|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

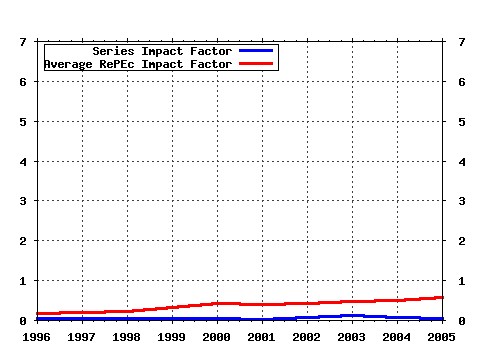

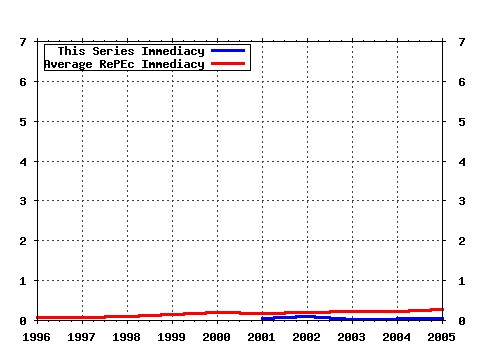

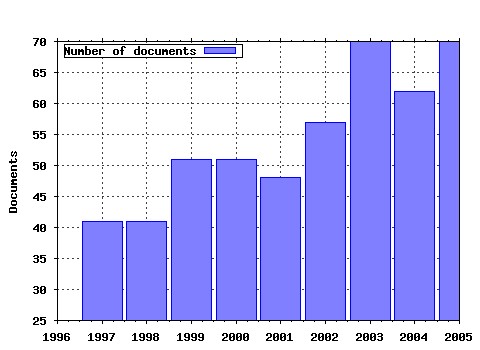

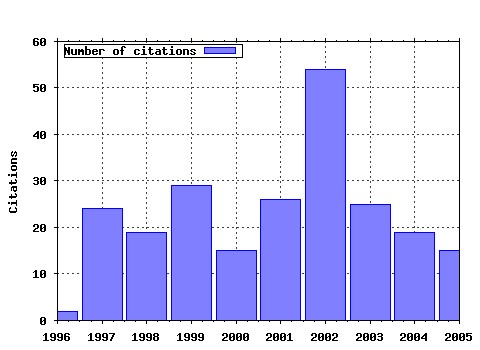

Insurance: Mathematics and Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:insuma:v:31:y:2002:i:1:p:3-33 The concept of comonotonicity in actuarial science and finance: theory (2002). (2) RePEc:eee:insuma:v:31:y:2002:i:2:p:249-265 Optimal portfolio and background risk: an exact and an approximated solution (2002). (3) RePEc:eee:insuma:v:33:y:2003:i:1:p:29-47 Pensionmetrics 2: stochastic pension plan design during the distribution phase (2003). (4) RePEc:eee:insuma:v:21:y:1997:i:2:p:173-183 Axiomatic characterization of insurance prices (1997). (5) RePEc:eee:insuma:v:31:y:2002:i:1:p:35-69 Optimal investment strategies and risk measures in defined contribution pension schemes (2002). (6) RePEc:eee:insuma:v:31:y:2002:i:2:p:267-284 Insurance premia consistent with the market (2002). (7) RePEc:eee:insuma:v:17:y:1995:i:1:p:43-54 Insurance pricing and increased limits ratemaking by proportional hazards transforms (1995). (8) RePEc:eee:insuma:v:31:y:2002:i:2:p:133-161 The concept of comonotonicity in actuarial science and finance: applications (2002). (9) RePEc:eee:insuma:v:30:y:2002:i:2:p:199-209 Optimal asset allocation in life annuities: a note (2002). (10) RePEc:eee:insuma:v:21:y:1997:i:2:p:113-127 Reserving for maturity guarantees: Two approaches (1997). (11) RePEc:eee:insuma:v:25:y:1999:i:3:p:337-347 A synthesis of risk measures for capital adequacy (1999). (12) RePEc:eee:insuma:v:28:y:2001:i:3:p:305-308 Does positive dependence between individual risks increase stop-loss premiums? (2001). (13) RePEc:eee:insuma:v:22:y:1998:i:3:p:235-242 Comonotonicity, correlation order and premium principles (1998). (14) RePEc:eee:insuma:v:31:y:2002:i:3:p:373-393 A Poisson log-bilinear regression approach to the construction of projected lifetables (2002). (15) RePEc:eee:insuma:v:24:y:1999:i:1-2:p:139-148 Fitting bivariate loss distributions with copulas (1999). (16) RePEc:eee:insuma:v:25:y:1999:i:1:p:11-21 The safest dependence structure among risks (1999). (17) RePEc:eee:insuma:v:16:y:1995:i:3:p:225-253 Equity-linked life insurance: A model with stochastic interest rates (1995). (18) RePEc:eee:insuma:v:29:y:2001:i:1:p:35-45 Minimization of risks in pension funding by means of contributions and portfolio selection (2001). (19) RePEc:eee:insuma:v:22:y:1998:i:2:p:145-161 Ordering risks: Expected utility theory versus Yaaris dual theory of risk (1998). (20) RePEc:eee:insuma:v:29:y:2001:i:2:p:187-215 Pensionmetrics: stochastic pension plan design and value-at-risk during the accumulation phase (2001). (21) RePEc:eee:insuma:v:11:y:1992:i:2:p:113-127 Stochastic discounting (1992). (22) RePEc:eee:insuma:v:33:y:2003:i:2:p:255-272 Lee-Carter mortality forecasting with age-specific enhancement (2003). (23) RePEc:eee:insuma:v:35:y:2004:i:2:p:187-203 Another look at the Picard-Lefevre formula for finite-time ruin probabilities (2004). (24) RePEc:eee:insuma:v:26:y:2000:i:1:p:37-57 Fair valuation of life insurance liabilities: The impact of interest rate guarantees, surrender options, and bonus policies (2000). (25) RePEc:eee:insuma:v:37:y:2005:i:1:p:13-26 Some notions of multivariate positive dependence (2005). (26) RePEc:eee:insuma:v:16:y:1995:i:1:p:7-22 Ruin estimates under interest force (1995). (27) RePEc:eee:insuma:v:11:y:1992:i:4:p:249-257 A Hilbert space proof of the fundamental theorem of asset pricing in finite discrete time (1992). (28) RePEc:eee:insuma:v:28:y:2001:i:2:p:233-262 Optimal investment strategy for defined contribution pension schemes (2001). (29) RePEc:eee:insuma:v:14:y:1994:i:1:p:33-37 An analytical inversion of a Laplace transform related to annuities certain (1994). (30) RePEc:eee:insuma:v:27:y:2000:i:2:p:151-168 Upper and lower bounds for sums of random variables (2000). (31) RePEc:eee:insuma:v:35:y:2004:i:1:p:113-136 Stochastic mortality in life insurance: market reserves and mortality-linked insurance contracts (2004). (32) RePEc:eee:insuma:v:22:y:1998:i:1:p:53-64 On some filtering problems arising in mathematical finance (1998). (33) RePEc:eee:insuma:v:35:y:2004:i:2:p:321-342 Optimal investment choices post-retirement in a defined contribution pension scheme (2004). (34) RePEc:eee:insuma:v:10:y:1991:i:2:p:125-131 A note on Shiu--Fisher--Weil immunization theorem (1991). (35) RePEc:eee:insuma:v:17:y:1996:i:3:p:215-222 Orderings of risks: A comparative study via stop-loss transforms (1996). (36) RePEc:eee:insuma:v:23:y:1998:i:3:p:263-286 Pension schemes as options on pension fund assets: implications for pension fund management (1998). (37) RePEc:eee:insuma:v:26:y:2000:i:2-3:p:175-183 An easy computable upper bound for the price of an arithmetic Asian option (2000). (38) RePEc:eee:insuma:v:32:y:2003:i:3:p:379-401 On the forecasting of mortality reduction factors (2003). (39) RePEc:eee:insuma:v:17:y:1995:i:1:p:19-34 Allocation of solvency cost in group annuities: Actuarial principles and cooperative game theory (1995). (40) RePEc:eee:insuma:v:23:y:1998:i:2:p:157-172 The moments of ruin time in the classical risk model with discrete claim size distribution (1998). (41) RePEc:eee:insuma:v:33:y:2003:i:3:p:595-609 Fair valuation of path-dependent participating life insurance contracts (2003). (42) RePEc:eee:insuma:v:12:y:1993:i:2:p:133-142 Ruin probabilities in the compound binomial model (1993). (43) RePEc:eee:insuma:v:6:y:1987:i:2:p:135-144 Retroactive price regulation and the fair rate of return (1987). (44) RePEc:eee:insuma:v:24:y:1999:i:1-2:p:67-81 Modelling different types of automobile insurance fraud behaviour in the Spanish market (1999). (45) RePEc:eee:insuma:v:27:y:2000:i:1:p:19-44 The moments of the time of ruin, the surplus before ruin, and the deficit at ruin (2000). (46) RePEc:eee:insuma:v:34:y:2004:i:2:p:177-192 Heterogeneous INAR(1) model with application to car insurance (2004). (47) RePEc:eee:insuma:v:25:y:1999:i:2:p:197-217 A new stochastically flexible event methodology with application to Proposition 103 (1999). (48) RePEc:eee:insuma:v:30:y:2002:i:3:p:405-420 Copula convergence theorems for tail events (2002). (49) RePEc:eee:insuma:v:37:y:2005:i:3:p:443-468 Affine processes for dynamic mortality and actuarial valuations (2005). (50) RePEc:eee:insuma:v:10:y:1991:i:3:p:173-179 A stop-loss experience rating scheme for fleets of cars (1991). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:bon:bonedp:bgse19_2005 Loss Analysis of a Life Insurance Company Applying Discrete-time Risk-minimizing Hedging Strategies (2005). University of Bonn, Germany / Bonn Econ Discussion Papers (2) RePEc:dnb:dnbwpp:063 Defined Benefit Pension Plans and Regulation (2005). Netherlands Central Bank, Research Department / DNB Working Papers (3) RePEc:ins:quaeco:qf05010 Multivariate hazard orderings of discrete random vectors (2005). Department of Economics, University of Insubria / Economics and Quantitative Methods Latest citations received in: 2004 Latest citations received in: 2003 (1) RePEc:mrr:papers:wp063 Betting on Death and Capital Markets in Retirement: A Shortfall Risk Analysis of Life Annuities versus Phased Withdrawal Plans (2003). University of Michigan, Michigan Retirement Research Center / Working Papers (2) RePEc:xrs:sfbmaa:03-02 Risk Based Capital Allocation (2003). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Latest citations received in: 2002 (1) RePEc:ctl:louvir:2002005 Optimal Portfolio Strategies with Stochastic Wage Income : The Case of A defined Contribution Pension Plan (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (2) RePEc:ctl:louvir:2002021 Optimal Pension Management under Stochastic Interest Rates, Wages, and Inflation (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (3) RePEc:ctl:louvir:2002022 How the Financial Managersâ Remuneration Can Affect the Optimal Portfolio Composition ? (2002). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (4) RePEc:icr:wpmath:10-2002 Coherence without Additivity. (2002). ICER - International Centre for Economic Research / ICER Working Papers - Applied Mathematics Series (5) RePEc:icr:wpmath:24-2002 Insurance Premia Consistent with the Market. (2002). ICER - International Centre for Economic Research / ICER Working Papers - Applied Mathematics Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |