|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

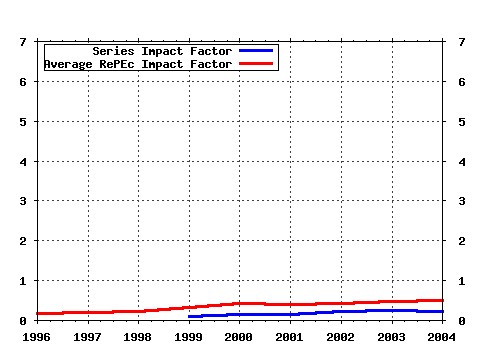

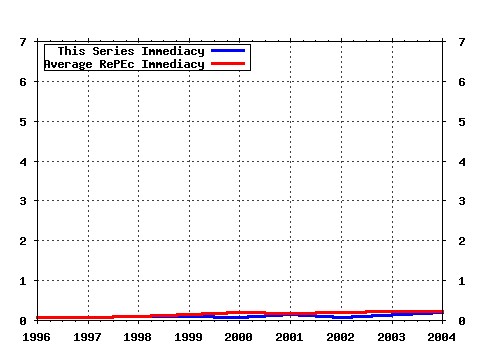

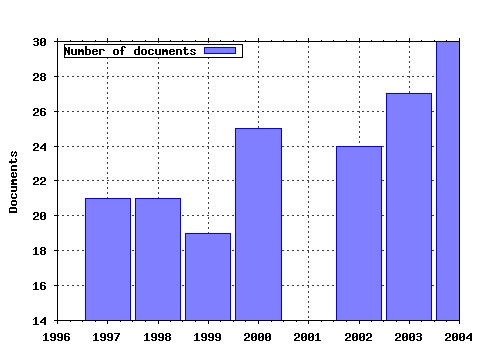

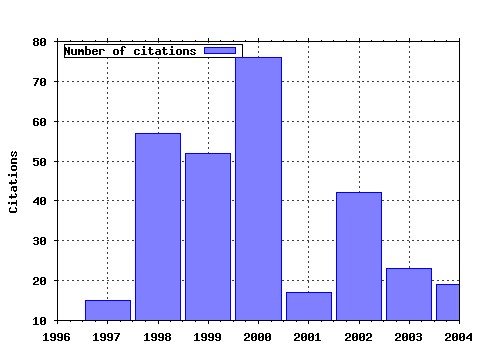

Journal of International Financial Markets, Institutions and Money Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:407-421 Intervention from an information perspective (2000). (2) RePEc:eee:intfin:v:12:y:2002:i:1:p:33-58 Cost and profit efficiency in European banks (2002). (3) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:303-322 Central bank intervention and exchange rates: the case of Sweden (2000). (4) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:287-302 The United States as an informed foreign-exchange speculator (2000). (5) RePEc:eee:intfin:v:9:y:1999:i:4:p:359-376 Long memory or structural breaks: can either explain nonstationary real exchange rates under the current float? (1999). (6) RePEc:eee:intfin:v:8:y:1998:i:2:p:117-153 What determines real exchange rates?: The long and the short of it (1998). (7) RePEc:eee:intfin:v:10:y:2000:i:2:p:107-130 Intraday and interday volatility in the Japanese stock market (2000). (8) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:381-405 Central bank intervention and exchange rate volatility -- Australian evidence (2000). (9) RePEc:eee:intfin:v:12:y:2002:i:3:p:183-200 On measuring volatility and the GARCH forecasting performance (2002). (10) RePEc:eee:intfin:v:10:y:2000:i:1:p:69-82 Testing for nonlinear Granger causality from fundamentals to exchange rates in the ERM (2000). (11) RePEc:eee:intfin:v:8:y:1998:i:1:p:21-38 The impact of exchange rate volatility on Australian trade flows (1998). (12) RePEc:eee:intfin:v:8:y:1998:i:2:p:155-173 An empirical examination of linkages between Pacific-Basin stock markets (1998). (13) RePEc:eee:intfin:v:9:y:1999:i:2:p:163-182 Factor price misspecification in bank cost function estimation (1999). (14) RePEc:eee:intfin:v:8:y:1998:i:1:p:1-19 Monetary-based models of the exchange rate: a panel perspective (1998). (15) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:393-412 Multimarket trading and liquidity: a transaction data analysis of Canada-US interlistings (1998). (16) RePEc:eee:intfin:v:9:y:1999:i:2:p:183-193 A test of purchasing power parity for emerging economies (1999). (17) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:229-247 Foreign reserve and money dynamics with asset portfolio adjustment: international evidence (2000). (18) RePEc:eee:intfin:v:11:y:2001:i:1:p:75-96 Inflation and rates of return on stocks: evidence from high inflation countries (2001). (19) RePEc:eee:intfin:v:13:y:2003:i:2:p:85-112 Information arrivals and intraday exchange rate volatility (2003). (20) RePEc:eee:intfin:v:9:y:1999:i:4:p:377-391 Assessing competitive conditions in the Greek banking system (1999). (21) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:363-379 Deviations from daily uncovered interest rate parity and the role of intervention (2000). (22) RePEc:eee:intfin:v:9:y:1999:i:1:p:61-74 Causal relations among stock returns and macroeconomic variables in a small, open economy (1999). (23) RePEc:eee:intfin:v:13:y:2003:i:4:p:383-399 Spillovers of stock return volatility to Asian equity markets from Japan and the US (2003). (24) RePEc:eee:intfin:v:9:y:1999:i:2:p:115-128 Asymmetric information and the bid-ask spread: an empirical comparison between automated order execution and open outcry auction (1999). (25) RePEc:eee:intfin:v:9:y:1999:i:3:p:267-283 A multivariate analysis of the determinants of Moodys bank financial strength ratings (1999). (26) RePEc:eee:intfin:v:10:y:2000:i:2:p:131-150 Cross-sectional variations in the degree of global integration: the case of Russian equities (2000). (27) RePEc:eee:intfin:v:14:y:2004:i:1:p:25-36 The accuracy of press reports regarding the foreign exchange interventions of the Bank of Japan (2004). (28) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:299-324 Two months in the life of several gilt-edged market makers on the London Stock Exchange (1998). (29) RePEc:eee:intfin:v:7:y:1997:i:1:p:73-87 The impact of exchange rate volatility on German-US trade flows (1997). (30) RePEc:eee:intfin:v:12:y:2002:i:2:p:139-155 Before and after international cross-listing: an intraday examination of volume and volatility (2002). (31) RePEc:eee:intfin:v:13:y:2003:i:2:p:113-136 Models of exchange rate expectations: how much heterogeneity? (2003). (32) RePEc:eee:intfin:v:11:y:2001:i:2:p:147-165 A test of the accuracy of the Lee/Ready trade classification algorithm (2001). (33) RePEc:eee:intfin:v:15:y:2005:i:2:p:141-157 Bank provisioning behaviour and procyclicality (2005). (34) RePEc:eee:intfin:v:9:y:1999:i:3:p:321-333 A preliminary look at gains from asset securitization (1999). (35) RePEc:eee:intfin:v:7:y:1997:i:4:p:303-327 International portfolio diversification: a synthesis and an update (1997). (36) RePEc:eee:intfin:v:14:y:2004:i:3:p:221-233 The future of cash: falling legal use and implications for government policy (2004). (37) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:323-347 The effect of interventions on realignment probabilities (2000). (38) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:225-241 The liquidity of automated exchanges: new evidence from German Bund futures (1998). (39) RePEc:eee:intfin:v:9:y:1999:i:3:p:303-320 Malmquist indices of productivity change in Australian financial services (1999). (40) RePEc:eee:intfin:v:11:y:2001:i:1:p:1-28 Global equity styles and industry effects: the pre-eminence of value relative to size (2001). (41) RePEc:eee:intfin:v:12:y:2002:i:3:p:253-278 Components of execution costs: evidence of asymmetric information at the Mexican Stock Exchange (2002). (42) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:325-356 Information asymmetry, market segmentation and the pricing of cross-listed shares: theory and evidence from Chinese A and B shares (1998). (43) RePEc:eee:intfin:v:14:y:2004:i:3:p:255-266 Who owns the major US subsidiaries of foreign banks?: A note (2004). (44) RePEc:eee:intfin:v:8:y:1998:i:1:p:83-100 Asymmetric impact of trade balance news on asset prices (1998). (45) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:277-298 Inter- and intra-day liquidity patterns on the Stock Exchange of Hong Kong (1998). (46) RePEc:eee:intfin:v:14:y:2004:i:3:p:203-219 Banking competition and macroeconomic conditions: a disaggregate analysis (2004). (47) RePEc:eee:intfin:v:13:y:2003:i:3:p:271-289 Gold factor exposures in international asset pricing (2003). (48) RePEc:eee:intfin:v:7:y:1997:i:1:p:43-60 Are banks market timers or market makers? Explaining foreign exchange trading profits (1997). (49) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:243-260 Price discovery in high and low volatility periods: open outcry versus electronic trading (1998). (50) RePEc:eee:intfin:v:9:y:1999:i:1:p:1-18 Modeling asset market volatility in a small market:: Accounting for non-synchronous trading effects (1999). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:hhs:bofrdp:2004_027 Less cash on the counter: Forecasting Finnish payment preferences (2004). Bank of Finland / Research Discussion Papers (2) RePEc:mmf:mmfc04:7 The Effects of Japanese Foreign Exchange Intervention, GARCH Estimation and Change Point Detection (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 (3) RePEc:mmf:mmfc04:90 Do Domestic Macroeconomic Factors Play a Role in Determining Long-Term Nominal Interest Rates? Application in the Case of a Small Open-Economy (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 (4) RePEc:wpa:wuwpfi:0411010 Integration or Segmentation of Malaysian Equity Market: An Analysis of Pre- and Post- Capital Controls (2004). EconWPA / Finance (5) RePEc:wpa:wuwpif:0405016 Financial Crises and the Presence of Foreign Banks (2004). EconWPA / International Finance (6) RePEc:wpa:wuwpif:0410008 The Effects of Japanese Foreign Exchange Intervention: GARCH Estimation and Change Point Detection (2004). EconWPA / International Finance Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:dgr:unutaf:eifc02-14 Integration of European Banking and Financial Markets (2002). United Nations University, Institute for New Technologies / EIFC - Technology and Finance Working Papers (2) RePEc:wop:pennin:02-27 Parametric and Nonparametric Volatility Measurement (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Latest citations received in: 2001 (1) RePEc:fip:fedgif:702 Home bias and high turnover reconsidered (2001). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (2) RePEc:wpa:wuwpif:0107003 Equity Returns and Inflation: The Puzzlingly Long Lags (2001). EconWPA / International Finance Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |