|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

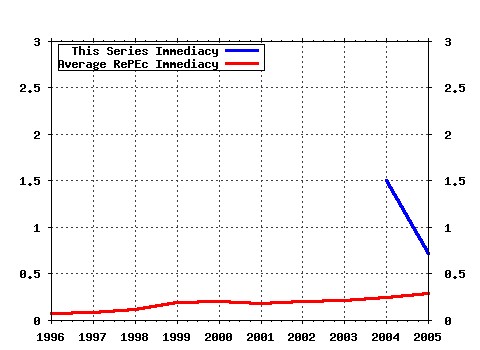

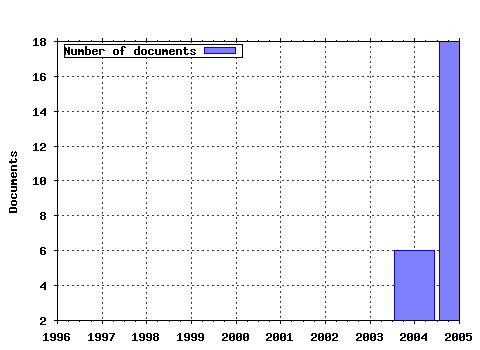

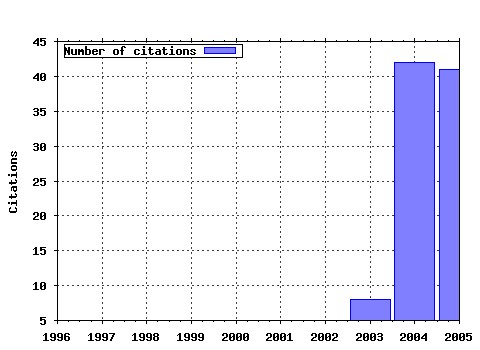

Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:zbw:bubdp2:2227 Forecasting Credit Portfolio Risk (2004). (2) RePEc:zbw:bubdp2:4264 Accounting for distress in bank mergers (2005). (3) RePEc:zbw:bubdp2:2226 Credit Risk Factor Modeling and the Basel II IRB Approach (2003). (4) RePEc:zbw:bubdp2:4269 Time series properties of a rating system based on financial ratios (2005). (5) RePEc:zbw:bubdp2:4270 Inefficient or just different? Effects of heterogeneity on bank efficiency scores (2005). (6) RePEc:zbw:bubdp2:2225 Measuring the Discriminative Power of Rating Systems (2003). (7) RePEc:zbw:bubdp2:4252 Does capital regulation matter for bank behaviour? Evidence for German savings banks (2004). (8) RePEc:zbw:bubdp2:4267 Evaluating the German bank merger wave (2005). (9) RePEc:zbw:bubdp2:4262 Banksâ regulatory capital buffer and the business cycle: evidence for German savings and

cooperative banks (2005). (10) RePEc:zbw:bubdp2:6927 Creditor concentration: an empirical investigation (2007). (11) RePEc:zbw:bubdp2:4255 Estimating probabilities of default for German savings banks and credit cooperatives (2004). (12) RePEc:zbw:bubdp2:5096 The stability of efficiency rankings when risk-preferences and objectives are different (2006). (13) RePEc:zbw:bubdp2:6352 Asset correlations and credit portfolio risk: an empirical analysis (2007). (14) RePEc:zbw:bubdp2:4254 How will Basel II affect bank lending to emerging markets? An analysis based on German bank level

data (2004). (15) RePEc:zbw:bubdp2:4536 Does diversification improve the performance of German banks? : Evidence from individual bank loan

portfolios (2006). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:zbw:bubdp1:4222 Recursive robust estimation and control without commitment (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (2) RePEc:zbw:bubdp1:4225 Umstellung der deutschen VGR auf Vorjahrespreisbasis (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (3) RePEc:zbw:bubdp1:4226 Determinants of current account developments in the central and east European EU member states â consequences for the enlargement of the euro area (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (4) RePEc:zbw:bubdp1:4228 Rational inattention: a research agenda (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (5) RePEc:zbw:bubdp1:4233 Short-run and long-run comovement of GDP and some expenditure aggregates in Germany, France and Italy (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (6) RePEc:zbw:bubdp1:4235 Trade balances of the central and east European EU member states and the role of foreign direct investment (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (7) RePEc:zbw:bubdp1:4236 Unit roots and cointegration in panels (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (8) RePEc:zbw:bubdp2:4265 The eurosystem money market auctions: a banking perspective (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (9) RePEc:zbw:bubdp2:4266 Financial integration and systemic risk (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (10) RePEc:zbw:bubdp2:4267 Evaluating the German bank merger wave (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (11) RePEc:zbw:bubdp2:4268 Incorporating prediction and estimation risk in point-in-time credit portfolio models (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (12) RePEc:zbw:bubdp2:4357 Forecasting stock market volatility with macroeconomic variables in real time (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (13) RePEc:zbw:bubdp2:4358 Finance and growth in a bank-based economy: is it quantity or quality that matters? (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Latest citations received in: 2004 (1) RePEc:zbw:bubdp1:2166 How effective are automatic stabilisers? : Theory and empirical results for Germany and other OECD countries (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (2) RePEc:zbw:bubdp1:2293 Do Consumer Confidence Indexes Help Forecast Consumer Spending in Real Time? (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (3) RePEc:zbw:bubdp1:2297 Measurement errors in GDP and forward-looking monetary policy : The Swiss case (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (4) RePEc:zbw:bubdp1:2302 Inflation and core money growth in the euro area (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (5) RePEc:zbw:bubdp1:2917 Optimal lender of last resort policy in different financial systems (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (6) RePEc:zbw:bubdp1:2918 Expected budget deficits and interest rate swap spreads - Evidence for France, Germany and Italy (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (7) RePEc:zbw:bubdp2:4252 Does capital regulation matter for bank behaviour? Evidence for German savings banks (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (8) RePEc:zbw:bubdp2:4253 German bank lending during emerging market crises: A bank level analysis (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies (9) RePEc:zbw:bubdp2:4255 Estimating probabilities of default for German savings banks and credit cooperatives (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Latest citations received in: 2003 Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |