|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

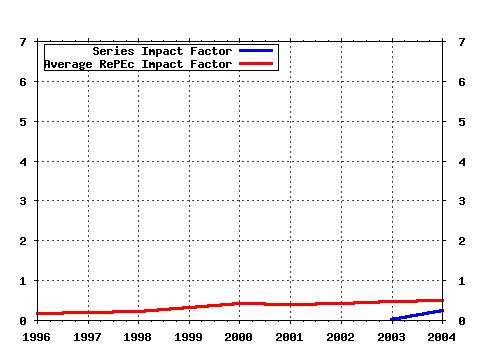

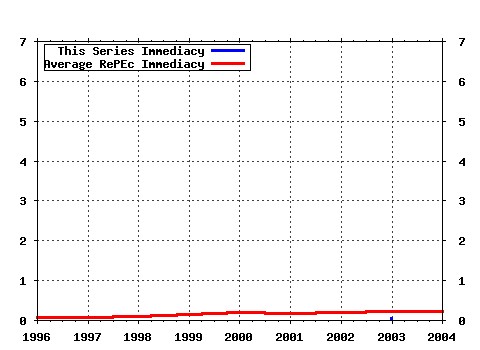

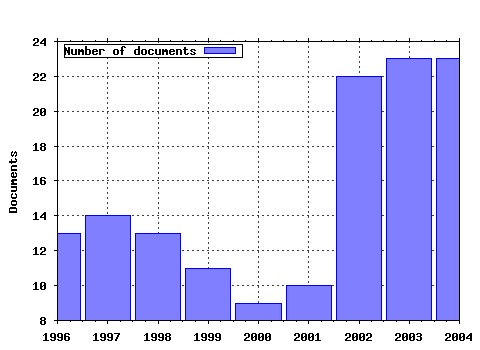

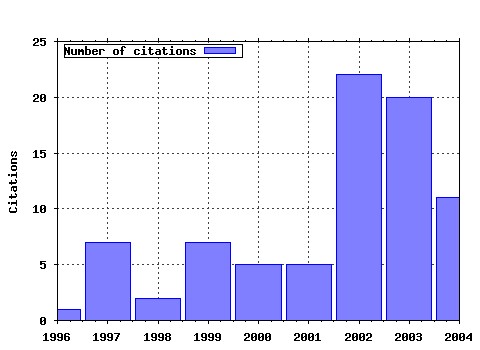

Review of Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:revfin:v:15:y:2006:i:4:p:289-304 The impact of macroeconomic uncertainty on non-financial firms demand for liquidity (2006). (2) RePEc:eee:revfin:v:11:y:2002:i:2:p:119-130 Long-term nominal interest rates and domestic fundamentals (2002). (3) RePEc:eee:revfin:v:11:y:2002:i:2:p:131-150 Financial development and economic growth: Another look at the evidence from developing countries (2002). (4) RePEc:eee:revfin:v:11:y:2002:i:2:p:91-108 Interrelationships among regional stock indices (2002). (5) RePEc:eee:revfin:v:12:y:2003:i:4:p:363-380 The day of the week effect on stock market volatility and volume: International evidence (2003). (6) RePEc:eee:revfin:v:8:y:1999:i:1:p:25-39 An analysis of nontraditional activities at U.S. commercial banks (1999). (7) RePEc:eee:revfin:v:9:y:2000:i:2:p:121-128 Microeconomic foundations of an optimal currency area (2000). (8) RePEc:eee:revfin:v:12:y:2003:i:2:p:191-205 The macroeconomic determinants of technology stock price volatility (2003). (9) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:323-351 The option value of patent litigation: Theory and evidence (2005). (10) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:41-63 Portuguese banking: A structural model of competition in the deposits market (2004). (11) RePEc:eee:revfin:v:8:y:1999:i:1:p:41-60 An empirical analysis of the equity markets in China (1999). (12) RePEc:eee:revfin:v:12:y:2003:i:2:p:207-231 Macroeconomic influences on optimal asset allocation (2003). (13) RePEc:eee:revfin:v:6:y:1997:i:1:p:95-112 Foreign trade and exchange-rate risk in the G-7 countries: Cointegration and error-correction models (1997). (14) RePEc:eee:revfin:v:12:y:2003:i:1:p:99-126 The Basel Committee proposals for a new capital accord: implications for Italian banks (2003). (15) RePEc:eee:revfin:v:12:y:2003:i:3:p:247-270 Return predictability in African stock markets (2003). (16) RePEc:eee:revfin:v:13:y:2004:i:3:p:245-258 Fractional cointegration and tests of present value models (2004). (17) RePEc:eee:revfin:v:11:y:2002:i:1:p:19-36 A model of brokers trading, with applications to order flow internalization (2002). (18) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:297-310 Real options and the value of generation capacity in the German electricity market (2005). (19) RePEc:eee:revfin:v:10:y:2001:i:3:p:191-212 Twenty-five years of corporate governance research ... and counting (2001). (20) RePEc:eee:revfin:v:12:y:2003:i:4:p:327-344 Explaining credit rating differences between Japanese and U.S. agencies (2003). (21) RePEc:eee:revfin:v:13:y:2004:i:3:p:269-281 Relative risk aversion among the elderly (2004). (22) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:371-393 Flexibility and technology choice in gas fired power plant investments (2005). (23) RePEc:eee:revfin:v:12:y:2003:i:2:p:161-172 Corporate governance and market valuation of capital and R&D investments (2003). (24) RePEc:eee:revfin:v:10:y:2001:i:3:p:251-277 CEO compensation, option incentives, and information disclosure (2001). (25) RePEc:eee:revfin:v:14:y:2005:i:2:p:147-171 Interest rate smoothing and financial stability (2005). (26) RePEc:eee:revfin:v:6:y:1997:i:1:p:113-119 Riding the yield curve: Term premiums and excess returns (1997). (27) RePEc:eee:revfin:v:10:y:2001:i:1:p:71-80 Does the January effect exist in high-yield bond market? (2001). (28) RePEc:eee:revfin:v:11:y:2002:i:4:p:299-315 Long-term trends and cycles in ASEAN stock markets (2002). (29) RePEc:eee:revfin:v:13:y:2004:i:4:p:305-326 Mutual fund characteristics, managerial attributes, and fund performance (2004). (30) RePEc:eee:revfin:v:4:y:1995:i:2:p:157-170 Federal-funds-rate volatility and the reserve-maintenance period (1995). (31) RePEc:eee:revfin:v:15:y:2006:i:1:p:28-48 Fractional integration in daily stock market indexes (2006). (32) RePEc:eee:revfin:v:7:y:1998:i:1:p:1-19 Founding family controlled firms: Efficiency and value (1998). (33) RePEc:eee:revfin:v:4:y:1995:i:2:p:125-139 The impact of gold price on the value of gold mining stock (1995). (34) RePEc:eee:revfin:v:6:y:1997:i:2:p:121-135 Participation rates of dividend reinvestment plans: Differences between utility and nonutility firms (1997). (35) RePEc:eee:revfin:v:4:y:1994:i:1:p:25-37 Contagion effects of the bank of new Englands failure (1994). (36) RePEc:eee:revfin:v:9:y:2000:i:1:p:15-26 Convertible debt: an effective financial instrument to control managerial opportunism (2000). (37) RePEc:eee:revfin:v:12:y:2003:i:2:p:131-159 Is presidential cycle in security returns merely a reflection of business conditions? (2003). (38) RePEc:eee:revfin:v:6:y:1997:i:1:p:57-75 Listing of put options: Is there any volatility effect? (1997). (39) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:121-148 Postmortem on the Federal Reserves Functional Cost Analysis Program: how useful was the FCA? (2004). (40) RePEc:eee:revfin:v:16:y:2007:i:3:p:291-304 Foreign participation in local currency bond markets (2007). (41) RePEc:eee:revfin:v:12:y:2003:i:1:p:7-33 The failure of new entrants in commercial banking markets: a split-population duration analysis (2003). (42) RePEc:eee:revfin:v:14:y:2005:i:1:p:81-91 Non-linear dynamics in international stock market returns (2005). (43) RePEc:eee:revfin:v:5:y:1996:i:2:p:117-129 Catastrophic events, contagion, and stock market efficiency: the case of the space shuttle challenger (1996). (44) RePEc:eee:revfin:v:15:y:2006:i:3:p:193-221 Financial deregulation and efficiency: An empirical analysis of Indian banks during the post reform period (2006). (45) RePEc:eee:revfin:v:7:y:1998:i:2:p:143-155 The effect of ownership structure on firm performance: Additional evidence (1998). (46) RePEc:eee:revfin:v:4:y:1995:i:2:p:141-155 Inter-industry differences and the impact of operating and financial leverages on equity risk (1995). (47) RePEc:eee:revfin:v:6:y:1997:i:2:p:187-198 A nonparametric investigation of the 90-day t-bill rate (1997). (48) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:79-102 The impact of banks expanded securities powers on small-business lending (2004). (49) RePEc:eee:revfin:v:4:y:1994:i:1:p:79-91 Professional portfolio managers and the January effect: theory and evidence (1994). (50) RePEc:eee:revfin:v:9:y:2000:i:1:p:43-53 A stochastic model of superstardom: evidence from institutional investors All-American Research Team (2000). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 (1) RePEc:qut:dpaper:159 Weak-form market efficiency in European emerging and developed stock markets (2003). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |