|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

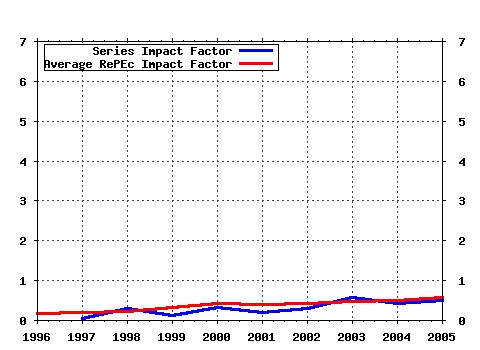

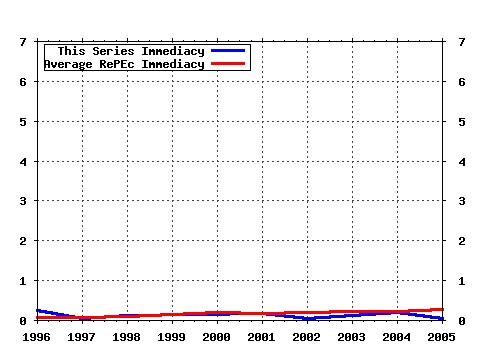

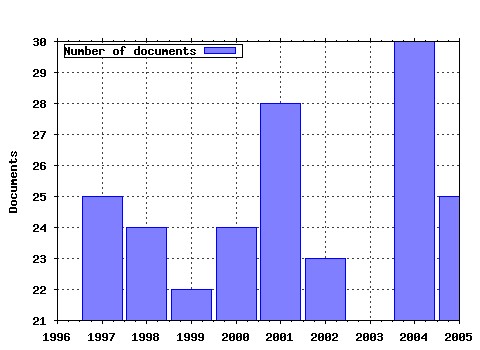

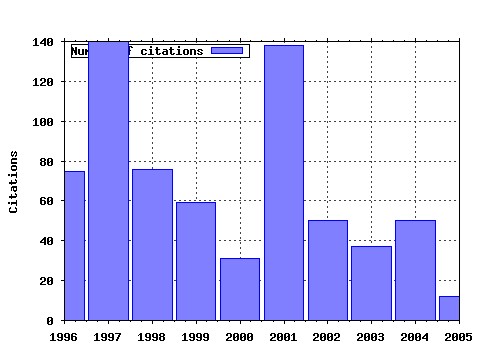

International Journal of Finance & Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ijf:ijfiec:v:2:y:1997:i:1:p:1-16 International Business Cycles and the ERM: Is There a European Business Cycle? (1997). (2) RePEc:ijf:ijfiec:v:1:y:1996:i:3:p:207-23 Capital Flows and Macroeconomic Management: Tequila Lessons. (1996). (3) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:325-42 The ECB Monetary Policy Strategy and the Money Market. (2001). (4) RePEc:ijf:ijfiec:v:2:y:1997:i:4:p:307-18 Examining the Use of Technical Currency Analysis. (1997). (5) RePEc:ijf:ijfiec:v:4:y:1999:i:1:p:1-26 Perspectives on the Recent Currency Crisis Literature. (1999). (6) RePEc:ijf:ijfiec:v:3:y:1998:i:4:p:279-89 Quasi Purchasing Power Parity. (1998). (7) RePEc:ijf:ijfiec:v:3:y:1998:i:2:p:169-88 The Feldstein-Horioka Puzzle and Capital Mobility: A Review. (1998). (8) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:343-68 Assessing Inflation Targeting after a Decade of World Experience. (2001). (9) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:315-23 The Empirics of Monetary Policy Rules in Open Economies. (2001). (10) RePEc:ijf:ijfiec:v:7:y:2002:i:3:p:165-93 Financial Market Integration in Europe: On the Effects of EMU on Stock Markets. (2002). (11) RePEc:ijf:ijfiec:v:2:y:1997:i:4:p:291-305 Switching between Chartists and Fundamentalists: A Markov Regime-Switching Approach. (1997). (12) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:401-19 Why Is the Business-Cycle Behaviour of Fundamentals Alike across Exchange-Rate Regimes? (2001). (13) RePEc:ijf:ijfiec:v:3:y:1998:i:3:p:195-215 Does the Term Structure Predict Recessions? The International Evidence. (1998). (14) RePEc:ijf:ijfiec:v:9:y:2004:i:4:p:307-313 The revived Bretton Woods system (2004). (15) RePEc:ijf:ijfiec:v:11:y:2006:i:4:p:327-338 Extended evidence on the use of technical analysis in foreign exchange (2006). (16) RePEc:ijf:ijfiec:v:11:y:2006:i:3:p:219-228 Look whos talking: ECB communication during the first years of EMU (2006). (17) RePEc:ijf:ijfiec:v:1:y:1996:i:1:p:55-67 The Distribution of Exchange Rates in the EMS. (1996). (18) RePEc:ijf:ijfiec:v:9:y:2004:i:4:p:289-306 How do UK-based foreign exchange dealers think their market operates? (2004). (19) RePEc:ijf:ijfiec:v:6:y:2001:i:1:p:81-93 Importance of Technical and Fundamental Analysis in the European Foreign Exchange Market. (2001). (20) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:369-87 Beyond Bipolar: A Three-Dimensional Assessment of Monetary Frameworks. (2001). (21) RePEc:ijf:ijfiec:v:8:y:2003:i:3:p:205-224 Capital account liberalization and growth: was Mr. Mahathir right? (2003). (22) RePEc:ijf:ijfiec:v:4:y:1999:i:1:p:27-54 On the Use of Reserve Requirements in Dealing with Capital Flow Problems. (1999). (23) RePEc:ijf:ijfiec:v:4:y:1999:i:2:p:93-111 Alternative Approaches to Real Exchange Rates and Real Interest Rates: Three Up and Three Down. (1999). (24) RePEc:ijf:ijfiec:v:8:y:2003:i:2:p:109-129 On currency crises and contagion (2003). (25) RePEc:ijf:ijfiec:v:8:y:2003:i:1:p:11-53 Do indicators of financial crises work? An evaluation of an early warning system (2003). (26) RePEc:ijf:ijfiec:v:5:y:2000:i:3:p:177-95 Country Funds and Asymmetric Information. (2000). (27) RePEc:ijf:ijfiec:v:6:y:2001:i:2:p:95-114 Market Structure and the Persistence of Sectoral Real Exchange Rates. (2001). (28) RePEc:ijf:ijfiec:v:1:y:1996:i:4:p:229-50 Alternative Long-Horizon Exchange-Rate Predictors. (1996). (29) RePEc:ijf:ijfiec:v:1:y:1996:i:3:p:183-95 Managing Risks to Financial Markets from Volatile Capital Flows: The Role of Prudential Regulation. (1996). (30) RePEc:ijf:ijfiec:v:5:y:2000:i:4:p:253-63 Is There a Base Currency Effect in Long-Run PPP? (2000). (31) RePEc:ijf:ijfiec:v:4:y:1999:i:4:p:271-96 Modelling Emerging Market Risk Premia Using Higher Moments. (1999). (32) RePEc:ijf:ijfiec:v:2:y:1997:i:2:p:87-100 The Reaction of Exchange Rates and Interest Rates to News Releases. (1997). (33) RePEc:ijf:ijfiec:v:11:y:2006:i:1:p:81-95 Under the microscope: the structure of the foreign exchange market (2006). (34) RePEc:ijf:ijfiec:v:1:y:1996:i:3:p:197-205 Capital Controls and Emerging Markets. (1996). (35) RePEc:ijf:ijfiec:v:7:y:2002:i:1:p:15-35 Debt Management in Brazil: Evaluation of the Real Plan and Challenges Ahead. (2002). (36) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:421-35 Macroeconomic Fundamentals and the DM/$ Exchange Rate: Temporal Instability and the Monetary Model. (2001). (37) RePEc:ijf:ijfiec:v:1:y:1996:i:1:p:1-23 Liberalized Portfolio Capital Inflows in Emerging Markets: Sterilization, Expectations, and the Incompleteness of Interest Rate Convergence. (1996). (38) RePEc:ijf:ijfiec:v:9:y:2004:i:2:p:135-149 Analysing changes in market integration through a cross-sectional test for the law of one price (2004). (39) RePEc:ijf:ijfiec:v:1:y:1996:i:1:p:25-35 Sovereign Debt, Reputation and Credit Terms. (1996). (40) RePEc:ijf:ijfiec:v:9:y:2004:i:1:p:49-69 Inflation targeting or fear of floating in disguise: the case of Mexico (2004). (41) RePEc:ijf:ijfiec:v:2:y:1997:i:3:p:189-98 Inflation Convergence within the European Union: A Panel Data Analysis. (1997). (42) RePEc:ijf:ijfiec:v:7:y:2002:i:1:p:1-14 Exchange Rate and Price Adjustments in the Aftermath of the Asian Crisis. (2002). (43) RePEc:ijf:ijfiec:v:2:y:1997:i:2:p:131-43 Measuring Economic Convergence. (1997). (44) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:277-88 The Euro Area and the Single Monetary Policy. (2001). (45) RePEc:ijf:ijfiec:v:4:y:1999:i:1:p:55-62 Openness and the Exchange Rate Exposure of National Stock Markets. (1999). (46) RePEc:ijf:ijfiec:v:7:y:2002:i:2:p:109-21 The Impact of Financial Liberalization Policies on Financial Development: Evidence from Developing Economies. (2002). (47) RePEc:ijf:ijfiec:v:2:y:1997:i:3:p:217-24 Central Bank Policy Reaction and the Expectations Hypothesis of the Term Structure. (1997). (48) RePEc:ijf:ijfiec:v:2:y:1997:i:3:p:177-87 The Real Exchange Rate and US Manufacturing Profits: A Theoretical Framework with Some Empirical Support. (1997). (49) RePEc:ijf:ijfiec:v:11:y:2006:i:4:p:339-354 A tale of two globalizations: capital flows from rich to poor in two eras of global finance (2006). (50) RePEc:ijf:ijfiec:v:7:y:2002:i:2:p:141-55 Monetary Policy Transparency, Inflation and the Sacrifice Ratio. (2002). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:ecb:ecbwps:20050567 Is time ripe for a currency union in emerging East Asia? The role of monetary stabilisation (2005). European Central Bank / Working Paper Series Latest citations received in: 2004 (1) RePEc:edj:ceauch:189 Time-Scale Decomposition of Price Transmission in International Markets (2004). Centro de Economía Aplicada, Universidad de Chile / Documentos de Trabajo (2) RePEc:fip:fednci:y:2004:i:sep:n:v.10no.10 Reserve accumulation: implications for global capital flows and financial markets (2004). Current Issues in Economics and Finance (3) RePEc:nbr:nberwo:10497 Global Imbalances and the Lessons of Bretton Woods (2004). National Bureau of Economic Research, Inc / NBER Working Papers (4) RePEc:nbr:nberwo:10869 The Unsustainable US Current Account Position Revisited (2004). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:wdi:papers:2004-716 The Evolution of Cross-Region Price Distribution in Russia (2004). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (6) RePEc:wpa:wuwpif:0406007 The Return to Soft Dollar Pegging in East Asia. Mitigating Conflicted Virtue (2004). EconWPA / International Finance Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:lev:wrkpap:362 Financial Policies and the Aggregate Productivity of the Capital Stock: Evidence from Developed and Developing Economies (2002). Levy Economics Institute, The / Economics Working Paper Archive Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |