|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

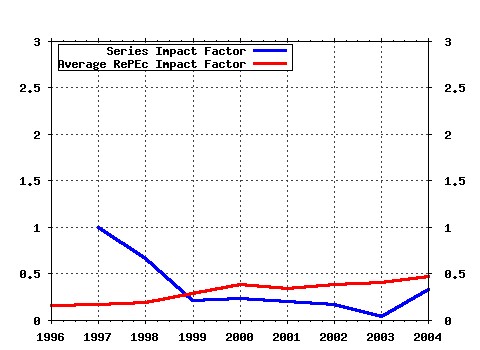

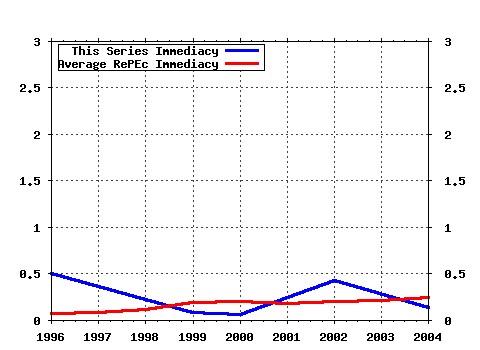

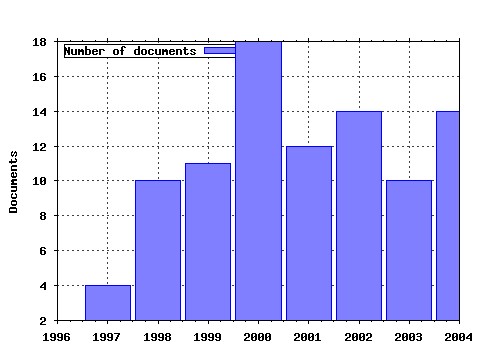

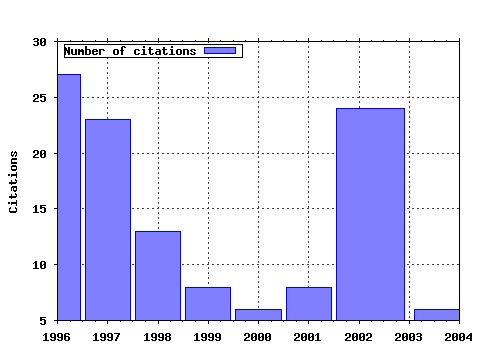

Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:dij:wpfarg:0960501 Vers une théorie du gouvernement des entreprises (1996). (2) RePEc:dij:wpfarg:0970801 Gouvernance des entreprises:valeur partenariale

contre valeur actionnariale (1997). (3) RePEc:dij:wpfarg:0980901 La théorie positive de lagence:lecture et relectures... (1998). (4) RePEc:dij:wpfarg:1020701 Determinants of required return in venture capital investments:A five country study (2002). (5) RePEc:dij:wpfarg:011201 Variation sur le thème A la recherche de nouvelles fondations pour la finance et la gouvernance dentreprise (2002). (6) RePEc:dij:wpfarg:0970901 Lentreprise publique est-elle nécessairement moins efficace? (1997). (7) RePEc:dij:wpfarg:0960601 Pour une véritable théorie de la latitude managériale et du gouvernement des entreprises. (1996). (8) RePEc:dij:wpfarg:001201 Le conseil dadministration dans les théories de la gouvernance (2000). (9) RePEc:dij:wpfarg:1010301 Corporate Governance: Stakeholder Value Versus Shareholder Value (2001). (10) RePEc:dij:wpfarg:1020702 The Impacts of LBOs on the Performance of Acquired Firms:the French Case (2002). (11) RePEc:dij:wpfarg:0991201 La théorie positive de lagence:positionnement et apports (1999). (12) RePEc:dij:wpfarg:1040101 Les théories de la gouvernance:de la gouvernance des entreprises à la gouvernance des systèmes nationaux (2004). (13) RePEc:dij:wpfarg:0991101 Motifs et conséquences de ladoption des stock-options (1999). (14) RePEc:dij:wpfarg:1021202 The syndication of venture capital investments in Europe: Evidence from five european countries (2002). (15) RePEc:dij:wpfarg:1040402 Les prises de contrôle par les actionnaires contestataires:le cas André (2004). (16) RePEc:dij:wpfarg:0980401 Le point sur la mesure de performance des entreprises (1998). (17) RePEc:dij:wpfarg:1021001 Lincidence des LBO sur la politique dinvestissement et la gestion opérationnelle des firmes acquises:le cas français (2002). (18) RePEc:dij:wpfarg:1000102 Les plans doption sur actions:théorie et pratique (2000). (19) RePEc:dij:wpfarg:1041202 Corporate Governance Theories: From Micro Theories to National Systems Theories (2004). (20) RePEc:dij:wpfarg:0970701 Le point sur le gouvernement des entreprises (1997). (21) RePEc:dij:wpfarg:1011003 Système national de gouvernance, structures locales et logique de création et dappropriation de rentes:les enseignements du cas Vodafone/Mannesmann (2001). (22) RePEc:dij:wpfarg:0990302 Évolution institutionnelle, schémas mentaux et gouvernement des entreprises:le cas Krupp - Thyssen (1999). (23) RePEc:dij:wpfarg:1040201 Caractéristiques et fonctionnement des conseils dadministration français:un état des lieux (2004). (24) RePEc:dij:wpfarg:010401 Quelle théorie pour la gouvernance?De la gouvernance actionnariale à la gouvernance cognitive... (2002). (25) RePEc:dij:wpfarg:1000301 Critères dévaluation des investisseurs en capital:le cas français (2000). (26) RePEc:dij:wpfarg:0980301 Structures de propriété, pouvoir discrétionnaire managérial

et choix dactivité dans lassurance dommages en France (1998). (27) RePEc:dij:wpfarg:1050601 Pour une gouvernance dentreprise «comportementale»:une réflexion exploratoire-Toward a Behavioral Corporate Governance Theory : An Exploratory View (2005). (28) RePEc:dij:wpfarg:1011101 Enjeux éthiques des formules dactionnariat des dirigeants (2001). (29) RePEc:dij:wpfarg:0990601 Gouvernement dentreprise et comptabilité (1999). (30) RePEc:dij:wpfarg:1010501 Privatisation, gouvernement dentreprise et processus décisionnel:une intégration de la dynamique organisationnelle à travers le cas de France Télécom (2001). (31) RePEc:dij:wpfarg:0981201 Les déterminants du choix entre un conseil dadministration et

un conseil de surveillance (1998). (32) RePEc:dij:wpfarg:1010201 Michael Jensen:Le pionnier de la finance organisationnelle (2001). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:dij:wpfarg:1040603 Les déterminants de la qualité des conseils dadministration français (2004). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO (2) RePEc:dij:wpfarg:1040701 The Changing Institutions of Governance in Corporate France:What Drives the Process? (2004). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:dij:wpfarg:1021001 Lincidence des LBO sur la politique dinvestissement et la gestion opérationnelle des firmes acquises:le cas français (2002). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO (2) RePEc:dij:wpfarg:1021002 The Impact of Lbos on Investment Policies and Operations of Acquired French Firms (2002). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO (3) RePEc:dij:wpfarg:1021201 Du processus délaboration du cadre conceptuel en gouvernance dentreprise A development process Of a conceptual framework of corporate governance (2002). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO (4) RePEc:dij:wpfarg:1021202 The syndication of venture capital investments in Europe: Evidence from five european countries (2002). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO (5) RePEc:vlg:vlgwps:2002-20 Why do European Venture Capital Companies syndicate? (2002). Vlerick Leuven Gent Management School / Vlerick Leuven Gent Management School Working Paper Series (6) RePEc:wpa:wuwpfi:0210006 Why do European Venture Capital Companies syndicate? (2002). EconWPA / Finance Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |