|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

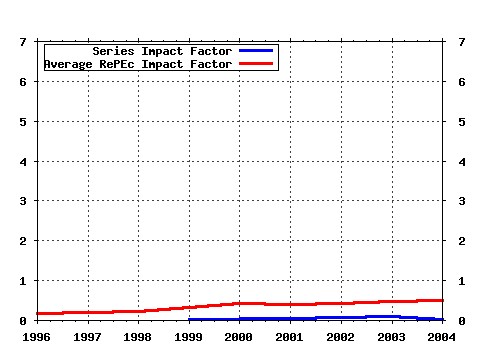

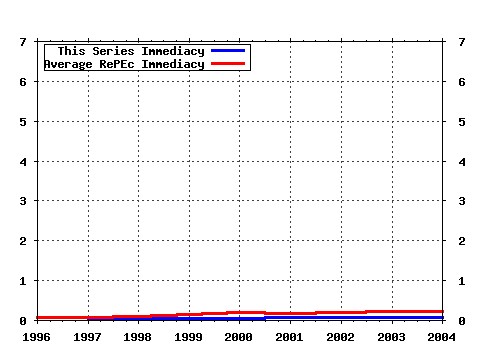

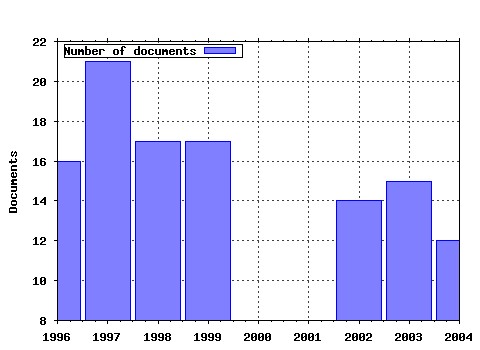

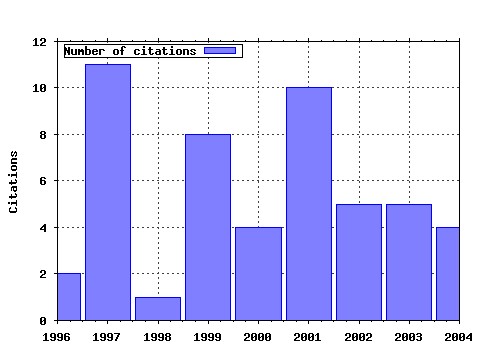

Global Finance Journal Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:glofin:v:8:y:1997:i:2:p:257-277 Co-movements of major European community stock markets: A vector autoregression analysis (1997). (2) RePEc:eee:glofin:v:12:y:2001:i:1:p:1-33 Equity market linkages in the Asia Pacific region: A comparison of the orthogonalised and generalised VAR approaches (2001). (3) RePEc:eee:glofin:v:3:y:1992:i:1:p:23-50 Intervention and the foreign exchange risk premium: An empirical investigation of daily effects (1992). (4) RePEc:eee:glofin:v:16:y:2005:i:1:p:69-85 A panel study on real interest rate parity in East Asian countries: Pre- and post-liberalization era (2005). (5) RePEc:eee:glofin:v:13:y:2002:i:2:p:217-235 International linkage of interest rates: Evidence from the emerging economies of Asia (2002). (6) RePEc:eee:glofin:v:8:y:1997:i:2:p:309-321 Political instability and country risk (1997). (7) RePEc:eee:glofin:v:15:y:2005:i:3:p:251-280 An analysis of the determinants of sovereign ratings (2005). (8) RePEc:eee:glofin:v:10:y:1999:i:1:p:71-81 Cointegration and causality between macroeconomic variables and stock market returns (1999). (9) RePEc:eee:glofin:v:10:y:1999:i:1:p:1-23 Nonlinear dynamics in foreign exchange rates (1999). (10) RePEc:eee:glofin:v:11:y:2000:i:1-2:p:31-52 The determination and international transmission of stock market volatility (2000). (11) RePEc:eee:glofin:v:12:y:2001:i:1:p:95-107 Price and volatility spillovers between interest rate and exchange value of the US dollar (2001). (12) RePEc:eee:glofin:v:12:y:2001:i:1:p:109-119 US exports and time-varying volatility of real exchange rate (2001). (13) RePEc:eee:glofin:v:14:y:2003:i:3:p:271-286 Determinants of emerging-market bond spreads: Cross-country evidence (2003). (14) RePEc:eee:glofin:v:11:y:2000:i:1-2:p:87-108 Long-run purchasing power parity, prices and exchange rates in transition: The case of six Central and East European countries (2000). (15) RePEc:eee:glofin:v:8:y:1997:i:1:p:113-128 Growth effects of integration among unequal countries (1997). (16) RePEc:eee:glofin:v:13:y:2002:i:1:p:29-38 Corporate risk management: Costs and benefits (2002). (17) RePEc:eee:glofin:v:12:y:2001:i:1:p:139-151 An examination of nonlinear dependence in exchange rates, using recent methods from chaos theory (2001). (18) RePEc:eee:glofin:v:16:y:2005:i:1:p:26-47 Country and size effects in financial ratios: A European perspective (2005). (19) RePEc:eee:glofin:v:9:y:1998:i:2:p:241-251 On the relationship between stock returns and exchange rates: Tests of granger causality (1998). (20) RePEc:eee:glofin:v:14:y:2003:i:3:p:319-332 Asymmetric information transmission between a transition economy and the U.S. market: evidence from the Warsaw Stock Exchange (2003). (21) RePEc:eee:glofin:v:3:y:1992:i:1:p:79-95 Evaluating country risk: A decision support approach (1992). (22) RePEc:eee:glofin:v:15:y:2005:i:3:p:281-302 Technical trading, monetary policy, and exchange rate regimes (2005). (23) RePEc:eee:glofin:v:14:y:2003:i:1:p:83-93 The forward rate unbiasedness hypothesis reexamined: evidence from a new test (2003). (24) RePEc:eee:glofin:v:16:y:2006:i:3:p:245-263 Volatility co-movements between emerging sovereign bonds: Is there segmentation between geographical areas? (2006). (25) RePEc:eee:glofin:v:15:y:2005:i:3:p:219-237 Long-run dynamics of official and black-market exchange rates in Latin America (2005). (26) RePEc:eee:glofin:v:7:y:1996:i:2:p:209-222 Foreign direct investment: The factors affecting the location of foreign branch plants in the United States (1996). (27) RePEc:eee:glofin:v:16:y:2005:i:1:p:86-98 Covered arbitrage with currency options: A theoretical analysis (2005). (28) RePEc:eee:glofin:v:10:y:1999:i:1:p:93-105 Seasonality in returns on the Chinese stock markets: the case of Shanghai and Shenzhen (1999). (29) RePEc:eee:glofin:v:15:y:2004:i:2:p:125-137 International transmission of stock exchange volatility: Empirical evidence from the Asian crisis (2004). (30) RePEc:eee:glofin:v:6:y:1995:i:2:p:121-134 Testing for the relationship between nominal exchange rates and economic fundamentals (1995). (31) RePEc:eee:glofin:v:16:y:2005:i:1:p:48-68 Contagion and impulse response of international stock markets around the 9-11 terrorist attacks (2005). (32) RePEc:eee:glofin:v:10:y:1999:i:1:p:53-70 Cross-border transmission of stock price volatility: evidence from the overlapping trading hours (1999). (33) RePEc:eee:glofin:v:15:y:2004:i:1:p:57-70 Financial markets and the financing choice of firms: Evidence from developing countries (2004). (34) RePEc:eee:glofin:v:4:y:1993:i:1:p:65-76 The official and black (parallel) foreign exchange markets: Causal relationships: Empirical evidence (1993). (35) RePEc:eee:glofin:v:15:y:2005:i:3:p:303-320 New European Union members on their way to adopting the Euro: An analysis of macroeconomic disturbances (2005). (36) RePEc:eee:glofin:v:14:y:2003:i:1:p:65-82 State equity ownership and firm market performance: evidence from Chinas newly privatized firms (2003). (37) RePEc:eee:glofin:v:16:y:2005:i:1:p:99-111 Biases in FX-forecasts: Evidence from panel data (2005). (38) RePEc:eee:glofin:v:10:y:1999:i:2:p:147-160 The impact of listing Latin American ADRs on the risks and returns of the underlying shares (1999). (39) RePEc:eee:glofin:v:15:y:2004:i:2:p:197-217 Increasing input information and realistically measuring potential diversification gains from international portfolio investments (2004). (40) RePEc:eee:glofin:v:7:y:1996:i:2:p:129-151 International real interest rate parity with error correction models (1996). (41) RePEc:eee:glofin:v:15:y:2004:i:1:p:81-102 Identification of common and idiosyncratic shocks in real equity prices: Australia, 1982-2002 (2004). (42) RePEc:eee:glofin:v:5:y:1994:i:1:p:121-140 Global market place and causality (1994). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:imf:imfwpa:03/251 Characterizing Global Investors Risk Appetite for Emerging Market Debt During Financial Crises (2004). International Monetary Fund / IMF Working Papers Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |