|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

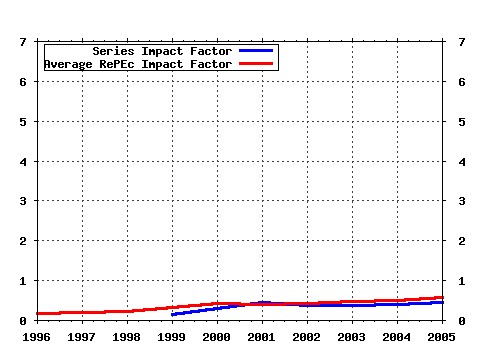

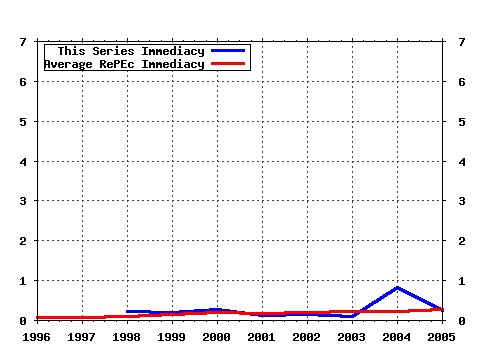

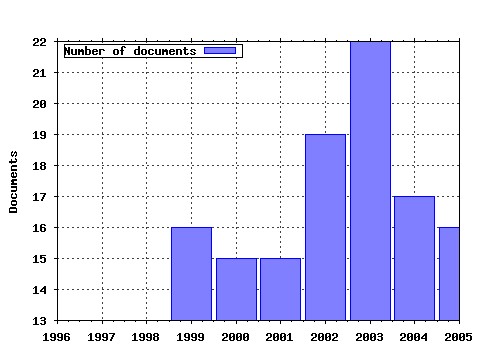

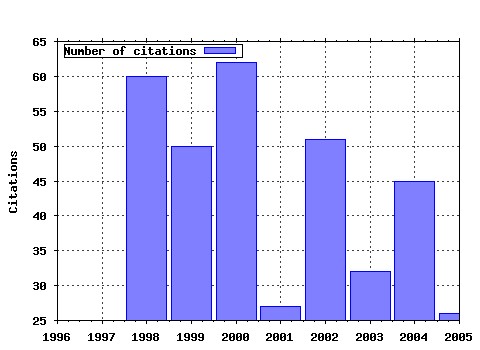

Journal of Financial Markets Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finmar:v:1:y:1998:i:3-4:p:353-383 Aggressiveness and survival of overconfident traders (1998). (2) RePEc:eee:finmar:v:3:y:2000:i:3:p:205-258 Market microstructure: A survey (2000). (3) RePEc:eee:finmar:v:5:y:2002:i:1:p:31-56 Illiquidity and stock returns: cross-section and time-series effects (2002). (4) RePEc:eee:finmar:v:7:y:2004:i:1:p:53-74 Order aggressiveness in limit order book markets (2004). (5) RePEc:eee:finmar:v:2:y:1999:i:2:p:99-134 Order flow composition and trading costs in a dynamic limit order market1 (1999). (6) RePEc:eee:finmar:v:3:y:2000:i:2:p:83-111 Inferring investor behavior: Evidence from TORQ data (2000). (7) RePEc:eee:finmar:v:1:y:1998:i:1:p:1-50 Optimal control of execution costs (1998). (8) RePEc:eee:finmar:v:3:y:2000:i:3:p:259-286 On the occurrence and consequences of inaccurate trade classification (2000). (9) RePEc:eee:finmar:v:7:y:2004:i:1:p:1-25 Impacts of trades in an error-correction model of quote prices (2004). (10) RePEc:eee:finmar:v:4:y:2001:i:1:p:73-84 On the survival of overconfident traders in a competitive securities market (2001). (11) RePEc:eee:finmar:v:2:y:1999:i:4:p:329-357 The organization of financial exchange markets: Theory and evidence (1999). (12) RePEc:eee:finmar:v:8:y:2005:i:2:p:217-264 Market microstructure: A survey of microfoundations, empirical results, and policy implications (2005). (13) RePEc:eee:finmar:v:5:y:2002:i:3:p:309-321 Price discovery and common factor models (2002). (14) RePEc:eee:finmar:v:1:y:1998:i:2:p:203-219 Liquidity and stock returns: An alternative test (1998). (15) RePEc:eee:finmar:v:6:y:2003:i:4:p:461-489 Quote setting and price formation in an order driven market (2003). (16) RePEc:eee:finmar:v:7:y:2004:i:3:p:271-299 Market liquidity as a sentiment indicator (2004). (17) RePEc:eee:finmar:v:8:y:2005:i:3:p:265-287 Should securities markets be transparent? (2005). (18) RePEc:eee:finmar:v:2:y:1999:i:3:p:227-271 Reputation and performance fee effects on portfolio choice by investment advisers1 (1999). (19) RePEc:eee:finmar:v:3:y:2000:i:4:p:333-363 Market structure, informational efficiency and liquidity: An experimental comparison of auction and dealer markets (2000). (20) RePEc:eee:finmar:v:5:y:2002:i:3:p:259-276 Some desiderata for the measurement of price discovery across markets (2002). (21) RePEc:eee:finmar:v:2:y:1999:i:3:p:193-226 Intra-day market activity (1999). (22) RePEc:eee:finmar:v:5:y:2002:i:3:p:277-308 Security price adjustment across exchanges: an investigation of common factor components for Dow stocks (2002). (23) RePEc:eee:finmar:v:6:y:2003:i:4:p:517-538 Traders choice between limit and market orders: evidence from NYSE stocks (2003). (24) RePEc:eee:finmar:v:6:y:2003:i:1:p:1-21 Excess demand and equilibration in multi-security financial markets: the empirical evidence (2003). (25) RePEc:eee:finmar:v:5:y:2002:i:1:p:57-82 Intraday analysis of market integration: Dutch blue chips traded in Amsterdam and New York (2002). (26) RePEc:eee:finmar:v:2:y:1999:i:1:p:49-68 The alpha factor asset pricing model: A parable (1999). (27) RePEc:eee:finmar:v:4:y:2001:i:4:p:385-412 Knowing me, knowing you: : Trader anonymity and informed trading in parallel markets (2001). (28) RePEc:eee:finmar:v:5:y:2002:i:2:p:223-257 The impact of the Federal Reserve Banks open market operations (2002). (29) RePEc:eee:finmar:v:4:y:2001:i:2:p:113-142 Predicting VNET: A model of the dynamics of market depth (2001). (30) RePEc:eee:finmar:v:8:y:2005:i:4:p:377-399 Duration, volume and volatility impact of trades (2005). (31) RePEc:eee:finmar:v:2:y:1999:i:1:p:29-48 Market depth and order size1 (1999). (32) RePEc:eee:finmar:v:7:y:2004:i:3:p:301-333 Trading strategies during circuit breakers and extreme market movements (2004). (33) RePEc:eee:finmar:v:5:y:2002:i:2:p:127-167 Market architecture: limit-order books versus dealership markets (2002). (34) RePEc:eee:finmar:v:3:y:2000:i:1:p:45-67 Stock returns and trading at the close (2000). (35) RePEc:eee:finmar:v:6:y:2003:i:3:p:233-257 Issues in assessing trade execution costs (2003). (36) RePEc:eee:finmar:v:10:y:2007:i:1:p:1-25 Measuring the resiliency of an electronic limit order book (2007). (37) RePEc:eee:finmar:v:8:y:2005:i:1:p:1-23 Trade-through prohibitions and market quality (2005). (38) RePEc:eee:finmar:v:4:y:2001:i:2:p:185-208 An experimental study of circuit breakers: The effects of mandated market closures and temporary halts on market behavior (2001). (39) RePEc:eee:finmar:v:1:y:1998:i:2:p:175-201 Financial analysts and information-based trade (1998). (40) RePEc:eee:finmar:v:9:y:2006:i:2:p:144-161 Cross-listing, price discovery and the informativeness of the trading process (2006). (41) RePEc:eee:finmar:v:3:y:2000:i:1:p:69-81 The capital asset pricing model and the liquidity effect: A theoretical approach (2000). (42) RePEc:eee:finmar:v:3:y:2000:i:4:p:365-387 Investor risk evaluation in the determination of management incentives in the mutual fund industry (2000). (43) RePEc:eee:finmar:v:7:y:2004:i:2:p:145-185 Expandable limit order markets (2004). (44) RePEc:eee:finmar:v:6:y:2003:i:2:p:99-141 Reputation and interdealer trading: a microstructure analysis of the Treasury Bond market (2003). (45) RePEc:eee:finmar:v:1:y:1998:i:1:p:51-87 Decimalization and competition among stock markets: Evidence from the Toronto Stock Exchange cross-listed securities (1998). (46) RePEc:eee:finmar:v:9:y:2006:i:2:p:180-198 Option-implied risk preferences: An extension to wider classes of utility functions (2006). (47) RePEc:eee:finmar:v:6:y:2003:i:3:p:259-280 Evaluation of the biases in execution cost estimation using trade and quote data (2003). (48) RePEc:eee:finmar:v:5:y:2002:i:3:p:329-339 Stalking the efficient price in market microstructure specifications: an overview (2002). (49) RePEc:eee:finmar:v:3:y:2000:i:1:p:17-43 Asset market equilibrium with general tastes, returns, and informational asymmetries (2000). (50) RePEc:eee:finmar:v:8:y:2005:i:1:p:25-67 The information content of the limit order book: evidence from NYSE specialist trading decisions (2005). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:ide:wpaper:4639 Does Order Flow Fragmentation Impact Market Quality? The Case of Nasdaq SuperMontage (2005). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (2) RePEc:nbr:nberwo:11444 Optimal Trading Strategy and Supply/Demand Dynamics (2005). National Bureau of Economic Research, Inc / NBER Working Papers (3) RePEc:sbs:wpsefe:2005fe10 Price, Trade Size, and Information Revelation in Multi-Period Securities Markets (2005). Oxford Financial Research Centre / OFRC Working Papers Series (4) RePEc:wpa:wuwpfi:0510031 Price, Trade Size, and Information Revelation in Multi-Period Securities Markets (2005). EconWPA / Finance Latest citations received in: 2004 (1) RePEc:cpr:ceprdp:4456 Price Discovery in Tick Time (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:ctl:louvec:2005015 Volatility regimes and the provisions of liquidity in order book markets (2004). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (3) RePEc:ecm:ausm04:272 Duration and Order Type Clusters (2004). Econometric Society / Econometric Society 2004 Australasian Meetings (4) RePEc:ecm:feam04:730 Duration and Order Type Clusters (2004). Econometric Society / Econometric Society 2004 Far Eastern Meetings (5) RePEc:ecm:latm04:142 Understanding limit order book depth: conditioning on trade informativeness (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (6) RePEc:ecm:nasm04:476 Estimation and Testing for Partially Nonstationary Vector Autoregressive Models with GARCH: WLS versus QMLE (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (7) RePEc:kud:kuiedp:0407 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). University of Copenhagen. Department of Economics (formerly Institute of Economics) / Discussion Papers (8) RePEc:kud:kuiefr:200403 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). University of Copenhagen. Institute of Economics. Finance Research Unit / FRU Working Papers (9) RePEc:kud:kuiefr:200504 Order Aggressiveness and Order Book Dynamics (2004). University of Copenhagen. Institute of Economics. Finance Research Unit / FRU Working Papers (10) RePEc:nbb:reswpp:200405-5 How does liquidity react to stress periods in a limit order market? (2004). National Bank of Belgium / Research series (11) RePEc:nbr:nberwo:10823 Pseudo Market Timing and Predictive Regressions (2004). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:uts:rpaper:121 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (13) RePEc:wpa:wuwpfi:0408009 A local non-parametric model for trade sign inference (2004). EconWPA / Finance (14) RePEc:wpa:wuwpfi:0412012 A piecewise linear model for trade sign inference (2004). EconWPA / Finance Latest citations received in: 2003 (1) RePEc:rut:rutres:200307 Analyst Recommendations and Nasdaq Market Making Activity (2003). Rutgers University, Department of Economics / Departmental Working Papers (2) RePEc:xrs:sfbmaa:03-14 Behavioral Finance (2003). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Latest citations received in: 2002 (1) RePEc:bca:bocawp:02-33 Alternative Trading Systems: Does One Shoe Fit All? (2002). Bank of Canada / Working Papers (2) RePEc:wop:pennin:02-23 Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange? (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (3) RePEc:wpa:wuwpem:0201003 Do Bid-Ask Spreads Or Bid and Ask Depths Convey New Information First? (2002). EconWPA / Econometrics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |