|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

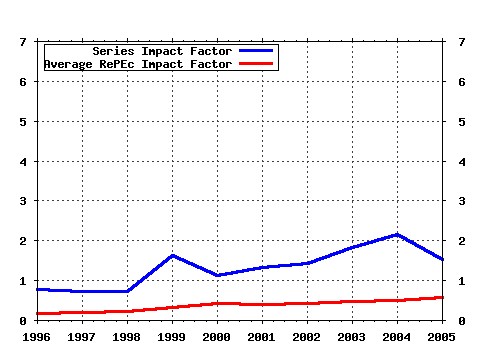

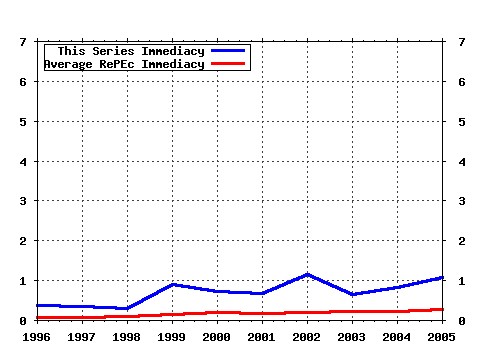

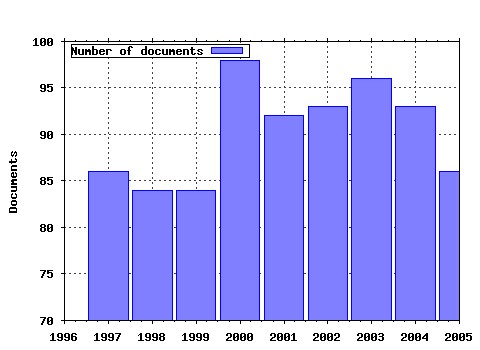

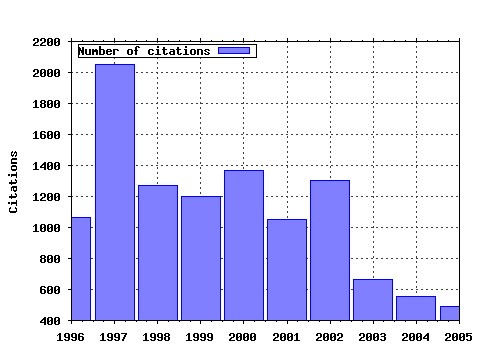

Journal of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jfinan:v:52:y:1997:i:3:p:1131-50

Legal Determinants of External Finance. (1997). (2) RePEc:bla:jfinan:v:52:y:1997:i:2:p:737-83

A Survey of Corporate Governance. (1997). (3) RePEc:bla:jfinan:v:54:y:1999:i:2:p:471-517 Corporate Ownership Around the World (1999). (4) RePEc:bla:jfinan:v:47:y:1992:i:2:p:427-65

The Cross-Section of Expected Stock Returns. (1992). (5) RePEc:bla:jfinan:v:49:y:1994:i:1:p:3-37

The Benefits of Lending Relationships: Evidence from Small Business Data. (1994). (6) RePEc:bla:jfinan:v:25:y:1970:i:2:p:383-417 Efficient Capital Markets: A Review of Theory and Empirical Work. (1970). (7) RePEc:bla:jfinan:v:47:y:1992:i:4:p:1367-400

Insiders and Outsiders: The Choice between Informed and Arms-Length Debt. (1992). (8) RePEc:bla:jfinan:v:42:y:1987:i:2:p:281-300

The Pricing of Options on Assets with Stochastic Volatilities. (1987). (9) RePEc:bla:jfinan:v:40:y:1985:i:3:p:793-805 Does the Stock Market Overreact? (1985). (10) RePEc:bla:jfinan:v:48:y:1993:i:5:p:1749-78

Measuring and Testing the Impact of News on Volatility. (1993). (11) RePEc:bla:jfinan:v:44:y:1989:i:5:p:1115-53

Why Does Stock Market Volatility Change over Time? (1989). (12) RePEc:bla:jfinan:v:52:y:1997:i:1:p:57-82

On Persistence in Mutual Fund Performance. (1997). (13) RePEc:bla:jfinan:v:32:y:1977:i:2:p:371-87 Informational Asymmetries, Financial Structure, and Financial Intermediation. (1977). (14) RePEc:bla:jfinan:v:39:y:1984:i:3:p:575-92

The Capital Structure Puzzle. (1984). (15) RePEc:bla:jfinan:v:46:y:1991:i:1:p:297-355

The Theory of Capital Structure. (1991). (16) RePEc:bla:jfinan:v:32:y:1977:i:2:p:261-75 Debt and Taxes. (1977). (17) RePEc:bla:jfinan:v:51:y:1996:i:1:p:55-84

Multifactor Explanations of Asset Pricing Anomalies. (1996). (18) RePEc:bla:jfinan:v:45:y:1990:i:4:p:1069-87

Asymmetric Information, Bank Lending, and Implicit Contracts: A Stylized Model of Customer Relationships. (1990). (19) RePEc:bla:jfinan:v:29:y:1974:i:2:p:449-70 On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. (1974). (20) RePEc:bla:jfinan:v:48:y:1993:i:1:p:65-91

Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. (1993). (21) RePEc:bla:jfinan:v:48:y:1993:i:5:p:1779-1801

On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. (1993). (22) RePEc:bla:jfinan:v:46:y:1991:i:5:p:1575-617

Efficient Capital Markets: II. (1991). (23) RePEc:bla:jfinan:v:53:y:1998:i:6:p:2107-2137 Law, Finance, and Firm Growth (1998). (24) RePEc:bla:jfinan:v:46:y:1991:i:2:p:555-76

The Term Structure as a Predictor of Real Economic Activity. (1991). (25) RePEc:bla:jfinan:v:47:y:1992:i:3:p:1209-27

An Empirical Comparison of Alternative Models of the Short-Term Interest Rate. (1992). (26) RePEc:bla:jfinan:v:50:y:1995:i:2:p:403-44

Time-Varying World Market Integration. (1995). (27) RePEc:bla:jfinan:v:43:y:1988:i:3:p:661-76

Stock Prices, Earnings, and Expected Dividends. (1988). (28) RePEc:bla:jfinan:v:45:y:1990:i:1:p:157-74

Purchasing Power Parity in the Long Run. (1990). (29) RePEc:bla:jfinan:v:51:y:1996:i:1:p:3-53

The Conditional CAPM and the Cross-Section of Expected Returns. (1996). (30) RePEc:bla:jfinan:v:55:y:2000:i:2:p:565-613 Foreign Speculators and Emerging Equity Markets (2000). (31) RePEc:bla:jfinan:v:42:y:1987:i:3:p:483-510

A Simple Model of Capital Market Equilibrium with Incomplete Information. (1987). (32) RePEc:bla:jfinan:v:52:y:1997:i:1:p:35-55

The Limits of Arbitrage. (1997). (33) RePEc:bla:jfinan:v:43:y:1988:i:1:p:1-19

The Determinants of Capital Structure Choice. (1988). (34) RePEc:bla:jfinan:v:50:y:1995:i:1:p:23-51

The New Issues Puzzle. (1995). (35) RePEc:bla:jfinan:v:53:y:1998:i:6:p:1839-1885 Investor Psychology and Security Market Under- and Overreactions (1998). (36) RePEc:bla:jfinan:v:48:y:1993:i:5:p:1629-58

Risk Management: Coordinating Corporate Investment and Financing Policies. (1993). (37) RePEc:bla:jfinan:v:55:y:2000:i:2:p:529-564 Stock Market Liberalization, Economic Reform, and Emerging Market Equity Prices (2000). (38) RePEc:bla:jfinan:v:48:y:1993:i:3:p:831-80

The Modern Industrial Revolution, Exit, and the Failure of Internal Control Systems. (1993). (39) RePEc:bla:jfinan:v:50:y:1995:i:1:p:131-55

Size and Book-to-Market Factors in Earnings and Returns. (1995). (40) RePEc:bla:jfinan:v:50:y:1995:i:5:p:1421-60

What Do We Know about Capital Structure? Some Evidence from International Data. (1995). (41) RePEc:bla:jfinan:v:57:y:2002:i:1:p:405-443 Term Premia and Interest Rate Forecasts in Affine Models (2002). (42) RePEc:bla:jfinan:v:55:y:2000:i:3:p:1163-1198 Portfolio Choice and Asset Prices: The Importance of Entrepreneurial Risk (2000). (43) RePEc:bla:jfinan:v:53:y:1998:i:5:p:1775-1798 Are Investors Reluctant to Realize Their Losses? (1998). (44) RePEc:bla:jfinan:v:45:y:1990:i:2:p:379-95

Positive Feedback Investment Strategies and Destabilizing Rational Speculation. (1990). (45) RePEc:bla:jfinan:v:50:y:1995:i:3:p:789-819

A Simple Approach to Valuing Risky Fixed and Floating Rate Debt. (1995). (46) RePEc:bla:jfinan:v:52:y:1997:i:5:p:1851-80

International Portfolio Investment Flows. (1997). (47) RePEc:bla:jfinan:v:31:y:1976:i:2:p:351-67 Valuing Corporate Securities: Some Effects of Bond Indenture Provisions. (1976). (48) RePEc:bla:jfinan:v:46:y:1991:i:1:p:179-207

Measuring the Information Content of Stock Trades. (1991). (49) RePEc:bla:jfinan:v:57:y:2002:i:3:p:1147-1170 Investor Protection and Corporate Valuation (2002). (50) RePEc:bla:jfinan:v:57:y:2002:i:6:p:2533-2570 Does Distance Still Matter? The Information Revolution in Small Business Lending (2002). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:aea:aecrev:v:95:y:2005:i:4:p:1005-1030 The Political Economy of Corporate Governance (2005). American Economic Review (2) RePEc:aea:aecrev:v:95:y:2005:i:5:p:1548-1572 Crises and Capital Requirements in Banking (2005). American Economic Review (3) RePEc:bca:bocawp:05-3 Pre-Bid Run-Ups Ahead of Canadian Takeovers: How Big Is the Problem? (2005). Bank of Canada / Working Papers (4) RePEc:bos:macppr:wp2005-005 Capital Structure, Credit Risk, and Macroeconomic Conditions (2005). Department of Economics, Boston University / Boston University Working Papers Series in Macroeconomics (5) RePEc:bos:wpaper:wp2005-002 Operating Leverage,Stock Market Cyclicality,and the Cross-Section of Returns (2005). Department of Economics, Boston University / Boston University Working Papers Series (6) RePEc:bos:wpaper:wp2005-019 THE CROSS-SECTION OF FOREIGN CURRENCY RISK PREMIA AND CONSUMPTION GROWTH RISK (2005). Department of Economics, Boston University / Boston University Working Papers Series (7) RePEc:bri:uobdis:05/569 Implementation Cycles in the New Economy (2005). Department of Economics, University of Bristol, UK / Bristol Economics Discussion Papers (8) RePEc:ces:ceswps:_1589 Bank Control and the Number of Bank Relations of Japanese Firms (2005). CESifo GmbH / CESifo Working Paper Series (9) RePEc:cfs:cfswop:wp200520 Equity Culture and the Distribution of Wealth (2005). Center for Financial Studies / CFS Working Paper Series (10) RePEc:cla:levrem:784828000000000439 Business Start-ups, The Lock-in Effect, and Capital Gains Taxation (2005). UCLA Department of Economics / Levine's Bibliography (11) RePEc:cla:uclaol:369 Knowing What Others Know: Coordination Motives in Information Acquisition (March 2006, with Laura Veldkamp) (2005). UCLA Department of Economics / UCLA Economics Online Papers (12) RePEc:col:000091:002203 Corporate Valuation and Governance: Evidence from Colombia (2005). UNIVERSIDAD DEL ROSARIO - FACULTAD DE ECONOMÃA / BORRADORES DE INVESTIGACIÃN (13) RePEc:cpr:ceprdp:4852 Wealth Accumulation and Portfolio Choice with Taxable and Tax-Deferred Accounts (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:cpr:ceprdp:4862 Do Demand Curves for Currencies Slope Down? Evidence from the MSCI Global Index Change (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (15) RePEc:cpr:ceprdp:4921 Why is Long-Horizon Equity Less Risky? A Duration-based Explanation of the Value Premium (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (16) RePEc:cpr:ceprdp:5117 Wealth Transfers, Contagion and Portfolio Constraints (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:5119 CEO-Firm Match and Principal-Agent Problem (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:5121 Is There a Diversification Discount in Financial Conglomerates? (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:5253 Financial Integration and Systemic Risk (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:dgr:kubcen:200557 Royal Ahold: a failure of corporate governance and an accounting scandal (2005). Tilburg University, Center for Economic Research / Discussion Paper (21) RePEc:dgr:kubcen:200561 Control structures and payout policy (2005). Tilburg University, Center for Economic Research / Discussion Paper (22) RePEc:dgr:kubtil:200514 Control structures and payout policy (2005). Tilburg University, Tilburg Law and Economic Center / Discussion Paper (23) RePEc:dgr:unuint:200507 Learning, Product Innovation and Firm Heterogeneity in Tanzania (2005). United Nations University, Institute for New Technologies / Discussion Papers (24) RePEc:dgr:uvatin:20050102 The Political Economy of Corporate Control (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (25) RePEc:dlw:wpaper:05-17 Information Asymmetries, Litigation Risk and the Demand for Fairness Opinions: Evidence from U.S. Mergers & Acquisitions, 1980-2002 (2005). University of Delaware, Department of Economics / Working Papers (26) RePEc:dnb:dnbwpp:061 Asymmetric Price Adjustment in the Dutch Mortgage Market (2005). Netherlands Central Bank, Research Department / DNB Working Papers (27) RePEc:dnb:dnbwpp:067 Valuation of pension liabilities in incomplete markets (2005). Netherlands Central Bank, Research Department / DNB Working Papers (28) RePEc:ebg:heccah:0828 Learning about Beta: time-varying factor loadings, expected returns and the conditional CAPM (2005). Groupe HEC / Les Cahiers de Recherche (29) RePEc:ebg:iesewp:d-0601 Governance structure and the weighting of performance measures in CEO compensation (2005). IESE Business School / IESE Research Papers (30) RePEc:ecb:ecbwps:20050498 Financial integration and entrepreneurial activity - evidence from foreign bank entry in emerging markets (2005). European Central Bank / Working Paper Series (31) RePEc:egc:wpaper:918 Whats Psychology Worth? A Field Experiment in the Consumer Credit Market (2005). Economic Growth Center, Yale University / Working Papers (32) RePEc:esi:egpdis:2005-37 Financial Constraints on New Firms: Looking for Regional Disparities (2005). Max Planck Institute of Economics, Group for Entrepreneurship, Growth and Public Policy / Discussion Papers on Entrepreneurship, Growth and Public Pol (33) RePEc:eui:euiwps:eco2005/18 Liquidity runs with endogenous information acquisition (2005). European University Institute / Economics Working Papers (34) RePEc:fip:fedbwp:05-7 Borrowing costs and the demand for equity over the life cycle (2005). Federal Reserve Bank of Boston / Working Papers (35) RePEc:fip:fedgfe:2005-36 Large investors: implications for equilibrium asset, returns, shock absorption, and liquidity (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (36) RePEc:fip:fedgfe:2005-40 Risk, uncertainty, and asset prices (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (37) RePEc:fip:fedgfe:2005-63 Explaining credit default swap spreads with the equity volatility and jump risks of individual firms (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (38) RePEc:fip:fedgif:844 The response of global equity indexes to U.S. monetary policy announcements (2005). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (39) RePEc:fip:fedhpr:y:2005:i:may:p:140-147 Information asymmetries and the effects of banking mergers of firm-bank relationships (2005). Proceedings (40) RePEc:fip:fedhwp:wp-05-06 Price discovery in a market under stress: the U.S. Treasury market in fall 1998 (2005). Federal Reserve Bank of Chicago / Working Paper Series (41) RePEc:fip:fedhwp:wp-05-17 Why do firms go public? evidence from the banking industry (2005). Federal Reserve Bank of Chicago / Working Paper Series (42) RePEc:hhs:uunewp:2005_011 Myopic Loss Aversion, the Equity Premium Puzzle, and GARCH (2005). Uppsala University, Department of Economics / Working Paper Series (43) RePEc:hit:hitcei:2005-10 The Effect of Auditor Choice on Financing Decisions (2005). Institute of Economic Research, Hitotsubashi University / Working Paper Series (44) RePEc:hit:hitcei:2005-8 Does Market Size Structure Affect Competition? The Cese of Small Business Lending (2005). Institute of Economic Research, Hitotsubashi University / Working Paper Series (45) RePEc:knz:cofedp:0510 The dynamics of overconfidence: Evidence from stock market forecasters (2005). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (46) RePEc:kud:epruwp:05-14 Monetary Policy News and Exchange Rate Responses: Do Only Surprises Matter? (2005). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (47) RePEc:kud:kuiedp:0509 Individual Irrationality and Aggregate Outcomes (2005). University of Copenhagen. Department of Economics (formerly Institute of Economics) / Discussion Papers (48) RePEc:lic:licosd:16205 Share Issuing Privatizations in China: Determinants of Public Share Allocation and Underpricing (2005). LICOS - Centre for Institutions and Economic Performance, K.U.Leuven / LICOS Discussion Papers (49) RePEc:mpg:wpaper:2005_6 Bank Size and Risk-Taking under Basel II (2005). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (50) RePEc:nbr:nberwo:11104 The Cross-Section of Currency Risk Premia and US Consumption Growth Risk (2005). National Bureau of Economic Research, Inc / NBER Working Papers (51) RePEc:nbr:nberwo:11144 Why is Long-Horizon Equity Less Risky? A Duration-Based Explanation of the Value Premium (2005). National Bureau of Economic Research, Inc / NBER Working Papers (52) RePEc:nbr:nberwo:11180 Uninsured Idiosyncratic Investment Risk and Aggregate Saving (2005). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:11224 SMEs, Growth, and Poverty (2005). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:11326 The Value Spread as a Predictor of Returns (2005). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:11357 Asset Fire Sales (and Purchases) in Equity Markets (2005). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:11361 Optimism and Economic Choice (2005). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:11424 Determinants of Vertical Integration: Finance, Contracts, and Regulation (2005). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:11440 Wealth Transfers, Contagion, and Portfolio Constraints (2005). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:nbr:nberwo:11443 The Growth of Executive Pay (2005). National Bureau of Economic Research, Inc / NBER Working Papers (60) RePEc:nbr:nberwo:11459 Investment-Based Underperformance Following Seasoned Equity Offerings (2005). National Bureau of Economic Research, Inc / NBER Working Papers (61) RePEc:nbr:nberwo:11468 Predicting the Equity Premium Out of Sample: Can Anything Beat the Historical Average? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (62) RePEc:nbr:nberwo:11500 Bank Concentration and Fragility: Impact and Mechanics (2005). National Bureau of Economic Research, Inc / NBER Working Papers (63) RePEc:nbr:nberwo:11505 Why Do Firms Become Widely Held? An Analysis of the ynamics of Corporate Ownership (2005). National Bureau of Economic Research, Inc / NBER Working Papers (64) RePEc:nbr:nberwo:11526 Dumb Money: Mutual Fund Flows and the Cross-Section of Stock Returns (2005). National Bureau of Economic Research, Inc / NBER Working Papers (65) RePEc:nbr:nberwo:11559 Solving Models with External Habit (2005). National Bureau of Economic Research, Inc / NBER Working Papers (66) RePEc:nbr:nberwo:11685 The Risk-Adjusted Cost of Financial Distress (2005). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:nbr:nberwo:11697 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2005). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:nbr:nberwo:11766 Unobserved Actions of Mutual Funds (2005). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:11816 Cash-Flow Risk, Discount Risk, and the Value Premium (2005). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:11824 Downside Risk (2005). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:11864 Equilibrium Commodity Prices with Irreversible Investment and Non-Linear Technology (2005). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nbr:nberwo:11886 Firm Expansion and CEO Pay (2005). National Bureau of Economic Research, Inc / NBER Working Papers (73) RePEc:nbr:nberwo:11901 Why Doesnt Capital Flow from Rich to Poor Countries? An Empirical Investigation (2005). National Bureau of Economic Research, Inc / NBER Working Papers (74) RePEc:sbs:wpsefe:2005fe18 Commitment to Overinvest and Price Informativeness (2005). Oxford Financial Research Centre / OFRC Working Papers Series (75) RePEc:taf:apfiec:v:15:y:2005:i:10:p:679-690 Long-run post-merger stock performance of UK acquiring firms: a stochastic dominance perspective (2005). Applied Financial Economics (76) RePEc:use:tkiwps:0515 The determinants of merger waves (2005). Utrecht School of Economics / Working Papers (77) RePEc:vlg:vlgwps:2005-15 National institutions and the allocation of entrepreneurial effort (2005). Vlerick Leuven Gent Management School / Vlerick Leuven Gent Management School Working Paper Series (78) RePEc:wbk:wbrwps:3485 Finance, Firm Size, and Growth (2005). The World Bank / Policy Research Working Paper Series (79) RePEc:wbk:wbrwps:3589 Access to financial services: a review of the issues and public policy objectives (2005). The World Bank / Policy Research Working Paper Series (80) RePEc:wbk:wbrwps:3674 Public debt in developing countries : has the market-based model worked? (2005). The World Bank / Policy Research Working Paper Series (81) RePEc:wbk:wbrwps:3709 How well do institutional theories explain firms perceptions of property rights? (2005). The World Bank / Policy Research Working Paper Series (82) RePEc:wdi:papers:2005-741 DO INSIDER TRADING LAWS MATTER? SOME PRELIMINARY COMPARATIVE EVIDENCE (2005). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (83) RePEc:wpa:wuwpem:0501005 Tracing the Source of Long Memory in Volatility (2005). EconWPA / Econometrics (84) RePEc:wpa:wuwpfi:0503009 Information Theory and Market Behavior (2005). EconWPA / Finance (85) RePEc:wpa:wuwpfi:0505011 Dynamic Adjustment of Corporate Leverage: Is there a lesson to learn from the Recent Asian Crisis? (2005). EconWPA / Finance (86) RePEc:wpa:wuwpif:0510001 What Has 100 Billion Dollars Worth of Debt Relief Done for Low- Income Countries? (2005). EconWPA / International Finance (87) RePEc:wpa:wuwpma:0508006 Do Stockholders Share Risk More Effectively Than Non- stockholders? (2005). EconWPA / Macroeconomics (88) RePEc:xrs:sfbmaa:05-07 Bank Size and Risk-Taking under Basel II (2005). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications (89) RePEc:xrs:sfbmaa:05-25 Overconfidence of Professionals and Lay Men: Individual Differences Within and Between Tasks? (2005). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications (90) RePEc:xrs:sfbmaa:05-40 Framing Effects in Stock Market Forecasts: The Difference Between Asking for Prices and Asking for Returns (2005). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications (91) RePEc:zbw:cauewp:3829 The Introduction of the Euro and its Effects on Investment Decisions (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (92) RePEc:zbw:zewdip:2904 How Does Ownersâ Exposure to Idiosyncratic Risk Influence the Capital Structure of Private Companies? (2005). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers (93) RePEc:zbw:zewdip:4566 The Dynamics of Overconfidence: Evidence from Stock Market Forecasters (2005). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2004 (1) RePEc:aea:aecrev:v:94:y:2004:i:2:p:29-32 Aggregate Short Interest and Market Valuations (2004). American Economic Review (2) RePEc:aea:aecrev:v:94:y:2004:i:5:p:1249-1275 Bad Beta, Good Beta (2004). American Economic Review (3) RePEc:anp:en2004:063 ARE BRAZILIAN FIRMS SAVINGS SENSITIVE TO CASH WINDFALLS? (2004). ANPEC - Associação Nacional do Centros de Pos-graduação em Economia [Brazilian Association of Graduate Programs in Economics] / Anais do XXXII Encontr (4) RePEc:bca:bocawp:04-16 The Effects of Economic News on Bond Market Liquidity (2004). Bank of Canada / Working Papers (5) RePEc:bca:bocawp:04-45 Modelling the Evolution of Credit Spreads in the United States (2004). Bank of Canada / Working Papers (6) RePEc:bro:econwp:2004-21 Which Institutional Investors Monitor? Evidence from Acquisition Activity (2004). Brown University, Department of Economics / Working Papers (7) RePEc:cep:cepdps:dp0631 Corporate Ownership Structure and Performance in Europe (2004). Centre for Economic Performance, LSE / CEP Discussion Papers (8) RePEc:cir:cirwor:2004s-56 Option Valuation with Long-run and Short-run Volatility Components (2004). CIRANO / CIRANO Working Papers (9) RePEc:cla:uclaol:299 The Market Price of Aggregate Risk and the Wealth Distribution (2004). UCLA Department of Economics / UCLA Economics Online Papers (10) RePEc:cpr:ceprdp:4206 The U-Shaped Investment Curve: Theory and Evidence (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:4221 Riding the South Sea Bubble (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:4232 Regulation of Multinational banks: A Theoretical Inquiry (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:dgr:eureri:30001393 The effects of systemic crises when investors can be crisis ignorant (2004). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (14) RePEc:diw:diwwpp:dp410 The Impact of Macroeconomic Uncertainty on Cash Holdings for Non-Financial Firms (2004). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (15) RePEc:diw:diwwpp:dp443 Macroeconomic Uncertainty and Firm Leverage (2004). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (16) RePEc:dnb:dnbwpp:001 Market Impact Costs of Institutional Equity Trades (2004). Netherlands Central Bank, Research Department / DNB Working Papers (17) RePEc:ecb:ecbwps:20040315 Option-implied asymmetries in bond market expectations around monetary policy actions of the ECB (2004). European Central Bank / Working Paper Series (18) RePEc:ecb:ecbwps:20040366 The information content of over-the-counter currency options (2004). European Central Bank / Working Paper Series (19) RePEc:ecm:latm04:61 Myopic Loss Aversion, Asymmetric Correlations, and the Home Bias (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (20) RePEc:ecm:nawm04:77 Statistical Models for High Frequency Security Prices (2004). Econometric Society / Econometric Society 2004 North American Winter Meetings (21) RePEc:fip:fedgfe:2004-22 The geography of stock market participation: the influence of communities and local firms (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (22) RePEc:fip:fedgfe:2004-56 Dynamic estimation of volatility risk premia and investor risk aversion from option-implied and realized volatilities (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (23) RePEc:fip:fedgif:815 Look at me now: the role of cross-listing in attracting U.S. investors (2004). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (24) RePEc:fip:fedgif:816 Corporate governance and the shareholder base (2004). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (25) RePEc:fip:fedhwp:wp-04-22 Betcha cant acquire just one: merger programs and compensation (2004). Federal Reserve Bank of Chicago / Working Paper Series (26) RePEc:fip:fedlwp:2004-027 Aggregate idiosyncratic volatility in G7 countries (2004). Federal Reserve Bank of St. Louis / Working Papers (27) RePEc:fip:fednsr:187 Inference, arbitrage, and asset price volatility (2004). Federal Reserve Bank of New York / Staff Reports (28) RePEc:fip:fednsr:193 Learning about beta: a new look at CAPM tests (2004). Federal Reserve Bank of New York / Staff Reports (29) RePEc:hit:hitcei:2005-2 Do Directors Perform for Pay? (2004). Institute of Economic Research, Hitotsubashi University / Working Paper Series (30) RePEc:iza:izadps:dp1376 Rent Sharing Before and After the Wage Bill (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (31) RePEc:lec:leecon:04/19 The Impact of Macroeconomic Uncertainty on Cash Holdings for NonâFinancial Firms (2004). Department of Economics, University of Leicester / Discussion Papers in Economics (32) RePEc:max:cprwps:58 Social Interaction and the Health Insurance Choices of the Elderly (2004). Center for Policy Research, Maxwell School, Syracuse University / Center for Policy Research Working Papers (33) RePEc:nbr:nberwo:10200 Wealth Destruction on a Massive Scale? A Study of Acquiring-Firm Returns in the Recent Merger Wave (2004). National Bureau of Economic Research, Inc / NBER Working Papers (34) RePEc:nbr:nberwo:10218 Aggregate Short Interest and Market Valuations (2004). National Bureau of Economic Research, Inc / NBER Working Papers (35) RePEc:nbr:nberwo:10221 Compensating Employees Below the Executive Ranks: A Comparison of Options, Restricted Stock, and Cash (2004). National Bureau of Economic Research, Inc / NBER Working Papers (36) RePEc:nbr:nberwo:10222 Why Do Some Firms Give Stock Options to All Employees?: An Empirical Examination of Alternative Theories (2004). National Bureau of Economic Research, Inc / NBER Working Papers (37) RePEc:nbr:nberwo:10235 The Geography of Stock Market Participation: The Influence of Communities and Local Firms (2004). National Bureau of Economic Research, Inc / NBER Working Papers (38) RePEc:nbr:nberwo:10236 Financial Development and Growth in the Short and Long Run (2004). National Bureau of Economic Research, Inc / NBER Working Papers (39) RePEc:nbr:nberwo:10259 Why Are Most Funds Open-End? Competition and the Limits of Arbitrage (2004). National Bureau of Economic Research, Inc / NBER Working Papers (40) RePEc:nbr:nberwo:10264 Investor Behavior in the Option Market (2004). National Bureau of Economic Research, Inc / NBER Working Papers (41) RePEc:nbr:nberwo:10411 Financial Claustrophobia: Asset Pricing in Illiquid Markets (2004). National Bureau of Economic Research, Inc / NBER Working Papers (42) RePEc:nbr:nberwo:10434 Short Interest and Stock Returns (2004). National Bureau of Economic Research, Inc / NBER Working Papers (43) RePEc:nbr:nberwo:10436 Information Diffusion Effects in Individual Investors Common Stock Purchases: Covet Thy Neighbors Investment Choices (2004). National Bureau of Economic Research, Inc / NBER Working Papers (44) RePEc:nbr:nberwo:10471 Corporate Tax Avoidance and High Powered Incentives (2004). National Bureau of Economic Research, Inc / NBER Working Papers (45) RePEc:nbr:nberwo:10559 The Stock Market and Investment: Evidence from FDI Flows (2004). National Bureau of Economic Research, Inc / NBER Working Papers (46) RePEc:nbr:nberwo:10574 Should We Fear Derivatives? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (47) RePEc:nbr:nberwo:10641 The History and Politics of Corporate Ownership in Sweden (2004). National Bureau of Economic Research, Inc / NBER Working Papers (48) RePEc:nbr:nberwo:10685 Can Mutual Fund Managers Pick Stocks? Evidence from the Trades Prior to Earnings Announcements (2004). National Bureau of Economic Research, Inc / NBER Working Papers (49) RePEc:nbr:nberwo:10794 Investor Sentiment Measures (2004). National Bureau of Economic Research, Inc / NBER Working Papers (50) RePEc:nbr:nberwo:10806 Economic Effects of Regional Tax Havens (2004). National Bureau of Economic Research, Inc / NBER Working Papers (51) RePEc:nbr:nberwo:10814 Asset Pricing with Liquidity Risk (2004). National Bureau of Economic Research, Inc / NBER Working Papers (52) RePEc:nbr:nberwo:10823 Pseudo Market Timing and Predictive Regressions (2004). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:10841 Dividend Taxes and Corporate Behavior: Evidence from the 2003 Dividend Tax Cut (2004). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:10912 Jump and Volatility Risk and Risk Premia: A New Model and Lessons from S&P 500 Options (2004). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:10925 The Information of Option Volume for Future Stock Prices (2004). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:10936 Do Tax Havens Flourish? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:10937 Patterns of Comovement: The Role of Information Technology in the U.S. Economy (2004). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:10978 Theft and Taxes (2004). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:nbr:nberwo:10998 Corporate Financing Decisions When Investors Take the Path of Least Resistance (2004). National Bureau of Economic Research, Inc / NBER Working Papers (60) RePEc:nbr:nberwo:10999 Growth vs. Margins: Destabilizing Consequences of Giving the Stock Market What it Wants (2004). National Bureau of Economic Research, Inc / NBER Working Papers (61) RePEc:nbr:nberwo:11002 Executive Financial Incentives and Payout Policy: Firm Responses to the 2003 Dividend Tax Cut (2004). National Bureau of Economic Research, Inc / NBER Working Papers (62) RePEc:rif:dpaper:887 Could Mr. and Mrs. Capital Market Imperfection Please Step Forward? An Empirical Analysis of Adverse Selection and Moral Hazard in Capital Markets. (2004). The Research Institute of the Finnish Economy / Discussion Papers (63) RePEc:rif:dpaper:923 Opacity of Young Firms: Faith or Fact? (2004). The Research Institute of the Finnish Economy / Discussion Papers (64) RePEc:rif:dpaper:957 The Determinants of Stock Option Compensation: Evidence from Finland (2004). The Research Institute of the Finnish Economy / Discussion Papers (65) RePEc:rut:rutres:200412 Experts Online: An Analysis of Trading Activity in a Public Internet Chat Room (2004). Rutgers University, Department of Economics / Departmental Working Papers (66) RePEc:sef:csefwp:126 The European Bond Markets under EMU (2004). Centre for Studies in Economics and Finance (CSEF), University of Salerno, Italy / CSEF Working Papers (67) RePEc:ttp:itpwps:0501 Theft and Taxes (2004). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers (68) RePEc:uct:uconnp:2004-09 Corporate Tax Avoidance and High Powered Incentives (2004). University of Connecticut, Department of Economics / Working papers (69) RePEc:uno:wpaper:2003-13 Market valuation and employee stock options (2004). University of New Orleans, Department of Economics and Finance / Working Papers (70) RePEc:uno:wpaper:2004-04 Quadratic term structure models with jumps in incomplete currency markets (2004). University of New Orleans, Department of Economics and Finance / Working Papers (71) RePEc:uno:wpaper:2004-05 Volatility clustering, leverage effects, and jumps dynamics in emerging Asian equity markets (2004). University of New Orleans, Department of Economics and Finance / Working Papers (72) RePEc:upf:upfgen:744 What Form of Relative Performance Evaluation? (2004). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (73) RePEc:upf:upfgen:861 Riding the South Sea Bubble (2004). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (74) RePEc:use:tkiwps:0517 Do Acquirers With More Uncertain Growth Prospects Gain Less From Acquisitions? (2004). Utrecht School of Economics / Working Papers (75) RePEc:use:tkiwps:0518 The Market for Mergers and the Boundaries of the Firm (2004). Utrecht School of Economics / Working Papers (76) RePEc:wbk:wbrwps:3319 Financial development and growth in the short and long run (2004). The World Bank / Policy Research Working Paper Series (77) RePEc:wpa:wuwpfi:0407014 Investment, Hedging, and Consumption Smoothing (2004). EconWPA / Finance (78) RePEc:zbw:zewdip:1611 The Impact of Macroeconomic Uncertainty on Cash Holdings for Non-Financial Firms (2004). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2003 (1) RePEc:aea:aecrev:v:93:y:2003:i:1:p:324-343 Winter Blues: A SAD Stock Market Cycle (2003). American Economic Review (2) RePEc:bro:econwp:2003-18 Per Capita Consumption, Luxury Consumption and the Presidential Puzzle: A Partial Resolution (2003). Brown University, Department of Economics / Working Papers (3) RePEc:bru:bruedp:03-23 A CHANGE OF FOCUS STOCK MARKET RECLASSIFICATION IN THE UK (2003). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (4) RePEc:bru:bruppp:03-23 A CHANGE OF FOCUS STOCK MARKET RECLASSIFICATION IN THE UK (2003). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers (5) RePEc:ces:ceswps:_1066 Public Policy and Venture Capital Backed Innovation (2003). CESifo GmbH / CESifo Working Paper Series (6) RePEc:cfs:cfswop:wp200325 The Role of the Value Added by the Venture Capitalists in Timing and Extent of IPOs (2003). Center for Financial Studies / CFS Working Paper Series (7) RePEc:cir:cirwor:2003s-16 Do IPOs Underperform in the Long-Run? New Evidence from the Canadian Stock Market (2003). CIRANO / CIRANO Working Papers (8) RePEc:cir:cirwor:2003s-38 News Arrival, Jump Dynamics and Volatility Components for Individual Stock Returns (2003). CIRANO / CIRANO Working Papers (9) RePEc:cla:levrem:666156000000000355 Two Trees: Asset Price Dynamics Induced by Market Clearing (2003). UCLA Department of Economics / Levine's Bibliography (10) RePEc:cpr:ceprdp:3832 Heterogeneity of Investors and Asset Pricing in a Risk-Value World (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:3843 Which Investors Fear Expropriation? Evidence from Investors Stock Picking (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:4002 Stock Prices and IPO Waves (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:cpr:ceprdp:4034 Trading Volume with Career Concerns (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:cpr:ceprdp:4068 Is There Evidence of Pessimism and Doubt in Subjective Distributions? A Comment on Abel (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (15) RePEc:cpr:ceprdp:4084 Does Binding of Feedback Influence Myopic Loss Aversion? An Experimental Analysis (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (16) RePEc:cpr:ceprdp:4097 Taxation and Venture Capital-Backed Entrepreneurship (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:4139 Corporate Venture Capital: The Upside of Failure and Competition for Talent (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:4162 Competing for Securities Underwriting Mandates: Banking Relationships and Analyst Recommendations (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:4163 Conflicts of Interest and Efficient Contracting in IPOs (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:dgr:eureri:3000323 Risk Aversion and Skewness Preference: a comment (2003). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (21) RePEc:dgr:eureri:3000450 Asset prices and omitted moments; A stochastic dominance analysis of market efficiency (2003). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (22) RePEc:dgr:uvatin:20030037 Round-the-Clock Price Discovery for Cross-Listed Stocks: US-Dutch Evidence (2003). Tinbergen Institute / Tinbergen Institute Discussion Papers (23) RePEc:dnb:staffs:110 Corporate Investment and Financing Constraints: Connections with Cash management (2003). Netherlands Central Bank / DNB Staff Reports (discontinued) (24) RePEc:ema:worpap:2003-45 Corporate Venture Capital: The Upside of Failure and Competition for Talent (2003). THEMA / Working papers (25) RePEc:fip:fedawp:2003-5 Playing the field: Geomagnetic storms and international stock markets (2003). Federal Reserve Bank of Atlanta / Working Paper (26) RePEc:fip:fedcwp:0309 An analysis of Japanese foreign exchange interventions, 1991-2002 (2003). Federal Reserve Bank of Cleveland / Working Paper (27) RePEc:fip:fedfer:y:2003:p:29-45 How might financial market information be used for supervisory purposes? (2003). Economic Review (28) RePEc:fip:fedgif:755 Diversification, original sin, and international bond portfolios (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (29) RePEc:fip:fedlwp:2003-025 Does idiosyncratic risk matter: another look (2003). Federal Reserve Bank of St. Louis / Working Papers (30) RePEc:fip:fedreq:y:2003:i:fall:p:1-24:n:v.89no.4 Boom and bust in telecommunications (2003). Economic Quarterly (31) RePEc:han:dpaper:dp-290 The Use of Momentum, Contrarian and Buy-&-Hold Strategies: Survey Evidence from Fund Managers (2003). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (32) RePEc:hhs:aareco:2003_016 Incentives, Sorting and Productivity along the Career: Evidence from a Sample of Top Economists (2003). Aarhus School of Business, Department of Economics / Working Papers (33) RePEc:hhs:sifrwp:0019 Is There Evidence of Pessimism and Doubt in Subjective Distributions? A Comment on Abel (2003). Swedish Institute for Financial Research / SIFR Research Report Series (34) RePEc:iza:izadps:dp897 Relational Contracts and the Nature of Market Interactions (2003). Institute for the Study of Labor (IZA) / IZA Discussion Papers (35) RePEc:knz:cofedp:0310 Incentive Contracts and Hedge Fund Management: A Numerical Evaluation Procedure (2003). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (36) RePEc:kud:kuieci:2004-02 Cooperation in International Banking Supervision (2003). University of Copenhagen. Department of Economics (formerly Institute of Economics). Centre for Industrial Economics / CIE Discussion Papers (37) RePEc:mit:sloanp:3514 Offsetting the Incentives: Risk Shifting and Benefits of Benchmarking in Money Management (2003). Massachusetts Institute of Technology (MIT), Sloan School of Management / Working papers (38) RePEc:nbr:nberwo:10116 Two Trees: Asset Price Dynamics Induced by Market Clearing (2003). National Bureau of Economic Research, Inc / NBER Working Papers (39) RePEc:nbr:nberwo:10153 The Character and Determinants of Corporate Capital Gains (2003). National Bureau of Economic Research, Inc / NBER Working Papers (40) RePEc:nbr:nberwo:10188 Do Firms in Countries with Poor Protection of Investor Rights Hold More Cash? (2003). National Bureau of Economic Research, Inc / NBER Working Papers (41) RePEc:nbr:nberwo:10623 How Have Borrowers Fared in Banking Mega-Mergers? (2003). National Bureau of Economic Research, Inc / NBER Working Papers (42) RePEc:nbr:nberwo:9454 The cash flow, return and risk characteristics of private equity (2003). National Bureau of Economic Research, Inc / NBER Working Papers (43) RePEc:nbr:nberwo:9544 Analysts Conflict of Interest and Biases in Earnings Forecasts (2003). National Bureau of Economic Research, Inc / NBER Working Papers (44) RePEc:nbr:nberwo:9674 Diversification and the Taxation of Capital Gains and Losses (2003). National Bureau of Economic Research, Inc / NBER Working Papers (45) RePEc:nbr:nberwo:9841 How Original Sin was Overcome: The Evolution of External Debt Denominated in Domestic Currencies in the United States and the British Dominions (2003). National Bureau of Economic Research, Inc / NBER Working Papers (46) RePEc:nbr:nberwo:9864 Explaining Sudden Stops, Growth Collapse and BOP Crises: The Case of Distortionary Output Taxes (2003). National Bureau of Economic Research, Inc / NBER Working Papers (47) RePEc:nbr:nberwo:9927 Uncovering the Risk-Return Relation in the Stock Market (2003). National Bureau of Economic Research, Inc / NBER Working Papers (48) RePEc:oxf:wpaper:170 Hard Debt, Soft CEO`s and Union Rents (2003). University of Oxford, Department of Economics / Economics Series Working Papers (49) RePEc:rba:rbardp:rdp2003-06 The Characteristics and Trading Behaviour of Dual-listed Companies (2003). Reserve Bank of Australia / RBA Research Discussion Papers (50) RePEc:rut:rutres:200307 Analyst Recommendations and Nasdaq Market Making Activity (2003). Rutgers University, Department of Economics / Departmental Working Papers (51) RePEc:sbs:wpsefe:2003fe05 Why are European IPOs so rarely priced outside the indicative price range? (2003). Oxford Financial Research Centre / OFRC Working Papers Series (52) RePEc:sbs:wpsefe:2003fe12 Hard Debt, Soft CEOs and Union Rents (2003). Oxford Financial Research Centre / OFRC Working Papers Series (53) RePEc:ste:nystbu:03-24 Conflicts of Interest and Market Discipline Among Financial Services Firms (2003). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers (54) RePEc:udt:wpbsdt:defactodollarization Prudential Responses to De Facto Dollarization (2003). Universidad Torcuato Di Tella / Business School Working Papers (55) RePEc:usg:dp2003:2003-17 Public Taxation and Venture Capital Backed Entrepreneurship (2003). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2003 (56) RePEc:wdi:papers:2003-546 Democratizationâs Risk Premium: Partisan and Opportunistic Political Business Cycle Effects on Sovereign Ratings in Developing Countries (2003). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (57) RePEc:wdi:papers:2003-575 DEMOCRACYâS SPREAD: Elections and Sovereign Debt in Developing Countries (2003). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (58) RePEc:wil:wileco:195 The Character and Determinants of Corporate Capital Gains (2003). Department of Economics, Williams College / Department of Economics Working Papers (59) RePEc:wil:wileco:196 What Can We Learn About the Sensitivity of Investment to Stock Prices with a Better Measure of Tobins q? (2003). Department of Economics, Williams College / Department of Economics Working Papers (60) RePEc:wpa:wuwpfi:0311010 The U-shaped Investment Curve: Theory and Evidence (2003). EconWPA / Finance (61) RePEc:xrs:sfbmaa:03-20 Does Binding or Feeback Influence Myopic Loss Aversion - An Experimental Analysis (2003). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications (62) RePEc:zbw:zewdip:1353 Is the Behavior of German Venture Capitalists Different? : Evidence from the Neuer Markt (2003). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers (63) RePEc:zbw:zewdip:1686 Option-Style Multi-Factor Comparable Company Valuation for Practical Use (2003). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2002 (1) RePEc:apr:aprewp:wp0008 Do Bank Characteristics Influence Loan Contract Terms? (2002). Australian Prudential Regulation Authority / Working Papers (2) RePEc:bca:bocawp:02-40 Inflation Changes, Yield Spreads, and Threshold Effects (2002). Bank of Canada / Working Papers (3) RePEc:bdi:wptemi:td_448_02 Are Mergers Beneficial to Consumers? Evidence from the Market for Bank Deposits (2002). Bank of Italy, Economic Research Department / Temi di discussione (Economic working papers) (4) RePEc:bon:bonedp:bgse31_2002 The Benefit and Cost of Winner Picking: Redistribution Vs Incentives (2002). University of Bonn, Germany / Bonn Econ Discussion Papers (5) RePEc:bro:econwp:2002-18 Asset Returns in an Endogenous Growth Model with Incomplete Markets (2002). Brown University, Department of Economics / Working Papers (6) RePEc:cdl:anderf:1043 Financial Market Runs (2002). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (7) RePEc:cdl:anderf:1046 Electricity Forward Prices: A High-Frequency Empirical Analysis (2002). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (8) RePEc:cdl:anderf:1049 Debt Policy, Corporate Taxes, and Discount Rates (2002). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (9) RePEc:cir:cirwor:2002s-02 Financial Asset Returns, Market Timing, and Volatility Dynamics (2002). CIRANO / CIRANO Working Papers (10) RePEc:cir:cirwor:2002s-58 Alternative Models for Stock Price Dynamics (2002). CIRANO / CIRANO Working Papers (11) RePEc:cir:cirwor:2002s-90 Analytic Evaluation of Volatility Forecasts (2002). CIRANO / CIRANO Working Papers (12) RePEc:cir:cirwor:2002s-92 ARMA Representation of Two-Factor Models (2002). CIRANO / CIRANO Working Papers (13) RePEc:cir:cirwor:2002s-93 ARMA Representation of Integrated and Realized Variances (2002). CIRANO / CIRANO Working Papers (14) RePEc:cla:princt:98734966f1c1a57373801367fbdf0a4b Overconfidence, Short-Sale Constraints and Bubbles (2002). UCLA Department of Economics / Princeton Economic Theory Working Papers (15) RePEc:cmu:gsiawp:1052333535 Imperfect Competition in Financial Markets: ISLAND vs. NASDAQ (2002). Carnegie Mellon University, Tepper School of Business / GSIA Working Papers (16) RePEc:cns:cnscwp:200202 Concentration in the banking industry and economic growth (2002). Centre for North South Economic Research, University of Cagliari and Sassari, Sardinia / Working Paper CRENoS (17) RePEc:cpr:ceprdp:3168 What Do State-Owned Firms Maximize? Evidence from the Italian Banks (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:3203 Venture Capital Contracts and Market Structure (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:3234 Family Firms (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:cpr:ceprdp:3243 Characteristics, Contracts and Actions: Evidence from Venture Capitalist Analyses (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (21) RePEc:cpr:ceprdp:3307 Does Local Financial Development Matter? (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (22) RePEc:cpr:ceprdp:3310 Some Contagion, Some Interdependence: More Pitfalls in Tests of Financial Contagion (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (23) RePEc:cpr:ceprdp:3353 Momentum and Turnover: Evidence from the German Stock Market (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (24) RePEc:cpr:ceprdp:3364 The Benefits and Costs of Group Affiliation: Evidence from East Asia (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (25) RePEc:cpr:ceprdp:3410 Stock Valuation and Learning about Profitability (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (26) RePEc:cpr:ceprdp:3411 Banks versus Venture Capital (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (27) RePEc:cpr:ceprdp:3461 Optimal Diversification (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (28) RePEc:cpr:ceprdp:3521 Europes New Stock Markets (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (29) RePEc:cpr:ceprdp:3546 The Performance of Optimally Diversified Firms: Reconciling Theory and Evidence (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (30) RePEc:cpr:ceprdp:3630 The Corporate Governance Role of the Media (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (31) RePEc:cpr:ceprdp:3644 Bids and Allocations in European IPO Bookbuilding (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (32) RePEc:cpr:ceprdp:3651 The Role of Transaction Costs for Financial Volatility: Evidence from the Paris Bourse (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (33) RePEc:cte:wbrepe:wb020702 BANK DEBT AND MARKET DEBT: AN EMPIRICAL ANALYSIS FOR SPANISH FRIMS (2002). Universidad Carlos III, Departamento de Economía de la Empresa / Business Economics Working Papers (34) RePEc:cte:wbrepe:wb026022 ASSET PRICING AND SYSTEMATIC LIQUIDITY RISK: AN EMPIRICAL INVESTIGATION OF THE SPANISH STOCK MARKET (2002). Universidad Carlos III, Departamento de Economía de la Empresa / Business Economics Working Papers (35) RePEc:cte:wsrepe:ws025414 ESTIMATION METHODS FOR STOCHASTIC VOLATILITY MODELS: A SURVEY (2002). Universidad Carlos III, Departamento de Estadística y Econometría / Statistics and Econometrics Working Papers (36) RePEc:ctl:louvir:2002002 Centralization Versus Decentralization in Credit Lending (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (37) RePEc:dgr:eureri:2002259 The Cost of Capital of Cross-Listed Firms (2002). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (38) RePEc:dgr:kubcen:200216 Distance, lending relationships, and competition (2002). Tilburg University, Center for Economic Research / Discussion Paper (39) RePEc:dgr:uvatin:20020070 Does Risk Seeking drive Asset Prices? (2002). Tinbergen Institute / Tinbergen Institute Discussion Papers (40) RePEc:ebg:iesewp:d-0471 Value creation in European M&As. (2002). IESE Business School / IESE Research Papers (41) RePEc:fip:fedawp:2002-12 Empirical studies of financial innovation: lots of talk, little action? (2002). Federal Reserve Bank of Atlanta / Working Paper (42) RePEc:fip:fedbcp:y:2002 Banking stability, reputational rents, and the stock market: should bank regulators care about stock prices? (2002). Conference Series ; [Proceedings] (43) RePEc:fip:fedder:y:2002:n:v.1no.2 Banks venture into new territory (2002). Economic and Financial Policy Review (44) RePEc:fip:fedfap:2002-23 Nonlinearities in international business cycles (2002). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (45) RePEc:fip:fedfpb:02-11 Loans to Japanese borrowers (2002). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (46) RePEc:fip:fedfpr:y:2002:i:sep:x:3 Loans to Japanese borrowers (2002). Proceedings (47) RePEc:fip:fedgfe:2002-26 Credit scoring and the availability, price, and risk of small business credit (2002). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (48) RePEc:fip:fedgfe:2002-58 Demand estimation and consumer welfare in the banking industry (2002). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (49) RePEc:fip:fedhpr:y:2002:i:may:p:469-493 Are mergers beneficial to consumers? evidence from the market for bank deposits (2002). Proceedings (50) RePEc:fip:fedhpr:y:2002:i:may:x:1 The effects of focus and diversification on bank risk and return: evidence from individual bank loan portfolios (2002). Proceedings (51) RePEc:fip:fedlsp:2002-03 The demise of community banks? local economic shocks arent to blame (2002). Federal Reserve Bank of St. Louis / Supervisory Policy Analysis Working Papers (52) RePEc:fip:fedlsp:2002-11 Community bank performance in the presence of county economic shocks (2002). Federal Reserve Bank of St. Louis / Supervisory Policy Analysis Working Papers (53) RePEc:fip:fednsr:153 Borrowers financial constraints and the transmission of monetary policy: evidence from financial conglomerates (2002). Federal Reserve Bank of New York / Staff Reports (54) RePEc:hhb:aarfin:2002_003 Revisiting the shape of the yield curve: the effect of interest rate volatility. (2002). Aarhus School of Business, Department of Finance / Working Papers (55) RePEc:hhb:aarfin:2002_023 Efficient Control Variates and Strategies for Bermudan Swaptions in a Libor Market Model (2002). Aarhus School of Business, Department of Finance / Working Papers (56) RePEc:hhs:sifrwp:0010 Which Investors Fear Expropriation? (2002). Swedish Institute for Financial Research / SIFR Research Report Series (57) RePEc:hhs:sifrwp:0011 Corporate Governance and the Home Bias (2002). Swedish Institute for Financial Research / SIFR Research Report Series (58) RePEc:hhs:sunrpe:2002_0006 Financial Markets, Industrial Specialization and Comparative Advantage - Evidence from OECD Countries (2002). Stockholm University, Department of Economics / Research Papers in Economics (59) RePEc:hit:hitcei:2002-8 Business Groups and Risk Sharing around the World (2002). Institute of Economic Research, Hitotsubashi University / Working Paper Series (60) RePEc:ide:wpaper:1037 Efficient Estimation of Jump Diffusions and General Dynamic Models with a Continuum of Moment Conditions (2002). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (61) RePEc:jae:japmet:v:17:y:2002:i:5:p:479-508 A theoretical comparison between integrated and realized volatility (2002). Journal of Applied Econometrics (62) RePEc:lau:crdeep:02.07 Cannibalization & Incentives in Venture Financing (2002). Université de Lausanne, Ecole des HEC, DEEP / Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) (63) RePEc:mtl:montde:2002-21 Correcting the Errors : A Note on Volatility Forecast Evaluation Based on High-Frequency Data and Realized Volatilities (2002). Universite de Montreal, Departement de sciences economiques / Cahiers de recherche (64) RePEc:mtl:montec:21-2002 Correcting the Errors : A Note on Volatility Forecast Evaluation Based on High-Frequency Data and Realized Volatilities (2002). Centre interuniversitaire de recherche en économie quantitative, CIREQ / Cahiers de recherche (65) RePEc:nbr:nberte:0286 Estimating Affine Multifactor Term Structure Models Using Closed-Form Likelihood Expansions (2002). National Bureau of Economic Research, Inc / NBER Technical Working Papers (66) RePEc:nbr:nberwo:8750 When Does the Market Matter? Stock Prices and the Investment of Equity-Dependent Firms (2002). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:nbr:nberwo:8752 Does Function Follow Organizational Form? Evidence From the Lending Practices of Large and Small Banks (2002). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:nbr:nberwo:8764 Characteristics, Contracts, and Actions: Evidence from Venture Capitalist Analyses (2002). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:8776 Family Firms (2002). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:8782 Columbus Egg: The Real Determinant of Capital Structure (2002). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:8793 Who Underreacts to Cash-Flow News? Evidence from Trading between Individuals and Institutions (2002). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nbr:nberwo:8805 A Review of IPO Activity, Pricing, and Allocations (2002). National Bureau of Economic Research, Inc / NBER Working Papers (73) RePEc:nbr:nberwo:8816 Market Liquidity as a Sentiment Indicator (2002). National Bureau of Economic Research, Inc / NBER Working Papers (74) RePEc:nbr:nberwo:8826 Rational Asset Prices (2002). National Bureau of Economic Research, Inc / NBER Working Papers (75) RePEc:nbr:nberwo:8848 Related Lending (2002). National Bureau of Economic Research, Inc / NBER Working Papers (76) RePEc:nbr:nberwo:8923 Does Local Financial Development Matter? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (77) RePEc:nbr:nberwo:8987 Stocks as Money: Convenience Yield and the Tech-Stock Bubble (2002). National Bureau of Economic Research, Inc / NBER Working Papers (78) RePEc:nbr:nberwo:8991 Stock Valuation and Learning about Profitability (2002). National Bureau of Economic Research, Inc / NBER Working Papers (79) RePEc:nbr:nberwo:9009 Bidder Discounts and Target Premia in Takeovers (2002). National Bureau of Economic Research, Inc / NBER Working Papers (80) RePEc:nbr:nberwo:9056 On the Relationship Between the Conditional Mean and Volatility of Stock Returns: A Latent VAR Approach (2002). National Bureau of Economic Research, Inc / NBER Working Papers (81) RePEc:nbr:nberwo:9070 Institutional Allocation In Initial Public Offerings: Empirical Evidence (2002). National Bureau of Economic Research, Inc / NBER Working Papers (82) RePEc:nbr:nberwo:9178 Bond Risk Premia (2002). National Bureau of Economic Research, Inc / NBER Working Papers (83) RePEc:nbr:nberwo:9252 Firm-Specific Resources, Financial-Market Development and the Growth of U.S. Multinationals (2002). National Bureau of Economic Research, Inc / NBER Working Papers (84) RePEc:nbr:nberwo:9264 What is the Price of Hubris? Using Takeover Battles to Infer Overpayments and Synergies (2002). National Bureau of Economic Research, Inc / NBER Working Papers (85) RePEc:nbr:nberwo:9277 Anomalies and Market Efficiency (2002). National Bureau of Economic Research, Inc / NBER Working Papers (86) RePEc:nbr:nberwo:9289 Employee Stock Options, Corporate Taxes and Debt Policy (2002). National Bureau of Economic Research, Inc / NBER Working Papers (87) RePEc:nbr:nberwo:9301 Stochastic Taxation and Asset Pricing in Dynamic General Equilibrium (2002). National Bureau of Economic Research, Inc / NBER Working Papers (88) RePEc:nbr:nberwo:9353 Debt Policy, Corporate Taxes, and Discount Rates (2002). National Bureau of Economic Research, Inc / NBER Working Papers (89) RePEc:nbr:nberwo:9369 Debt Relief: What Do the Markets Think? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (90) RePEc:rif:dpaper:768 Asymmetric Information and the Market Structure of the Venture Capital Industry (Revised) (2002). The Research Institute of the Finnish Economy / Discussion Papers (91) RePEc:sbs:wpsefe:2002mf05 Variational Sums and Power Variation: a unifying approach to model selection and estimation in semimartingale models (2002). Oxford Financial Research Centre / OFRC Working Papers Series (92) RePEc:sef:csefwp:80 Distance, Lending Relationships, and Competition (2002). Centre for Studies in Economics and Finance (CSEF), University of Salerno, Italy / CSEF Working Papers (93) RePEc:ste:nystbu:02-18 Empirical Studies of Financial Innovation: Lots of Talk, Little Action? (2002). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers (94) RePEc:ucy:cypeua:0209 Household Stockholding in Europe: Where Do We Stand and Where Do We Go? (2002). University of Cyprus Department of Economics / University of Cyprus Working Papers in Economics (95) RePEc:una:unccee:wp0102 Stock Market Cycles and Stock Market Development in Spain (2002). School of Economics and Business Administration, University of Navarra / Faculty Working Papers (96) RePEc:wbk:wbrwps:2818 Corporate Governance, Investor Protection, and Performance in Emerging Markets (2002). The World Bank / Policy Research Working Paper Series (97) RePEc:wbk:wbrwps:2904 Law and Finance: Why Does Legal Origin Matter? (2002). The World Bank / Policy Research Working Paper Series (98) RePEc:wop:jopovw:257 Defined Contribution Pensions: Plan Rules, Participant Decisions, and the Path of Least Resistance (2002). Northwestern University/University of Chicago Joint Center for Poverty Research / JCPR Working Papers (99) RePEc:wop:pennin:02-27 Parametric and Nonparametric Volatility Measurement (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (100) RePEc:wop:pennin:02-34 Forecasting the Term Structure of Government Bond Yields (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers More than 100 citations. List broken... Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |