary Policy (2004). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers (3) RePEc:cty:dpaper:0405 Uncertainty and UK Monetary Policy (2004). Department of Economics, City University, London / City University Economics Discussion Papers (4) RePEc:ecm:latm04:132 The Use and Abuse of Taylor Rules: How precisely can we estimate them? (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (5) RePEc:mmf:mmfc04:65 Uncertainty and UK Monetary Policy (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 Latest citations received in: 2003 (1) RePEc:del:abcdef:2003-28 Coordination on Saddle-Path Solutions: the Eductive Viewpoint - Linear Multivariate Models. (2003). DELTA (Ecole normale supérieure) / DELTA Working Papers (2) RePEc:eui:euiwps:eco2003/10 Will the Monetary Pillar Stay? A Few Lessons from the UK (2003). European University Institute / Economics Working Papers (3) RePEc:kie:kieliw:1179 Is European Money Demand Still Stable? (2003). Kiel Institute for World Economics / Working Papers (4) RePEc:nbr:nberwo:9960 The Unique Minimum State Variable RE Solution is E-Stable in All Well Formulated Linear Models (2003). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:nus:nusewp:wp0306 Non-Fundamental Expectations and Economic Fluctuations: Evidence from Professional Forecasts (2003). National University of Singapore, Department of Economics / Departmental Working Papers (6) RePEc:uno:wpaper:2003-02 Explaining speculative expansions (2003). University of New Orleans, Department of Economics and Finance / Working Papers Latest citations received in: 2002 (1) RePEc:aea:aecrev:v:92:y:2002:i:2:p:96-101 The Natural Rate of Q (2002). American Economic Review (2) RePEc:cla:levarc:391749000000000523 A Central-Planning Approach to Dynamic Incomplete-Market Equilibrium (2002). UCLA Department of Economics / Levine's Working Paper Archive (3) RePEc:cpr:ceprdp:3581 Determinacy Through Intertemporal Capital Adjustment Costs (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:ecb:ecbwps:20020169 Modeling model uncertainty. (2002). European Central Bank / Working Paper Series (5) RePEc:szg:worpap:0208 Product Market Deregulation and Labor Market Outcomes (2002). Swiss National Bank, Study Center Gerzensee / Working Papers (6) RePEc:wpa:wuwpma:0210006 Bifurcations in Macroeconomic Models (2002). EconWPA / Macroeconomics (7) RePEc:wpa:wuwpma:0211006 Squeezing the Interest Rate Smoothing Weight with a Hybrid Expectations Model (2002). EconWPA / Macroeconomics Latest citations received in: 2001 (1) RePEc:aea:jecper:v:15:y:2001:i:3:p:23-45 A Theory of the Consumption Function, with and without Liquidity Constraints (2001). Journal of Economic Perspectives (2) RePEc:cns:cnscwp:200104 Non linearity between finance and growth (2001). Centre for North South Economic Research, University of Cagliari and Sassari, Sardinia / Working Paper CRENoS (3) RePEc:cns:cnscwp:200105 Financial Institutions Expertise and Growth Effects of Financial Liberalisation (2001). Centre for North South Economic Research, University of Cagliari and Sassari, Sardinia / Working Paper CRENoS (4) RePEc:fip:fedkrw:rwp01-14 Evaluating long-horizon forecasts (2001). Federal Reserve Bank of Kansas City / Research Working Paper (5) RePEc:wbk:wbrwps:2608 Financial development and international trade : is there a link? (2001). The World Bank / Policy Research Working Paper Series (6) RePEc:wop:humbsf:2001-19 Sources of German Unemployment: A Structural Vector Error Correction Analysis (2001). Humboldt Universitaet Berlin / Sonderforschungsbereich 373 (7) RePEc:wop:humbsf:2001-93 Stability Results for Nonlinear Vector Autoregressions with an Application to a Nonlinear Error Correction Model (2001). Humboldt Universitaet Berlin / Sonderforschungsbereich 373 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |