|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

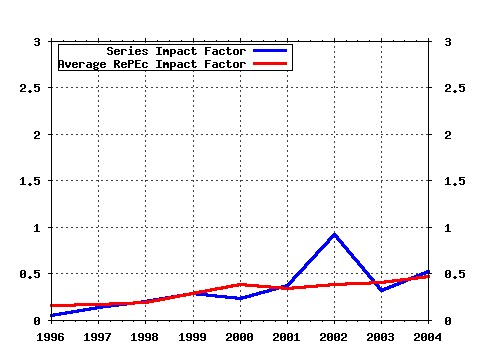

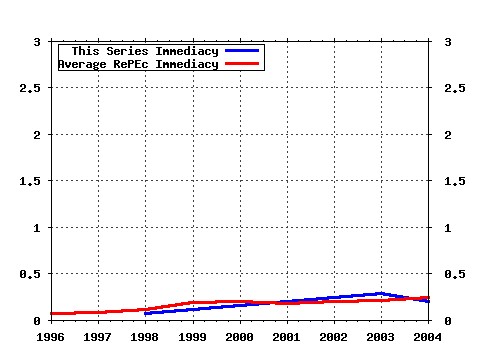

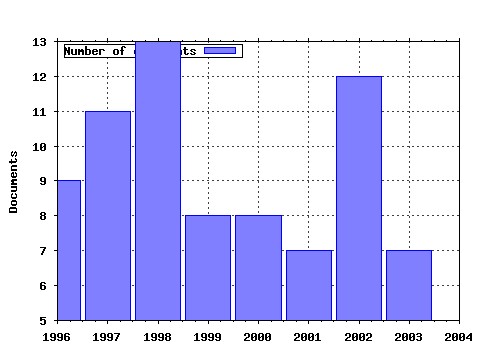

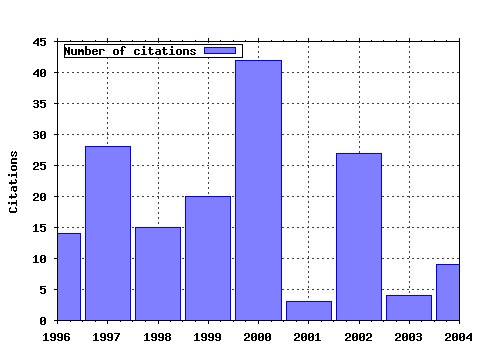

International Monetary Fund / IMF Policy Discussion Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:imf:imfpdp:00/3 Exchange Rate Regimes in Selected Advanced Transition Economies - Coping with Transition, Capital Inflows, and EU Accession (2000). (2) RePEc:imf:imfpdp:00/1 Pros and Cons of Currency Board Arrangements in the Lead-Up to EU Accession and Participation in the Euro Zone (2000). (3) RePEc:imf:imfpdp:02/10 Reviving the Case for GDP-Indexed Bonds (2002). (4) RePEc:imf:imfpdp:05/1 Putting the Cart Before the Horse? Capital Account Liberalization and Exchange Rate Flexibility in China (2005). (5) RePEc:imf:imfpdp:99/5 Monetary and Exchange Rate Policy of Transition Economies of Central and Eastern Europe after the Launch of EMU (1999). (6) RePEc:imf:imfpdp:00/6 Capital Flight from Russia (2000). (7) RePEc:imf:imfpdp:97/2 Conditionality as an Instrument of Borrower Credibility (1997). (8) RePEc:imf:imfpdp:92/3 The Operation of the Estonian Currency Board (1993). (9) RePEc:imf:imfpdp:05/7 Controlled Capital Account Liberalization: A Proposal (2005). (10) RePEc:imf:imfpdp:97/11 Bank Soundness and Currency Board Arrangements: Issues and Experience (1997). (11) RePEc:imf:imfpdp:99/3 The Role of the Currency Board in Bulgarias Stabilization (1999). (12) RePEc:imf:imfpdp:94/18 Currency Boards: Issues and Experiences (1994). (13) RePEc:imf:imfpdp:02/3 Foreign Direct Investment in China: Some Lessons for Other Countries (2002). (14) RePEc:imf:imfpdp:05/6 Primary Surpluses and sustainable Debt Levels in Emerging Market Countries (2005). (15) RePEc:imf:imfpdp:93/10 The Capital Inflows Problem: Concepts and Issues (1993). (16) RePEc:imf:imfpdp:96/7 Fiscal Dimensions of EMU (1996). (17) RePEc:imf:imfpdp:05/4 Understanding Fiscal Space (2005). (18) RePEc:imf:imfpdp:04/1 Intraregional Trade in Emerging Asia (2004). (19) RePEc:imf:imfpdp:93/8 The State of Tax Policy in the Central Asian and Transcaucasian Newly Independent States (NIS) (1993). (20) RePEc:imf:imfpdp:96/6 Regulatory and Tax Treatment of Loan Loss Provisions (1996). (21) RePEc:imf:imfpdp:97/3 Are Europes Social Security Finances Compatible with EMU? (1997). (22) RePEc:imf:imfpdp:05/5 Does Excess Liquidity Pose a Threat in Japan? (2005). (23) RePEc:imf:imfpdp:98/8 Sequencing Capital Account Liberalizations and Financial Sector Reform (1998). (24) RePEc:imf:imfpdp:97/7 Dedicated Road Funds - A Preliminary View on a World Bank Initiative (1997). (25) RePEc:imf:imfpdp:05/8 Africa in the Doha Round: Dealing with Preference Erosion and Beyond (2005). (26) RePEc:imf:imfpdp:03/5 FDI and the Investment Climate in the CIS Countries (2003). (27) RePEc:imf:imfpdp:98/6 Africa - Is This the Turning Point? (1998). (28) RePEc:imf:imfpdp:02/5 Challenges in Expanding Development Assistance (2002). (29) RePEc:imf:imfpdp:96/1 Discretion with Rules? Lessons from the Currency Board Arrangement in Lithuania (1996). (30) RePEc:imf:imfpdp:98/2 Transparency in Central Bank Operations in the Foreign Exchange Market (1998). (31) RePEc:imf:imfpdp:02/11 Poverty and Social Impact Analysis in PRGF-Supported Programs (2002). (32) RePEc:imf:imfpdp:05/2 Reforming the Stability and Growth Pact (2005). (33) RePEc:imf:imfpdp:00/7 Large-Scale Post-Crisis Corporate Sector Restructuring (2000). (34) RePEc:imf:imfpdp:04/4 Pension Reform, Investment Restrictions and Capital Markets (2004). (35) RePEc:imf:imfpdp:93/5 A Cautionary Note on the Use of Exchange Rate Indicators (1993). (36) RePEc:imf:imfpdp:93/14 Institutional and Operational Aspects of Central Bank Losses (1993). (37) RePEc:imf:imfpdp:98/1 Aid Effectiveness - A Survey of the Recent Empirical Literature (1998). (38) RePEc:imf:imfpdp:02/7 Privatization in Ukraine: Challenges of Assessment and Coverage in Fund Conditionality (2002). (39) RePEc:imf:imfpdp:94/3 On the Political Sustainability of Economic Reform (1994). (40) RePEc:imf:imfpdp:97/8 Legal and Institutional Obstacles to Growth and Business in Russia (1997). (41) RePEc:imf:imfpdp:93/7 Restructuring of Commercial Bank Debt by Developing Countries: Lessons from Recent Experience (1993). (42) RePEc:imf:imfpdp:97/5 Fiscal Accounting of Bank Restructuring (1997). (43) RePEc:imf:imfpdp:04/3 Issues in the Establishment of Asset Management Companies (2004). (44) RePEc:imf:imfpdp:93/2 Real Exchange Rate Targeting in Developing Countries (1993). (45) RePEc:imf:imfpdp:99/6 A Modernized Approach to Managing the Risks in Cross-Border Capital Movements (1999). (46) RePEc:imf:imfpdp:93/12 Options for Monetary and Exchange Arrangements in Transition Economies (1993). (47) RePEc:imf:imfpdp:95/10 Discrepancies in Bilateral Trade Statistics: The Case of China (1995). (48) RePEc:imf:imfpdp:98/11 Capital Account Liberalization in the Southern Mediterranean Region (1998). (49) RePEc:imf:imfpdp:01/7 Monetary Operations and Central Bank Balance Sheets in a World of Limited Government Securities (2001). (50) RePEc:imf:imfpdp:94/11 Use of Central Bank Credit Auctions in Economies in Transition (1994). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:imf:imfwpa:04/172 The Role of KAMCO in Resolving Nonperforming Loans in the Republic of Korea (2004). International Monetary Fund / IMF Working Papers Latest citations received in: 2003 (1) RePEc:cpr:ceprdp:3984 Why Does FDI Go Where it Goes? New Evidence from the Transitional Economies (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:wdi:papers:2003-573 WHY DOES FDI GO WHERE IT GOES? NEW EVIDENCE FROM THE TRANSITION ECONOMIES (2003). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |