|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

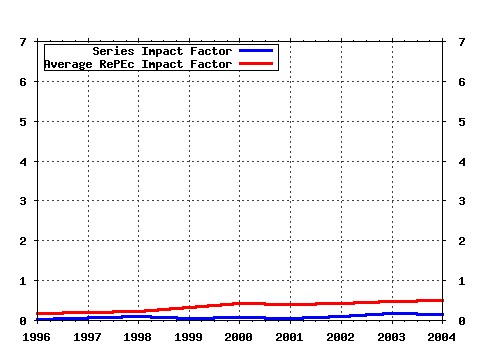

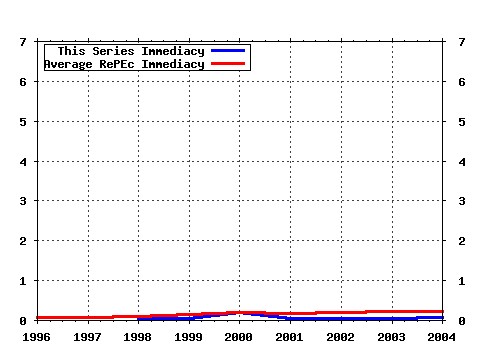

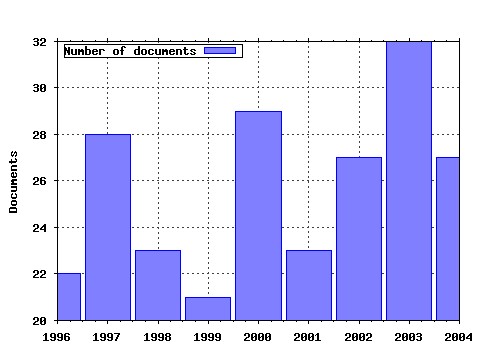

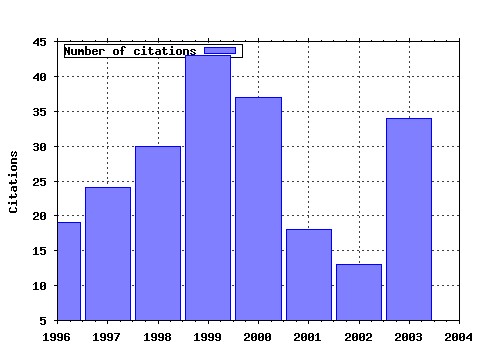

Pacific-Basin Finance Journal Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:pacfin:v:2:y:1994:i:2-3:p:165-199 Initial public offerings: International insights (1994). (2) RePEc:eee:pacfin:v:7:y:1999:i:2:p:173-202 An empirical investigation of underpricing in Chinese IPOs (1999). (3) RePEc:eee:pacfin:v:8:y:2000:i:1:p:85-113 International linkages and macroeconomic news effects on interest rate volatility -- Australia and the US (2000). (4) RePEc:eee:pacfin:v:2:y:1994:i:2-3:p:243-260 Risk and return on Chinas new stock markets: Some preliminary evidence (1994). (5) RePEc:eee:pacfin:v:3:y:1995:i:2-3:p:257-284 The profitability of technical trading rules in the Asian stock markets (1995). (6) RePEc:eee:pacfin:v:9:y:2001:i:4:p:323-362 Controlling shareholders and corporate value: Evidence from Thailand (2001). (7) RePEc:eee:pacfin:v:11:y:2003:i:1:p:23-43 International equity market comovements: Economic fundamentals or contagion? (2003). (8) RePEc:eee:pacfin:v:10:y:2002:i:4:p:411-442 Did the Asian financial crisis scare foreign investors out of Japan? (2002). (9) RePEc:eee:pacfin:v:3:y:1995:i:4:p:485-496 Reducing tick size on the Stock Exchange of Singapore (1995). (10) RePEc:eee:pacfin:v:2:y:1994:i:2-3:p:349-373 Pacific-Basin stock markets and real activity (1994). (11) RePEc:eee:pacfin:v:6:y:1998:i:5:p:453-474 Underpricing and aftermarket performance of IPOs in Shanghai, China (1998). (12) RePEc:eee:pacfin:v:7:y:1999:i:3-4:p:229-249 Bank monitoring and the maturity structure of Japanese corporate debt issues (1999). (13) RePEc:eee:pacfin:v:8:y:2000:i:5:p:587-610 Shareholding structure and corporate performance of partially privatized firms: Evidence from listed Chinese companies (2000). (14) RePEc:eee:pacfin:v:6:y:1998:i:1-2:p:1-26 The deterioration of bank balance sheets in Japan: Risk-taking and recapitalization (1998). (15) RePEc:eee:pacfin:v:11:y:2003:i:2:p:153-173 An empirical analysis of the Australian dollar swap spreads (2003). (16) RePEc:eee:pacfin:v:5:y:1997:i:4:p:389-417 The investment and operating performance of Japanese initial public offerings (1997). (17) RePEc:eee:pacfin:v:9:y:2001:i:3:p:195-217 The impact of salient political and economic news on the trading activity (2001). (18) RePEc:eee:pacfin:v:8:y:2000:i:5:p:v-vii Editorial (2000). (19) RePEc:eee:pacfin:v:4:y:1996:i:1:p:15-30 The winners curse and international methods of allocating initial public offerings (1996). (20) RePEc:eee:pacfin:v:7:y:1999:i:3-4:p:251-282 Are Asian stock market fluctuations due mainly to intra-regional contagion effects? Evidence based on Asian emerging stock markets (1999). (21) RePEc:eee:pacfin:v:6:y:1998:i:5:p:427-451 Privatisation initial public offerings in Malaysia: Initial premium and long-term performance (1998). (22) RePEc:eee:pacfin:v:4:y:1996:i:2-3:p:259-275 Political risk and stock price volatility: The case of Hong Kong (1996). (23) RePEc:eee:pacfin:v:2:y:1994:i:1:p:73-90 Assessing the cost of Taiwans deposit insurance (1994). (24) RePEc:eee:pacfin:v:7:y:1999:i:5:p:471-493 Cross-autocorrelation in Asian stock markets (1999). (25) RePEc:eee:pacfin:v:11:y:2003:i:1:p:45-59 How should liquidity be measured? (2003). (26) RePEc:eee:pacfin:v:2:y:1994:i:4:p:463-479 Beta stability and portfolio formation (1994). (27) RePEc:eee:pacfin:v:7:y:1999:i:1:p:1-22 Alternative mechanisms for corporate governance in Japan: An analysis of independent and bank-affiliated firms (1999). (28) RePEc:eee:pacfin:v:8:y:2000:i:2:p:177-216 Banks, the IMF, and the Asian crisis (2000). (29) RePEc:eee:pacfin:v:8:y:2000:i:5:p:iii-iv Editorial (2000). (30) RePEc:eee:pacfin:v:6:y:1998:i:3-4:p:321-346 Fundamental and nonfundamental components in stock prices of Pacific-Rim countries (1998). (31) RePEc:eee:pacfin:v:7:y:1999:i:5:p:557-586 Why does return volatility differ in Chinese stock markets? (1999). (32) RePEc:eee:pacfin:v:11:y:2003:i:2:p:175-195 The cross-sectional and cross-temporal universality of nonlinear serial dependencies: Evidence from world stock indices and the Taiwan Stock Exchange (2003). (33) RePEc:eee:pacfin:v:4:y:1996:i:2-3:p:241-258 The effects of removing price limits and introducing auctions upon short-term IPO returns: The case of Japanese IPOs (1996). (34) RePEc:eee:pacfin:v:8:y:2000:i:3-4:p:483-503 The value of liquidity: Evidence from the derivatives market (2000). (35) RePEc:eee:pacfin:v:5:y:1997:i:2:p:195-213 Capital market integration in the Pacific-Basin region: An analysis of real interest rate linkages (1997). (36) RePEc:eee:pacfin:v:5:y:1997:i:1:p:63-85 An analysis of the stock market performance of new issues in New Zealand (1997). (37) RePEc:eee:pacfin:v:6:y:1998:i:1-2:p:61-76 Economic growth and stationarity of real exchange rates: Evidence from some fast-growing Asian countries (1998). (38) RePEc:eee:pacfin:v:8:y:2000:i:2:p:135-152 Understanding the financial crisis in Asia (2000). (39) RePEc:eee:pacfin:v:11:y:2003:i:3:p:305-325 A review of Japans bank crisis from the governance perspective (2003). (40) RePEc:eee:pacfin:v:12:y:2004:i:1:p:1-18 Determinants of the decision to submit market or limit orders on the ASX (2004). (41) RePEc:eee:pacfin:v:3:y:1995:i:4:p:429-448 The aftermarket performance of initial public offerings in Korea (1995). (42) RePEc:eee:pacfin:v:5:y:1997:i:5:p:527-537 Testing the conditional CAPM and the effect of intervaling: A note (1997). (43) RePEc:eee:pacfin:v:11:y:2003:i:4:p:413-428 What kind of multinational deposit-insurance arrangements might best enhance world welfare? (2003). (44) RePEc:eee:pacfin:v:4:y:1996:i:2-3:p:297-314 Price clustering on the Australian Stock Exchange (1996). (45) RePEc:eee:pacfin:v:8:y:2000:i:5:p:529-558 Institutional affiliation and the role of venture capital: Evidence from initial public offerings in Japan (2000). (46) RePEc:eee:pacfin:v:10:y:2002:i:1:p:29-54 Private placements and rights issues in Singapore (2002). (47) RePEc:eee:pacfin:v:3:y:1995:i:1:p:113-136 Volatility and price change spillover effects across the developed and emerging markets (1995). (48) RePEc:eee:pacfin:v:5:y:1997:i:5:p:539-557 The interaction between order imbalance and stock price (1997). (49) RePEc:eee:pacfin:v:7:y:1999:i:3-4:p:371-403 An empirical study on the determinants of the capital structure of Thai firms (1999). (50) RePEc:eee:pacfin:v:2:y:1994:i:4:p:405-438 Good news, bad news and international spillovers of stock return volatility between Japan and the U.S. (1994). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:wpa:wuwpfi:0408009 A local non-parametric model for trade sign inference (2004). EconWPA / Finance (2) RePEc:wpa:wuwpfi:0412012 A piecewise linear model for trade sign inference (2004). EconWPA / Finance Latest citations received in: 2003 (1) RePEc:wai:econwp:03/01 Modelling the Yield Curve with Orthonomalised Laguerre Polynomials: An Intertemporally Consistent Approach with an Economic Interpretation (2003). University of Waikato, Department of Economics / Working Papers in Economics (2) RePEc:wpa:wuwpfi:0312012 Weak-form Efficient Market Hypothesis, Behavioural Finance and Episodic Transient Dependencies: The Case of the Kuala Lumpur Stock Exchange (2003). EconWPA / Finance Latest citations received in: 2002 Latest citations received in: 2001 (1) RePEc:clm:clmeco:2001-23 Testing for Contagion during the Asian Crisis (2001). Claremont Colleges / Claremont Colleges Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |