|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

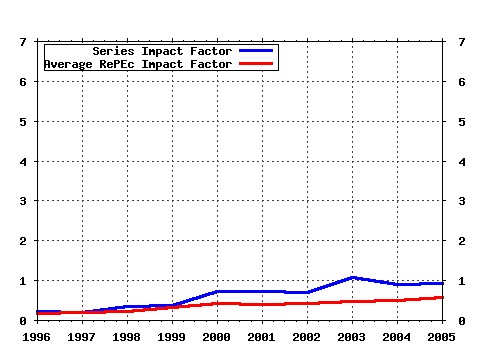

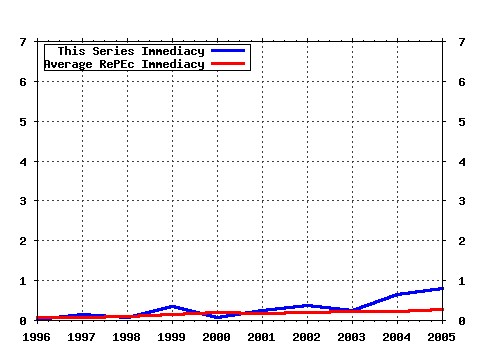

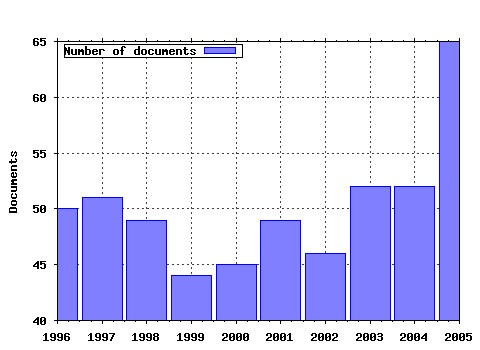

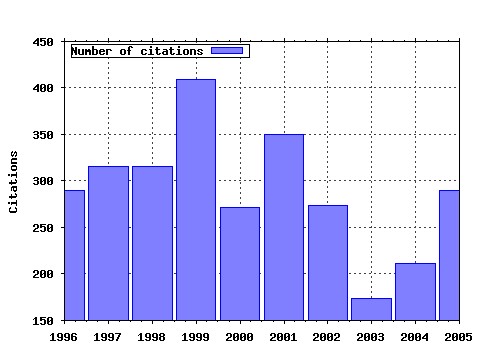

Journal of International Money and Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jimfin:v:14:y:1995:i:4:p:467-492 Home bias and high turnover (1995). (2) RePEc:eee:jimfin:v:11:y:1992:i:3:p:304-314 The use of technical analysis in the foreign exchange market (1992). (3) RePEc:eee:jimfin:v:18:y:1999:i:4:p:603-617 Contagion and trade: Why are currency crises regional? (1999). (4) RePEc:eee:jimfin:v:20:y:2001:i:2:p:249-272 Unit root tests for panel data (2001). (5) RePEc:eee:jimfin:v:20:y:2001:i:3:p:379-399 Nonlinear adjustment to purchasing power parity in the post-Bretton Woods era (2001). (6) RePEc:eee:jimfin:v:21:y:2002:i:6:p:749-776 International financial integration and economic growth (2002). (7) RePEc:eee:jimfin:v:18:y:1999:i:4:p:537-560 What triggers market jitters?: A chronicle of the Asian crisis (1999). (8) RePEc:eee:jimfin:v:19:y:2000:i:1:p:33-53 Nonlinear adjustment, long-run equilibrium and exchange rate fundamentals (2000). (9) RePEc:eee:jimfin:v:15:y:1996:i:3:p:405-418 Purchasing power parity and unit root tests using panel data (1996). (10) RePEc:eee:jimfin:v:10:y:1991:i:4:p:571-581 Cointegration: how short is the long run? (1991). (11) RePEc:eee:jimfin:v:12:y:1993:i:4:p:413-438 A geographical model for the daily and weekly seasonal volatility in the foreign exchange market (1993). (12) RePEc:eee:jimfin:v:20:y:2001:i:4:p:439-471 Currency traders and exchange rate dynamics: a survey of the US market (2001). (13) RePEc:eee:jimfin:v:17:y:1998:i:1:p:161-190 Central bank intervention and exchange rate volatility1 (1998). (14) RePEc:eee:jimfin:v:16:y:1997:i:6:p:945-954 Real exchange rate behavior (1997). (15) RePEc:eee:jimfin:v:24:y:2005:i:8:p:1177-1199 Some contagion, some interdependence: More pitfalls in tests of financial contagion (2005). (16) RePEc:eee:jimfin:v:13:y:1994:i:3:p:276-290 The monetary model of the exchange rate: long-run relationships, short-run dynamics and how to beat a random walk (1994). (17) RePEc:eee:jimfin:v:21:y:2002:i:6:p:725-748 A century of current account dynamics (2002). (18) RePEc:eee:jimfin:v:18:y:1999:i:4:p:709-723 Lessons from the Asian crisis (1999). (19) RePEc:eee:jimfin:v:15:y:1996:i:6:p:853-878 Central bank intervention and the volatility of foreign exchange rates: evidence from the options market (1996). (20) RePEc:eee:jimfin:v:16:y:1997:i:1:p:19-35 Multi-country evidence on the behavior of purchasing power parity under the current float (1997). (21) RePEc:eee:jimfin:v:16:y:1997:i:6:p:909-919 Why do central banks intervene? (1997). (22) RePEc:eee:jimfin:v:2:y:1983:i:3:p:231-237 Foreign currency option values (1983). (23) RePEc:eee:jimfin:v:24:y:2005:i:7:p:1150-1175 Empirical exchange rate models of the nineties: Are any fit to survive? (2005). (24) RePEc:eee:jimfin:v:12:y:1993:i:1:p:29-45 Exchange rate exposure and industry characteristics: evidence from Canada, Japan, and the USA (1993). (25) RePEc:eee:jimfin:v:20:y:2001:i:6:p:895-948 The microstructure of the euro money market (2001). (26) RePEc:eee:jimfin:v:16:y:1997:i:5:p:779-793 Intervention strategies and exchange rate volatility: a noise trading perspective (1997). (27) RePEc:eee:jimfin:v:19:y:2000:i:4:p:471-488 The forward premium anomaly is not as bad as you think (2000). (28) RePEc:eee:jimfin:v:16:y:1997:i:2:p:305-321 The term structure of Euro-rates: some evidence in support of the expectations hypothesis (1997). (29) RePEc:eee:jimfin:v:21:y:2002:i:3:p:295-350 The dynamics of emerging market equity flows (2002). (30) RePEc:eee:jimfin:v:3:y:1984:i:1:p:5-29 An investigation of risk and return in forward foreign exchange (1984). (31) RePEc:eee:jimfin:v:14:y:1995:i:2:p:289-310 Markup adjustment and exchange rate fluctuations: evidence from panel data on automobile exports (1995). (32) RePEc:eee:jimfin:v:15:y:1996:i:4:p:535-550 Mean reversion in real exchange rates: evidence and implications for forecasting (1996). (33) RePEc:eee:jimfin:v:12:y:1993:i:2:p:115-138 On biases in the measurement of foreign exchange risk premiums (1993). (34) RePEc:eee:jimfin:v:18:y:1999:i:4:p:587-602 Contagion:: macroeconomic models with multiple equilibria (1999). (35) RePEc:eee:jimfin:v:18:y:1999:i:4:p:561-586 Predicting currency crises:: The indicators approach and an alternative (1999). (36) RePEc:eee:jimfin:v:3:y:1984:i:3:p:327-342 Capital mobility and the relationship between saving and investment rates in OECD countries (1984). (37) RePEc:eee:jimfin:v:17:y:1998:i:4:p:671-689 On inflation and inflation uncertainty in the G7 countries (1998). (38) RePEc:eee:jimfin:v:17:y:1998:i:1:p:41-50 Increasing evidence of purchasing power parity over the current float (1998). (39) RePEc:eee:jimfin:v:12:y:1993:i:3:p:298-318 The impact of exchange rate volatility on international trade: Reduced form estimates using the GARCH-in-mean model (1993). (40) RePEc:eee:jimfin:v:19:y:2000:i:6:p:813-832 The determinants of bank interest rate margins: an international study (2000). (41) RePEc:eee:jimfin:v:13:y:1994:i:5:p:565-571 The long memory of the forward premium (1994). (42) RePEc:eee:jimfin:v:11:y:1992:i:1:p:3-16 Realistic cross-country consumption correlations in a two-country, equilibrium, business cycle model (1992). (43) RePEc:eee:jimfin:v:12:y:1993:i:5:p:451-474 The significance of technical trading-rule profits in the foreign exchange market: a bootstrap approach (1993). (44) RePEc:eee:jimfin:v:10:y:1991:i:2:p:292-307 Exchange rate volatility and international trading strategy (1991). (45) RePEc:eee:jimfin:v:17:y:1998:i:4:p:597-614 Parity reversion in real exchange rates during the post-Bretton Woods period (1998). (46) RePEc:eee:jimfin:v:16:y:1997:i:1:p:1-17 Understanding the empirical literature on purchasing power parity: the post-Bretton Woods era (1997). (47) RePEc:eee:jimfin:v:13:y:1994:i:1:p:3-25 Hourly volatility spillovers between international equity markets (1994). (48) RePEc:eee:jimfin:v:18:y:1999:i:1:p:27-45 Modeling non-linearities in real effective exchange rates (1999). (49) RePEc:eee:jimfin:v:24:y:2005:i:3:p:481-507 Simple monetary policy rules and exchange rate uncertainty (2005). (50) RePEc:eee:jimfin:v:1:y:1982:i::p:39-56 Fluctuations in the dollar: A model of nominal and real exchange rate determination (1982). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:acb:cbeeco:2005-451 Forecasting the Volatility of Australian Stock Returns: Do Common Factors Help? (2005). Australian National University, College of Business and Economics, School of Economics / ANUCBE School of Economics Working Papers (2) RePEc:aea:aecrev:v:95:y:2005:i:2:p:405-414 Meese-Rogoff Redux: Micro-based Exchange-Rate Forecasting (2005). American Economic Review (3) RePEc:bog:wpaper:27 The Comparative Performance of Q-type and Dynamic Models of Firm Investment: Empirical Evidence from the UK (2005). Special Studies Division, Economic Research Department, Bank of Greece / Working Papers (4) RePEc:bog:wpaper:29 Real Exchange Rate Dynamics and Output Contraction under Transition (2005). Special Studies Division, Economic Research Department, Bank of Greece / Working Papers (5) RePEc:chb:bcchwp:352 Monetary Policy, Exchange Rate and Inflation Inertia in Chile: a Structural Approach (2005). Central Bank of Chile / Working Papers Central Bank of Chile (6) RePEc:crt:wpaper:0521 Conditional autoregressive valu at risk by regression quantile: Estimatingmarket risk for major stock markets (2005). University of Crete, Department of Economics / Working Papers (7) RePEc:ctl:louvec:2005043 Exchange Rate Volatility and the Mixture of Distribution Hypothesis (2005). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (8) RePEc:dgr:umamet:2005024 Evidences of Interdependence and Contagion using a Frequency Domain Framework (2005). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (9) RePEc:dnb:dnbwpp:033 Were Verbal Efforts to Support the Euro Effective? A High-Frequency Analysis of ECB Statements (2005). Netherlands Central Bank, Research Department / DNB Working Papers (10) RePEc:dnb:dnbwpp:060 Bond Market and Stock Market Integration in Europe (2005). Netherlands Central Bank, Research Department / DNB Working Papers (11) RePEc:ewc:wpaper:wp76 FDI and Trade - Two Way Linkages? (2005). East-West Center, Economics Study Area / Economics Study Area Working Papers (12) RePEc:ewc:wpaper:wp84 The IMF and the Liberalization of Capital Flows (2005). East-West Center, Economics Study Area / Economics Study Area Working Papers (13) RePEc:fam:rpseri:rp155 Can Information Heterogeneity Explain the Exchange Rate Determination? (2005). International Center for Financial Asset Management and Engineering / FAME Research Paper Series (14) RePEc:fip:fedfpb:2004-15 Currency crises, capital account liberalization, and selection bias (2005). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (15) RePEc:fip:fedgfe:2005-63 Explaining credit default swap spreads with the equity volatility and jump risks of individual firms (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (16) RePEc:hai:wpaper:200505 FDI and Trade Two Way Linkages? (2005). University of Hawaii at Manoa, Department of Economics / Working Papers (17) RePEc:hhs:bofrdp:2005_001 An intuitive guide to wavelets for economists (2005). Bank of Finland / Research Discussion Papers (18) RePEc:hhs:bofrdp:2005_020 Robust monetary policy in a small open economy (2005). Bank of Finland / Research Discussion Papers (19) RePEc:imf:imfstp:v:52:y:2005:i:si:p:4 Growth and Volatility in an Era of Globalization (2005). IMF Staff Papers (20) RePEc:imf:imfwpa:05/217 How Important Is Sovereign Risk in Determining Corporate Default Premia? The Case of South Africa (2005). International Monetary Fund / IMF Working Papers (21) RePEc:kof:wpskof:05-113 The Intriguing Nexus between Corruption and Capital Account Restrictions (2005). Swiss Institute for Business Cycle Research (KOF), Swiss Federal Institute of Technology Zurich (ETH), / Working papers (22) RePEc:kud:epruwp:05-14 Monetary Policy News and Exchange Rate Responses: Do Only Surprises Matter? (2005). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (23) RePEc:man:cgbcrp:57 The Optimal Public Expenditure Financing Policy: Does the Level of Economic Development Matter? (2005). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (24) RePEc:man:cgbcrp:59 Fiscal Policy and Endogenous Growth with Public Infrastructure (2005). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (25) RePEc:mmf:mmfc05:13 Non-Linear Properties of Currency Crises in Emerging Markets (2005). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2005 (26) RePEc:mse:wpsorb:j05070 A new look at the Feldstein-Horioka puzzle : an European-Regional perspective. (2005). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (27) RePEc:nbr:nberte:0305 Using Out-of-Sample Mean Squared Prediction Errors to Test the Martingale Difference (2005). National Bureau of Economic Research, Inc / NBER Technical Working Papers (28) RePEc:nbr:nberwo:11077 Testing Uncovered Interest Parity at Short and Long Horizons during the Post-Bretton Woods Era (2005). National Bureau of Economic Research, Inc / NBER Working Papers (29) RePEc:nbr:nberwo:11166 Stocks, Bonds, Money Markets and Exchange Rates: Measuring International Financial Transmission (2005). National Bureau of Economic Research, Inc / NBER Working Papers (30) RePEc:nbr:nberwo:11403 FDI and Trade -- Two Way Linkages? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (31) RePEc:nbr:nberwo:11697 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2005). National Bureau of Economic Research, Inc / NBER Working Papers (32) RePEc:nbr:nberwo:11701 International Capital Flows, Returns and World Financial Integration (2005). National Bureau of Economic Research, Inc / NBER Working Papers (33) RePEc:nbr:nberwo:11769 What Defines News in Foreign Exchange Markets? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (34) RePEc:nbr:nberwo:11823 Current Account Deficits in Industrial Countries: The Bigger They are, the Harder They Fall? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (35) RePEc:nbr:nberwo:11840 The Information in Long-Maturity Forward Rates: Implications for Exchange Rates and the Forward Premium Anomaly (2005). National Bureau of Economic Research, Inc / NBER Working Papers (36) RePEc:onb:oenbmp:y:2005:i:1:b:4 Fundamental and Nonfundamental Factors in the Euro/U.S. Dollar Market in 2002 and 2003 (2005). Monetary Policy & the Economy (37) RePEc:rba:rbardp:rdp2005-08 Declining Output Volatility: What Role for Structural Change? (2005). Reserve Bank of Australia / RBA Research Discussion Papers (38) RePEc:sce:scecf5:419 International Capital Flows in a World of Greater Financial Integration (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (39) RePEc:taf:apfiec:v:15:y:2005:i:11:p:745-752 Testing for symmetry and proportionality in a European panel (2005). Applied Financial Economics (40) RePEc:taf:applec:v:37:y:2005:i:9:p:1063-1071 New evidence on purchasing power parity from 17 OECD countries (2005). Applied Economics (41) RePEc:tuf:tuftec:0506 International Capital Flows and Boom-Bust Cycles in the Asia Pacific Region (2005). Department of Economics, Tufts University / Discussion Papers Series, Department of Economics, Tufts University (42) RePEc:uts:rpaper:168 Multivariate Autoregressive Conditional Heteroskedasticity with Smooth Transitions in Conditional Correlations (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (43) RePEc:wpa:wuwpem:0503017 An intuitive guide to wavelets for economists (2005). EconWPA / Econometrics (44) RePEc:wpa:wuwpge:0508009 An intuitive guide to wavelets for economists (2005). EconWPA / GE, Growth, Math methods (45) RePEc:wpa:wuwpif:0501002 CAN LONG HORIZON DATA BEAT RANDOM WALK UNDER ENGEL-WEST EXPLANATION? (2005). EconWPA / International Finance (46) RePEc:wpa:wuwpif:0510005 Health Expenditures Under the HIPC Debt Initiative (2005). EconWPA / International Finance (47) RePEc:wpa:wuwpma:0504002 ASSESSING THE MEAN REVERSION BEHAVIOR OF FISCAL POLICY: THE CASE OF ASIAN COUNTRIES (2005). EconWPA / Macroeconomics (48) RePEc:wpa:wuwpma:0506017 Regime Shifts and the Stability of Backward Looking Phillips Curves in Open Economies (2005). EconWPA / Macroeconomics (49) RePEc:zbw:cauewp:2880 Dynamic Effects of Raw Materials Price Shocks for Large Oil-Dependent Economies (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (50) RePEc:zbw:cauewp:3196 Oil Price Shocks and Currency Denomination (A revised version of EWP 2005-01) (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (51) RePEc:zbw:cauewp:3834 Monetary Policy Dynamics in Large Oil-Dependent Economies (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (52) RePEc:zbw:cauewp:3836 Dynamische Effekte der Geld-und Fiskalpolitik in einem asymmetrischen Drei-Länder-Modell mit einer Währungsunion (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers Latest citations received in: 2004 (1) RePEc:cin:ucecwp:2004-02 The Political Economy of Unconditional and Conditional Foreign Assistance: Grants vs. Loan Rollovers (2004). University of Cincinnati, Department of Economics / University of Cincinnati, Economics Working Papers Series (2) RePEc:ecm:latm04:263 Currency Substitution, Portfolio Diversification and Money Demand (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (3) RePEc:eui:euiwps:eco2004/35 Potential Welfare Losses from Financial Autarky and Trade Sanctions (2004). European University Institute / Economics Working Papers (4) RePEc:fip:fedkrw:rwp04-02 Financial intermediaries, markets, and growth (2004). Federal Reserve Bank of Kansas City / Research Working Paper (5) RePEc:fip:fedpwp:04-24 Financial intermediaries, markets, and growth. (2004). Federal Reserve Bank of Philadelphia / Working Papers (6) RePEc:han:dpaper:dp-292 The Impact of Experience on Risk Taking, Overconfidence, and Herding of Fund Managers: Complementary Survey Evidence (2004). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (7) RePEc:han:dpaper:dp-296 What Drives Home Bias? Evidence from Fund Managers Views (2004). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (8) RePEc:hhs:bofrdp:2004_004 An approach to bank insolvency in transition and emerging economies (2004). Bank of Finland / Research Discussion Papers (9) RePEc:hhs:bofrdp:2004_010 Capital adequacy regulation and financial conglomerates (2004). Bank of Finland / Research Discussion Papers (10) RePEc:hhs:bofrdp:2004_017 The efficiency implications of financial conglomeration (2004). Bank of Finland / Research Discussion Papers (11) RePEc:hhs:bofrdp:2004_025 Multihoming in the market for payment media: evidence from young Finnish consumers (2004). Bank of Finland / Research Discussion Papers (12) RePEc:hhs:bofrdp:2004_026 Trading Nokia: The roles of the Helsinki vs the New York stock exchanges (2004). Bank of Finland / Research Discussion Papers (13) RePEc:hhs:bofrdp:2004_028 Stable price level and changing prices (2004). Bank of Finland / Research Discussion Papers (14) RePEc:hhs:bofrdp:2004_029 Equilibrium dynamics under lump-sum taxation in an exchange economy with skewed endowments (2004). Bank of Finland / Research Discussion Papers (15) RePEc:hhs:bofrdp:2004_031 Robust monetary policy in the New-Keynesian framework (2004). Bank of Finland / Research Discussion Papers (16) RePEc:imf:imfwpa:04/189 Can Higher Reserves Help Reduce Exchange Rate Volatility? (2004). International Monetary Fund / IMF Working Papers (17) RePEc:imf:imfwpa:04/38 The Political Economy of Conditional and Unconditional Foreign Assistance: Grants vs. Loan Rollovers (2004). International Monetary Fund / IMF Working Papers (18) RePEc:imf:imfwpa:04/70 Credit Rationing in Emerging Economies Access to Global Capital Markets (2004). International Monetary Fund / IMF Working Papers (19) RePEc:kap:openec:v:15:y:2004:i:1:p:5-22 Do IMF and IBRD Cause Moral Hazard and Political Business Cycles? Evidence from Panel Data (2004). Open Economies Review (20) RePEc:kls:series:0014 Purchasing Power Parity and the Real Exchange Rate in Bangladesh: A Nonlinear Analysis (2004). University of Cologne, Seminar of Economics / Working Paper Series in Economics (21) RePEc:kud:epruwp:04-15 Capital Utilization and the Foundations of Club Convergence (2004). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (22) RePEc:lsu:lsuwpp:2004-06 Productivity and Prices in Europe: Micro-Evidence for the Period 1975 to 1990 (2004). Department of Economics, Louisiana State University / Departmental Working Papers (23) RePEc:mse:wpsorb:v04013 Limited participation and exchange rate dynamics : does theory meet the data ? (2004). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (24) RePEc:nbr:nberwo:10396 The Trilemma in History: Tradeoffs among Exchange Rates, Monetary Policies, and Capital Mobility (2004). National Bureau of Economic Research, Inc / NBER Working Papers (25) RePEc:nbr:nberwo:10614 Unbiased Estimation of the Half-Life to PPP Convergence in Panel Data (2004). National Bureau of Economic Research, Inc / NBER Working Papers (26) RePEc:nip:nipewp:9/2004 Currency Substitution, portfolio Diversification and Money Demand (2004). NIPE - Universidade do Minho / NIPE Working Papers (27) RePEc:nzb:nzbbul:june2004:7 Bank regulation and foreign-owned banks (2004). Reserve Bank of New Zealand Bulletin (28) RePEc:uct:uconnp:2004-45 Exchange rate depreciation and exports: The case of Singapore revisited (2004). University of Connecticut, Department of Economics / Working papers (29) RePEc:wdi:papers:2004-687 Financial Sector Returns and Creditor Moral Hazard: Evidence from Indonesia, Korea, and Thailand (2004). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (30) RePEc:wpa:wuwpfi:0404015 An approach to bank insolvency in transition and emerging economies (2004). EconWPA / Finance (31) RePEc:zbw:bubdp1:1818 FDI versus cross-border financial services : The globalisation of German banks (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (32) RePEc:zbw:bubdp1:1819 Clustering or competition? : The foreign investment behaviour of German banks (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (33) RePEc:zbw:bubdp1:1820 PPP : a Disaggregated View (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (34) RePEc:zbw:zewdip:1604 German Exchange Rate Exposure at DAX and Aggregate Level, International Trade, and the Role of Exchange Rate Adjustment Costs (2004). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2003 (1) RePEc:bca:bocawp:03-35 Real Exchange Rate Persistence in Dynamic General-Equilibrium Sticky-Price Models: An Analytical Characterization (2003). Bank of Canada / Working Papers (2) RePEc:chb:bcchwp:237 The Role of Credibility in the Cyclical Properties of Macroeconomic Policies in Emerging Economies (2003). Central Bank of Chile / Working Papers Central Bank of Chile (3) RePEc:dnb:wormem:741 Shortfall allowed: loss aversion and habit formation (2003). Netherlands Central Bank, Research Department / WO Research Memoranda (discontinued) (4) RePEc:epr:enepwp:wp021 Fiscal Policy in the New Open Economy. Macroeconomics and Prospects for Fiscal Policy Coordination. (2003). European Network of Economic Policy Research Institutes / Economics Working Papers (5) RePEc:fip:fedcwp:0315 Government intervention in the foreign exchange market (2003). Federal Reserve Bank of Cleveland / Working Paper (6) RePEc:hhb:aarfin:2003_008 Volatility-Spillover E ffects in European Bond Markets (2003). Aarhus School of Business, Department of Finance / Working Papers (7) RePEc:nbr:nberwo:10036 Currency Mismatches, Debt Intolerance and Original Sin: Why They Are Not the Same and Why it Matters (2003). National Bureau of Economic Research, Inc / NBER Working Papers (8) RePEc:ssa:lemwps:2003/07 Graphical Models for Structural Vector Autoregressions (2003). Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy / LEM Papers Series (9) RePEc:taf:apeclt:v:10:y:2003:i:9:p:527-533 Financial crisis and African stock market integration (2003). Applied Economics Letters (10) RePEc:tcd:tcduee:20039 Public Spending Management and Macroeconomic Interdependence (2003). Trinity College Dublin, Department of Economics / Trinity Economics Papers (11) RePEc:wiw:wiwrsa:ersa03p273 Evidence on the Purchasing Power Parity in Panel of Cities (2003). European Regional Science Association / ERSA conference papers (12) RePEc:wpa:wuwpif:0311014 Exchange Rate Relative Price Relationship: Nonlinear Evidence from Malaysia (2003). EconWPA / International Finance (13) RePEc:wpa:wuwpif:0312001 Exchange Rate Relative Price Relationship: Nonlinear Evidence from Malaysia (2003). EconWPA / International Finance Latest citations received in: 2002 (1) RePEc:clu:wpaper:0102-42 Income inequality: The aftermath of stock market liberalization in emerging markets (2002). Columbia University, Department of Economics / Discussion Papers (2) RePEc:dnb:wormem:716 External Wealth and the Trade Balance: A Time-Series Analysis for the Netherlands (2002). Netherlands Central Bank, Research Department / WO Research Memoranda (discontinued) (3) RePEc:eab:financ:385 The Compatibility of Capital Controls and Financial Development: A Selective Survey and Empirical Evidence (2002). East Asian Bureau of Economic Research / Finance Working Papers (4) RePEc:fip:fedgif:722 Financial centers and the geography of capital flows (2002). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (5) RePEc:hhs:bofitp:2002_014 Do efficient banking sectors accelerate economic growth in transition countries (2002). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (6) RePEc:hhs:hastef:0513 International Financial Liberalization and Industry Growth (2002). Stockholm School of Economics / Working Paper Series in Economics and Finance (7) RePEc:hhs:iuiwop:0586 International Financial Liberalization and Industry Growth (2002). The Research Institute of Industrial Economics / IUI Working Paper Series (8) RePEc:lsu:lsuwpp:2002-01 Macroeconomic Stabilization and Economic Growth: Analysis of Reform Policies in Tanzania (2002). Department of Economics, Louisiana State University / Departmental Working Papers (9) RePEc:nbr:nberwo:8959 Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange (2002). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:nbr:nberwo:8994 Are Financial Assets Priced Locally or Globally? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (11) RePEc:nbr:nberwo:9000 Daily Cross-Border Equity Flows: Pushed or Pulled? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:nbr:nberwo:9398 Exchange Rate, Equity Prices and Capital Flows (2002). National Bureau of Economic Research, Inc / NBER Working Papers (13) RePEc:taf:intecj:v:16:y:2002:i:1:p:21-42 ASYMMETRY IN ECONOMIC FLUCTUATIONS IN THE US ECONOMY: THE PRE-WAR AND THE 1946--1991 PREIODS COMPARED (2002). International Economic Journal (14) RePEc:tcb:dpaper:0206 Is there Room for Forex Interventions under Inflation Targeting Framework? Evidence from Mexico and Turkey (2002). Research and Monetary Policy Department, Central Bank of the Republic of Turkey / Discussion Papers (15) RePEc:una:unccee:wp0102 Stock Market Cycles and Stock Market Development in Spain (2002). School of Economics and Business Administration, University of Navarra / Faculty Working Papers (16) RePEc:wfo:wpaper:y:2002:i:187 The Politics of Financial Development. The Case of Austria (2002). WIFO / WIFO Working Papers (17) RePEc:wpa:wuwpma:0212013 Do efficient banking sectors accelerate economic growth in transition countries? (2002). EconWPA / Macroeconomics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |