|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

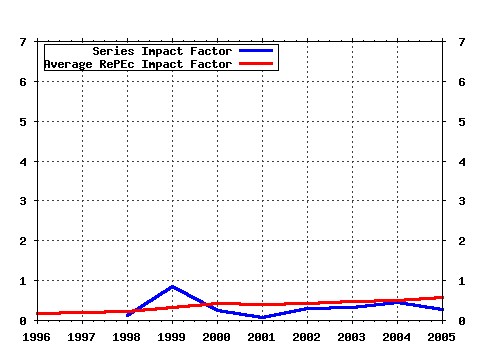

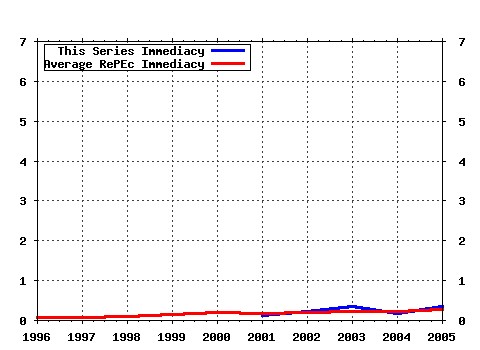

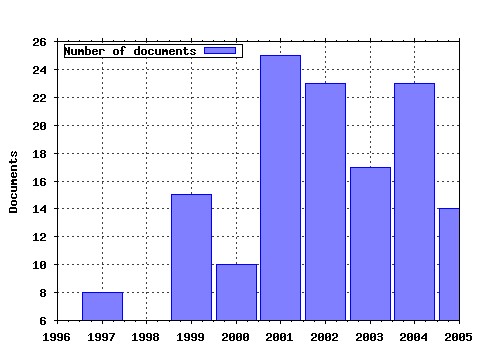

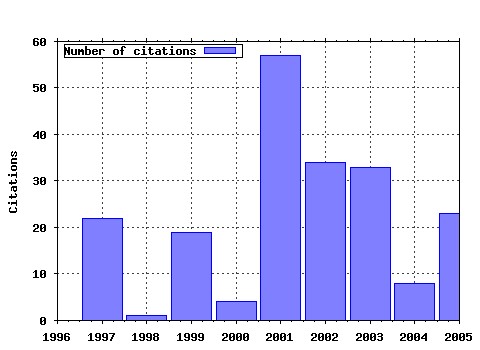

Monetary and Economic Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ime:imemes:v:21:y:2003:i:2:p:69-92 Forbearance Lending: The Case of Japanese Firms (2003). (2) RePEc:ime:imemes:v:15:y:1997:i:2:p:1-26 Inflation Measures for Monetary Policy: Measuring the Underlying

Inflation Trend and Its Implication for Monetary Policy Implementation (1997). (3) RePEc:ime:imemes:v:15:y:1997:i:1:p:63-87 Money and Debt in the Structure of Payments (1997). (4) RePEc:ime:imemes:v:19:y:2001:i:1:p:1-29 What Happened to Japanese Banks? (2001). (5) RePEc:ime:imemes:v:20:y:2002:i:3:p:35-76 Asset Price Bubbles, Price Stability, and Monetary Policy: Japan

s Experience (2002). (6) RePEc:ime:imemes:v:19:y:2001:i:s1:p:277-312 The Zero Bound in an Open Economy: A Foolproof Way of Escaping

from a Liquidity Trap (2001). (7) RePEc:ime:imemes:v:21:y:2003:i:3:p:53-81 The Decline in the Exchange Rate Pass-Through: Evidence from

Japanese Import Prices (2003). (8) RePEc:ime:imemes:v:20:y:2002:i:2:p:1-23 Is There a Stable Money Demand Function under the Low Interest

Rate Policy? A Panel Data Analysis (2002). (9) RePEc:ime:imemes:v:19:y:2001:i:s1:p:395-450 The Asset Price Bubble and Monetary Policy: Japans Experience in

the Late 1980s and the Lessons: Background Paper (2001). (10) RePEc:ime:imemes:v:20:y:2002:i:s1:p:23-46 Exchange Rates and Adjustment: Perspectives from the New Open-

Economy Macroeconomics (2002). (11) RePEc:ime:imemes:v:23:y:2005:i:1:p:47-111 Japans Deflation, Problems in the Financial System, and Monetary

Policy (2005). (12) RePEc:ime:imemes:v:17:y:1999:i:1:p:77-101 The Monthly Measurement of Core Inflation in Japan (1999). (13) RePEc:ime:imemes:v:19:y:2001:i:s1:p:53-102 Policy Responses to the Post-bubble Adjustments in Japan: A

Tentative Review (2001). (14) RePEc:ime:imemes:v:19:y:2001:i:s1:p:35-51 Low Inflation, Deflation, and Policies for Future Price Stability (2001). (15) RePEc:ime:imemes:v:24:y:2006:i:1:p:61-75 Revisiting the Decline in the Exchange Rate Pass-Through: Further

Evidence from Japans Import Prices (2006). (16) RePEc:ime:imemes:v:19:y:2001:i:2:p:109-54 Effects of Measurement Error on the Output Gap in Japan (2001). (17) RePEc:ime:imemes:v:23:y:2005:i:s1:p:37-82 The Monetary Policy Committee and the Incentive Problem: A

Selective Survey (2005). (18) RePEc:ime:imemes:v:19:y:2001:i:s1:p:177-208 Structural Issues in the Japanese Labor Market: An Era of Variety

, Equity, and Efficiency or an Era of Bipolarization? (2001). (19) RePEc:ime:imemes:v:19:y:2001:i:1:p:89-130 Monetary Policy under Zero Interest Rate: Viewpoints of Central

Bank Economists (2001). (20) RePEc:ime:imemes:v:19:y:2001:i:2:p:1-19 Should Japanese Banks Be Recapitalized? (2001). (21) RePEc:ime:imemes:v:20:y:2002:i:2:p:117-34 Has Japan Been Left Out in the Cold by Regional Integration? (2002). (22) RePEc:ime:imemes:v:21:y:2003:i:3:p:21-52 Precautionary Savings and Income Uncertainty: Evidence from

Japanese Micro Data (2003). (23) RePEc:ime:imemes:v:23:y:2005:i:s1:p:197-217 Searching for Non-monotonic Effects of Fiscal Policy: New Evidence (2005). (24) RePEc:ime:imemes:v:17:y:1999:i:3:p:103-28 Asset Price Fluctuation and Price Indices (1999). (25) RePEc:ime:imemes:v:17:y:1999:i:2:p:21-46 Japans Experience with Deposit Insurance and Failing Banks:

Implications for Financial Regulatory Design? (1999). (26) RePEc:ime:imemes:v:19:y:2001:i:s1:p:113-34 Monetary Policy, Deflation, and Economic History: Lessons for the

Bank of Japan (2001). (27) RePEc:ime:imemes:v:24:y:december:i:s1:p:209-225 The Great Moderation and the U.S. External Imbalance (2006). (28) RePEc:ime:imemes:v:20:y:2002:i:3:p:1-34 Pricing-to-Market (PTM) and the International Monetary Policy

Transmission: The New Open-Economy Macroeconomics Approach (2002). (29) RePEc:ime:imemes:v:19:y:2001:i:s1:p:143-67 Financial Stability, Deflation, and Monetary Policy (2001). (30) RePEc:ime:imemes:v:22:y:2004:i:3:p:1-23 Price Stability and Japanese Monetary Policy (2004). (31) RePEc:ime:imemes:v:20:y:2002:i:2:p:25-41 Money Demand near Zero Interest Rate: Evidence from Regional Data (2002). (32) RePEc:ime:imemes:v:22:y:2004:i:2:p:71-99 Distortions in Factor Markets and Structural Adjustments in the

Economy (2004). (33) RePEc:ime:imemes:v:15:y:1997:i:1:p:1-25 Indexed Bonds and Monetary Policy: The Real Interest Rate and the

Expected Rate of Inflation (1997). (34) RePEc:ime:imemes:v:23:y:2005:i:2:p:1-29 Wage Fluctuations in Japan after the Bursting of the Bubble

Economy: Downward Nominal Wage Rigidity, Payroll, and the Unemployment

Rate (2005). (35) RePEc:ime:imemes:v:19:y:2001:i:3:p:143-70 Information Content of Implied Probability Distributions:

Empirical Studies of Japanese Stock Price Index Options (2001). (36) RePEc:ime:imemes:v:20:y:2002:i:s1:p:11-22 New International Financial Arrangements (2002). (37) RePEc:ime:imemes:v:23:y:2005:i:1:p:113-48 What Do the Purified Solow Residuals Tell Us about Japans Lost

Decade? (2005). (38) RePEc:ime:imemes:v:19:y:2001:i:2:p:49-83 Is There a Desirable Rate of Inflation? A Theoretical and

Empirical Survey (2001). (39) RePEc:ime:imemes:v:21:y:2003:i:4:p:1-20 Monetary Implications of the Hayashi-Prescott Hypothesis for Japan (2003). (40) RePEc:ime:imemes:v:17:y:1999:i:3:p:157-82 Monetary Policy under Zero Inflation: A Response to Criticisms

and Questions Regarding Monetary Policy (1999). (41) RePEc:ime:imemes:v:19:y:2001:i:s1:p:239-70 Financial Crises As the Failure of Arbitrage: Implications for

Monetary Policy (2001). (42) RePEc:ime:imemes:v:20:y:2002:i:s1:p:91-111 Exchange Rate Regimes in the Americas: Is Dollarization the

Solution? (2002). (43) RePEc:ime:imemes:v:25:y:2007:i:1:p:1-48 (). (44) RePEc:ime:imemes:v:18:y:2000:i:2:p:1-24 What Is Systemic Risk? Moral Hazard, Initial Shocks, and

Propagation (2000). (45) RePEc:ime:imemes:v:21:y:2003:i:4:p:57-85 The Impact of Downward Nominal Wage Rigidity on the Unemployment

Rate: Quantitative Evidence from Japan (2003). (46) RePEc:ime:imemes:v:17:y:1999:i:3:p:41-68 The Boskin Commission Report and Its Aftermath (1999). (47) RePEc:ime:imemes:v:23:y:2005:i:1:p:1-46 Monetary and Fiscal Policy to Escape from a Deflationary Trap (2005). (48) RePEc:ime:imemes:v:20:y:2002:i:s1:p:47-79 Do Currency Regimes Matter in the 21st Century? An Overview (2002). (49) RePEc:ime:imemes:v:21:y:2003:i:3:p:1-20 Precautionary Motives versus Waiting Options: Evidence from

Aggregate Household Saving in Japan (2003). (50) RePEc:ime:imemes:v:23:y:2005:i:s1:p:13-24 What Is the Proper Perspective for Monetary Policy Optimality? (2005). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:fip:fedfel:y:2005:i:sep2:n:2005-22 Policymaking on the FOMC: transparency and continuity (2005). FRBSF Economic Letter (2) RePEc:fip:fedfsp:y:2005:i:may31 Policymaking on the Federal Open Market Committee (FOMC): transparency and continuity (2005). Speech (3) RePEc:fip:fedkpr:y:2005:i:aug:p:507-516 Monetary policy strategies : a central bank panel (2005). Proceedings (4) RePEc:pra:mprapa:4648 A Historical Evaluation of Financial Accelerator Effects in Japans Economy (2005). University Library of Munich, Germany / MPRA Paper (5) RePEc:tky:fseres:2005cf336 The Effects of the Bank of Japans Zero Interest Rate Commitment and Quantitative Monetary Easing on the Yield Curve: A Macro-Finance Approach (2005). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series Latest citations received in: 2004 (1) RePEc:fip:fedgfe:2004-48 Monetary policy alternatives at the zero bound: an empirical assessment (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (2) RePEc:icr:wpicer:29-2004 The Japanese Deflation: Has It Had Real Effects? Could It Have Been Avoided? (2004). ICER - International Centre for Economic Research / ICER Working Papers (3) RePEc:ime:imemes:v:22:y:2004:i:3:p:145-82 Japans Foreign Direct Investment and Structural Changes in Japanese and East Asian Trade (2004). Monetary and Economic Studies (4) RePEc:ime:imemes:v:22:y:2004:i:3:p:37-46 Comments on Price Stability and Japanese Monetary Policy. (2004). Monetary and Economic Studies Latest citations received in: 2003 (1) RePEc:cep:cepdps:dp0603 Collateral Value and Forbearance Lending (2003). Centre for Economic Performance, LSE / CEP Discussion Papers (2) RePEc:ime:imemes:v:21:y:2003:i:2:p:1-29 Are Japanese Nominal Wages Downwardly Rigid? (Part I): Examinations of Nominal Wage Change Distributions (2003). Monetary and Economic Studies (3) RePEc:ime:imemes:v:21:y:2003:i:3:p:1-20 Precautionary Motives versus Waiting Options: Evidence from Aggregate Household Saving in Japan (2003). Monetary and Economic Studies (4) RePEc:ime:imemes:v:21:y:2003:i:3:p:21-52 Precautionary Savings and Income Uncertainty: Evidence from Japanese Micro Data (2003). Monetary and Economic Studies (5) RePEc:ime:imemes:v:21:y:2003:i:4:p:57-85 The Impact of Downward Nominal Wage Rigidity on the Unemployment Rate: Quantitative Evidence from Japan (2003). Monetary and Economic Studies (6) RePEc:tky:fseres:2003cf222 Does Natural Selection Mechanism Still Work in Severe Recessions'DONE' --]Examination of the Japanese Economy in the 1990s --- (2003). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series Latest citations received in: 2002 (1) RePEc:cpd:pd2002:a4-1 Aggregate vs Disaggregate Data Analysis - A Paradox in the Estimation of Money Demand Function of Japan Under the Low Interest Rate Policy (2002). International Conferences on Panel Data / 10th International Conference on Panel Data, Berlin, July 5-6, 2002 (2) RePEc:eti:dpaper:02011 An Econometric Analysis of Trade Diversion under NAFTA (2002). Research Institute of Economy, Trade and Industry (RIETI) / Discussion papers (3) RePEc:hit:hitcei:2003-13 Exchange Rate Fluctuations, Financing Constraints, Hedging, and Exports: Evidence from Firm Level Data (2002). Institute of Economic Research, Hitotsubashi University / Working Paper Series (4) RePEc:hit:hituec:a431 An Econometric Analysis of Trade Diversion under NAFTA (2002). Institute of Economic Research, Hitotsubashi University / Discussion Paper Series (5) RePEc:ioe:doctra:228 Another Look at Exhange Rate and Monetary Regime Options for Latin America (2002). Instituto de Economía. Pontificia Universidad Católica de Chile. / Documentos de Trabajo Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |