|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

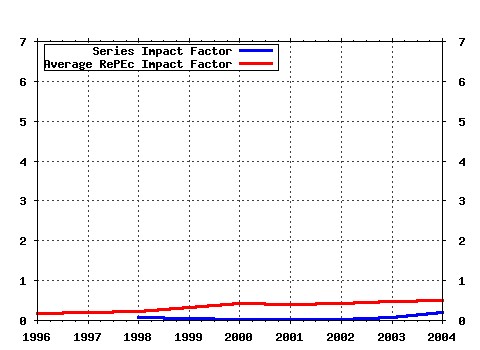

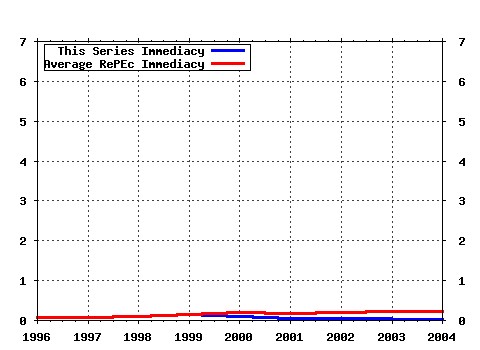

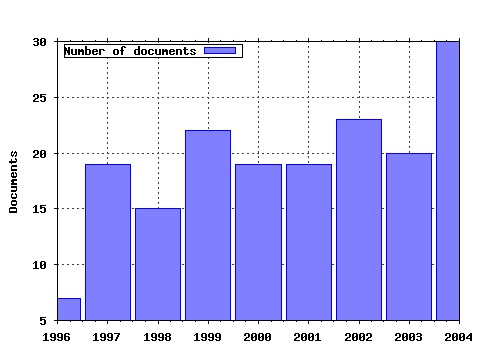

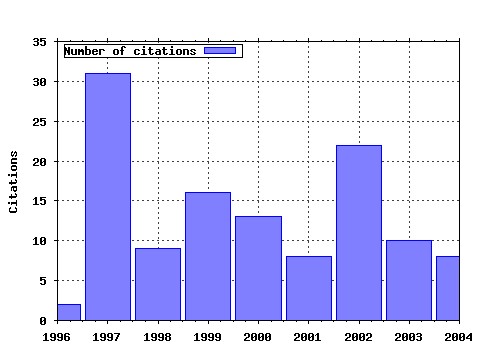

European Journal of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:eurjfi:v:3:y:1997:i:4:p:291-309 The numeraire portfolio: a new perspective on financial theory (1997). (2) RePEc:taf:eurjfi:v:3:y:1997:i:3:p:203-224 Comment (1997). (3) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:371-401 Modelling the demand for M3 in the Euro area (2002). (4) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:402-421 Forecasting inflation in the European Monetary Union: A disaggregated approach by countries and by sectors (2002). (5) RePEc:taf:eurjfi:v:3:y:1997:i:1:p:73-85 Implied volatility skews and stock return skewness and kurtosis implied by stock option prices (1997). (6) RePEc:taf:eurjfi:v:9:y:2003:i:4:p:343-357 Asset pricing implications of benchmarking: a two-factor CAPM (2003). (7) RePEc:taf:eurjfi:v:10:y:2004:i:5:p:329-344 Predictability of stock markets with disequilibrium trading (2004). (8) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:213-224 Beta lives - some statistical perspectives on the capital asset pricing model (1999). (9) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:163-175 The effects of trading activity on market volatility (2000). (10) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:202-212 Is beta still alive? Conclusive evidence from the Swiss stock market (1999). (11) RePEc:taf:eurjfi:v:5:y:1999:i:4:p:331-341 Modelling normal returns in event studies: a model-selection approach and pilot study (1999). (12) RePEc:taf:eurjfi:v:7:y:2001:i:3:p:198-230 Implied volatility surfaces: uncovering regularities for options on financial futures (2001). (13) RePEc:taf:eurjfi:v:10:y:2004:i:2:p:105-122 Employee stock option plans and stock market reaction: evidence from Finland (2004). (14) RePEc:taf:eurjfi:v:7:y:2001:i:2:p:165-183 Bank failure: a multidimensional scaling approach (2001). (15) RePEc:taf:eurjfi:v:12:y:2006:i:2:p:171-188 (). (16) RePEc:taf:eurjfi:v:11:y:2005:i:3:p:169-181 Generating science-based growth: an econometric analysis of the impact of organizational incentives on university--industry technology transfer (2005). (17) RePEc:taf:eurjfi:v:8:y:2002:i:1:p:21-45 The information in the term structure of German interest rates (2002). (18) RePEc:taf:eurjfi:v:12:y:2006:i:6-7:p:567-582 Comovements and correlations in international stock markets (2006). (19) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:196-224 Further insights on the puzzle of technical analysis profitability (2000). (20) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:257-278 Fund managers attitudes to risk and time horizons: the effect of performance benchmarking (1998). (21) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:126-145 Combining forecasts: some results on exchange and interest rates (2000). (22) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:322-343 World capital markets and Finnish stock returns (2002). (23) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:165-180 An introduction to security returns (1999). (24) RePEc:taf:eurjfi:v:7:y:2001:i:1:p:63-91 Derivatives usage in UK non-financial listed companies (2001). (25) RePEc:taf:eurjfi:v:9:y:2003:i:5:p:514-532 Evaluating capital mobility in the EU: a new approach using swaps data (2003). (26) RePEc:taf:eurjfi:v:8:y:2002:i:2:p:152-175 An analysis of the causes of recent banking crises (2002). (27) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:480-501 US dollar/Euro exchange rate: a monthly econometric model for forecasting (2002). (28) RePEc:taf:eurjfi:v:12:y:2006:i:6-7:p:473-494 Small sample properties of GARCH estimates and persistence (2006). (29) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:291-304 Board size and corporate performance: evidence from European countries (1998). (30) RePEc:taf:eurjfi:v:9:y:2003:i:6:p:557-580 Information criteria for GARCH model selection (2003). (31) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:233-256 A survey of corporate perceptions of short-termism among analysts and fund managers (1998). (32) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:113-125 Expectations of monetary policy in Australia implied by the probability distribution of interest rate derivatives (2000). (33) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:302-321 Forecasting stock market volatility and the informational efficiency of the DAX-index options market (2002). (34) RePEc:taf:eurjfi:v:5:y:1999:i:2:p:123-139 LIFFE cycles: intraday evidence from the FTSE-100 Stock Index futures market (1999). (35) RePEc:taf:eurjfi:v:6:y:2000:i:3:p:298-310 Forecasting the returns on UK investment trusts: a comparison (2000). (36) RePEc:taf:eurjfi:v:4:y:1998:i:2:p:129-155 Financial institutions, private acquisition of corporate information, and fund management (1998). (37) RePEc:taf:eurjfi:v:8:y:2002:i:2:p:187-205 New evidence on the implied-realized volatility relation (2002). (38) RePEc:taf:eurjfi:v:2:y:1996:i:1:p:103-123 A comparison of diffusion models of the term structure (1996). (39) RePEc:taf:eurjfi:v:5:y:1999:i:1:p:29-50 Insider trading and portfolio structure in experimental asset markets with a long-lived asset (1999). (40) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:93-112 Switching regime models in the Spanish inter-bank market (2000). (41) RePEc:taf:eurjfi:v:9:y:2003:i:3:p:199-218 Legal constraints, transaction costs and the evaluation of mutual funds (2003). (42) RePEc:taf:eurjfi:v:10:y:2004:i:6:p:542-566 On the bi-dimensionality of liquidity (2004). (43) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:236-246 Estimating the equity premium (1999). (44) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:305-309 The influence of earnings per share on capital issues: some evidence from UK companies (1998). (45) RePEc:taf:eurjfi:v:3:y:1997:i:3:p:261-275 Information asymmetry, long-run relationship and price discovery in property investment markets (1997). (46) RePEc:taf:eurjfi:v:9:y:2003:i:6:p:581-601 Motives for partial acquisitions between firms in the spanish stock market (2003). (47) RePEc:taf:eurjfi:v:12:y:2006:i:5:p:449-453 Volatility clustering and event-induced volatility: Evidence from UK mergers and acquisitions (2006). (48) RePEc:taf:eurjfi:v:3:y:1997:i:3:p:183-202 Feedforward neural networks in the classification of financial information (1997). (49) RePEc:taf:eurjfi:v:12:y:2006:i:1:p:1-22 (). (50) RePEc:taf:eurjfi:v:4:y:1998:i:2:p:93-111 A study on the efficiency of the market for Dutch long-term call options (1998). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:rif:dpaper:957 The Determinants of Stock Option Compensation: Evidence from Finland (2004). The Research Institute of the Finnish Economy / Discussion Papers Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:bdi:wptemi:td_440_02 Bootstrap bias-correction procedure in estimating long-run relationships from dynamic panels, with an application to money demand in the euro area (2002). Bank of Italy, Economic Research Department / Temi di discussione (Economic working papers) Latest citations received in: 2001 (1) RePEc:dgr:kubcen:200162 The impact of institutional differences on derivatives usage : a comparative study of US and Dutch firms (2001). Tilburg University, Center for Economic Research / Discussion Paper Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |