|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

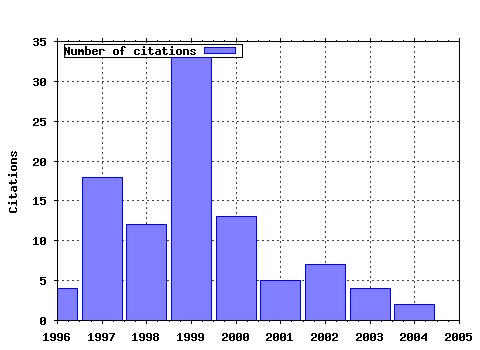

Review of Quantitative Finance and Accounting Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:rqfnac:v:13:y:1999:i:2:p:111-35

Estimating and Testing Exponential-Affine Term Structure Models by Kalman Filter. (1999). (2) RePEc:kap:rqfnac:v:9:y:1997:i:3:p:251-67

Nonparametric Smoothing of Yield Curves. (1997). (3) RePEc:kap:rqfnac:v:9:y:1997:i:1:p:53-70

Asset Allocation via the Conditional First Exit Time or How to Avoid Outliving Your Money. (1997). (4) RePEc:kap:rqfnac:v:10:y:1998:i:3:p:269-84

Product Quality and Payment Policy. (1998). (5) RePEc:kap:rqfnac:v:13:y:1999:i:1:p:39-62

Review of Categorical Models for Classification Issues in Accounting and Finance. (1999). (6) RePEc:kap:rqfnac:v:15:y:2000:i:3:p:259-76

A Neural Network Approach for Analyzing Small Business Lending Decisions. (2000). (7) RePEc:kap:rqfnac:v:9:y:1997:i:2:p:131-46

The Relation between Patent Citations and Tobins Q in the Semiconductor Industry. (1997). (8) RePEc:kap:rqfnac:v:20:y:2003:i:1:p:49-62

Are All Rivals Affected Equally by Bond Rating Downgrades? (2003). (9) RePEc:kap:rqfnac:v:19:y:2002:i:2:p:155-80

Intraday Return Volatility Process: Evidence from NASDAQ Stocks. (2002). (10) RePEc:kap:rqfnac:v:8:y:1997:i:1:p:69-81

Do Interest Rates Follow Unit-Root Processes? Evidence from Cross-Maturity Treasury Bill Yields. (1997). (11) RePEc:kap:rqfnac:v:15:y:2000:i:2:p:107-26

The Effects of Downsizing on Operating Performance. (2000). (12) RePEc:kap:rqfnac:v:15:y:2000:i:4:p:349-70

The Valuation Accuracy of the Price-Earnings and Price-Book Benchmark Valuation Methods. (2000). (13) RePEc:kap:rqfnac:v:13:y:1999:i:2:p:171-88

Random Walks and Market Efficiency Tests: Evidence from Emerging Equity Markets. (1999). (14) RePEc:kap:rqfnac:v:22:y:2004:i:2:p:79-95 Value-at-Risk Analysis for Taiwan Stock Index Futures: Fat Tails and Conditional Asymmetries in Return Innovations (2004). (15) RePEc:kap:rqfnac:v:16:y:2001:i:3:p:223-50

Bank Managers Heterogeneous Decisions on Discretionary Loan Loss Provisions. (2001). (16) RePEc:kap:rqfnac:v:10:y:1998:i:3:p:285-302

Volume and Volatility in Foreign Currency Futures Markets. (1998). (17) RePEc:kap:rqfnac:v:19:y:2002:i:4:p:399-416

A Generalized Method for Detecting Abnormal Returns and Changes in Systematic Risk. (2002). (18) RePEc:kap:rqfnac:v:13:y:1999:i:4:p:323-45

Predicting Corporate Financial Distress: A Time-Series CUSUM Methodology. (1999). (19) RePEc:kap:rqfnac:v:12:y:1999:i:1:p:89-96

A Note on Perceptions of Finance Journal Quality. (1999). (20) RePEc:kap:rqfnac:v:29:y:2007:i:1:p:1-24 Disclosure and the cost of equity in international cross-listing (2007). (21) RePEc:kap:rqfnac:v:10:y:1998:i:1:p:95-113

Fractionally Integrated Models with ARCH Errors: With an Application to the Swiss One-Month Euromarket Interest Rate. (1998). (22) RePEc:kap:rqfnac:v:18:y:2002:i:2:p:95-118

Estimating Beta. (2002). (23) RePEc:kap:rqfnac:v:7:y:1996:i:1:p:65-79

Refining the Bootstrap Method of Stochastic Dominance Analysis: The Case of the January Effect. (1996). (24) RePEc:kap:rqfnac:v:11:y:1998:i:3:p:293-310

Corporate Policy and Market Value: A q-Theory Approach. (1998). (25) RePEc:kap:rqfnac:v:22:y:2004:i:1:p:15-28 (). (26) RePEc:kap:rqfnac:v:12:y:1999:i:4:p:351-70

On the Nonlinear Specifications of Short-Term Interest Rate Behavior: Evidence from Euro-Currency Markets. (1999). (27) RePEc:kap:rqfnac:v:17:y:2001:i:3:p:283-300

Market Imperfections as the Cause of Accounting Income Smoothing--The Case of Differential Capital Access. (2001). (28) RePEc:kap:rqfnac:v:6:y:1996:i:2:p:103-31

Sequential Parameter Nonstationarity in Stock Market Returns. (1996). (29) RePEc:kap:rqfnac:v:11:y:1998:i:2:p:165-82

Information Asymmetry around Earnings Announcements. (1998). (30) RePEc:kap:rqfnac:v:15:y:2000:i:1:p:21-35

Valuation Implications of Investment Opportunities and Earnings Permanence. (2000). (31) RePEc:kap:rqfnac:v:12:y:1999:i:3:p:283-301

Predicting UK Takeover Targets: Some Methodological Issues and an Empirical Study. (1999). (32) RePEc:kap:rqfnac:v:16:y:2001:i:2:p:103-15

The Relationship between REITs Returns and Inflation: A Vector Error Correction Approach. (2001). (33) RePEc:kap:rqfnac:v:5:y:1995:i:2:p:179-201

Options and Efficiency: Some Experimental Evidence. (1995). (34) RePEc:kap:rqfnac:v:14:y:2000:i:1:p:17-43

U.S. Banking Sector Risk in an Era of Regulatory Change: A Bivariate GARCH Approach. (2000). (35) RePEc:kap:rqfnac:v:12:y:1999:i:2:p:135-57

The Estimation of Systematic Risk under Differentiated Risk Aversion: A Mean-Extended Gini Approach. (1999). (36) RePEc:kap:rqfnac:v:5:y:1995:i:1:p:55-70

Simultaneous Estimation of the Demand and Supply of Differentiated Audits. (1995). (37) RePEc:kap:rqfnac:v:10:y:1998:i:2:p:207-26

Companies Modest Claims about the Value of CEO Stock Option Awards. (1998). (38) RePEc:kap:rqfnac:v:18:y:2002:i:3:p:273-91

The Usefulness of Derivative-Related Accounting Disclosures. (2002). (39) RePEc:kap:rqfnac:v:7:y:1996:i:2:p:177-86

Optimal Growth Portfolios Reconciling Theory and Practice. (1996). (40) RePEc:kap:rqfnac:v:12:y:1999:i:1:p:21-34

Stochastic Discount Rates, Productivity Shocks and Capital Asset Pricing. (1999). (41) RePEc:kap:rqfnac:v:15:y:2000:i:2:p:169-85

Managerial Ownership and Accounting Disclosures: An Empirical Study. (2000). (42) RePEc:kap:rqfnac:v:17:y:2001:i:3:p:301-18

Empirical Analysis of Stock Returns and Volatility: Evidence from Seven Asian Stock Markets Based on TAR-GARCH Model. (2001). (43) RePEc:kap:rqfnac:v:6:y:1996:i:2:p:133-47

CVP under Uncertainty and the Managers Utility Function. (1996). (44) RePEc:kap:rqfnac:v:11:y:1998:i:3:p:269-91

Rationalizable and Coalition Proof Shareholder Tendering Strategies in Corporate Takeovers. (1998). (45) RePEc:kap:rqfnac:v:15:y:2000:i:1:p:37-55

Are There Sectoral Anomalies Too? The Pitfalls of Unreported Multiple Hypothesis Testing and a Simple Solution. (2000). (46) RePEc:kap:rqfnac:v:20:y:2003:i:1:p:5-34

Trade-Off Model of Debt Maturity Structure. (2003). (47) RePEc:kap:rqfnac:v:9:y:1997:i:1:p:71-88

Financial Ratio Adjustment: Industry-Wide Effects or Strategic Management. (1997). (48) RePEc:kap:rqfnac:v:12:y:1999:i:4:p:341-50

The Determinants of Debt Maturity: The Case of Bank Financing in Singapore. (1999). (49) RePEc:kap:rqfnac:v:5:y:1995:i:4:p:365-73

The Early Exercise Premia of American Put Options on Stocks. (1995). (50) RePEc:kap:rqfnac:v:14:y:2000:i:4:p:361-80

A Complete Nonparametric Event Study Approach. (2000). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 Latest citations received in: 2004 Latest citations received in: 2003 (1) RePEc:lar:wpaper:2003-02 Contagion effects of successive bond rating downgrades (2003). Laboratoire de Recherche en Gestion et Economie, Université Louis Pasteur, Strasbourg (France) / Working Papers of LaRGE (Laboratoire de Recherche en Latest citations received in: 2002 (1) RePEc:tky:fseres:2002cf171 Concept and Relevance of Income (2002). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |