|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

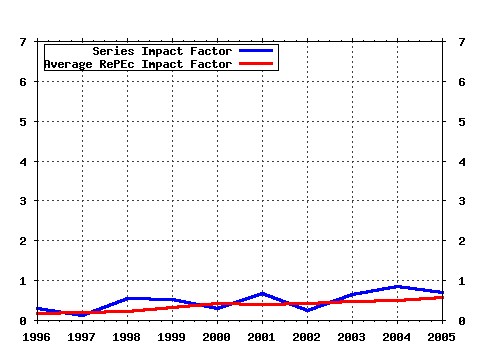

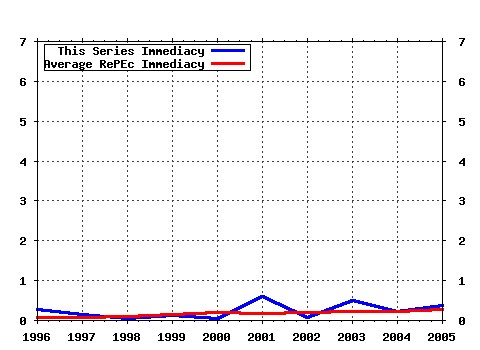

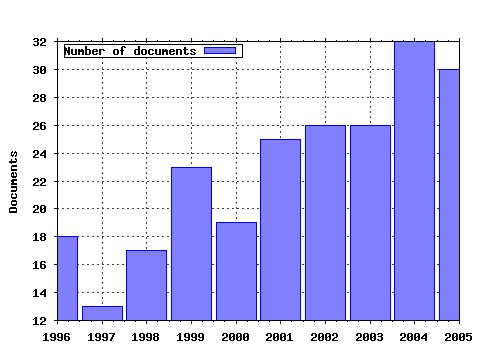

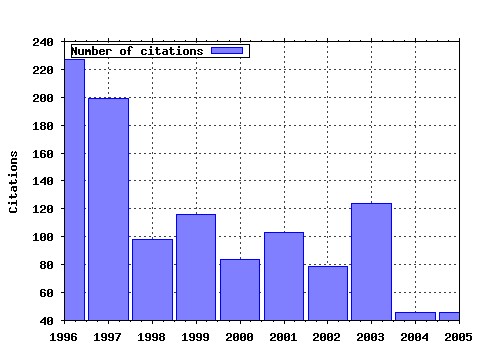

Journal of Empirical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:empfin:v:1:y:1993:i:1:p:83-106 A long memory property of stock market returns and a new model (1993). (2) RePEc:eee:empfin:v:3:y:1996:i:2:p:123-192 The forward discount anomaly and the risk premium: A survey of recent evidence (1996). (3) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:115-158 Intraday periodicity and volatility persistence in financial markets (1997). (4) RePEc:eee:empfin:v:3:y:1996:i:1:p:15-102 The econometrics of financial markets (1996). (5) RePEc:eee:empfin:v:5:y:1998:i:4:p:397-416 Volatility and cross correlation across major stock markets (1998). (6) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:73-114 High frequency data in financial markets: Issues and applications (1997). (7) RePEc:eee:empfin:v:4:y:1997:i:4:p:317-340 The incremental volatility information in one million foreign exchange quotations (1997). (8) RePEc:eee:empfin:v:10:y:2003:i:1-2:p:3-56 Emerging markets finance (2003). (9) RePEc:eee:empfin:v:1:y:1994:i:3-4:p:313-341 Alternative constructions of Tobins q: An empirical comparison (1994). (10) RePEc:eee:empfin:v:9:y:2002:i:5:p:495-510 Market timing and return prediction under model instability (2002). (11) RePEc:eee:empfin:v:6:y:1999:i:5:p:457-477 Forecasting financial market volatility: Sample frequency vis-a-vis forecast horizon (1999). (12) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:213-239 Volatilities of different time resolutions -- Analyzing the dynamics of market components (1997). (13) RePEc:eee:empfin:v:10:y:2003:i:1-2:p:81-103 A simple measure of the intensity of capital controls (2003). (14) RePEc:eee:empfin:v:9:y:2002:i:3:p:271-285 Asymmetric information and price discovery in the FX market: does Tokyo know more about the yen? (2002). (15) RePEc:eee:empfin:v:8:y:2001:i:5:p:573-637 The specification of conditional expectations (2001). (16) RePEc:eee:empfin:v:7:y:2000:i:3-4:p:271-300 Estimation of tail-related risk measures for heteroscedastic financial time series: an extreme value approach (2000). (17) RePEc:eee:empfin:v:7:y:2000:i:3-4:p:225-245 Sensitivity analysis of Values at Risk (2000). (18) RePEc:eee:empfin:v:1:y:1994:i:2:p:133-160 A contingent claim approach to performance evaluation (1994). (19) RePEc:eee:empfin:v:1:y:1994:i:2:p:211-248 Testing the covariance stationarity of heavy-tailed time series: An overview of the theory with applications to several financial datasets (1994). (20) RePEc:eee:empfin:v:8:y:2001:i:5:p:459-491 Why long horizons? A study of power against persistent alternatives (2001). (21) RePEc:eee:empfin:v:4:y:1997:i:4:p:295-315 Public information releases, private information arrival and volatility in the foreign exchange market (1997). (22) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:187-212 Forecasting the frequency of changes in quoted foreign exchange prices with the autoregressive conditional duration model (1997). (23) RePEc:eee:empfin:v:1:y:1993:i:1:p:3-31 Common stock offerings across the business cycle : Theory and evidence (1993). (24) RePEc:eee:empfin:v:10:y:2003:i:4:p:505-531 Univariate and multivariate stochastic volatility models: estimation and diagnostics (2003). (25) RePEc:eee:empfin:v:6:y:1999:i:2:p:193-215 Real exchange rates and nontradables: A relative price approach (1999). (26) RePEc:eee:empfin:v:4:y:1997:i:1:p:17-46 An artificial neural network-GARCH model for international stock return volatility (1997). (27) RePEc:eee:empfin:v:1:y:1993:i:1:p:107-131 International asset pricing with alternative distributional specifications (1993). (28) RePEc:eee:empfin:v:5:y:1998:i:3:p:281-296 International evidence on the stock market and aggregate economic activity (1998). (29) RePEc:eee:empfin:v:6:y:1999:i:4:p:335-353 Multivariate unit root tests of the PPP hypothesis (1999). (30) RePEc:eee:empfin:v:8:y:2001:i:1:p:83-110 Recovering the probability density function of asset prices using garch as diffusion approximations (2001). (31) RePEc:eee:empfin:v:8:y:2001:i:3:p:325-342 Testing and comparing Value-at-Risk measures (2001). (32) RePEc:eee:empfin:v:6:y:1999:i:3:p:309-331 A primer on hedge funds (1999). (33) RePEc:eee:empfin:v:7:y:2000:i:5:p:531-554 Value-at-Risk: a multivariate switching regime approach (2000). (34) RePEc:eee:empfin:v:2:y:1995:i:3:p:225-251 The relationship between GARCH and symmetric stable processes: Finding the source of fat tails in financial data (1995). (35) RePEc:eee:empfin:v:2:y:1995:i:1:p:71-93 Small sample rank tests with applications to asset pricing (1995). (36) RePEc:eee:empfin:v:11:y:2004:i:3:p:379-398 Modelling daily Value-at-Risk using realized volatility and ARCH type models (2004). (37) RePEc:eee:empfin:v:2:y:1995:i:3:p:173-197 The structure of international stock returns and the integration of capital markets (1995). (38) RePEc:eee:empfin:v:1:y:1994:i:3-4:p:279-311 Neglected common factors in exchange rate volatility (1994). (39) RePEc:eee:empfin:v:3:y:1996:i:2:p:215-238 Unit roots and the estimation of interest rate dynamics (1996). (40) RePEc:eee:empfin:v:6:y:1999:i:4:p:355-384 Mean reversion in Southeast Asian stock markets (1999). (41) RePEc:eee:empfin:v:10:y:2003:i:5:p:641-660 Central bank interventions and jumps in double long memory models of daily exchange rates (2003). (42) RePEc:eee:empfin:v:7:y:2000:i:1:p:87-111 Coincident and leading indicators of the stock market (2000). (43) RePEc:eee:empfin:v:8:y:2001:i:2:p:111-155 Testing for mean-variance spanning: a survey (2001). (44) RePEc:eee:empfin:v:1:y:1993:i:1:p:33-55 The performance of international asset allocation strategies using conditioning information (1993). (45) RePEc:eee:empfin:v:8:y:2001:i:5:p:537-572 The independence axiom and asset returns (2001). (46) RePEc:eee:empfin:v:4:y:1997:i:4:p:341-372 The analysis of foreign exchange data using waveform dictionaries (1997). (47) RePEc:eee:empfin:v:11:y:2004:i:3:p:399-421 Occasional structural breaks and long memory with an application to the S&P 500 absolute stock returns (2004). (48) RePEc:eee:empfin:v:12:y:2005:i:3:p:476-489 Testing for contagion: a conditional correlation analysis (2005). (49) RePEc:eee:empfin:v:6:y:1999:i:2:p:177-192 Target zones and conditional volatility: The role of realignments (1999). (50) RePEc:eee:empfin:v:7:y:2000:i:5:p:509-530 Bivariate FIGARCH and fractional cointegration (2000). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:bru:bruedp:05-08 TESTING FOR FINANCIAL CONTAGION BETWEEN DEVELOPED AND EMERGING MARKETS DURING THE 1997 EAST ASIAN CRISIS (2005). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:cfs:cfswop:wp200533 The Volatility of Realized Volatility (2005). Center for Financial Studies / CFS Working Paper Series (3) RePEc:cpr:ceprdp:5261 Rational Inattention: A Solution to the Forward Discount Puzzle (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:crt:wpaper:0521 Conditional autoregressive valu at risk by regression quantile: Estimatingmarket risk for major stock markets (2005). University of Crete, Department of Economics / Working Papers (5) RePEc:dgr:kubcen:200599 Testing for mean-coherent regular risk spanning (2005). Tilburg University, Center for Economic Research / Discussion Paper (6) RePEc:dul:wpaper:06-07rs Sector diversification during crises: A European perspective (2005). Université libre de Bruxelles, Department of Applied Economics (DULBEA) / Working Papers DULBEA (7) RePEc:eea:boewps:wp2005-06 Application of investment models in foreign exchange reserve management in Eesti Pank (2005). Bank of Estonia / Bank of Estonia Working Papers (8) RePEc:ijf:ijfiec:v:10:y:2005:i:4:p:359-367 Testing for financial contagion between developed and emerging markets during the 1997 East Asian crisis (2005). International Journal of Finance & Economics (9) RePEc:nbr:nberwo:11452 The Effects of Taxes on Market Responses to Dividend Announcements and Payments: What Can we Learn from the 2003 Dividend Tax Cut? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:sca:scaewp:0512 Do the technical indicators reward chartists? A study on the stock markets of China, Hong Kong and Taiwan (2005). National University of Singapore, Department of Economics, SCAPE / SCAPE Policy Research Working Paper Series (11) RePEc:sce:scecf5:384 The Long and the Short of It: Long Memory Regressors and Predictive Regressions (2005). Society for Computational Economics / Computing in Economics and Finance 2005 Latest citations received in: 2004 (1) RePEc:ctl:louvec:2005015 Volatility regimes and the provisions of liquidity in order book markets (2004). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (2) RePEc:dgr:eureri:30001967 Fund liquidation, self-selection and look-ahead bias in the hedge fund industry (2004). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (3) RePEc:dgr:uvatin:20040016 Forecasting Daily Variability of the S&P 100 Stock Index using Historical, Realised and Implied Volatility Measurements (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (4) RePEc:dgr:uvatin:20040067 Modeling and Forecasting S&P 500 Volatility: Long Memory, Structural Breaks and Nonlinearity (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (5) RePEc:fip:fedkrw:rwp04-07 Aggregate consumption wealth ratio : does it work internationally? (2004). Federal Reserve Bank of Kansas City / Research Working Paper (6) RePEc:nbb:reswpp:200405-5 How does liquidity react to stress periods in a limit order market? (2004). National Bank of Belgium / Research series (7) RePEc:zbw:bubdp1:2162 Who do you trust while bubbles grow and blow? : A comparative analysis of the explanatory power of accounting and patent information for the market values of German firms (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Latest citations received in: 2003 (1) RePEc:cfs:cfswop:wp200335 Some Like it Smooth, and Some Like it Rough: Untangling Continuous and Jump Components in Measuring, Modeling, and Forecasting Asset Return Volatility (2003). Center for Financial Studies / CFS Working Paper Series (2) RePEc:dgr:umamet:2003057 Central Bank Forex Interventions Assessed Using Realized Moments (2003). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (3) RePEc:fip:fedcwp:0315 Government intervention in the foreign exchange market (2003). Federal Reserve Bank of Cleveland / Working Paper (4) RePEc:fip:fedgif:755 Diversification, original sin, and international bond portfolios (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (5) RePEc:fip:fedgif:770 Cross-board listings, capital controls, and equity flows to emerging markets (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (6) RePEc:fip:fedgif:771 U.S. investors emerging market equity portfolios: a security-level analysis (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (7) RePEc:hhs:umnees:0614 Temporal Aggregation of the Returns of a Stock Index Series (2003). Umeå University, Department of Economics / Umeå Economic Studies (8) RePEc:imf:imfwpa:03/236 Cross-Border Listings, Capital Controls, and U.S. Equity Flows to Emerging Markets (2003). International Monetary Fund / IMF Working Papers (9) RePEc:imf:imfwpa:03/238 U.S. Investors Emerging Market Equity Portfolios: A Security-Level Analysis (2003). International Monetary Fund / IMF Working Papers (10) RePEc:imf:imfwpa:03/86 International Financial Integration (2003). International Monetary Fund / IMF Working Papers (11) RePEc:ind:icrier:109 The Dynamics of foreign portfolio inflows and equity returns in India (2003). Indian Council for Research on International Economic Relations, New Delhi, India / Indian Council for Research on International Economic Relations, (12) RePEc:ivi:wpasad:2003-34 FORECASTING THE CONDITIONAL COVARIANCE MATRIX OF A PORTFOLIO UNDER LONG-RUN TEMPORAL DEPENDENCE (2003). Instituto Valenciano de Investigaciones Económicas, S.A. (Ivie) / Working Papers. Serie AD (13) RePEc:wpa:wuwpfi:0305007 CONDITIONAL VOLATILITY OF MOST ACTIVE SHARES OF CASABLANCA STOCK EXCHANGE (2003). EconWPA / Finance Latest citations received in: 2002 (1) RePEc:cte:wsrepe:ws025414 ESTIMATION METHODS FOR STOCHASTIC VOLATILITY MODELS: A SURVEY (2002). Universidad Carlos III, Departamento de Estadística y Econometría / Statistics and Econometrics Working Papers (2) RePEc:fip:fedkrw:rwp02-05 Forecast-based model selection in the presence of structural breaks (2002). Federal Reserve Bank of Kansas City / Research Working Paper Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |