|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

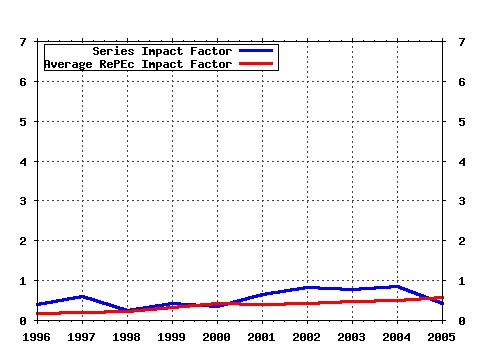

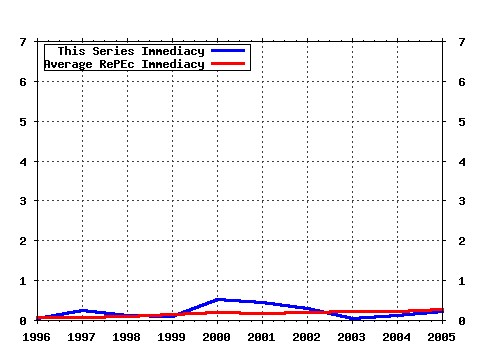

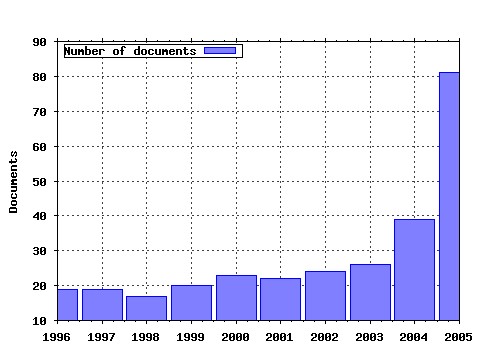

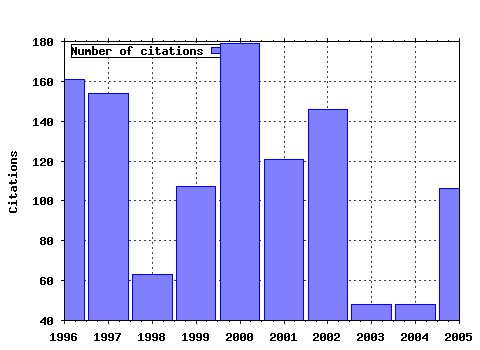

Journal of Business Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ucp:jnlbus:v:59:y:1986:i:3:p:383-403 Economic Forces and the Stock Market. (1986). (2) RePEc:ucp:jnlbus:v:68:y:1995:i:3:p:351-81 Relationship Lending and Lines of Credit in Small Firm Finance. (1995). (3) RePEc:ucp:jnlbus:v:60:y:1987:i:4:p:473-89 Parsimonious Modeling of Yield Curves. (1987). (4) RePEc:ucp:jnlbus:v:51:y:1978:i:4:p:621-51 Prices of State-contingent Claims Implicit in Option Prices. (1978). (5) RePEc:ucp:jnlbus:v:59:y:1986:i:2:p:197-216 The Hubris Hypothesis of Corporate Takeovers. (1986). (6) RePEc:ucp:jnlbus:v:59:y:1986:i:4:p:s251-78 Rational Choice and the Framing of Decisions. (1986). (7) RePEc:ucp:jnlbus:v:45:y:1972:i:3:p:444-55 Capital Market Equilibrium with Restricted Borrowing. (1972). (8) RePEc:ucp:jnlbus:v:58:y:1985:i:2:p:135-57 Evaluating Natural Resource Investments. (1985). (9) RePEc:ucp:jnlbus:v:59:y:1986:i:3:p:405-31 Salaries and Piece Rates. (1986). (10) RePEc:ucp:jnlbus:v:70:y:1997:i:2:p:249-79 Business Cycles for G7 and European Countries. (1997). (11) RePEc:ucp:jnlbus:v:54:y:1981:i:4:p:513-33 On Market Timing and Investment Performance. II. Statistical Procedures for Evaluating Forecasting Skills. (1981). (12) RePEc:ucp:jnlbus:v:73:y:2000:i:3:p:287-329 Managerial Decisions and Long-Term Stock Price Performance. (2000). (13) RePEc:ucp:jnlbus:v:51:y:1978:i:3:p:413-38 Deposit Insurance and Bank Regulation: A Partial-Equilibrium Exposition. (1978). (14) RePEc:ucp:jnlbus:v:55:y:1982:i:2:p:253-67 Intertemporal Asset Pricing with Heterogeneous Consumers and without Demand Aggregation. (1982). (15) RePEc:ucp:jnlbus:v:64:y:1991:i:1:p:1-19 The Survival of Noise Traders in Financial Markets. (1991). (16) RePEc:ucp:jnlbus:v:34:y:1961:p:411 Dividend Policy, Growth, and the Valuation of Shares (1961). (17) RePEc:ucp:jnlbus:v:59:y:1986:i:4:p:s285-300 Fairness and the Assumptions of Economics. (1986). (18) RePEc:ucp:jnlbus:v:63:y:1990:i:3:p:331-45 The Exchange-Rate Exposure of U.S. Multinationals. (1990). (19) RePEc:ucp:jnlbus:v:63:y:1990:i:1:p:s125-40 The Distribution of the Instrumental Variables Estimator and Its t-Ratio When the Instrument Is a Poor One. (1990). (20) RePEc:ucp:jnlbus:v:72:y:1999:i:3:p:285-318 The Government as Venture Capitalist: The Long-Run Impact of the SBIR Program. (1999). (21) RePEc:ucp:jnlbus:v:62:y:1989:i:3:p:311-37 Nonlinear Dynamics and Stock Returns. (1989). (22) RePEc:ucp:jnlbus:v:62:y:1989:i:3:p:369-91 Scoring the Leading Indicators. (1989). (23) RePEc:ucp:jnlbus:v:56:y:1983:i:4:p:419-52 Measuring the Average Marginal Tax Rate from the Individual Income Tax. (1983). (24) RePEc:ucp:jnlbus:v:58:y:1985:i:3:p:259-78 International Portfolio Diversification with Estimation Risk. (1985). (25) RePEc:ucp:jnlbus:v:62:y:1989:i:3:p:393-416 Mutual Fund Performance: An Analysis of Quarterly Portfolio Holdings. (1989). (26) RePEc:ucp:jnlbus:v:53:y:1980:i:1:p:61-65 The Extreme Value Method for Estimating the Variance of the Rate of Return. (1980). (27) RePEc:ucp:jnlbus:v:53:y:1980:i:1:p:27-44 A Theory of Self-enforcing Agreements. (1980). (28) RePEc:ucp:jnlbus:v:67:y:1994:i:4:p:539-61 How Good Are Standard Debt Contracts? Stochastic versus Nonstochastic Monitoring in a Costly State Verification Environment. (1994). (29) RePEc:ucp:jnlbus:v:44:y:1971:i:1:p:19-31 Measuring the Term Structure of Interest Rates. (1971). (30) RePEc:ucp:jnlbus:v:68:y:1995:i:3:p:309-49 Do Arbitrage Pricing Models Explain the Predictability of Stock Returns? (1995). (31) RePEc:ucp:jnlbus:v:75:y:2002:i:2:p:305-332 The Fine Structure of Asset Returns: An Empirical Investigation (2002). (32) RePEc:ucp:jnlbus:v:74:y:2001:i:1:p:101-24 Forecasting Bankruptcy More Accurately: A Simple Hazard Model. (2001). (33) RePEc:ucp:jnlbus:v:54:y:1981:i:4:p:579-96 Day of the Week Effects and Asset Returns. (1981). (34) RePEc:ucp:jnlbus:v:65:y:1992:i:1:p:1-29 Waiting to Invest: Investment and Uncertainty. (1992). (35) RePEc:ucp:jnlbus:v:45:y:1972:i:2:p:179-211 The Market for Securities: Substitution versus Price Pressure and the Effects of Information on Share Prices. (1972). (36) RePEc:ucp:jnlbus:v:54:y:1981:i:3:p:435-51 The Speculative Efficiency Hypothesis. (1981). (37) RePEc:ucp:jnlbus:v:54:y:1981:i:3:p:363-406 On Market Timing and Investment Performance. I. An Equilibrium Theory of Value for Market Forecasts. (1981). (38) RePEc:ucp:jnlbus:v:62:y:1989:i:3:p:339-68 Testing for Nonlinear Dependence in Daily Foreign Exchange Rates. (1989). (39) RePEc:ucp:jnlbus:v:69:y:1996:i:3:p:279-312 The Determinants of Corporate Debt Maturity Structure. (1996). (40) RePEc:ucp:jnlbus:v:61:y:1988:i:4:p:427-49 Competitive Promotional Strategies. (1988). (41) RePEc:ucp:jnlbus:v:68:y:1995:i:3:p:281-308 Can Bank Health Affect Investment? Evidence from Japan. (1995). (42) RePEc:ucp:jnlbus:v:72:y:1999:i:1:p:1-33 Earnings Management to Exceed Thresholds. (1999). (43) RePEc:ucp:jnlbus:v:69:y:1996:i:3:p:383-408 The Asymptotic Distribution of Extreme Stock Market Returns. (1996). (44) RePEc:ucp:jnlbus:v:47:y:1974:i:3:p:410-28 Special Information and Insider Trading. (1974). (45) RePEc:ucp:jnlbus:v:64:y:1991:i:2:p:165-87 Why Investors Value Multinationality. (1991). (46) RePEc:ucp:jnlbus:v:69:y:1996:i:2:p:133-57 The Persistence of Risk-Adjusted Mutual Fund Performance. (1996). (47) RePEc:ucp:jnlbus:v:73:y:2000:i:1:p:1-23 Do Banking Shocks Affect Borrowing Firm Performance? An Analysis of the Japanese Experience. (2000). (48) RePEc:ucp:jnlbus:v:69:y:1996:i:4:p:429-55 Rational Capital Budgeting in an Irrational World. (1996). (49) RePEc:ucp:jnlbus:v:46:y:1973:i:3:p:434-53 The Variability of the Market Factor of the New York Stock Exchange. (1973). (50) RePEc:ucp:jnlbus:v:61:y:1988:i:3:p:275-98 An Analysis of the Implications for Stock and Futures Price Volatility of Program Trading and Dynamic Hedging Strategies. (1988). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:bos:macppr:wp2005-005 Capital Structure, Credit Risk, and Macroeconomic Conditions (2005). Department of Economics, Boston University / Boston University Working Papers Series in Macroeconomics (2) RePEc:cpb:docmnt:96 Competition in markets for life insurance. (2005). CPB Netherlands Bureau for Economic Policy Analysis / CPB Documents (3) RePEc:cpr:ceprdp:5352 Non-synchronous Trading and Testing for Market Integration in Central European Emerging Markets (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:dgr:eureri:30007069 Bond underwriting fees and keiretsu affiliation in Japan (2005). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (5) RePEc:dnb:dnbwpp:047 An Exploration into Competition and Efficiency in the Dutch Life Insurance Industry (2005). Netherlands Central Bank, Research Department / DNB Working Papers (6) RePEc:dnb:dnbwpp:060 Bond Market and Stock Market Integration in Europe (2005). Netherlands Central Bank, Research Department / DNB Working Papers (7) RePEc:dnb:dnbwpp:072 Correlated Trading and Returns (2005). Netherlands Central Bank, Research Department / DNB Working Papers (8) RePEc:ecb:ecbwps:20050527 Banking system stability - a cross-Atlantic perspective (2005). European Central Bank / Working Paper Series (9) RePEc:fip:fedgfe:2005-15 The effects of competition from large, multimarket firms on the performance of small, single-market firms: evidence from the banking industry (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (10) RePEc:fip:fedkpw:psrwp05-02 Technological innovation and market turbulence: the dot-com experience (2005). Federal Reserve Bank of Kansas City / Payments System Research Working Paper (11) RePEc:fip:fedkrw:rwp05-05 Approximately normal tests for equal predictive accuracy in nested models (2005). Federal Reserve Bank of Kansas City / Research Working Paper (12) RePEc:hhs:nhhfms:2005_018 Does Prospect Theory Explain the Disposition Effect? (2005). Department of Finance and Management Science, Norwegian School of Economics and Business Administration / Discussion Papers (13) RePEc:nbr:nberwo:11698 Banking System Stability: A Cross-Atlantic Perspective (2005). National Bureau of Economic Research, Inc / NBER Working Papers (14) RePEc:nbr:nberwo:11860 Can the European Community Afford to Neglect the Need for More Accountable Safety-Net Management? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (15) RePEc:nbr:nberwo:11903 CAPM Over the Long Run: 1926-2001 (2005). National Bureau of Economic Research, Inc / NBER Working Papers (16) RePEc:nbr:nberwo:11906 International Stock Return Comovements (2005). National Bureau of Economic Research, Inc / NBER Working Papers (17) RePEc:pse:psecon:2005-24 A dynamic equilibrium model of imperfectly integrated financial markets. (2005). PSE (Ecole normale supérieure) / PSE Working Papers (18) RePEc:san:crieff:0510 Venture Capital Investor Behaviour in the Backing of UK High Technology Firms: Financial Reporting and the Level of Investment (2005). Centre for Research into Industry, Enterprise, Finance and the Firm / CRIEFF Discussion Papers (19) RePEc:wpa:wuwpif:0511005 Structural versus Temporary Drivers of Country and Industry Risk (2005). EconWPA / International Finance Latest citations received in: 2004 (1) RePEc:aea:aecrev:v:94:y:2004:i:5:p:1249-1275 Bad Beta, Good Beta (2004). American Economic Review (2) RePEc:cir:cirwor:2004s-55 The Determinants of Credit Default Swap Premia (2004). CIRANO / CIRANO Working Papers (3) RePEc:fip:fedgfe:2004-12 Potential competitive effects of Basel II on banks in SME credit markets in the United States (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (4) RePEc:idb:wpaper:1016 Bank Ownership and Performance (2004). Inter-American Development Bank, Research Department / Working Papers (5) RePEc:kud:kuiefr:200401 The Equity Premium Puzzle and the Ex Post Bias (2004). University of Copenhagen. Institute of Economics. Finance Research Unit / FRU Working Papers Latest citations received in: 2003 (1) RePEc:huj:dispap:dp355 Adding the Noise: A Theory of Compensation-Driven Earnings Management (2003). Center for Rationality and Interactive Decision Theory, Hebrew University, Jerusalem / Discussion Paper Series Latest citations received in: 2002 (1) RePEc:aea:aecrev:v:92:y:2002:i:2:p:422-427 Exchange-Traded Funds: A New Investment Option for Taxable Investors (2002). American Economic Review (2) RePEc:apr:aprewp:wp0008 Do Bank Characteristics Influence Loan Contract Terms? (2002). Australian Prudential Regulation Authority / Working Papers (3) RePEc:fip:fedgfe:2002-35 Small business loan turndowns, personal wealth and discrimination (2002). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (4) RePEc:tuf:tuftec:0214 Product Differentiation, Cost-Reducing Mergers, and Consumer Welfare (2002). Department of Economics, Tufts University / Discussion Papers Series, Department of Economics, Tufts University (5) RePEc:wpa:wuwpfi:0207011 Time-Changed Levy Processes and Option Pricing (2002). EconWPA / Finance (6) RePEc:wpa:wuwpfi:0207013 Are Interest Rate Derivatives Spanned by the Term Structure of Interest Rates? (2002). EconWPA / Finance (7) RePEc:zbw:bubdp1:4193 Further Evidence On The Relationship Between Firm Investment And Financial Status (2002). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |