|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

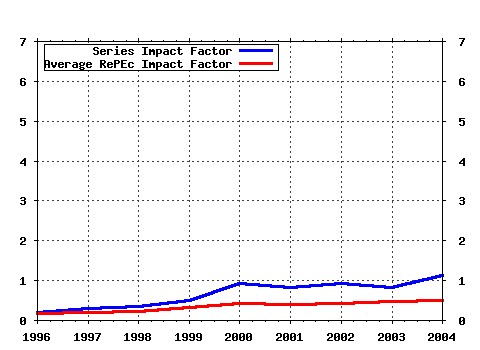

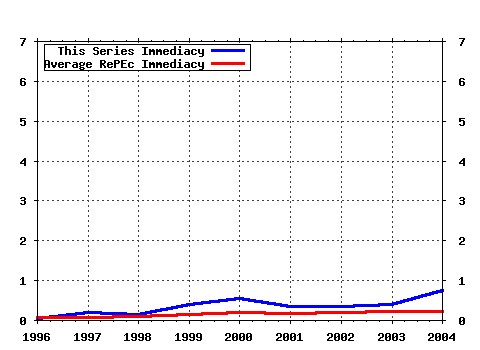

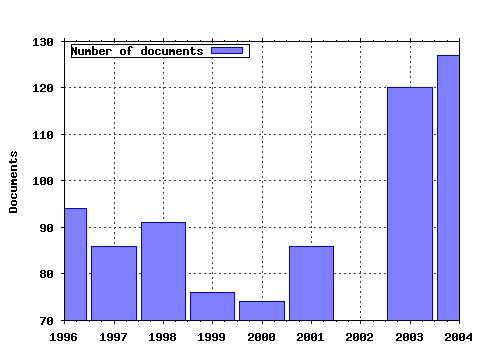

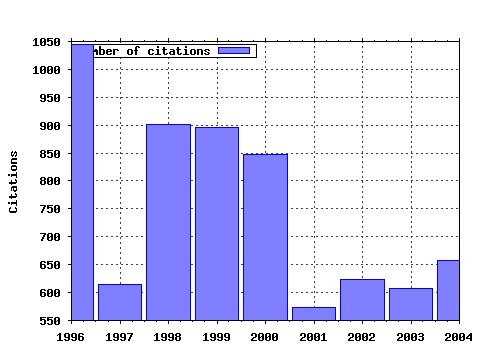

Journal of Public Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:pubeco:v:61:y:1996:i:3:p:359-381 Satisfaction and comparison income (1996). (2) RePEc:eee:pubeco:v:1:y:1972:i:3-4:p:323-338 Income tax evasion: a theoretical analysis (1972). (3) RePEc:eee:pubeco:v:28:y:1985:i:1:p:59-83 Redistributive taxation in a simple perfect foresight model (1985). (4) RePEc:eee:pubeco:v:88:y:2004:i:7-8:p:1359-1386 Well-being over time in Britain and the USA (2004). (5) RePEc:eee:pubeco:v:76:y:2000:i:3:p:399-457 The causes of corruption: a cross-national study (2000). (6) RePEc:eee:pubeco:v:29:y:1986:i:1:p:25-49 On the private provision of public goods (1986). (7) RePEc:eee:pubeco:v:8:y:1977:i:3:p:329-340 Voting over income tax schedules (1977). (8) RePEc:eee:pubeco:v:41:y:1990:i:1:p:45-72 The impact of the potential duration of unemployment benefits on the duration of unemployment (1990). (9) RePEc:eee:pubeco:v:6:y:1976:i:1-2:p:55-75 The design of tax structure: Direct versus indirect taxation (1976). (10) RePEc:eee:pubeco:v:52:y:1993:i:3:p:309-328 Strategies for the international protection of the environment (1993). (11) RePEc:eee:pubeco:v:85:y:2002:i:2:p:207-234 Who trusts others? (2002). (12) RePEc:eee:pubeco:v:68:y:1998:i:3:p:335-367 Taxes and the location of production: evidence from a panel of US multinationals (1998). (13) RePEc:eee:pubeco:v:25:y:1984:i:3:p:329-369 A complete solution to a class of principal-agent problems with an application to the control of a self-managed firm (1984). (14) RePEc:eee:pubeco:v:10:y:1978:i:3:p:295-336 A model of social insurance with variable retirement (1978). (15) RePEc:eee:pubeco:v:76:y:2000:i:3:p:459-493 Dodging the grabbing hand: the determinants of unofficial activity in 69 countries (2000). (16) RePEc:eee:pubeco:v:83:y:2002:i:3:p:325-345 Decentralization and corruption: evidence across countries (2002). (17) RePEc:eee:pubeco:v:37:y:1988:i:3:p:291-304 Why free ride? : Strategies and learning in public goods experiments (1988). (18) RePEc:eee:pubeco:v:17:y:1982:i:2:p:213-240 Self-selection and Pareto efficient taxation (1982). (19) RePEc:eee:pubeco:v:35:y:1988:i:2:p:229-240 Nash equilibria in models of fiscal competition (1988). (20) RePEc:eee:pubeco:v:74:y:1999:i:2:p:171-190 Fiscal policy and growth: evidence from OECD countries (1999). (21) RePEc:eee:pubeco:v:3:y:1974:i:4:p:303-328 The measurement of urban travel demand (1974). (22) RePEc:eee:pubeco:v:59:y:1996:i:3:p:313-334 Unemployment duration, unemployment benefits, and labor market programs in Sweden (1996). (23) RePEc:eee:pubeco:v:35:y:1988:i:3:p:333-354 Economic competition among jurisdictions: efficiency enhancing or distortion inducing? (1988). (24) RePEc:eee:pubeco:v:2:y:1973:i:3:p:193-216 Higher education as a filter (1973). (25) RePEc:eee:pubeco:v:23:y:1984:i:1-2:p:81-114 Individual retirement and savings behavior (1984). (26) RePEc:eee:pubeco:v:14:y:1980:i:1:p:49-68 Redistributive taxation as social insurance (1980). (27) RePEc:eee:pubeco:v:52:y:1993:i:3:p:285-307 Budget spillovers and fiscal policy interdependence : Evidence from the states (1993). (28) RePEc:eee:pubeco:v:15:y:1981:i:1:p:1-22 The incidence and allocation effects of a tax on corporate distributions (1981). (29) RePEc:eee:pubeco:v:48:y:1992:i:1:p:21-38 Why do people pay taxes? (1992). (30) RePEc:eee:pubeco:v:38:y:1989:i:2:p:183-198 Overlapping families of infinitely-lived agents (1989). (31) RePEc:eee:pubeco:v:71:y:1999:i:1:p:121-139 Country size and tax competition for foreign direct investment (1999). (32) RePEc:eee:pubeco:v:6:y:1976:i:4:p:327-358 Optimal tax theory : A synthesis (1976). (33) RePEc:eee:pubeco:v:62:y:1996:i:3:p:297-325 Ends against the middle: Determining public service provision when there are private alternatives (1996). (34) RePEc:eee:pubeco:v:8:y:1977:i:3:p:275-298 A framework for social security analysis (1977). (35) RePEc:eee:pubeco:v:11:y:1979:i:1:p:25-45 Incentives and incomplete information (1979). (36) RePEc:eee:pubeco:v:21:y:1983:i:2:p:129-158 The effective tax rate and the pretax rate of return (1983). (37) RePEc:eee:pubeco:v:77:y:2000:i:2:p:155-184 Does parents money matter? (2000). (38) RePEc:eee:pubeco:v:3:y:1974:i:2:p:201-202 Income tax evasion: A theoretical analysis (1974). (39) RePEc:eee:pubeco:v:59:y:1996:i:2:p:219-237 Majority voting with single-crossing preferences (1996). (40) RePEc:eee:pubeco:v:87:y:2003:i:12:p:2611-2637 Centralized versus decentralized provision of local public goods: a political economy approach (2003). (41) RePEc:eee:pubeco:v:26:y:1985:i:1:p:107-121 Tax policy and foreign direct investment (1985). (42) RePEc:eee:pubeco:v:35:y:1988:i:1:p:57-73 Privately provided public goods in a large economy: The limits of altruism (1988). (43) RePEc:eee:pubeco:v:72:y:1999:i:3:p:329-360 The cost-effectiveness of alternative instruments for environmental protection in a second-best setting (1999). (44) RePEc:eee:pubeco:v:84:y:2002:i:1:p:1-32 The elasticity of taxable income: evidence and implications (2002). (45) RePEc:eee:pubeco:v:5:y:1976:i:3-4:p:193-208 Effluent charges and licenses under uncertainty (1976). (46) RePEc:eee:pubeco:v:39:y:1989:i:3:p:245-273 Analyzing the length of welfare spells (1989). (47) RePEc:eee:pubeco:v:2:y:1973:i:4:p:319-337 Does fiscal policy matter? (1973). (48) RePEc:eee:pubeco:v:32:y:1987:i:3:p:287-305 Peer group effects and educational attainment (1987). (49) RePEc:eee:pubeco:v:69:y:1998:i:3:p:305-321 Openness, country size and government (1998). (50) RePEc:eee:pubeco:v:52:y:1993:i:1:p:1-29 Wage setting and the tax system theory and evidence for the United Kingdom (1993). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:ads:wpaper:0045 Decentralization and Political Institutions (2004). Institute for Advanced Study, School of Social Science / Economics Working Papers (2) RePEc:ads:wpaper:0046 Laws for Sale: Evidence from Russia (2004). Institute for Advanced Study, School of Social Science / Economics Working Papers (3) RePEc:aea:aecrev:v:94:y:2004:i:2:p:161-165 Toward a Consumption Tax, and Beyond (2004). American Economic Review (4) RePEc:aea:aecrev:v:94:y:2004:i:3:p:741-752 Examining the Role of Social Isolation on Stated Preferences (2004). American Economic Review (5) RePEc:aea:jecper:v:18:y:2004:i:1:p:163-190 Understanding Why Crime Fell in the 1990s: Four Factors That Explain the Decline and Six That Do Not (2004). Journal of Economic Perspectives (6) RePEc:ays:ispwps:paper0432 Taxing Consumption in Jamaica:The GCT and the SCT (2004). International Studies program, Andrew young School of policy Studies, Georgia State University / International Studies Program Working P (7) RePEc:bri:cmpowp:04/095 Mapping choice in the NHS: Analysis of routine data (2004). Department of Economics, University of Bristol, UK / The Centre for Market and Public Organisation (8) RePEc:bri:cmpowp:04/099 Local Neighbourhood and Mental Health: Evidence from the UK (2004). Department of Economics, University of Bristol, UK / The Centre for Market and Public Organisation (9) RePEc:bri:cmpowp:04/111 Sorting and Choice in English Secondary Schools (2004). Department of Economics, University of Bristol, UK / The Centre for Market and Public Organisation (10) RePEc:cen:wpaper:04-20 IT and Beyond: The Contribution of Heterogenous Capital to Productivity (2004). Center for Economic Studies, U.S. Census Bureau / Working Papers (11) RePEc:ces:ceswps:_1163 Using Happiness Surveys to Value Intangibles: The Case of Airport Noise (2004). CESifo GmbH / CESifo Working Paper Series (12) RePEc:ces:ceswps:_1190 Whatâs in a Name? (2004). CESifo GmbH / CESifo Working Paper Series (13) RePEc:ces:ceswps:_1228 Politiciansâ Motivation, Political Culture, and Electoral Competition (2004). CESifo GmbH / CESifo Working Paper Series (14) RePEc:ces:ceswps:_1275 The Effect of Mandated State Education Spending on Total Local Resources (2004). CESifo GmbH / CESifo Working Paper Series (15) RePEc:ces:ceswps:_1291 Non-Welfarist Optimal Taxation and Behavioral Public Economics (2004). CESifo GmbH / CESifo Working Paper Series (16) RePEc:ces:ceswps:_1309 Educational Reform and Disadvantaged Students: Are They Better Off or Worse Off? (2004). CESifo GmbH / CESifo Working Paper Series (17) RePEc:ces:ceswps:_1340 Combining Dutch Presumptive Capital Income Tax and US Qualified Intermediaries to Set Forth a New System of International Savings Taxation (2004). CESifo GmbH / CESifo Working Paper Series (18) RePEc:ces:ceswps:_1352 The Value of Non-Binding Announcements in Public Goods Experiments: Some Theory and Experimental Evidence (2004). CESifo GmbH / CESifo Working Paper Series (19) RePEc:cir:cirwor:2004s-47 Output and Wages with Inequality Averse Agents (2004). CIRANO / CIRANO Working Papers (20) RePEc:cla:levrem:122247000000000006 Behavioral Identification in Coalition Bargaining: An Experimental Analysis of Demand Bargaining and Alternating Offers (2004). UCLA Department of Economics / Levine's Bibliography (21) RePEc:cpb:memodm:100 Towards efficient unemployment insurance in the Netherlands (2004). CPB Netherlands Bureau for Economic Policy Analysis / CPB Memoranda (22) RePEc:cpp:issued:v:30:y:2004:i:3:p:241-256 Canada Needs Better Data for Evidence-Based Policy: Inconsistencies Between Administrative and Survey Data on Welfare Dependence and Education (2004). Canadian Public Policy (23) RePEc:cpr:ceprdp:4267 Federal Tax Arrears in Russia: Liquidity Problems, Federal Redistribution or Russian Resistance? (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (24) RePEc:cpr:ceprdp:4273 Who is in Favour of Enlargement? Determinants of Support for EU Membership in the Candidate Countries Referenda (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (25) RePEc:crr:crrwps:2004-06 Choice And Other Determinants Of Employee Contributions To Defined Contribution Plans (2004). Center for Retirement Research / Working Papers, Center for Retirement Research at Boston College (26) RePEc:cte:werepe:we044116 ENDOGENOUS FINANCING OF THE UNIVERSAL SERVICE (2004). Universidad Carlos III, Departamento de Economía / Economics Working Papers (27) RePEc:cwl:cwldpp:1465 Time-inconsistency and Welfare Program Participation: Evidence from the NLSY (2004). Cowles Foundation, Yale University / Cowles Foundation Discussion Papers (28) RePEc:del:abcdef:2004-17 Relativizing relative income. (2004). DELTA (Ecole normale supérieure) / DELTA Working Papers (29) RePEc:dgr:kubcen:200469 Competition, incomplete discrimination and versioning (2004). Tilburg University, Center for Economic Research / Discussion Paper (30) RePEc:dgr:uvatin:20040024 Using Happiness Surveys to value Intangibles; the Case of Airport Noise (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (31) RePEc:dgr:uvatin:20040037 Policy Makers, Advisors, and Reputation (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (32) RePEc:edn:esedps:92 Running to Keep in the Same Place: Consumer Choice as a Game of Status (2004). Edinburgh School of Economics, University of Edinburgh / ESE Discussion Papers (33) RePEc:egc:wpaper:895 Motives for Household Private Transfers in Burkina Faso (2004). Economic Growth Center, Yale University / Working Papers (34) RePEc:epr:enepwp:029 The Impact of Unemployment on Individual Well-Being in the EU (2004). European Network of Economic Policy Research Institutes / Economics Working Papers (35) RePEc:fip:fedbpp:04-10 Social Security and unsecured debt (2004). Federal Reserve Bank of Boston / Public Policy Discussion Paper (36) RePEc:fip:fedfap:2004-13 IT and beyond: the contribution of heterogeneous capital to productivity (2004). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (37) RePEc:fip:fedgfe:2004-33 To leave or not to leave: the distribution of bequest motives (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (38) RePEc:gen:geneem:2004.11 The Redistributive Impact of Alternative Income Maintenance Schemes: A Microsimulation Study using Swiss Data (2004). Département d'Econométrie, Université de Genève / Cahiers du Département d'Econométrie (39) RePEc:iae:iaewps:wp2004n03 The Effects of Wealth and Income on Subjective Well-Being and Ill-Being (2004). Melbourne Institute of Applied Economic and Social Research, The University of Melbourne / Melbourne Institute Working Paper Series (40) RePEc:ide:wpaper:2990 Pensions with Endogenous and Stochastic Fertility (2004). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (41) RePEc:ide:wpaper:3371 Pensions with Heterogenous Individuals and Endogenous Fertility (2004). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (42) RePEc:iza:izadps:dp1004 The Effects of Enforcement on Illegal Markets: Evidence from Migrant Smuggling along the Southwestern Border (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (43) RePEc:iza:izadps:dp1016 Subjective Well-Being and the Family: Results from an Ordered Probit Model with Multiple Random Effects (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (44) RePEc:iza:izadps:dp1096 Using Happiness Surveys to Value Intangibles: The Case of Airport Noise (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (45) RePEc:iza:izadps:dp1195 Candidate Quality (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (46) RePEc:iza:izadps:dp1283 On the Inefficiency of Inequality (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (47) RePEc:iza:izadps:dp1336 Diploma No Problem: Can Private Schools Be of Lower Quality than Public Schools? (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (48) RePEc:kud:epruwp:04-10 Optimal Taxation of Married Couples with Household Production (2004). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (49) RePEc:lvl:lacicr:0419 Output and Wages with Inequality Averse Agents (2004). (50) RePEc:mar:volksw:200419 On Government Centralization and Fiscal Referendums: A Theoretical Model and Evidence from Switzerland (2004). Philipps-Universität Marburg, Faculty of Business Administration and Economics, Department of Economics (Volkswirtschaftliche Abteilung) / Working Pap (51) RePEc:mar:volksw:200420 Fiscal Federalism and Economic Performance: Evidence from Swiss Cantons (2004). Philipps-Universität Marburg, Faculty of Business Administration and Economics, Department of Economics (Volkswirtschaftliche Abteilung) / Working Pap (52) RePEc:max:cprwps:59 Maternal Employment and Adolescent Self-Care (2004). Center for Policy Research, Maxwell School, Syracuse University / Center for Policy Research Working Papers (53) RePEc:nbr:nberwo:10275 Tax-Motivated Trading by Individual Investors (2004). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:10330 Empirical Estimates for Environmental Policy Making in a Second-Best Setting (2004). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:10345 Time-Inconsistency and Welfare (2004). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:10399 Top Wealth Shares in the United States: 1916-2000: Evidence from Estate Tax Returns (2004). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:10407 On the Undesirability of Commodity Taxation Even When Income Taxation is Not Optimal (2004). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:10486 Plan Design and 401(k) Savings Outcomes (2004). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:nbr:nberwo:10541 Incentive Effects of Social Assistance: A Regression Discontinuity Approach (2004). National Bureau of Economic Research, Inc / NBER Working Papers (60) RePEc:nbr:nberwo:10559 The Stock Market and Investment: Evidence from FDI Flows (2004). National Bureau of Economic Research, Inc / NBER Working Papers (61) RePEc:nbr:nberwo:10645 Do the Rich Flee from High State Taxes? Evidence from Federal Estate Tax Returns (2004). National Bureau of Economic Research, Inc / NBER Working Papers (62) RePEc:nbr:nberwo:10667 Neighbors as Negatives: Relative Earnings and Well-Being (2004). National Bureau of Economic Research, Inc / NBER Working Papers (63) RePEc:nbr:nberwo:10676 The X Tax in the World Economy (2004). National Bureau of Economic Research, Inc / NBER Working Papers (64) RePEc:nbr:nberwo:10701 The Effect of Mandated State Education Spending on Total Local Resources (2004). National Bureau of Economic Research, Inc / NBER Working Papers (65) RePEc:nbr:nberwo:10804 Why Do Households Without Children Support Local Public Schools? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (66) RePEc:nbr:nberwo:10871 Tiebout Sorting, Social Multipliers and the Demand for School Quality (2004). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:nbr:nberwo:10935 Evaluation of Four Tax Reforms in the United States: Labor Supply and Welfare Effects for Single Mothers (2004). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:nbr:nberwo:10936 Do Tax Havens Flourish? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:10977 Tax Policy for Health Insurance (2004). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nsr:niesrd:244 Does Means Testing Exacerbate Early Retirement? (2004). National Institute of Economic and Social Research / NIESR Discussion Papers (71) RePEc:oxf:wpaper:188 Demand shifts and imperfect competition (2004). University of Oxford, Department of Economics / Economics Series Working Papers (72) RePEc:oxf:wpaper:216 Isolation and Subjective Welfare (2004). University of Oxford, Department of Economics / Economics Series Working Papers (73) RePEc:pra:mprapa:1334 To be or not to be in the euro? Benefits and costs of monetary unification as perceived by voters in the Swedish euro referendum 2003 (2004). University Library of Munich, Germany / MPRA Paper (74) RePEc:rff:dpaper:dp-04-14 Are Absolute Emissions Better for Modeling? Its All Relative (2004). Resources For the Future / Discussion Papers (75) RePEc:rif:dpaper:958 Job Satisfaction in Finland - Some results from the European Community Household Panel 1996-2001 (2004). The Research Institute of the Finnish Economy / Discussion Papers (76) RePEc:roc:wallis:wp38 Proposal Rights and Political Power (2004). University of Rochester - Wallis Institute of Political Economy / Wallis Working Papers (77) RePEc:soz:wpaper:0204 Subjective Well-Being and the Family: Results from an Ordered Probit Model with Multiple Random Effects (2004). University of Zurich, Socioeconomic Institute / Working Papers (78) RePEc:taf:edecon:v:12:y:2004:i:2:p:151-167 Do the teachers grading practices affect student achievement? (2004). Education Economics (79) RePEc:taf:jhisec:v:26:y:2004:i:1:p:19-43 The ``Technology of Happiness and the Tradition of Economic Science (2004). Journal of the History of Economic Thought (80) RePEc:trn:utwpce:0401 Lotteries as a funding tool for financing public goods (2004). Computable and Experimental Economics Laboratory, Department of Economics, University of Trento, Italia / CEEL Working Papers (81) RePEc:ttp:itpwps:0408 Assessing Expenditure and Tax Reform Measures: A Review (2004). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers (82) RePEc:ttp:itpwps:0414 Taxing Consumption in Jamaica: The GCT and the SCT (2004). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers (83) RePEc:umc:wpaper:0407 Whats in a Name? (2004). Department of Economics, University of Missouri-Columbia / Working Papers (84) RePEc:wbk:wbrwps:3360 On the Inefficiency of Inequality (2004). The World Bank / Policy Research Working Paper Series (85) RePEc:wpa:wuwpit:0412004 The New Regionalism: Integration as a Commitment Device for Developing Countries (2004). EconWPA / International Trade (86) RePEc:wpa:wuwpla:0403037 Testing for Utility Interdependence in Marriage: Evidence from Panel Data (2004). EconWPA / Labor and Demography (87) RePEc:wpa:wuwpla:0404008 Whats in a Name? (2004). EconWPA / Labor and Demography (88) RePEc:wpa:wuwpla:0409003 Unemployment in South Africa: the nature of the beast (2004). EconWPA / Labor and Demography (89) RePEc:wpa:wuwpmi:0407012 The level of satisfaction with life: evidence gathered among women from Greater Montevideo (2004). EconWPA / Microeconomics (90) RePEc:wpa:wuwppe:0402005 Empirical Estimates for Environmental Policy Making in a Second- Best Setting (2004). EconWPA / Public Economics (91) RePEc:wpa:wuwppe:0406009 Candidate Quality (2004). EconWPA / Public Economics (92) RePEc:wpa:wuwpur:0411002 Catalysts for regional development: putting territorial coordination in practice (2004). EconWPA / Urban/Regional (93) RePEc:wrk:warwec:705 TESTING FOR UTILITY INTERDEPENDENCE IN MARRIAGE : EVIDENCE FROM PANEL DATA (2004). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) (94) RePEc:wrk:warwec:712 TAX INCIDENCE, MAJORITY VOTING AND CAPITAL MARKET INTEGRATION (2004). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) (95) RePEc:wrk:warwec:717 Are Hard Budget Constraints for Sub-National Governments Always Efficient? (2004). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) Latest citations received in: 2003 (1) RePEc:aea:aecrev:v:93:y:2003:i:3:p:792-812 Do Government Grants to Private Charities Crowd Out Giving or Fund-Raising? (2003). American Economic Review (2) RePEc:ces:ceswps:_1066 Public Policy and Venture Capital Backed Innovation (2003). CESifo GmbH / CESifo Working Paper Series (3) RePEc:ces:ceswps:_1072 Electoral Uncertainty, Fiscal Policies & Growth: Theory and Evidence from Germany, the UK and the US (2003). CESifo GmbH / CESifo Working Paper Series (4) RePEc:ces:ceswps:_1094 Taxes and Venture Capital Support (2003). CESifo GmbH / CESifo Working Paper Series (5) RePEc:ces:ceswps:_872 Tax Policy and Entrepreneurship in the Presence of Asymmetric Information in Capital Markets (2003). CESifo GmbH / CESifo Working Paper Series (6) RePEc:ces:ceswps:_877 Public Economics and Startup Entrepreneurs (2003). CESifo GmbH / CESifo Working Paper Series (7) RePEc:ces:ceswps:_882 Venture Cycles: Theory and Evidence (2003). CESifo GmbH / CESifo Working Paper Series (8) RePEc:ces:ceswps:_898 Capital Market Institutions and Venture Capital: Do They Affect Unemployment and Labour Demand? (2003). CESifo GmbH / CESifo Working Paper Series (9) RePEc:ces:ceswps:_906 Economic Growth and Judicial Independence: Cross Country Evidence Using a New Set of Indicators (2003). CESifo GmbH / CESifo Working Paper Series (10) RePEc:ces:ceswps:_958 Financing Entrepreneurial Firms in Europe: Facts, Issues, and Research Agenda (2003). CESifo GmbH / CESifo Working Paper Series (11) RePEc:cpr:ceprdp:3850 Optimal Public Policy for Venture Capital Backed Innovation (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:3950 Aging Population and Education Finance (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:cpr:ceprdp:4097 Taxation and Venture Capital-Backed Entrepreneurship (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:crr:crrwps:2003-15 Can Unexpected Retirement Explain The Retirement-Consumption Puzzle? Evidence For Subjective Retirement Expectations (2003). Center for Retirement Research / Working Papers, Center for Retirement Research at Boston College (15) RePEc:del:abcdef:2003-21 Stochastic fertility, moral hazard, and the design of pay-as-you-go pension plans. (2003). DELTA (Ecole normale supérieure) / DELTA Working Papers (16) RePEc:diw:diwwpp:dp357 Corruption, Growth, and the Environment : A Cross-Country Analysis (2003). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (17) RePEc:edj:ceauch:167 The Privatization of Social Services in Chile: an Evaluation (2003). Centro de Economía Aplicada, Universidad de Chile / Documentos de Trabajo (18) RePEc:ete:etewps:ete0317 Coalition Formation in a Global Warming Game: How the Design of Protocols Affects the Success of Environmental Treaty-Making (2003). Katholieke Universiteit Leuven, Centrum voor Economische Studiën, Energy, Transport and Environment / Energy, Transport and Environment Working Pape (19) RePEc:eti:dpaper:03012 Secure Implementation Experiments:Do Strategy-proof Mechanisms Really Work? (2003). Research Institute of Economy, Trade and Industry (RIETI) / Discussion papers (20) RePEc:fem:femwpa:2003.36 Voluntary Agreements under Endogenous Legislative Threats (2003). Fondazione Eni Enrico Mattei / Working Papers (21) RePEc:gla:glaewp:2003_16 Electoral Uncertainty, Fiscal Policies and Growth: Theory and Evidence from Germany, the UK and the US (2003). Department of Economics, University of Glasgow / Working Papers (22) RePEc:hhs:aareco:2003_013 Corruption and Social Capital (2003). Aarhus School of Business, Department of Economics / Working Papers (23) RePEc:hhs:bofrdp:2003_017 Investor protection and business creation (2003). Bank of Finland / Research Discussion Papers (24) RePEc:hhs:gunwpe:0095 Anyone for Higher Speed Limits? - Self-Interested and Adaptive Political Preferences (2003). Göteborg University, Department of Economics / Working Papers in Economics (25) RePEc:hhs:gunwpe:0119 Farm Animal Welfare - testing for market failure (2003). Göteborg University, Department of Economics / Working Papers in Economics (26) RePEc:hhs:osloec:2003_031 Green consumers and public policy: On socially contingent moral motivation (2003). Oslo University, Department of Economics / Memorandum (27) RePEc:hhs:umnees:0604 Empirical Studies in Local Public Finance: Spillovers, Amalgamations, and Tactical Redistribution (2003). Umeå University, Department of Economics / Umeå Economic Studies (28) RePEc:hol:holodi:0305 Private vs. Public Regulation: Political Economy of the International Environment (2003). Department of Economics, Royal Holloway University of London / Royal Holloway, University of London: Discussion Papers in Economics (29) RePEc:hrr:papers:0305 Economic and Hypothetical Dictator Game Experiments: Incentive Effects at the Individual Level (2003). Industrial Relations Center, University of Minnesota (Twin Cities Campus) / Working Papers (30) RePEc:iis:dispap:iiisdp05 Divergent Inflation Rates in EMU (2003). IIIS / The Institute for International Integration Studies Discussion Paper Series (31) RePEc:lvl:lacicr:0324 Agglomeration Effects and the Competition for Firms (2003). (32) RePEc:mrr:papers:wp061 The Impact of Financial Education on Savings and Asset (2003). University of Michigan, Michigan Retirement Research Center / Working Papers (33) RePEc:nbr:nberwo:10151 Commitment Vs. Flexibility (2003). National Bureau of Economic Research, Inc / NBER Working Papers (34) RePEc:nbr:nberwo:9686 Local Revenue Hills: Evidence from Four U.S. Cities (2003). National Bureau of Economic Research, Inc / NBER Working Papers (35) RePEc:nbr:nberwo:9988 A New Method of Estimating Risk Aversion (2003). National Bureau of Economic Research, Inc / NBER Working Papers (36) RePEc:ore:uoecwp:2006-18 Cooperation in Environmental Policy: A Spatial Approach (2003). University of Oregon Economics Department / University of Oregon Economics Department Working Papers (37) RePEc:pen:papers:03-012 Local Revenue Hills: Evidence from Four U. S. Cities (2003). Penn Institute for Economic Research, Department of Economics, University of Pennsylvania / PIER Working Paper Archive (38) RePEc:pen:papers:03-037 The Effects of Constitutions on Coalition Governments in Parliamentary Democracies (2003). Penn Institute for Economic Research, Department of Economics, University of Pennsylvania / PIER Working Paper Archive (39) RePEc:rif:dpaper:857 Government Size and Output Volatility: New International Evidence (2003). The Research Institute of the Finnish Economy / Discussion Papers (40) RePEc:tcd:tcduee:20034 Divergent Inflation Rates in EMU (2003). Trinity College Dublin, Department of Economics / Trinity Economics Papers (41) RePEc:uct:uconnp:2003-47 A Median Voter Theorem for Postelection Politics (2003). University of Connecticut, Department of Economics / Working papers (42) RePEc:upf:upfgen:713 The Impact of Interest-rate Subsidies on Long-term Household Debt: Evidence from a Large Program (2003). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (43) RePEc:usg:dp2003:2003-09 Optimal Public Policy For Venture Capital Backed Innovation (2003). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2003 (44) RePEc:usg:dp2003:2003-17 Public Taxation and Venture Capital Backed Entrepreneurship (2003). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2003 (45) RePEc:wpa:wuwpga:0312001 Statistical Discrimination with Neighborhood Effects: Can Integration Eliminate Negative Stereotypes? (2003). EconWPA / Game Theory and Information (46) RePEc:wpa:wuwpmi:0304002 Uncommitted Couples: Some Efficiency and Policy Implications of Marital Bargaining (2003). EconWPA / Microeconomics (47) RePEc:wpe:papers:wpeoeos Equality of opportunity versus equality of opportunity sets (2003). (48) RePEc:zbw:zewdip:1342 Family Tax Splitting : A Microsimulation of its Potential Labour Supply and Intra-household Welfare Effects in Germany (2003). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers (49) RePEc:zbw:zewdip:1675 Welfare analysis of fiscal reforms : does the representation of the family decision process matter? ; Evidence for Germany (2003). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2002 (1) RePEc:anu:eenwps:0210 EmissionTaxes and Tradable Permits: A Comparison of views on Long Run Efficiency (2002). Australian National University, Economics and Environment Network / Economics and Environment Network Working Papers (2) RePEc:ces:ceswps:_714 Psychological Foundations of Incentives (2002). CESifo GmbH / CESifo Working Paper Series (3) RePEc:cir:cirwor:2002s-60 Voluntary Contributions to Reduce Expected Public Losses (2002). CIRANO / CIRANO Working Papers (4) RePEc:cpr:ceprdp:3668 Transparency Gloves for Grabbing Hands? Politics and (Mis)Governance (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:diw:diwwpp:dp319 A Nation-Wide Laboratory : Examining Trust and Trustworthiness by Integrating Behavioral Experiments into Representative Surveys (2002). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (6) RePEc:esi:discus:2005-02 Trust between individuals and groups: Groups are less rusting than individuals but just as trustworthy (2002). Max Planck Institute of Economics, Strategic Interaction Group / Discussion Papers on Strategic Interaction (7) RePEc:fip:fedbcp:y:2002:i:jun:p:143-180:n:47 Do state governments matter?: a review of the evidence on the impact on educational outcomes of the changing role of the states in the financing of public education (2002). Conference Series ; [Proceedings] (8) RePEc:fip:feddwp:0202 State and local policy, factor markets and regional growth (2002). Federal Reserve Bank of Dallas / Working Papers (9) RePEc:fip:fedmbp:2-02 The affordable housing shortage: considering the problem, causes and solutions (2002). Federal Reserve Bank of Minneapolis / Banking and Policy Studies (10) RePEc:hhs:fiefwp:0177 Taxable Income Responses to Tax Changes - A Panel Analysis of the 1990/91 Swedish Reform (2002). Trade Union Institute for Economic Research / Working Paper Series (11) RePEc:hhs:osloec:2002_001 Prices vs quantitities: the case of risk averse agents (2002). Oslo University, Department of Economics / Memorandum (12) RePEc:hpe:journl:y:2002:v:160:i:1:p:147-173 Redistribución e incentivos a la oferta de trabajo: Desarrollos recientes de la teorÃa de la imposición óptima sobre la renta (2002). Hacienda Pública Española (13) RePEc:lvl:lacicr:0203 On the Impact of Better Targeted Transfers on Poverty in Tunisia (2002). (14) RePEc:mcm:mceelp:2002-01 Individual Decision Making in Exogenous Targeting Instrument Experiments (2002). McMaster University / McMaster Experimental Economics Laboratory Publications (15) RePEc:nbr:nberwo:9012 The Bush Tax Cut and National Saving (2002). National Bureau of Economic Research, Inc / NBER Working Papers (16) RePEc:nbr:nberwo:9183 The Social Security Early Entitlement Age in a Structural Model of Retirement and Wealth (2002). National Bureau of Economic Research, Inc / NBER Working Papers (17) RePEc:nbr:nberwo:9342 Why Measure Inequality? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (18) RePEc:nbr:nberwo:9404 Retirement and the Stock Market Bubble (2002). National Bureau of Economic Research, Inc / NBER Working Papers (19) RePEc:nzt:nztwps:02/22 Income Tax Revenue Elasticities with Endogenous Labour Supply (2002). New Zealand Treasury / Treasury Working Paper Series (20) RePEc:phd:dpaper:dp_2002-07 Governance in Southeast Asia: Issues and Options (2002). Philippine Institute for Development Studies / Discussion Papers (21) RePEc:rff:dpaper:dp-02-45 Efficient Emission Fees in the U.S. Electricity Sector (2002). Resources For the Future / Discussion Papers (22) RePEc:sef:csefwp:88 Household Stockholding in Europe: Where Do We Stand and Where Do We Go? (2002). Centre for Studies in Economics and Finance (CSEF), University of Salerno, Italy / CSEF Working Papers (23) RePEc:ucy:cypeua:0209 Household Stockholding in Europe: Where Do We Stand and Where Do We Go? (2002). University of Cyprus Department of Economics / University of Cyprus Working Papers in Economics (24) RePEc:wbk:wbrwps:2764 What determines the quality of institutions? (2002). The World Bank / Policy Research Working Paper Series (25) RePEc:wrk:warwec:658 PARENTS CURRENT INCOME, LONG-TERM CHARACTERISTICS AND CHILDRENS EDUCATION : EVIDENCE FROM THE 1970 BRITISH COHORT STUDY (2002). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) Latest citations received in: 2001 (1) RePEc:anu:eenwps:0104 Sustainability Policy and Environmental Policy (2001). Australian National University, Economics and Environment Network / Economics and Environment Network Working Papers (2) RePEc:aub:autbar:500.01 On the Relation between Tax Rates and Evasion in a Multi-period Economy (2001). Unitat de Fonaments de l'Anà lisi Econòmica (UAB) and Institut d'Anà lisi Econòmica (CSIC) / UFAE and IAE Working Papers (3) RePEc:cen:wpaper:01-18 When Do Firms Shift Production Across States to Avoid Environmental Regulation? (2001). Center for Economic Studies, U.S. Census Bureau / Working Papers (4) RePEc:cep:stitep:412 Ownership and Managerial Competition: Employee, Customer, or Outside Ownership (2001). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Theoretical Economics Paper Series (5) RePEc:ces:ceswps:_592 Education and Efficient Redistribution (2001). CESifo GmbH / CESifo Working Paper Series (6) RePEc:cpr:ceprdp:2977 Taxes and Privatization (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (7) RePEc:dgr:kubcen:2001100 Why announce leadership contributions? : An experimental study of the signaling and reciprocity hypotheses (2001). Tilburg University, Center for Economic Research / Discussion Paper (8) RePEc:esi:discus:2001-04 An Application of the English Clock Market Mechanism to Public Goods Games (2001). Max Planck Institute of Economics, Strategic Interaction Group / Discussion Papers on Strategic Interaction (9) RePEc:fip:feddcl:0601 Limited enforcement and the organization of production (2001). Federal Reserve Bank of Dallas / Center for Latin America Working Papers (10) RePEc:got:vwldps:108 International Commodity Taxation under Monopolistic Competition (2001). University of Goettingen, Department of Economics / Departmental Discussion Papers (11) RePEc:hhs:gunwpe:0063 How Much Do We Care About Absolute Versus Relative Income and Consumption? (2001). Göteborg University, Department of Economics / Working Papers in Economics (12) RePEc:hit:hitcei:2001-20 Ownership Structure, Banks and the Role of Stakeholders: The Spanish Case (2001). Institute of Economic Research, Hitotsubashi University / Working Paper Series (13) RePEc:ifs:fistud:v:22:y:2001:i:2:p:151-183 Expenditure on healthcare in the UK: a review of the issues (2001). Fiscal Studies (14) RePEc:ifs:fistud:v:22:y:2001:i:4:p:403-456 Public and private spending for environmental protection: a cross-country policy analysis (2001). Fiscal Studies (15) RePEc:kap:expeco:v:4:y:2001:i:2:p:131-144 Strength of the Social Dilemma in a Public Goods Experiment: An Exploration of the Error Hypothesis (2001). Experimental Economics (16) RePEc:mcm:deptwp:2001-04 Equalization and the Decentralization of Revenue-Raising in a Federation (2001). McMaster University / Department of Economics Working Papers (17) RePEc:mrr:papers:wp017 Wealth, Inequality, and Altruistic Bequests (2001). University of Michigan, Michigan Retirement Research Center / Working Papers (18) RePEc:mrr:papers:wp018 Social Security, Pensions and Retirement Behavior Within the Family (2001). University of Michigan, Michigan Retirement Research Center / Working Papers (19) RePEc:mrr:papers:wp019 Wealth Accumulation in the U.S.: Do Inheritances and Bequests Play a Significant Role? (2001). University of Michigan, Michigan Retirement Research Center / Working Papers (20) RePEc:mtl:montde:2001-06 The Axiomatic Approach to Population Ethics (2001). Universite de Montreal, Departement de sciences economiques / Cahiers de recherche (21) RePEc:mtl:montde:2001-16 A Representation Theorem for Domains with Discrete and Continuous Variables. (2001). Universite de Montreal, Departement de sciences economiques / Cahiers de recherche (22) RePEc:nbr:nberwo:8205 Rethinking the Estate and Gift Tax: Overview (2001). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:nbr:nberwo:8261 Distortion Costs of Taxing Wealth Accumulation: Income Versus Estate Taxes (2001). National Bureau of Economic Research, Inc / NBER Working Papers (24) RePEc:rff:dpaper:dp-01-31- Is There a Rationale for Rebating Environmental Levies? (2001). Resources For the Future / Discussion Papers (25) RePEc:uca:ucapdv:22 Should the death tax die? And should it leave an inheritance? (2001). Department of Public Policy and Public Choice - POLIS / P.O.L.I.S. department's Working Papers (26) RePEc:vir:virpap:353 Effciency and surplus bounds in Cournot competition (2001). University of Virginia, Department of Economics / Virginia Economics Online Papers (27) RePEc:vir:virpap:360 Efficiency and surplus bounds in Cournot competition (2001). University of Virginia, Department of Economics / Virginia Economics Online Papers (28) RePEc:wop:jopovw:243 Food Insecurity and Public Assistance (2001). Northwestern University/University of Chicago Joint Center for Poverty Research / JCPR Working Papers (29) RePEc:wpa:wuwphe:0108001 Financial Education and Savings Outcomes in Individual Development Accounts (2001). EconWPA / HEW (30) RePEc:wrk:warwec:622 Tax Competition Reconsidered (2001). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |