|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

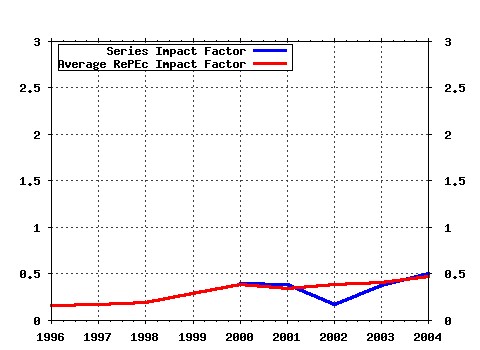

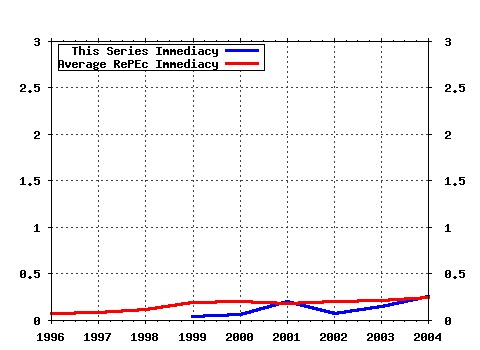

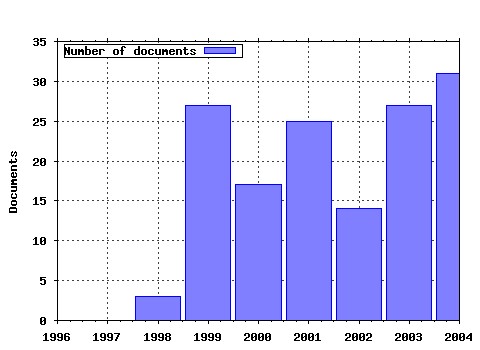

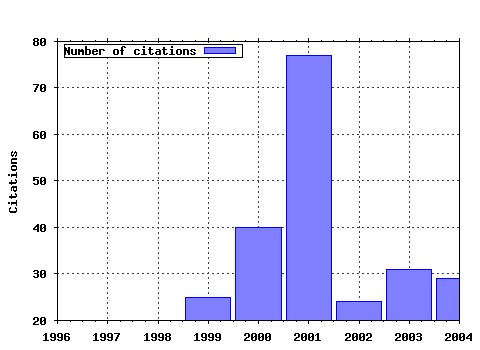

Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:uts:rpaper:72 Arbitrage in Continuous Complete Markets (2001). (2) RePEc:uts:rpaper:56 Asset Price and Wealth Dynamics Under Heterogeneous Expectations (2001). (3) RePEc:uts:rpaper:35 Heterogeneous Beliefs, Risk and Learning in a Simple Asset Pricing Model with a Market Maker (2000). (4) RePEc:uts:rpaper:48 A Minimal Financial Market Model (2001). (5) RePEc:uts:rpaper:103 Modeling the Volatility and Expected Value of a Diversified World Index (2003). (6) RePEc:uts:rpaper:49 Speculative Behaviour and Complex Asset Price Dynamics (2001). (7) RePEc:uts:rpaper:55 Dynamics of Beliefs and Learning Under aL Processes - The Heterogeneous Case (2001). (8) RePEc:uts:rpaper:84 An Adaptive Model on Asset Pricing and Wealth Dynamics with Heterogeneous Trading Strategies (2002). (9) RePEc:uts:rpaper:129 Diversified Portfolios with Jumps in a Benchmark Framework (2004). (10) RePEc:uts:rpaper:78 Consistent Pricing and Hedging for a Modified Constant Elasticity of Variance Model (2002). (11) RePEc:uts:rpaper:138 A Benchmark Approach to Finance (2004). (12) RePEc:uts:rpaper:153 On the Distributional Characterization of Log-returns of a World Stock Index (2005). (13) RePEc:uts:rpaper:5 Forward Rate Dependent Markovian Transformations of the Heath-Jarrow-Morton Term Structure Model (1999). (14) RePEc:uts:rpaper:113 A Benchmark Framework for Risk Management (2003). (15) RePEc:uts:rpaper:46 Mean Variance Preferences, Expectations Formation, and the Dynamics of Random Asset Prices (2000). (16) RePEc:uts:rpaper:101 Pricing of Index Options Under a Minimal Market Model with Lognormal Scaling (2003). (17) RePEc:uts:rpaper:81 Benchmark Model with Intensity Based Jumps (2002). (18) RePEc:uts:rpaper:6 An Introduction to Numerical Methods for Stochastic Differential Equations (1999). (19) RePEc:uts:rpaper:168 Multivariate Autoregressive Conditional Heteroskedasticity with Smooth Transitions in Conditional Correlations (2005). (20) RePEc:uts:rpaper:143 Capital Asset Pricing for Markets with Intensity Based Jumps (2004). (21) RePEc:uts:rpaper:53 Dynamics of Beliefs and Learning Under aL Processes - The Homogeneous Case (2001). (22) RePEc:uts:rpaper:91 A Structure for General and Specific Market Risk (2003). (23) RePEc:uts:rpaper:74 A Discrete Time Benchmark Approach for Finance and Insurance (2002). (24) RePEc:uts:rpaper:144 On the Role of the Growth Optimal Portfolio in Finance (2005). (25) RePEc:uts:rpaper:45 Risk Premia and Financial Modelling Without Measure Transformation (2000). (26) RePEc:uts:rpaper:125 Intraday Empirical Analysis and Modeling of Diversified World Stock Indices (2004). (27) RePEc:uts:rpaper:114 On the Efficiency of Simplified Weak Taylor Schemes for Monte Carlo Simulation in Finance (2004). (28) RePEc:uts:rpaper:13 Classes of Interest Rate Models Under the HJM Framework (1999). (29) RePEc:uts:rpaper:44 Strong Discrete Time Approximation of Stochastic Differential Equations with Time Delay (2000). (30) RePEc:uts:rpaper:128 Understanding the Implied Volatility Surface for Options on a Diversified Index (2004). (31) RePEc:uts:rpaper:32 Bayesian Target Zones (2000). (32) RePEc:uts:rpaper:139 A General Benchmark Model for Stochastic Jump Sizes (2004). (33) RePEc:uts:rpaper:65 On Filtering in Markovian Term Structure Models (An Approximation Approach) (2001). (34) RePEc:uts:rpaper:106 Fair Pricing of Weather Derivatives (2003). (35) RePEc:uts:rpaper:118 A Survey of the Integral Representation of American Option Prices (2004). (36) RePEc:uts:rpaper:130 Two-Factor Model for Low Interest Rate Regimes (2004). (37) RePEc:uts:rpaper:175 Volatility Forecast Comparison using Imperfect Volatility Proxies (2006). (38) RePEc:uts:rpaper:54 Rate of Weak Convergence of the Euler Approximation for Diffusion Processes with Jumps (2001). (39) RePEc:uts:rpaper:68 Estimation in Models of the Instantaneous Short Term Interest Rate By Use of a Dynamic Bayesian Algorithm (2001). (40) RePEc:uts:rpaper:31 Using Bayesian Variable Selection Methods to Choose Style Factors in Global Stock Return (2000). (41) RePEc:uts:rpaper:63 Filtering and Forecasting Spot Electricity Prices in the Increasingly Deregulated Australian Electricity Market (2001). (42) RePEc:uts:rpaper:157 On the Strong Approximation of Jump-Diffusion Processes (2005). (43) RePEc:uts:rpaper:21 A Minimal Share Market Model with Stochastic Volatility (1999). (44) RePEc:uts:rpaper:110 Pricing and Hedging for Incomplete Jump Diffusion Benchmark Models (2003). (45) RePEc:uts:rpaper:29 Fourth Moment Structure of a Family of First-Order Exponential GARCH Models (1999). (46) RePEc:uts:rpaper:184 Approximating the Growth Optimal Portfolio with a Diversified World Stock Index (2006). (47) RePEc:uts:rpaper:155 Benchmarking and Fair Pricing Applied to Two Market Models (2005). (48) RePEc:uts:rpaper:87 Diversified Portfolios in a Benchmark Framework (2003). (49) RePEc:uts:rpaper:83 Evaluation of American Strangles (2002). (50) RePEc:uts:rpaper:165 Panel Smooth Transition Regression Models (2005). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:sce:scecf4:345 Valuation of American Continuous-Installment Options (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (2) RePEc:uts:rpaper:128 Understanding the Implied Volatility Surface for Options on a Diversified Index (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (3) RePEc:uts:rpaper:129 Diversified Portfolios with Jumps in a Benchmark Framework (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (4) RePEc:uts:rpaper:130 Two-Factor Model for Low Interest Rate Regimes (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (5) RePEc:uts:rpaper:138 A Benchmark Approach to Finance (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (6) RePEc:uts:rpaper:140 An Intraday Empirical Analysis of Electricity Price Behaviour (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (7) RePEc:uts:rpaper:142 Statistical Properties of a Heterogeneous Asset Price Model with Time-Varying Second Moment (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (8) RePEc:uts:rpaper:143 Capital Asset Pricing for Markets with Intensity Based Jumps (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2003 (1) RePEc:uts:rpaper:103 Modeling the Volatility and Expected Value of a Diversified World Index (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (2) RePEc:uts:rpaper:106 Fair Pricing of Weather Derivatives (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (3) RePEc:uts:rpaper:110 Pricing and Hedging for Incomplete Jump Diffusion Benchmark Models (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (4) RePEc:uts:rpaper:113 A Benchmark Framework for Risk Management (2003). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2002 (1) RePEc:uts:rpaper:77 A Benchmark Approach to Filtering in Finance (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2001 (1) RePEc:ams:cdws01:5a.2 Asset Price and Wealth Dynamics under Heterogeneous Expectations (2001). Universiteit van Amsterdam, Center for Nonlinear Dynamics in Economics and Finance / CeNDEF Workshop Papers, January 2001 (2) RePEc:uts:rpaper:53 Dynamics of Beliefs and Learning Under aL Processes - The Homogeneous Case (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (3) RePEc:uts:rpaper:56 Asset Price and Wealth Dynamics Under Heterogeneous Expectations (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (4) RePEc:uts:rpaper:65 On Filtering in Markovian Term Structure Models (An Approximation Approach) (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (5) RePEc:uts:rpaper:68 Estimation in Models of the Instantaneous Short Term Interest Rate By Use of a Dynamic Bayesian Algorithm (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |