|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

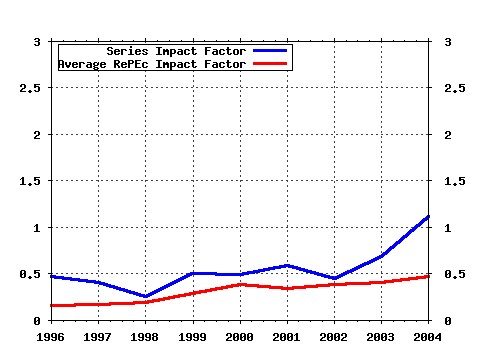

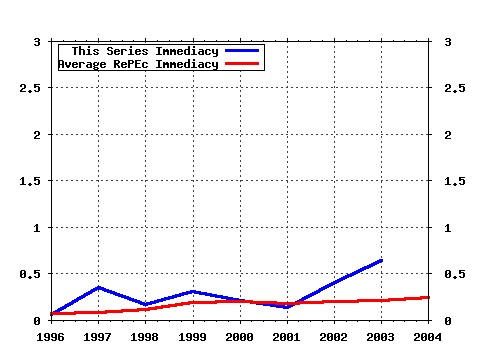

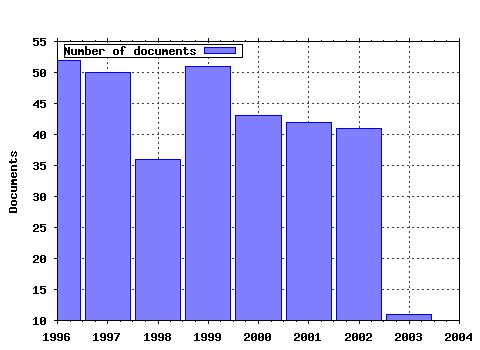

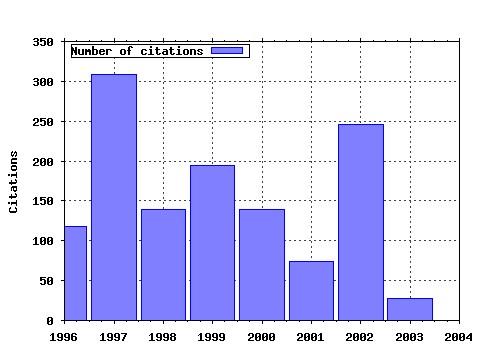

Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wop:pennin:97-04 Inside the Black Box: What Explains Differences in the Efficiencies of Financial Institutions? (1997). (2) RePEc:wop:pennin:97-05 Efficiency of Financial Institutions: International Survey and Directions for Future Research (1997). (3) RePEc:wop:pennin:96-06 The Transformation of the U.S. Banking Industry: What a Long, Strange Trip Its Been (1995). (4) RePEc:wop:pennin:98-31 Financial Contagion Journal of Political Economy (1998). (5) RePEc:wop:pennin:95-01 The Role of Capital in Financial Institutions (1995). (6) RePEc:wop:pennin:02-23 Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange? (2002). (7) RePEc:wop:pennin:97-01 Optimal Financial Crises (1976). (8) RePEc:wop:pennin:94-29 The Efficiency Cost of Market Power in the Banking Industry: A Test of the Quiet Life and Related Hypotheses (1994). (9) RePEc:wop:pennin:01-21 Payout Policy (2002). (10) RePEc:wop:pennin:02-27 Parametric and Nonparametric Volatility Measurement (2002). (11) RePEc:wop:pennin:96-03 The Effects of Megamergers on Efficiency and Prices: Evidence from a Bank Profit Function (1996). (12) RePEc:wop:pennin:98-30 Diversity of Opinion and Financing of New Technologies (1999). (13) RePEc:wop:pennin:96-32 The Theory of Financial Intermediation (1996). (14) RePEc:wop:pennin:02-34 Forecasting the Term Structure of Government Bond Yields (2002). (15) RePEc:wop:pennin:99-18 The Role of Real Annuities and Indexed Bonds in an Individual Accounts Retirement Program (1999). (16) RePEc:wop:pennin:00-23 Optimal Currency Crises (2000). (17) RePEc:wop:pennin:00-26 Ratings Migration and the Business Cycle, With Application to Credit Portfolio Stress Testing (2000). (18) RePEc:wop:pennin:02-28 Financial Intermediation (2002). (19) RePEc:wop:pennin:99-08 The Distribution of Exchange Rate Volatility (1999). (20) RePEc:wop:pennin:99-30 What Do Financial Intermediaries Do? (1999). (21) RePEc:wop:pennin:96-12 Catastrophe Insurance, Capital Markets and Uninsurable Risks (1996). (22) RePEc:wop:pennin:97-12 Retirement Wealth Accumulation and Decumulation: New Developments and Outstanding Opportunities (1997). (23) RePEc:wop:pennin:98-10 Pitfalls and Opportunities in the Use of Extreme Value Theory in Risk Management (1998). (24) RePEc:wop:pennin:01-38 Modeling Regional Interdependencies Using a Global Error-Correcting Macroeconometric Model (2002). (25) RePEc:wop:pennin:01-01 Modeling and Forecasting Realized Volatility (2001). (26) RePEc:wop:pennin:97-43 On the Profitability and Cost of Relationship Lending (1997). (27) RePEc:wop:pennin:95-02 Financial Markets, Intermediaries, and Intertemporal Smoothing (1995). (28) RePEc:wop:pennin:99-28 Corporate Governance and Competition (1999). (29) RePEc:wop:pennin:95-07 Banks and Derivatives (1995). (30) RePEc:wop:pennin:99-27 Real Estate Booms and Banking Busts: An International Perspective (1999). (31) RePEc:wop:pennin:00-11 Should Banking Supervision and Monetary Policy Tasks Be Given to Different Agencies (1999). (32) RePEc:wop:pennin:02-44 Law, Finance, and Economic Growth in China (2002). (33) RePEc:wop:pennin:01-08 The Case of the Missing Market: The Bond Market and Why It Matters for Financial Development (2000). (34) RePEc:wop:pennin:99-41 At Last the Internationalization of Retail Banking? The Case of the Spanish Banks in Latin America (1999). (35) RePEc:wop:pennin:95-16 Recovering Technologies that Account for Generalized Managerial Preferences: An Application to Non-Risk-Neutral Banks (1995). (36) RePEc:wop:pennin:01-15 Comparative Financial Systems: A Survey (2001). (37) RePEc:wop:pennin:96-16 Risk Management by Insurers: An Analysis of the Process (1997). (38) RePEc:wop:pennin:00-29 Exchange Rate Returns Standardized by Realized Volatility Are (Nearly) Gaussian (1999). (39) RePEc:wop:pennin:97-03 Comparison of Frontier Efficiency Methods: An Application to the U.S. Life Insurance Industry (1997). (40) RePEc:wop:pennin:98-09 Pricing Excess-of-loss Reinsurance Contracts Against Catastrophic Loss (1998). (41) RePEc:wop:pennin:00-17 A Comparative Study of Efficiency in European Banking (2000). (42) RePEc:wop:pennin:99-10 What Explains the Dramatic Changes in Cost and Profit Performance of the U.S. Banking Industry? (1999). (43) RePEc:wop:pennin:00-10 Learning by Lending, Competition, and Screening Incentives in the Banking Industry (2000). (44) RePEc:wop:pennin:94-24 The Information Content of Bank Examinations (1994). (45) RePEc:wop:pennin:98-16 Horizon Problems and Extreme Events in Financial Risk Management (1998). (46) RePEc:wop:pennin:01-22 Explaining the Dramatic Changes in Performance of U.S. Banks: Technological Change, Deregulation and Dynamic Changes in Competition (2001). (47) RePEc:wop:pennin:99-29 Conglomeration Versus Strategic Focus: Evidence from the Insurance Industry (2000). (48) RePEc:wop:pennin:00-20 Bank Competition and Firm Creation (2000). (49) RePEc:wop:pennin:97-24 On the Pricing of Intermediated Risks: Theory and Application to Catastrophe Reinsurance (1997). (50) RePEc:wop:pennin:01-37 Financial Fragility, Liquidity and Asset Prices (2003). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 (1) RePEc:att:wimass:200311 Sunk investments lead to unpredictable prices (2003). Wisconsin Madison - Social Systems / Working papers (2) RePEc:ces:ceswps:_995 Macroeconomic Dynamics and Credit Risk: A Global Perspective (2003). CESifo GmbH / CESifo Working Paper Series (3) RePEc:cla:levrem:666156000000000019 Sunk Investments Lead to Unpredictable Prices (2003). UCLA Department of Economics / Levine's Bibliography (4) RePEc:dgr:uvatin:20030096 Go Public or Stay Private: A Theory of Entrepreneurial Choice (2003). Tinbergen Institute / Tinbergen Institute Discussion Papers (5) RePEc:pen:papers:03-014 Sunk Investments Lead to Unpredictable Prices (2003). Penn Institute for Economic Research, Department of Economics, University of Pennsylvania / PIER Working Paper Archive (6) RePEc:wop:pennin:03-08 Measurement and Estimation of Credit Migration Matrices (2003). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (7) RePEc:wop:pennin:03-09 Metrics for Comparing Credit Migration Matrices (2003). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Latest citations received in: 2002 (1) RePEc:cir:cirwor:2002s-02 Financial Asset Returns, Market Timing, and Volatility Dynamics (2002). CIRANO / CIRANO Working Papers (2) RePEc:cir:cirwor:2002s-03 Macro Surprises And Short-Term Behaviour In Bond Futures (2002). CIRANO / CIRANO Working Papers (3) RePEc:cir:cirwor:2002s-91 Correcting the Errors: A Note on Volatility Forecast Evaluation Based on High-Frequency Data and Realized Volatilities (2002). CIRANO / CIRANO Working Papers (4) RePEc:cpr:ceprdp:3301 Explaining the Migration of Stocks from Exchanges in Emerging Economies to International Centres (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:ecb:ecbwps:20020200 Interdependence between the euro area and the US: what role for EMU? (2002). European Central Bank / Working Paper Series (6) RePEc:fip:fedpwp:02-22 Collateral and competition (2002). Federal Reserve Bank of Philadelphia / Working Papers (7) RePEc:jae:japmet:v:17:y:2002:i:5:p:535-548 Bridging the gap between the distribution of realized (ECU) volatility and ARCH modelling (of the Euro): the GARCH-NIG model (2002). Journal of Applied Econometrics (8) RePEc:mtl:montde:2002-21 Correcting the Errors : A Note on Volatility Forecast Evaluation Based on High-Frequency Data and Realized Volatilities (2002). Universite de Montreal, Departement de sciences economiques / Cahiers de recherche (9) RePEc:mtl:montec:21-2002 Correcting the Errors : A Note on Volatility Forecast Evaluation Based on High-Frequency Data and Realized Volatilities (2002). Centre interuniversitaire de recherche en économie quantitative, CIREQ / Cahiers de recherche (10) RePEc:ude:wpaper:1002 The Economics of financial Matching (2002). Department of Economics - dECON / Documentos de Trabajo (working papers) (11) RePEc:wbk:wbrwps:2816 Explaining the migration of stocks from exchanges in emerging economies to international centers (2002). The World Bank / Policy Research Working Paper Series (12) RePEc:wop:pennin:02-25 On Measuring Skewness and Kurtosis in Short Rate Distributions: The Case of the US Dollar London Inter Bank Offer Rates (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (13) RePEc:wop:pennin:02-27 Parametric and Nonparametric Volatility Measurement (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (14) RePEc:wop:pennin:02-29 Bank Panics and the Endogeneity of Central Banking (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (15) RePEc:wop:pennin:02-33 Liquidity, Efficiency and Bank Bailouts (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (16) RePEc:wop:pennin:02-42 Weather Forecasting for Weather Derivatives (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (17) RePEc:zbw:zewdip:557 The Prospects of Capital Markets in Central and Eastern Europe (2002). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2001 (1) RePEc:bro:econwp:2001-04 A Forecast Comparison of Volatility Models: Does Anything Beat a GARCH(1,1)? (2001). Brown University, Department of Economics / Working Papers (2) RePEc:fip:fedlwp:2001-009 Predicting exchange rate volatility: genetic programming vs. GARCH and RiskMetrics (2001). Federal Reserve Bank of St. Louis / Working Papers (3) RePEc:hhs:hastef:0482 Where to Go after the Lamfalussy Report? - An Economic Analysis of Securities Market Regulation and Supervision (2001). Stockholm School of Economics / Working Paper Series in Economics and Finance (4) RePEc:nbr:nberwo:8510 An Empirical Investigation of Continuous-Time Equity Return Models (2001). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:sce:scecf1:85 Exchange Rate Effects on the Volume of Trade Flows: An Empirical Analysis Employing High-Frequency Data (2001). Society for Computational Economics / Computing in Economics and Finance 2001 (6) RePEc:wop:pennin:01-29 Banking Regulation versus Securities Market Regulation (2001). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |