|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

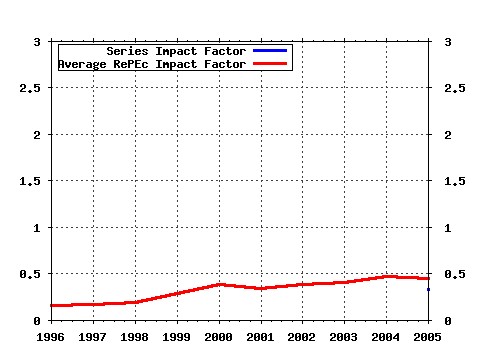

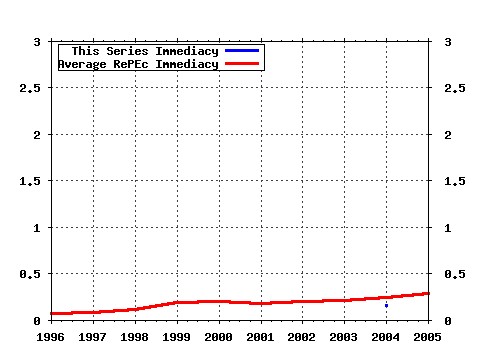

Society for Computational Economics / Computing in Economics and Finance 2004 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf4:152 On the Indeterminacy of New-Keynesian Economics (2004). (2) RePEc:sce:scecf4:3 Can Long-Run Restrictions Identify Technology Shocks? (2004). (3) RePEc:sce:scecf4:169 The Great Depression and the Friedman-Schwartz Hypothesis (2004). (4) RePEc:sce:scecf4:277 State-Dependent or Time-Dependent Pricing: Does It Matter For Recent U.S. Inflation? (2004). (5) RePEc:sce:scecf4:135 Exchange Rate Pass-Through and the Inflation Environment in Industrialized Countries: An Empirical Investigation (2004). (6) RePEc:sce:scecf4:125 Optimal Taylor Rules in an Estimated Model of a Small Open Economy (2004). (7) RePEc:sce:scecf4:325 Monetary and Fiscal Policy Switching (2004). (8) RePEc:sce:scecf4:291 A Search for a Structural Phillips Curve (2004). (9) RePEc:sce:scecf4:67 Optimal Monetary Policy under Commitment with a Zero Bound on Nominal Interest Rates (2004). (10) RePEc:sce:scecf4:224 The magnitude and Cyclical Behavior of Financial Market Frictions (2004). (11) RePEc:sce:scecf4:65 Exchange Rate Policy and the Zero Bound on Nominal Interest Rates (2004). (12) RePEc:sce:scecf4:342 Forecasting daily variability of the S&P 100 stock index using historical, realised and implied volatility measurements (2004). (13) RePEc:sce:scecf4:31 Why are long rates sensitive to monetary policy? (2004). (14) RePEc:sce:scecf4:108 Inflation Targeting and Nonlinear Policy Rules: the Case of Asymmetric Preferences (2004). (15) RePEc:sce:scecf4:97 Inflation targeting (2004). (16) RePEc:sce:scecf4:212 The New Keynesian Phillips Curve: An Empirical Assessment (2004). (17) RePEc:sce:scecf4:16 Are European business cycles close enough to be just one? (2004). (18) RePEc:sce:scecf4:137 Practical guide to real options in discrete time (2004). (19) RePEc:sce:scecf4:215 Habit formation and Interest-Rate Smoothing (2004). (20) RePEc:sce:scecf4:117 The short-run dynamics of optimal growth models with delays (2004). (21) RePEc:sce:scecf4:230 Forecasting euro area inflation: Does aggregating forecasts by HICP component improve forecast accuracy? (2004). (22) RePEc:sce:scecf4:144 The Decline of Activist Stabilization Policy: Natural Rate Misperceptions, Learning, and Expectations (2004). (23) RePEc:sce:scecf4:83 Monetary Rules, Indeterminacy, and the Business-Cycle Stylised Facts (2004). (24) RePEc:sce:scecf4:12 Value-at-Risk and Expected Shortfall for Quadratic Portfolio of Securities with Mixture of Elliptic Distribution Risk Factors (2004). (25) RePEc:sce:scecf4:99 Learning with Heterogeneous Expectations in an Evolutionary World (2004). (26) RePEc:sce:scecf4:217 On Learning Equilibria (2004). (27) RePEc:sce:scecf4:89 Empirical Calibration of Simulation Models (2004). (28) RePEc:sce:scecf4:172 The second moments matter: The response of bank lending behavior to macroeconomic uncertainty (2004). (29) RePEc:sce:scecf4:145 New Phenomena Identified in a Stochastic Dynamic Macroeconometric Model: A Bifurcation Perspective (2004). (30) RePEc:sce:scecf4:19 Monetary policy and the transition to rational expectations (2004). (31) RePEc:sce:scecf4:30 A Bayesian algorithm for a Markov Switching GARCH model (2004). (32) RePEc:sce:scecf4:130 Performance of Inflation Targeting Based on constant Interest Rate Projections (2004). (33) RePEc:sce:scecf4:62 Exchange rate overshooting and the costs of floating (2004). (34) RePEc:sce:scecf4:194 Occasionally Binding Collateral Constraints in RBC Models (2004). (35) RePEc:sce:scecf4:213 Stochastic Optimisation and Worst Case Analysis in Monetary Policy Design (2004). (36) RePEc:sce:scecf4:51 Does Employment Protection Inhibit Technical Diffusion? (2004). (37) RePEc:sce:scecf4:149 Keynesian Dynamics and the Wage-Price Spiral:Estimating a Baseline Disequilibrium Approach (2004). (38) RePEc:sce:scecf4:166 Optimal monetary policy in a regime-switching economy (2004). (39) RePEc:sce:scecf4:252 Conditional Welfare Comparisons of Monetary Policy Rules (2004). (40) RePEc:sce:scecf4:61 Advertising Dynamics and Competitive Advantage (2004). (41) RePEc:sce:scecf4:176 Does Central Bank Transparency Matter for Economic Stability (2004). (42) RePEc:sce:scecf4:84 Towards an Evolutionary Interpretation of Aggregate Labor Market Regularities (2004). (43) RePEc:sce:scecf4:35 Strongly rational expectations equilibria with endogenous acquisition of information (2004). (44) RePEc:sce:scecf4:262 Keynesian Dynamics and the wage price spiral. A baseline disequilibrium approach (2004). (45) RePEc:sce:scecf4:196 Competition as a Coordination Device (2004). (46) RePEc:sce:scecf4:158 Forecasting Volume and Volatility in the Tokyo Stock Market: The Advantage of Long Memory Models (2004). (47) RePEc:sce:scecf4:60 Uninsurable Investment Risk (2004). (48) RePEc:sce:scecf4:188 Filtering Long-Run Inflation Expectations with a Structural Macro Model of the Yield Curve (2004). (49) RePEc:sce:scecf4:153 Intertemporal and Spatial Location of Disposal Facilities (2004). (50) RePEc:sce:scecf4:206 Neighborhood models of minority opinion spreading (2004). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 Latest citations received in: 2004 (1) RePEc:cfs:cfswop:wp200414 Exchange-Rate Policy and the Zero Bound on Nominal Interest (2004). Center for Financial Studies / CFS Working Paper Series (2) RePEc:cla:levrem:122247000000000300 A Unified Theory of the Evolution of International Income Levels (2004). UCLA Department of Economics / Levine's Bibliography (3) RePEc:cla:levrem:122247000000000518 A Critique of Structural VARs Using Real Business Cycle Theory (2004). UCLA Department of Economics / Levine's Bibliography (4) RePEc:ctl:louvir:2004004 Modelling vintage structures with DDEs : principles and applications (2004). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (5) RePEc:dgr:tuecis:0419 History friendly simulations for modelling industrial dynamics (2004). Eindhoven Centre for Innovation Studies, Eindhoven University of Technology / ECIS Working Papers (6) RePEc:dgr:uvatin:20040067 Modeling and Forecasting S&P 500 Volatility: Long Memory, Structural Breaks and Nonlinearity (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (7) RePEc:dnb:dnbwpp:017 Inflation Targets as Focal Points (2004). Netherlands Central Bank, Research Department / DNB Working Papers (8) RePEc:ecb:ecbwps:20040350 Exchange-rate policy and the zero bound on nominal interest rates (2004). European Central Bank / Working Paper Series (9) RePEc:ecb:ecbwps:20040377 Optimal monetary policy under commitment with a zero bound on nominal interest rates (2004). European Central Bank / Working Paper Series (10) RePEc:ecb:ecbwps:20040380 Optimal monetary policy under discretion with a zero bound on nominal interest rates (2004). European Central Bank / Working Paper Series (11) RePEc:ecb:ecbwps:20040418 Identifying the influences of nominal and real rigidities in aggregate price-setting behavior (2004). European Central Bank / Working Paper Series (12) RePEc:ema:worpap:2004-23 Environmental Policy and Growth when Inputs are Differentiated in Pollution Intensity (2004). THEMA / Working papers (13) RePEc:eui:euiwps:eco2004/06 Modelling vintage structures with DDEs: principles and applications (2004). European University Institute / Economics Working Papers (14) RePEc:eui:euiwps:eco2004/17 (In)determinacy and Time-to-Build (2004). European University Institute / Economics Working Papers (15) RePEc:fip:fedgfe:2004-48 Monetary policy alternatives at the zero bound: an empirical assessment (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (16) RePEc:fip:fedgfe:2004-70 The magnitude and cyclical behavior of financial market frictions (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (17) RePEc:fip:fedhwp:wp-04-20 Are technology improvements contractionary? (2004). Federal Reserve Bank of Chicago / Working Paper Series (18) RePEc:fip:fedmsr:333 A unified theory of the evolution of international income levels (2004). Federal Reserve Bank of Minneapolis / Staff Report (19) RePEc:fip:fedmsr:338 Comment on Gali and Rabanals Technology shocks and aggregate fluctuations: how well does the RBC model fit postwar U.S. data? (2004). Federal Reserve Bank of Minneapolis / Staff Report (20) RePEc:fip:fedmwp:631 A critique of structural VARs using real business cycle theory (2004). Federal Reserve Bank of Minneapolis / Working Papers (21) RePEc:hhs:bofrdp:2004_019 Expectational business cycles (2004). Bank of Finland / Research Discussion Papers (22) RePEc:ide:wpaper:2148 Indeterminacy Produces Determinacy (2004). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (23) RePEc:ide:wpaper:2870 Some Perils of Policy Rule Regression (2004). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (24) RePEc:kan:wpaper:200403 The Nonlinear Skeletons in the Closet (2004). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (25) RePEc:kan:wpaper:200412 SINGULARITY BIFURCATIONS (2004). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (26) RePEc:kud:epruwp:04-13 How Similar Are European Business Cycles? (2004). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (27) RePEc:mdl:mdlpap:0412 Who is Post-Walrasian Man? (2004). Middlebury College, Department of Economics / Middlebury College Working Paper Series (28) RePEc:mmf:mmfc04:97 Expectational Business Cycles (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 (29) RePEc:nbr:nberwo:10592 Are Technology Improvements Contractionary? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (30) RePEc:nbr:nberwo:10889 The Cost of Nominal Inertia in NNS Models (2004). National Bureau of Economic Research, Inc / NBER Working Papers (31) RePEc:sce:scecf4:149 Keynesian Dynamics and the Wage-Price Spiral:Estimating a Baseline Disequilibrium Approach (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (32) RePEc:sce:scecf4:224 The magnitude and Cyclical Behavior of Financial Market Frictions (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (33) RePEc:sce:scecf4:262 Keynesian Dynamics and the wage price spiral. A baseline disequilibrium approach (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (34) RePEc:wpa:wuwpco:0407002 Social Structure and Opinion Formation (2004). EconWPA / Computational Economics (35) RePEc:wpa:wuwpfi:0405024 American options: the EPV pricing model (2004). EconWPA / Finance (36) RePEc:wpa:wuwpfi:0409055 A Continuous-Time Asset Pricing Model with Boundedly Rational Heterogeneous Agents (2004). EconWPA / Finance (37) RePEc:wpa:wuwpfi:0410016 Optimal stopping made easy (2004). EconWPA / Finance (38) RePEc:wpa:wuwpge:0403003 VaR and ES for linear Portfolis with mixture of elliptically distributed Risk Factors. (2004). EconWPA / GE, Growth, Math methods (39) RePEc:wpa:wuwpge:0403004 VaR and ES for linear Portfolios with mixture of elliptically distributed Risk Factors. (2004). EconWPA / GE, Growth, Math methods (40) RePEc:wpa:wuwpge:0409009 Heterogeneous Researchers in a Two-Sector Representative Consumer Economy (2004). EconWPA / GE, Growth, Math methods (41) RePEc:wpa:wuwpge:0409010 Volatility, Heterogeneous Agents and Chaos (2004). EconWPA / GE, Growth, Math methods (42) RePEc:wpa:wuwpma:0409001 Keynesian Dynamics and the Wage Price Spiral. A Baseline Disequilibrium Approach (2004). EconWPA / Macroeconomics (43) RePEc:wpa:wuwpri:0403001 Value-at-Risk and Expected Shortfall for Linear Portfolios with elliptically distributed RisK Factors (2004). EconWPA / Risk and Insurance (44) RePEc:wpa:wuwpri:0406001 VaR and ES for Linear Portfolios with mixture of Generalized Laplace Distributed Risk Factors (2004). EconWPA / Risk and Insurance Latest citations received in: 2003 Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |