|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

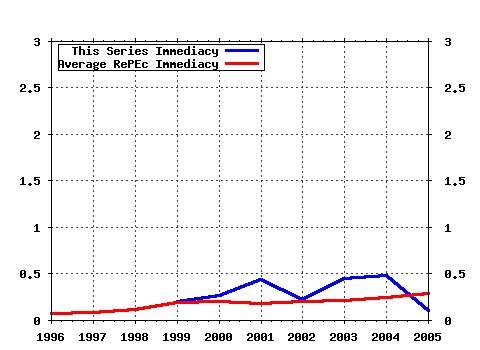

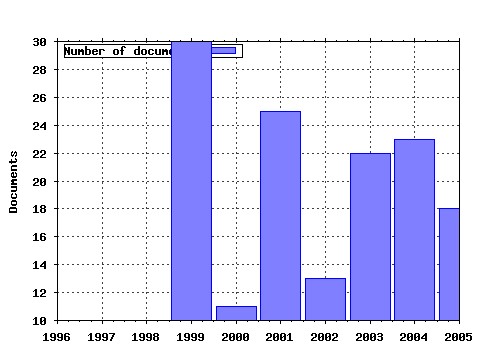

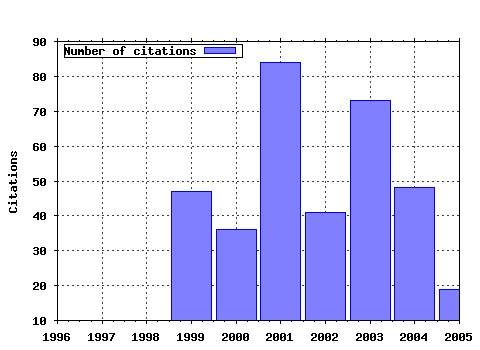

Oxford Financial Research Centre / OFRC Working Papers Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sbs:wpsefe:2001fe11 Ownership and Control of German Corporations (2001). (2) RePEc:sbs:wpsefe:2001fe06 Global Integration in Primary Equity Markets: The Role of U.S. Banks and U.S. Investors (2001). (3) RePEc:sbs:wpsefe:2003fe08 Equilibrium Analysis, Banking and Financial Instability (2003). (4) RePEc:sbs:wpsefe:1999fe09 Finance, Investment and Growth (1999). (5) RePEc:sbs:wpsefe:2003fe13 A Model to Analyse Financial Fragility (2003). (6) RePEc:sbs:wpsefe:2000mf01 Non-Gaussian OU based models and some of their uses in financial economics (2000). (7) RePEc:sbs:wpsefe:2002fe07 IPO Pricing in the Dot-com Bubble (2002). (8) RePEc:sbs:wpsefe:2006fe05 Designing realised kernels to measure the ex-post variation of equity prices

in the presence of noise (2006). (9) RePEc:sbs:wpsefe:2003fe03 Equilibrium Analysis, Banking, Contagion and Financial Fragility (2003). (10) RePEc:sbs:wpsefe:2004fe05 A Model to Analyse Financial Fragility: Applications (2004). (11) RePEc:sbs:wpsefe:2001fe05 A Theory of the Syndicate: Form Follows Function (2001). (12) RePEc:sbs:wpsefe:2004fe20 Regular and Modified Kernel-Based Estimators of Integrated Variance: The Case with Independent Noise (2004). (13) RePEc:sbs:wpsefe:2001fe15 Sources of Funds and Investment Strategies of Venture Capital Funds: Evidence from Germany, Israel, Japan and the UK (2001). (14) RePEc:sbs:wpsefe:1999fe08 How Do Financial Systems Affect Economic Performance? (1999). (15) RePEc:sbs:wpsefe:2000mf02 Likelihood inference for discretely observed non-linear diffusions (2000). (16) RePEc:sbs:wpsefe:2003fe06 Procyclicality and the new Basel Accord - Banks choice of loan rating system (2003). (17) RePEc:sbs:wpsefe:2004fe21 A Central Limit Theorem for Realised Power and Bipower Variations of Continuous Semimartingales (2004). (18) RePEc:sbs:wpsefe:2005fe09 Limit theorems for bipower variation in financial econometrics (2005). (19) RePEc:sbs:wpsefe:2003fe14 Ownership: Evolution and Regulation (2003). (20) RePEc:sbs:wpsefe:2004fe11 A Risk Assessment Model for Banks (2004). (21) RePEc:sbs:wpsefe:2003fe16 A New Test of Capital Structure (2003). (22) RePEc:sbs:wpsefe:2004fe18 A Time Series Analysis of Financial Fragility in the UK Banking System (2004). (23) RePEc:sbs:wpsefe:2004fe10 Financial Liberalisation and Capital Regulation in Open Economies (2004). (24) RePEc:sbs:wpsefe:2003fe02 Partnership Firms, Reputation and Human Capital (2003). (25) RePEc:sbs:wpsefe:2006fe03 Devaluation without common knowledge (2006). (26) RePEc:sbs:wpsefe:2002fe05 Crises and Capital Requirements in Banking (2002). (27) RePEc:sbs:wpsefe:1999fe07 Firm Control (1999). (28) RePEc:sbs:wpsefe:2001fe08 IPO Allocations: Discriminatory or Discretionary? (2001). (29) RePEc:sbs:wpsefe:2002mf05 Variational Sums and Power Variation: a unifying approach to model selection and estimation in semimartingale models (2002). (30) RePEc:sbs:wpsefe:2003fe11 Multinational Bank Capital Regulation with Deposit Insurance and Diversification Effects (2003). (31) RePEc:sbs:wpsefe:2005fe04 Why are Securitization Issues Tranched? (2005). (32) RePEc:sbs:wpsefe:2000fe03 Firm Value and Managerial Incentives: A Stochastic Frontier Approach (2000). (33) RePEc:sbs:wpsefe:1999fe04 IPO Underpricing, Wealth Losses and the Curious Role of Venture Capitalists in the Creation of Public Companies (1999). (34) RePEc:sbs:wpsefe:2002mf04 Distinguished Limits of Levy-Stable Processes, and Applications to Option Pricing (2002). (35) RePEc:sbs:wpsefe:2006fe01 (). (36) RePEc:sbs:wpsefe:2005fe05 Estimating quadratic variation when quoted prices jump by a constant increment (2005). (37) RePEc:sbs:wpsefe:1999fe01 Who Disciplines Management in Poorly Performing Companies? (1999). (38) RePEc:sbs:wpsefe:2003mf05 Estimation of Integrated Volatility in Stochastic Volatility Models (2003). (39) RePEc:sbs:wpsefe:2007fe03 A Note on the Central Limit Theorem for Bipower Variation of General Functions (2007). (40) RePEc:sbs:wpsefe:2001fe01 Credit Derivatives, Disintermediation and Investment Decisions (2001). (41) RePEc:sbs:wpsefe:2001fe10 Institutional Investment and Private Equity in the UK (2001). (42) RePEc:sbs:wpsefe:2005fe15 On Modelling Endogenous Default (2005). (43) RePEc:sbs:wpsefe:2004fe02 Likelihood-based estimation of latent generalised ARCH structures (2004). (44) RePEc:sbs:wpsefe:2002mf03 Analytical Comparisons of Option prices in Stochastic Volatility Models (2002). (45) RePEc:sbs:wpsefe:2002fe06 Evidence of Information Spillovers in the Production of Investment Banking Services (2002). (46) RePEc:sbs:wpsefe:2003fe05 Why are European IPOs so rarely priced outside the indicative price range? (2003). (47) RePEc:sbs:wpsefe:2000fe04 Has the introduction of bookbuilding increased the efficiency of international IPOs? (2000). (48) RePEc:sbs:wpsefe:2001mf02 From market games to real-world markets (2001). (49) RePEc:sbs:wpsefe:2001fe03 Emerging Market Spreads: Then Versus Now (2001). (50) RePEc:sbs:wpsefe:2004fe08 Is Deposit Insurance a Good Thing, and If So, Who Should Pay for It? (2004). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:oxf:wpaper:230 Explaining Launch Spreads on Structured Bonds (2005). University of Oxford, Department of Economics / Economics Series Working Papers (2) RePEc:sbs:wpsefe:2005fe06 Limit theorems for multipower variation in the presence of jumps (2005). Oxford Financial Research Centre / OFRC Working Papers Series Latest citations received in: 2004 (1) RePEc:cmf:wpaper:wp2004_0422 ECONOMIC AND REGULATORY CAPITAL. WHAT IS THE DIFFERENCE? (2004). CEMFI / Working Papers (2) RePEc:ecm:ausm04:273 Testing and Modelling Market Microstructure Effects with an Application to the Dow Jones Industrial Average (2004). Econometric Society / Econometric Society 2004 Australasian Meetings (3) RePEc:ecm:nasm04:487 Testing and Modelling Market Microstructure Effects with an Application to the Dow Jones Industrial Average (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (4) RePEc:fip:fedgfe:2004-56 Dynamic estimation of volatility risk premia and investor risk aversion from option-implied and realized volatilities (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (5) RePEc:mse:wpsorb:b04118 The limit-price exchange process (2004). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (6) RePEc:nbr:nberwo:10664 A Model of Forum Shopping, with Special Reference to Standard Setting Organizations (2004). National Bureau of Economic Research, Inc / NBER Working Papers (7) RePEc:nuf:econwp:0430 Multipower Variation and Stochastic Volatility (2004). Economics Group, Nuffield College, University of Oxford / Economics Papers (8) RePEc:sbs:wpsefe:2004fe11 A Risk Assessment Model for Banks (2004). Oxford Financial Research Centre / OFRC Working Papers Series (9) RePEc:sbs:wpsefe:2004fe18 A Time Series Analysis of Financial Fragility in the UK Banking System (2004). Oxford Financial Research Centre / OFRC Working Papers Series (10) RePEc:sbs:wpsefe:2004fe22 Multipower Variation and Stochastic Volatility (2004). Oxford Financial Research Centre / OFRC Working Papers Series (11) RePEc:upf:upfgen:802 Interbank Comptetition with Costly Screening (2004). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Latest citations received in: 2003 (1) RePEc:nuf:econwp:0319 Power variation & stochastic volatility: a review and some new results (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (2) RePEc:nuf:econwp:0321 Econometrics of testing for jumps in financial economics using bipower variation (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (3) RePEc:sbs:wpsefe:2003fe03 Equilibrium Analysis, Banking, Contagion and Financial Fragility (2003). Oxford Financial Research Centre / OFRC Working Papers Series (4) RePEc:sbs:wpsefe:2003fe06 Procyclicality and the new Basel Accord - Banks choice of loan rating system (2003). Oxford Financial Research Centre / OFRC Working Papers Series (5) RePEc:sbs:wpsefe:2003fe08 Equilibrium Analysis, Banking and Financial Instability (2003). Oxford Financial Research Centre / OFRC Working Papers Series (6) RePEc:sbs:wpsefe:2003fe13 A Model to Analyse Financial Fragility (2003). Oxford Financial Research Centre / OFRC Working Papers Series (7) RePEc:sbs:wpsefe:2003mf05 Estimation of Integrated Volatility in Stochastic Volatility Models (2003). Oxford Financial Research Centre / OFRC Working Papers Series (8) RePEc:sbs:wpsefe:2003mf08 Purely discontinuous Levy processes and power variation: inference for integrated volatility and the scale parameter (2003). Oxford Financial Research Centre / OFRC Working Papers Series (9) RePEc:wpa:wuwpfi:0305005 Efficient Path-Dependent Valuation Using Lattices: Fixed and Floating Strike Asian Options (2003). EconWPA / Finance (10) RePEc:wpa:wuwpma:0312006 A Unified Approach to Credit Crunches, Financial Instability, and Banking Crises (2003). EconWPA / Macroeconomics Latest citations received in: 2002 (1) RePEc:cir:cirwor:2002s-93 ARMA Representation of Integrated and Realized Variances (2002). CIRANO / CIRANO Working Papers (2) RePEc:sbs:wpsefe:2002fe07 IPO Pricing in the Dot-com Bubble (2002). Oxford Financial Research Centre / OFRC Working Papers Series (3) RePEc:sbs:wpsefe:2002fe08 The Economics of Capital Regulation in Financial Conglomerates (2002). Oxford Financial Research Centre / OFRC Working Papers Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |