|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

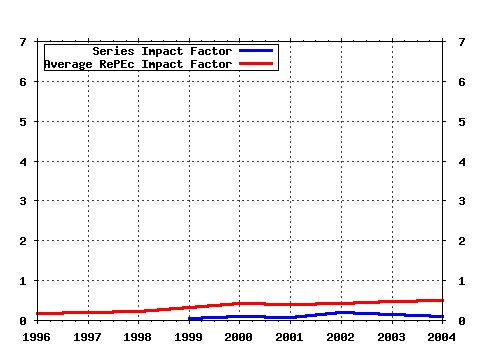

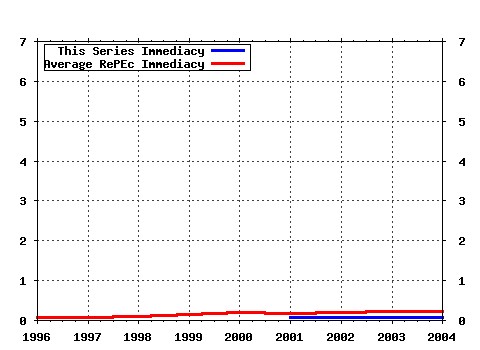

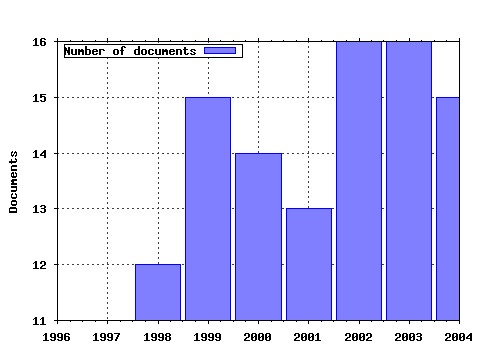

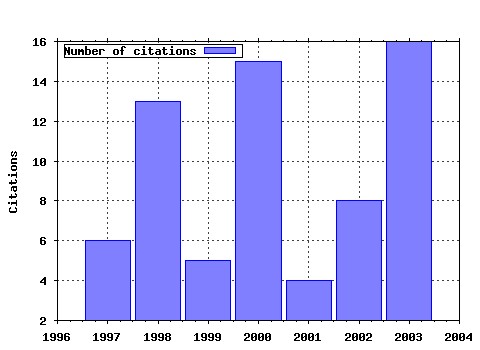

Applied Mathematical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apmtfi:v:7:y:2000:i:1:p:1-32 Volatility skews and extensions of the Libor market model (2000). (2) RePEc:taf:apmtfi:v:12:y:2005:i:4:p:313-335 (). (3) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:45-82 General Black-Scholes models accounting for increased market volatility from hedging strategies (1998). (4) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:17-52 The Dynamic Interaction of Speculation and Diversification (2005). (5) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:39-59 A Theoretically Consistent Version of the Nelson and Siegel Class of Yield Curve Models (2006). (6) RePEc:taf:apmtfi:v:10:y:2003:i:4:p:303-324 On arbitrage-free pricing of weather derivatives based on fractional Brownian motion (2003). (7) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:1-18 A Semi-Explicit Approach to Canary Swaptions in HJM One-Factor Model (2006). (8) RePEc:taf:apmtfi:v:9:y:2002:i:2:p:69-85 Bivariate option pricing with copulas (2002). (9) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:1-18 Optimal execution with nonlinear impact functions and trading-enhanced risk (2003). (10) RePEc:taf:apmtfi:v:10:y:2003:i:4:p:325-336 A note on arbitrage-free pricing of forward contracts in energy markets (2003). (11) RePEc:taf:apmtfi:v:4:y:1997:i:1:p:37-64 Calibrating volatility surfaces via relative-entropy minimization (1997). (12) RePEc:taf:apmtfi:v:6:y:1999:i:2:p:87-106 A finite element approach to the pricing of discrete lookbacks with stochastic volatility (1999). (13) RePEc:taf:apmtfi:v:8:y:2001:i:2:p:79-95 Liquidity and credit risk (2001). (14) RePEc:taf:apmtfi:v:5:y:1998:i:2:p:107-116 Optimal exercise boundary for an American put option (1998). (15) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:49-74 A new approximate swaption formula in the LIBOR market model: an asymptotic expansion approach (2003). (16) RePEc:taf:apmtfi:v:4:y:1997:i:4:p:181-199 Interest rate futures: estimation of volatility parameters in an arbitrage-free framework (1997). (17) RePEc:taf:apmtfi:v:11:y:2004:i:3:p:259-282 Calculating hedge fund risk: the draw down and the maximum draw down (2004). (18) RePEc:taf:apmtfi:v:6:y:1999:i:3:p:197-208 Optimal hedging strategies for misspecified asset price models (1999). (19) RePEc:taf:apmtfi:v:4:y:1997:i:1:p:21-36 Misspecified asset price models and robust hedging strategies (1997). (20) RePEc:taf:apmtfi:v:8:y:2001:i:4:p:209-233 valuation of options on joint minima and maxima (2001). (21) RePEc:taf:apmtfi:v:5:y:1998:i:3-4:p:143-163 A framework for valuing corporate securities (1998). (22) RePEc:taf:apmtfi:v:8:y:2001:i:1:p:49-77 A numerical PDE approach for pricing callable bonds (2001). (23) RePEc:taf:apmtfi:v:10:y:2003:i:2:p:91-119 Tracking error decision rules and accumulated wealth (2003). (24) RePEc:taf:apmtfi:v:9:y:2002:i:3:p:143-161 A model of speculative behaviour with a strange attractor (2002). (25) RePEc:taf:apmtfi:v:7:y:2000:i:1:p:33-60 Unstructured meshing for two asset barrier options (2000). (26) RePEc:taf:apmtfi:v:10:y:2003:i:2:p:121-147 Stock options as barrier contingent claims (2003). (27) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:1-15 Detecting mean reversion within reflecting barriers: application to the European Exchange Rate Mechanism (1998). (28) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:45-60 Basics of electricity derivative pricing in competitive markets (2002). (29) RePEc:taf:apmtfi:v:6:y:1999:i:3:p:209-232 Phenomenology of the interest rate curve (1999). (30) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:19-47 Contingent claim pricing using probability distortion operators: methods from insurance risk pricing and their relationship to financial theory (2003). (31) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:1-20 On modelling and pricing weather derivatives (2002). (32) RePEc:taf:apmtfi:v:11:y:2004:i:2:p:125-146 Modelling credit default swap spreads by means of normal mixtures and copulas (2004). (33) RePEc:taf:apmtfi:v:13:y:2006:i:4:p:309-331 An EZI Method to Reduce the Rank of a Correlation Matrix in Financial Modelling (2006). (34) RePEc:taf:apmtfi:v:7:y:2000:i:2:p:115-125 Estimating fees for managed futures: a continuous-time model with a knockout feature (2000). (35) RePEc:taf:apmtfi:v:10:y:2003:i:2:p:163-181 Minimizing coherent risk measures of shortfall in discrete-time models with cone constraints (2003). (36) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:17-43 An explicit finite difference approach to the pricing of barrier options (1998). (37) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:53-85 Stochastic Modelling of Temperature Variations with a View Towards Weather Derivatives (2005). (38) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:21-43 Energy futures prices: term structure models with Kalman filter estimation (2002). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:ecm:feam04:797 The Markovian Dynamics of "Smart Money" (2004). Econometric Society / Econometric Society 2004 Far Eastern Meetings Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 (1) RePEc:taf:apmtfi:v:8:y:2001:i:4:p:197-208 Valuation formulae for window barrier options (2001). Applied Mathematical Finance Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |